Summary:

- VICI Properties is a growth company trading at a value stock multiple.

- It has superior organic revenue growth, reduced operating frictions, and flexibility of strategy and capital availability.

- VICI has performed well for investors with a 5-year total return of 84% and is currently undervalued.

Sezeryadigar

The buy thesis

VICI Properties (NYSE:VICI) is currently trading at a value stock multiple but is fundamentally a growth company. A steady cash flowing base and excellent balance sheet provide the foundation from which to pursue accretive acquisitions. It has 3 key advantages:

- Superior organic revenue growth rate

- Reduced operating frictions resulting in higher margins

- Flexibility of strategy and capital availability to exploit mispricing

Let us begin with a look at VICI’s price movement and valuation.

Performing but staying cheap

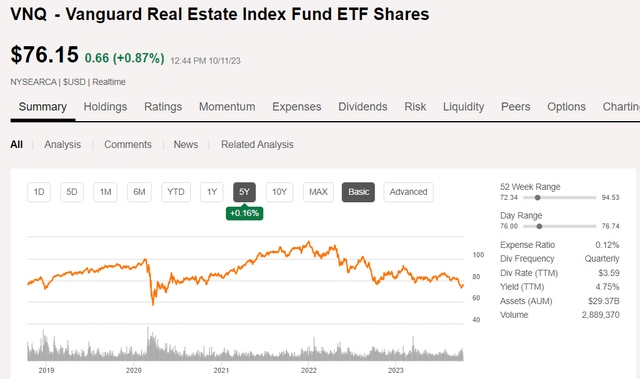

VICI has performed well for investors with a 5-year total return of 84%

S&P Global Market Intelligence

Note that this is against a REIT index that has had 5 years of dormancy as measured by the flat Vanguard Real Estate ETF (VNQ).

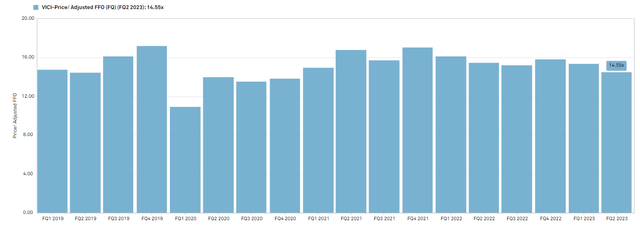

As a value-focused investor, I don’t usually like to buy things that are up so much, but in VICI’s case, it has actually gotten cheaper.

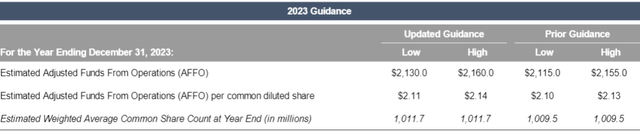

As the price rose, the AFFO/share rose even more resulting in a multiple that is lower today than it was 5 years ago.

S&P Global Market Intelligence

If we look at forward AFFO which consensus spots at $2.23 for 2024, VICI is trading at 13X AFFO. That is a value multiple and I think VICI deserves a growth multiple for the reasons detailed below.

Superior organic revenue growth

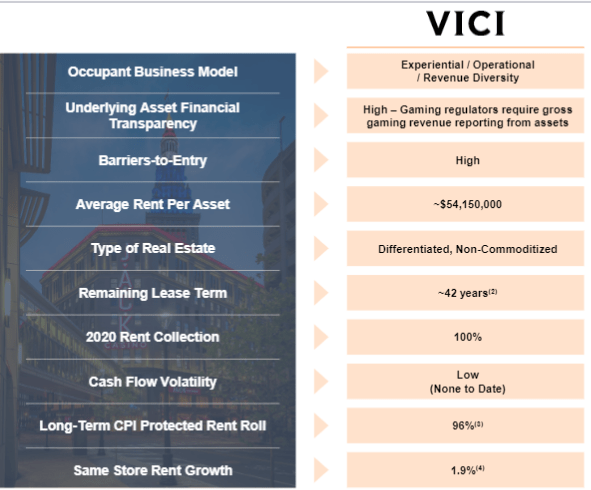

I will keep this section brief because while it is important to the thesis, this information is also broadly known. Basically, VICI just has good escalators with 96% of them having CPI inflation-based rollups.

