Summary:

- Interest rates have reached their highest level in 16 years, causing REITs to suffer.

- REITs tend to rebound after a significant drop, as seen in historical data from the 1970s.

- VICI Properties is the king of gaming REITs, with a ridiculously great business model that suffered zero rent defaults even during the pandemic.

- VICI stock is now 20% undervalued and yielding 6%. It’s growing almost 11% and offers 19% annual return potential for the next decade, 3x better than the S&P.

- VICI Properties is a potentially great idea for anyone comfortable with the risk profile, including a complex business that will get more complex over time.

VITALII BORKOVSKYI/iStock via Getty Images

This article was coproduced with Dividend Sensei.

Interest rates have soared to their highest level in 16 years, and real estate investment trusts (“REITs”) have gotten crushed.

From 1972 to 1974, inflation started picking up, and bond yields rose 1.4%.

Rates are up 1.4%, and REITs have fallen 30%, precisely as VNQ has done, and so have many blue-chip REITs, including aristocrats like O and Dividend King FRT.

Today, I’m here to explain why VICI Properties Inc. (NYSE:VICI), with a nearly 6% yield, is a very low-risk bet in today’s table-pounding time for REITs.

Why?

As Mark Twain said:

History doesn’t repeat, but it often rhymes.”

What happened in 1974 after REITs fell 30% during that rate spike?

Rates continued soaring, from an average of 7.6% to 12.5% by 1984.

So you know what happened to REITs, right?

Rates soared 5% over ten years, and REITs went up 720%!

Adjusted for the 2nd highest inflation in U.S. history, REITs quadrupled, delivering 16% annual returns.

Nareit

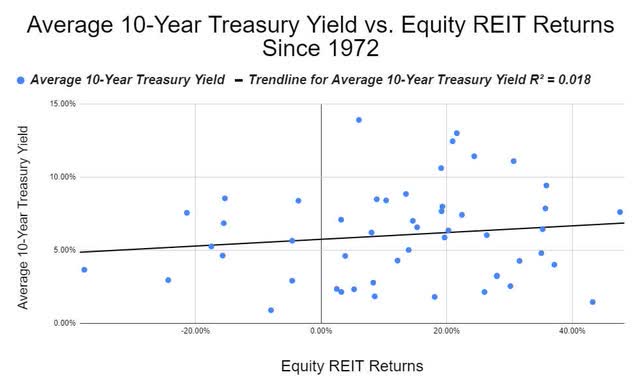

Since 1972 interest rates only explain 2% of annual REIT returns.

That’s 51 years proving that “rates up, REITs down” is a lie.

It might happen in the short term and even last for a year or two.

But after REITs fall about 30%…as they have now, REITs tend to bottom and then take off like a coiled spring bat out of hell.

REITs Fell 30% And Then Had 12 Straight Years Of Gains = 1061% Gain

|

Year |

Equity REIT Returns |

Average 10-Year Treasury Yield |

|

1972 |

8.01% |

6.21% |

|

1973 |

-15.52% |

6.85% |

|

1974 |

-21.40% |

7.56% |

|

1975 |

19.30% |

7.99% |

|

1976 |

47.59% |

7.61% |

|

1977 |

22.42% |

7.42% |

|

1978 |

10.34% |

8.41% |

|

1979 |

35.86% |

9.43% |

|

1980 |

24.37% |

11.43% |

|

1981 |

6% |

13.92% |

|

1982 |

21.60% |

13.01% |

|

1983 |

30.64% |

11.10% |

|

1984 |

20.93% |

12.46% |

|

1985 |

19.10% |

10.62% |

|

1986 |

19.16% |

7.67% |

|

1987 |

-3.64% |

8.39% |

(Source: NAREIT.)

Notice how interest rates were rising from 1974 through 1981 and yet REITs just kept soaring.

That’s because REITs are a natural inflation hedge.

Rising prices = rising rents = rising AFFO = rising dividends.

And guess what stock prices are 97% based on over the long term?

Cash flow and dividends.

Interest rates do not affect REIT growth rates; it’s the investment spread that matters.

-

cash flow yield (cap rate) – weighted cost of capital (what interest rates influence).

In the 1970s, the cost of capital got as high as 20% for some REITs. But property prices fell so much that cash flow yields soared and investment spreads were maintained.

And that is why the market’s obsession with interest rates is silly. It’s like worrying about Apple’s $109 billion mountain of debt.