VICI

While many triple net REITs have their escalators somewhat offset by the expenses of re-leasing as leases roll over, VICI has extremely long remaining lease terms so the incremental revenue directly translates to incremental AFFO.

Thus, the revenue growth represents true organic growth. This concept is heavily featured in all of VICI’s presentations and other investor communications so I think the market is largely aware of this advantage.

The aspect of VICI’s business that I think is not being appreciated by the market is the significant cost savings associated with their minimal friction.

Low friction operations

Friction in economics or finance is quite similar to friction in physics. Just as a moving object loses kinetic energy to friction as it slides along a surface, some portion of profits gets eaten up by transactional and operational frictions.

Any time multiple entities are involved it creates friction. Consider the concept of property maintenance in a 1 entity system where the owner is the tenant versus a 2 entity system in which the landlord and tenant are separate.

The 1 entity system

The property owner is economically inclined to perform maintenance capex in such a way as to maximize the sum of residual value of the property less the costs incurred.

The 2 entity system

The property owner wants the above, but the tenant wants only the capex that directly affects its operations within the window in which the tenant will occupy the property.

There is a misalignment of incentives which creates friction. In triple net lease contracts, the tenants will typically be responsible for some level of maintenance but inevitably there will be some amount of deferred maintenance which eventually falls on the landlord when it comes time to re-tenant the property.

Band-aid fixes during the lease term result in more overall capex than if the right repair had been made in the first place.

Such frictions are just the cost of doing business. Triple net REITs have managed to be quite successful over long periods of time despite the frictions.

VICI is on the next level. It has structured its business in such a way as to minimize friction. There is an automatic alignment of incentives that comes from tenants knowing they will occupy the property for 50 or more years.

Switching costs are insurmountable for casinos. In apartments, someone without much stuff can move every couple years to catch whatever move-in discounts are available, but in casinos, the gambling license is tied to the property.

Mandalay Bay cannot just move to a new location. Its operations are one with the building. The tenant will likely be there as long as they remain in business. This aligns the tenant’s capex incentives with those of the landlord. Both naturally want the property to be beautiful and functional and so they will capex accordingly.

VICI’s leasing contracts have some of the best language I have seen among triple net REITs as the tenants are obligated to put a certain percentage of revenues back into the building. This capex budget is on top of the contracted rent.

Through the extremely long lease terms, high switching costs for the tenant, and the lease contracts, VICI has taken its operational frictions close to 0.

Transactional frictions are also minimized at VICI. They do not need to be cycling in and out of properties every decade, which incurs underwriting fees on the way in and the way out. They buy the property once and it can cashflow for the next 50 years under the initial contract and potentially well beyond that.

With leases this long it is probably wise to not use straight-line GAAP accounting.

VICI emphasizes its AFFO which uses cash rents, not the average rent over the long lease term. The average rent is significantly higher which is why VICI’s FFO is much higher than its AFFO, but VICI provides its guidance in AFFO so as to cleanly present today’s cash flow.

Current rents fully cover VICI’s dividend.

VICI also avoids organizational frictions through minimizing the use of Joint Ventures or other structures that create more complexity without providing incremental value. JVs have become extremely popular among REITs which I think is going to prove to be a mistake over the long run. I was very enthused to hear Ed Pitoniak (VICI’s CEO) discuss JVs on the conference call in the following manner:

John G. DeCree

Fair enough. And maybe a little easier of a question. Going just back to the Bellagio, potential opportunity as an example. Do you — how do you consider owning whole or part of an asset? I think there was some discussion that maybe it would only be a partial sale or a minority stake. Is that — would that be a consideration or how that factor into a decision for investment from VICI, whether it’s the Bellagio or any asset that you make in the future?