Is Apple going bankrupt?

It has $109 billion in debt!

Anyone who is bullish about Apple is a fool!

A darn fool I tell you!

Oh wait, they have $62 billion in cash, a net debt position of $57 billion and a debt/EBITDA ratio of 0.9.

That’s why they have an AA+ stable credit rating, equal to the U.S. treasury.

Do you see what I mean?

If you focus on just one factor in investing, you can get the completely wrong idea.

Apple’s (AAPL) $109 billion in debt is 100% irrelevant to its balance sheet safety.

And interest rates are 100% irrelevant to REITs. Investment spreads, access to capital, and management quality are what count.

This is what will make you rich over time in REITs.

And that’s why we are so bullish on 6% yielding VICI Properties right now.

So let me show you the three reasons we love VICI, and so will you.

The Best Business Model In Gaming

VICI was created in 2016 and spun out of Caesar’s Entertainment in 2017. It was a way for Caesar’s, which was struggling and would eventually go bankrupt, to raise cash via a triple-net-leaseback.

It sold its Casinos to VICI and then leased back their use over decades.

VICI started out speculative and junk bond rated because it completely depended on Caesar’s for its revenue.

But today VICI has diversified enough to earn a BBB- stable credit rating from Fitch and S&P.

-

54 gaming facilities across the United States and Canada

-

124 million square feet

-

about 60,300 hotel rooms

-

over 450 restaurants, bars, nightclubs, and sportsbooks

-

Four gold courses.

Vegas is VICI’s crown jewel city with almost 40 million annual visitors, an $80 billion economy, and 11 of the world’s 20 largest hotels. Vegas is known for gaming, but $8.3 billion in gambling revenue is just about 10% of the actual economy.

Vegas is now home to professional hockey, football and potentially a baseball team soon.

It now has Formula 1 and will host the NCAA final four, the NBA championships, and the 2024 Super Bowl. If you love Vegas, you will love VICI, which owns 10 of the best casinos on the strip.

Here is just a sample of what VICI owns in Vegas.

-

Caesar’s Palace

-

The Venetian

-

The MGM Grand

-

Harrah’s

-

Mandalay Bay

-

The Palazzo

-

New York, New York

-

Luxor

-

Excalibur.

And those are just the Vegas properties. It owns properties in:

-

Cleveland

-

Cincinnati

-

Detroit

-

Biloxi, Mississippi

-

Prince George’s County, Maryland (wealthy DC suburb)

-

Lake Tahoe

-

Atlantic City.

That gaming empire has been built up through $35 billion in investments, $21 billion of which was equity financed (see risk section).

I love that VICI has as close to zero risk from casino gambling as on Wall Street. Those 54 properties are rented out to 11 tenants in 15 states and Alberta, 80% of whom are publicly traded companies with SEC regulatory oversight.

VICI has started acquiring international properties, with its first Canadian properties in 2023.

Today it’s the 2nd largest triple net REIT in the world, behind only Realty Income ($3.6 billion EBITDA to $2.9 billion).

During the Pandemic, when it was locked down without a single customer, it remained at 100% occupancy and collected 100% of rent.

Its leases are so safe that adjusted funds from operations, or AFFO, grew 11% annually during the pandemic, and even in the recession of 2024 or possibly 2025, AFFO is still expected to grow about 4% to 5%.

FAST Graphs, FactSet

In fact, since its formation seven years ago, no tenant has ever missed a rent check!

And guess what?

Gaming is highly regulated.

And building a new casino is very expensive.

This creates a wide moat that allows VICI to enjoy profitability in the top 20% of peers.

-

75% AFFO margins.

Remember how triple-net-lease REITs work. The tenants pay for insurance, taxes, utilities, and maintenance.

VICI just collects those super stable rent checks and practically mints money.

VICI’s leases aren’t just long. They are by far the longest in the NNN industry. While Realty usually buys a new property with a 15-year lease, and some NNN REITs get 20-year leases, VICI’s average remaining lease is for another 42 years.

-

cash flow visibility through 2065.

That’s because these are the most mission-critical properties you can imagine.

If you’re the Venetian, will you not renew your lease? Do you have a better property nearby that all your customers are comfortable moving to?

Unlike traditional NNN REITs, where the properties are free-standing retail with no differentiation, casinos are all about the brand.

The average rent for a retail box that NNN or O owns is $460,000 per year or just under $40,000 monthly.

VICI collects $54 million or 100 times as much per property, almost $5 million monthly.

And that $4.5 million monthly rent is a drop for Caesar, who has $7.5 billion in annual operating costs. MGM?

Almost $8 billion in operating costs.

And while anyone with a couple of hundred thousand can build a standalone retail property, it costs $1.5 billion to build the Venetian, and Apollo Management (who owns it) plans to spend $1 billion to remodel it.

-

$943,000 average cost to build a retail store

-

$1+ billion to build a casino.

So to recap, VICI’s average property is so wide that it collects 100X the rent of the average NNN property and costs 1,000X more to build.

And the locations for new gaming properties tend to be highly regulated. A gaming license in most states is an effective monopoly that is essentially a license to mint money.

VICI’s money-minting machine is funding a generous, secure 6% dividend, growing at 8% annually for the last five years.

Management targets a conservative 75% AFFO payout ratio in an industry where 90% is considered safe. Based on its 100% rent collection during the Pandemic, 95% might be VICI’s safety limit.

Rating agencies want to see 6X leverage or less – VICI is at 5.6X with 99% fixed rate debt and a well-staggered bond maturity profile of 6.5 years.

Some Of The Best Growth Prospects In REIT-dom

According to Morningstar, REITs are growing about 6% per year.

That’s slightly below the S&P’s 8.5% growth rate and on par with utilities.

VICI doesn’t just buy casinos in triple net leaseback deals; it’s run by very savvy management capable of building its own projects and diversifying geographically and into non-gaming.

VICI owns a loan portfolio of various resources used to finance expansion.

-

95% of revenue from NNN leases

-

2% income from loans

-

1% golf

-

2% other.

Right now, the loans and various other diversifiers contribute 5% of cash flow, but analysts are excited about what these businesses could mean for VICI long-term.

But in the meantime, its core business has plenty of growth opportunities, including the right to buy another five properties from Harrah’s, Horseshoe, and Caesar’s.

VICI has the right of first refusal and the ability to buy through call rights another seven non-gaming properties it is already an investor in.

OK, so VICI is packed with amazing properties and tons of growth opportunities, led by a CEO who Brad Thomas considers a mad genius, an operator with vision, adaptability, and a proven track record.

So, what does that mean for VICI’s growth prospects?

In a sector growing at 6%, what does VICI offer income investors?

How about a blistering 10.7% annual long-term growth consensus from all 23 analysts covering VICI for a living?

That’s almost 2X the sector’s growth rate, and VICI now has the scale and trust of Wall Street to make that growth happen. Its low cost of capital, ridiculously lucrative business model, and 25% retained AFFO mean $542 million in post-dividend retained cash flow.

That’s more than just about any large blue-chip REIT. VICI could fund a decent amount of investments with pure retained cash flow, something almost no other large REIT can claim.

OK, so VICI is the best way to profit from gambling, or at least the best and safest high-yield way. And it’s a REIT growing at 2X the sector norm and 3X faster than Realty Income (O) (which also, incidentally, owns a casino).

But here’s we are so excited to recommend VICI today.

A Wonderful Company At A Fair Price And Buffett-Like Return Potential

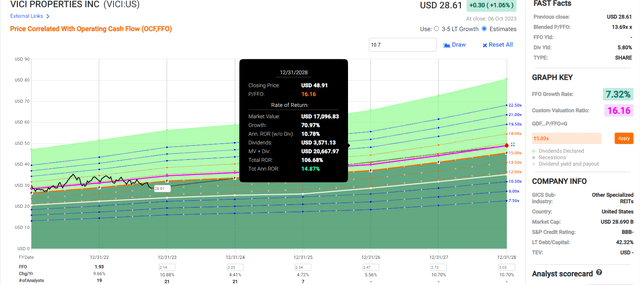

Let me give you a basic summary of VICI first.