Edward Baltazar Pitoniak

Well, John, one of the strategic motivators for doing the deal we did back in late November, early December, was to consolidate what had been a joint venture with MGM Grand/Mandalay Bay. So generally speaking, while we do not rule out joint ventures, generally speaking, we are obviously going to prefer complete ownership of our assets, both in gaming and non-gaming. Again, we’re not absolutely dogmatic, but it is our preference and I think there is significance and meaning in the fact that our most recent deal in Las Vegas was the consolidation of what had been a joint venture, not the creation of a new joint venture.

All of these friction-reducing business practices sum to a lower cost structure. This means a bigger pie for both the tenant and the landlord and from a valuation standpoint, it means more of the rent flows through to AFFO. VICI’s G&A in 2Q23 was just 2% of revenue, which is far lower than most of its peers.

Capital availability to exploit mispricing

The above organic growth functions as a great base from which to grow externally. With this core set of stable assets that require minimal capital investment while generating substantial cash flow, VICI is in a position of excess liquidity.

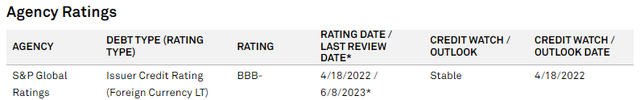

VICI also has access to external capital given its size and credit rating.

S&P Global Market Intelligence

It can and likely will invest many billions in acquisitions over the coming years.

The interest rate opportunity

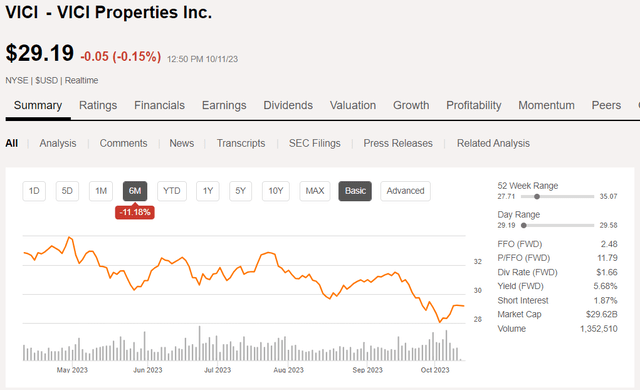

As interest rates rose violently over the past 6 months, triple net REITs got clobbered. VICI fell along with its category.

I last wrote about VICI on March 6th, in which I downgraded it to a hold on valuation. The selloff since that time has once again made it opportunistically cheap which is why I am returning to a strongly bullish stance.

Additionally, VICI has gained a new growth angle which we will detail below.

Rising interest rates are thought to be the death knell of triple net REITs but for VICI they are actually an opportunity. I will explain more deeply below why it is an opportunity, but for starters, you can see below that VICI grew AFFO per share through the entire rising rate environment and is expected to continue growing AFFO/share.

S&P Global Market Intelligence

There are 2 big moving parts when interest rates rise.

- Interest expense increases

- Cap rates rise

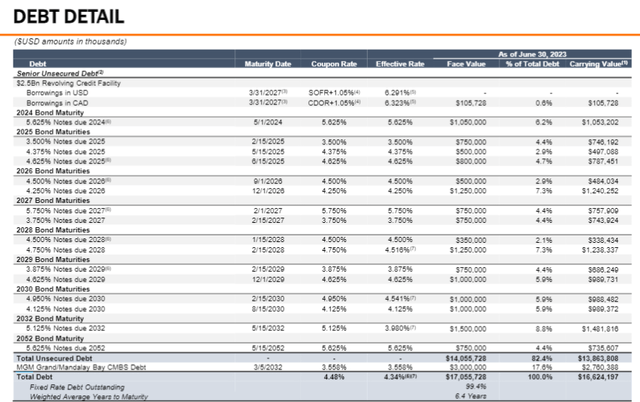

VICI’s interest expense does not look like it will rise all that much. They are 99% fixed rate debt with a weighted average remaining term of 6.4 years.