Fundamentals Summary

-

yield: 5.8%

-

dividend safety: 79% safe (2.3% dividend cut risk)

-

overall quality: 79% SWAN

-

credit rating: BBB- stable (11% 30-year default risk)

-

long-term growth consensus: 10.7%

-

long-term total return potential: 16.5%

-

Historical Fair Value: $35.64

-

Current Price: $28.72

-

discount to fair value: 19% discount (very strong buy) vs 5% overvaluation on S&P

-

DK rating: potentially reasonable buy (20% discount = good buy)

-

10-year valuation boost: 2.1% annually

-

10-year consensus annual return potential: 5.8% yield + 10.7% growth + 2.1% valuation boost = 16.7% vs 10.2% S&P 500

-

10-year consensus total return potential: = 375% vs 130% S&P 500.

|

Rating |

Margin Of Safety For High-Risk 11/13 SWAN Quality |

2023 Fair Value Price |

2024 Fair Value Price |

12-Month Forward Fair Value |

|

Potentially Reasonable Buy |

0% |

$35.01 |

$35.80 |

$35.64 |

|

Potentially Good Buy |

20% |

$28.01 |

$28.64 |

$28.51 |

|

Potentially Strong Buy |

30% |

$24.51 |

$25.06 |

$24.95 |

|

Potentially Very Strong Buy |

40% |

$16.80 |

$21.48 |

$21.38 |

|

Potentially Ultra-Value Buy |

50% |

$17.51 |

$17.90 |

$17.82 |

|

Currently |

$28.68 |

18.08% |

19.89% |

19.53% |

|

Upside To Fair Value (Including Dividends) |

27.86% |

30.61% |

30.06% |

VICI could turn $1 into $4.75 within ten years, but you don’t have to wait ten years to potentially make a killing from this 6% yielding gambling king.

It’s pennies away from a good buy price.

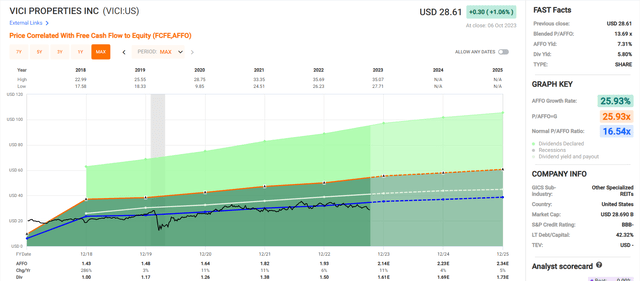

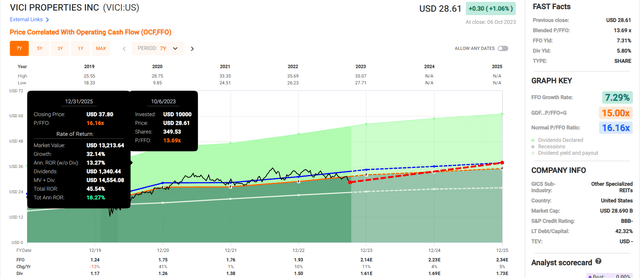

VICI 2025 Consensus Total Return Potential

FAST Graphs, FactSet

VICI 2028 Consensus Total Return Potential

FAST Graphs, FactSet

So, to summarize:

-

30% upside potential in the next year

-

46% upside potential in the next two years vs 20% S&P

-

106% upside potential in the next five years vs 46% S&P 500

-

375% upside potential in the next ten years vs 130% S&P.

And, of course, you’re earning a 6% safe yield, growing at one of the fastest rates in REIT-dom while waiting for these potential returns.

Risk Profile: Why VICI Isn’t Right For Everyone

There are no risk-free companies, and no company is right for everyone. You have to be comfortable with the fundamental risk profile.

Risk Profile Summary

-

Economic cyclicality risk: minimal since its leases take priority over even senior debt for its tenants

-

Tenant credit risk: Caesar’s and MGM are B+ stable rated companies, a 14% risk of default

-

Tenant concentration risk: Caesar’s and MGM are 76% of rent

-

M&A Risk: the lifeblood of the REIT industry, how the sector operates, execution risk

-

High inflation risk: VICI IPO’d in 2017 during a period of very low and stable inflation

-

Interest rate risk: could negatively affect its cost of capital

-

Share price risk: If the stock price were to remain depressed for long enough, management might not be able to adapt to a higher rate environment

-

Diversification risk: the loan portfolio could become a significant part of the business creating higher cash flow variability.

VICI kept occupancy at 100% and collected all rent during Pandemic lockdowns when its guest visits fell to zero.

Unless you think a future recession will result in negative traffic, I’m not particularly worried about VICI’s tenants being able to pay rent.

However, another matter is whether its stock price can recover to prevent investment spread compression.

Net leaseback in gaming is relatively new and began during an era of low rates. Given the specialty nature of casinos, it’s possible that the prices of casinos won’t fall at the same rate that VICI’s cost of capital rises.

That could compress investment spreads and cut its growth outlook significantly.