The most notable near-term maturity is the 5.625% notes due 2024. It is just over $1B but this is among VICI’s most expensive debt so I don’t think it would be all that much more expensive today. Given VICI’s size and credit rating, I suspect they could refinance at 6.5% or less. That would be around $10 million in incremental interest expense or about a penny a share.

So the expense side looks quite manageable and I think it will be more than offset by the increased acquisition opportunity.

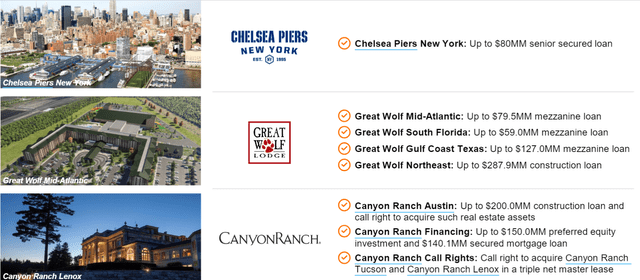

There is a big opportunity in being well-capitalized in a world where others are not. VICI has started hinting at plans to acquire or otherwise accretively take advantage of distress in experiential real estate as existing loans come due. Ed Pitoniak discussed the potential opportunity on the earnings call:

“more than $37 billion of resort and hotel CMBS financing will come due from 2024 through 2028. And I should point out that’s only a fraction of the overall mortgage financing on U.S. hotels and resorts during this period”

The implication is that through their Canyon Ranch strategy, they can scoop things up (potentially at distressed prices) and convert to this business model.

A key distinction here is that experiential properties like hotels and resorts are not struggling operationally. Demand is strong and continues to look strong going forward. The problems many operators are running into are on the financing side. Thus, it is not a plan of acquiring distressed properties, but rather highly profitable properties that are distressed due to financing.

VICI can eliminate the financing distress and get a great deal in the process. They have moved rather significantly into the experiential space.

Just as VICI got into casinos at very high cap rates before they were a hot real estate sector, they may soon have the opportunity to finance or own a variety of experiential real estate at IRRs well above going market rates.

VICI has a history of opportunism, and it now has the financial strength to capitalize on whatever opportunities it sees. I’m sure some of these will be misses along with the hits, but the key here is that they are consistently getting in at higher returns than are otherwise available.

Win/win of loans

A REIT lending to a real estate operator is quite different than a bank doing it because the REIT wants the real estate. When a bank receives real estate through foreclosure they usually end up selling it at fire sale prices such as the foreclosed homes in the financial crisis. Thus, foreclosure is a negative for the bank in most cases.

It is a different situation for a REIT. These loans are collateralized by real estate that VICI wants to own. If the borrower defaults, VICI functionally purchases the property at the discounted rate of the loan-to-value ratio. VICI has explicitly stated that they only provide loans attached to real estate they want to own. I don’t anticipate these counterparties defaulting, but the potentially favorable aspects of foreclosure significantly reduce the risk of the loans.

Global pursuits

A significant portion of U.S. casinos are now owned by big financial institutions or REITs, but the ownership is perhaps more fragmented in other countries. VICI has moved into Canada with some accretive casino acquisitions and is actively pursuing other countries as well.

Canadian casinos strike me as well positioned as the country seems to have an even higher propensity for gaming than the U.S. with greater demand per capita.

Overall, VICI has a rather large pipeline of potential deals with returns on invested capital (ROIC) that significantly exceed their weighted average cost of capital (WACC).

Growth at a value multiple

VICI is trading at 13X forward AFFO which is cheaper than the average REIT and much cheaper than the S&P. I find this multiple to be significantly too low as VICI has attributes that would typically be associated with companies that trade at premium multiples.

- Strong growth outlook from both organic and external

- Trophy caliber properties

- Investment grade balance sheet

- Large market cap

- Track record of dividend growth and shareholder returns

I think it should trade at 16X forward AFFO or about $35.50. That represents just over 20% upside from today’s price. This is not the largest upside available today in the beaten-up REIT sector, but it is quite a large upside relative to the risk level of such an established company. That said, there are always risks to investment.

Risks to thesis

While VICI is diversifying somewhat, the vast majority of its revenues still come from casinos which means that anything that threatens the industry also threatens VICI.

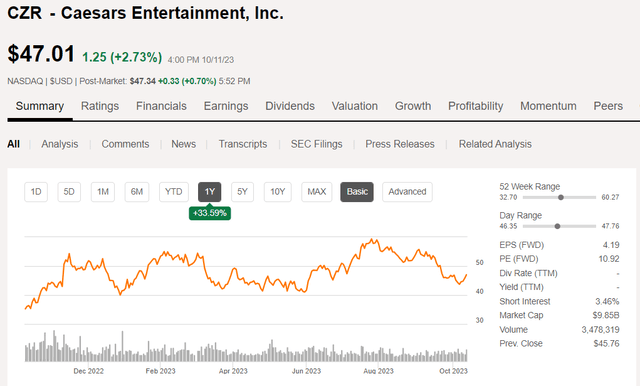

Presently the risks to casinos appear rather low. VICI’s tenants are currently in great shape with ample EBITDAR coverage of rent. Its largest tenant, Caesars (CZR) is trading up nicely with strong earnings.

However, the currently strong state does not mean the future is without risk.

Gambling is a vice. Some would argue that it is harmful to the human condition. At the current moment, society does not seem to have any sort of appetite to ban or limit gaming, but things can change. My crystal ball is not good enough to estimate the chance of such an occurrence, but in my eyes that is the biggest risk to watch out for – a societal or cultural disapprobation of gambling at large.

The Bottom Line

VICI presently represents the best kind of value stock; one which is trading at a value multiple but does not belong there. Market volatility creates opportunity and it appears VICI has fallen through the cracks. We are scooping this up for its combination of value, yield, and growth.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Value Idea investment competition, which runs through October 25. With cash prizes, this competition — open to all contributors — is one you don’t want to miss. If you are interested in becoming a contributor and taking part in the competition, click here to find out more and submit your article today!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VICI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

All articles are published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person.

The information offered is impersonal and not tailored to the investment needs of any specific person. Readers should verify all claims and do their own due diligence before investing in any securities, including those mentioned in the article. NEVER make an investment decision based solely on the information provided in our articles.

It should not be assumed that any of the securities transactions or holdings discussed were profitable or will prove to be profitable. Past Performance does not guarantee future results. Investing in publicly held securities is speculative and involves risk, including the possible loss of principal. Historical returns should not be used as the primary basis for investment decisions.

Commentary may contain forward looking statements which are by definition uncertain. Actual results may differ materially from our forecasts or estimations, and 2MC and its affiliates cannot be held liable for the use of and reliance upon the opinions, estimates, forecasts, and findings in this article.

S&P Global Market Intelligence LLC. Contains copyrighted material distributed under license from S&P

2nd Market Capital Advisory Corporation (2MCAC) is a Wisconsin registered investment advisor. Dane Bowler is an investment advisor representative of 2nd Market Capital Advisory Corporation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Opportunistic Market Sale: 20% off for a limited time!

Right now there are abnormally great investment opportunities. With the market crash, some fundamentally strong stocks have gotten outrageously cheap and I want to show you how to take advantage and slingshot out of the dip.

To encourage readers to get in at this time of enhanced opportunity we are offering a limited time 20% discount to Portfolio Income Solutions. Our portfolio is freshly updated and chock full of babies that were thrown out with the market bathwater.

Grab your free trial today while these stocks are still cheap!