How do we quantify, monitor, and track such a complex risk profile? By doing what big institutions do.

Long-Term Risk Management Analysis: How Large Institutions Measure Total Risk Management

DK uses S&P Global’s global long-term risk-management ratings for our risk rating.

-

S&P has spent over 20 years perfecting its risk model

-

which is based on over 30 major risk categories, over 130 subcategories, and 1,000 individual metrics

-

50% of metrics are industry-specific

-

this risk rating has been included in every credit rating for decades.

The DK risk rating is based on the global percentile of a company’s risk management compared to 8,000 S&P-rated companies covering 90% of the world’s market cap.

Vici Scores 27th Percentile On Global Long-Term Risk Management

S&P’s risk management scores factor in things like:

-

supply chain management

-

crisis management

-

cyber-security

-

privacy protection

-

efficiency

-

R&D efficiency

-

innovation management

-

labor relations

-

talent retention

-

worker training/skills improvement

-

customer relationship management

-

climate strategy adaptation

-

corporate governance

-

brand management.

VICI’s Long-Term Risk Management Is The 434th Best In The Master List (13th Percentile In The Master List)

|

Classification |

S&P LT Risk-Management Global Percentile |

Risk-Management Interpretation |

Risk-Management Rating |

|

BTI, ILMN, SIEGY, SPGI, WM, CI, CSCO, WMB, SAP, CL |

100 |

Exceptional (Top 80 companies in the world) |

Very Low Risk |

|

Strong ESG Stocks |

86 |

Very Good |

Very Low Risk |

|

Foreign Dividend Stocks |

77 |

Good, Bordering On Very Good |

Low Risk |

|

Ultra SWANs |

74 |

Good |

Low Risk |

|

Dividend Aristocrats |

67 |

Above-Average (Bordering On Good) |

Low Risk |

|

Low Volatility Stocks |

65 |

Above-Average |

Low Risk |

|

Master List average |

61 |

Above-Average |

Low Risk |

|

Dividend Kings |

60 |

Above-Average |

Low Risk |

|

Hyper-Growth stocks |

59 |

Average, Bordering On Above-Average |

Medium Risk |

|

Dividend Champions |

55 |

Average |

Medium Risk |

|

Monthly Dividend Stocks |

41 |

Average |

Medium Risk |

|

Vici Properties |

27 |

Poor |

High Risk |

(Source: DK Research Terminal.)

VICI’s risk-management consensus is in the bottom 13% of the world’s highest quality companies and similar to that of such other blue-chips as

-

National Fuel Gas: dividend king

-

NNN REIT: dividend aristocrat

-

A.O Smith: dividend aristocrat

-

Franklin Electric: dividend champion

-

Roper Technologies: dividend aristocrats.

The bottom line is that all companies have risks.

How We Monitor VICI’s Risk Profile

-

23 analysts,

-

three credit rating agencies

-

26 experts who collectively know this business better than anyone other than management.

“When the facts change, I change my mind. What do you do, sir?”

– John Maynard Keynes.

There are no sacred cows. Wherever the fundamentals lead, we always follow. That’s the essence of disciplined financial science, the math behind retiring rich and staying rich in retirement.

Bottom Line: It’s Time To Bet Big On 6% Yielding Vici Properties

No one can tell you what the stock market or VICI will do in the next year, two years or even three years.

You’ve come to the wrong place if you’re looking for quick trading ideas.

If you want to earn hundreds of % of profit from some of the safest dividends in the world, then you’re in the right place.

VICI is a titan of gaming and one of the most profitable REITs in the world.

-

top 20% of REITs in the world, in fact.

It’s a triple-net lease gaming-focused business with ten core trophy assets in Vegas, making it my favorite low-risk way to profit from the rise of gambling in the US and abroad.

As the world gets richer, people will want to enjoy life, go to resorts, and gamble. And VICI will be cashing in on the simple fact that the house always wins in Vegas, and as we saw in the Pandemic, even when the Casino is closed, VICI still wins.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VICI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Note: Brad Thomas is a Wall Street writer, which means he's not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Introducing iREIT®

Join iREIT® on Alpha today to get the most in-depth research that includes REITs, mREIT, Preferreds, BDCs, MLPs, ETFs, Builders, and Asset Managers. Our iREIT® Tracker provides data on over 250 tickers with our quality scores, buy targets, and trim targets.

We recently added an all-new Ratings Tracker called iREIT Buy Zone to help members screen for value. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus my FREE book.