Summary:

- Exxon Mobil has historically focused on organic growth, but recent market conditions have made acquisitions more profitable.

- The current period of bargain-priced acquisitions is likely coming to an end as the industry recovers from the effects of 2020.

- Industry insiders are buying, indicating a recovery phase rather than a market top, and consolidation is expected to continue.

- Market tops are marked by speculative inexperienced money pouring into the industry to fund unsound projects and acquisitions.

- Exxon Mobil is becoming a growth and income play.

Vladimirovic

Exxon Mobil (NYSE:XOM) has a relatively long history of growing organically while making an occasional acquisition to supplement that growth. Generally organic growth costs a lot less and is usually more profitable for shareholders. There has been an exceptional period where insiders believe that it is more profitable to acquire growth than to grow it organically and Mr. Market has been demanding return of capital rather than production growth. But this industry has long had little resistance to decent pricing. So, the current period of bargain priced acquisitions is likely coming to an end as the recovery from fiscal year 2020 proceeds. Should that be the case, then a company like Exxon Mobil is ideally placed to grow organically for years to come without having to take the more expensive acquisition route in the future as relationships return to traditional levels.

Where We Are Now

Generally, a market top is when speculative money pours into the industry “to make a killing” and ends up making financially risky deals while paying too much. This often leads to rapid production growth like we saw in the early 2000’s and eventually leads to a cycle end (in 2015) as overproduction leads to low prices which discourages drilling activity to bring supply and demand back into balance.

While there has been talk about all the deals and the fact that it marks a market top, the facts really are that insiders see a lot of bargains due to the market demand for no premium in a lot of deals. Note that Chevron (CVX) offered a small premium for Hess (HES) and the stock promptly got punished by the market.

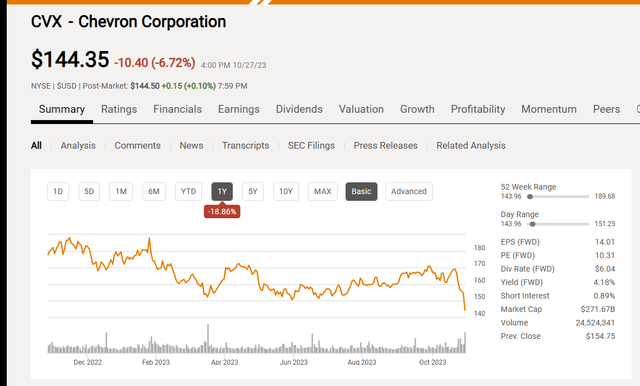

Chevron Common Stock Price History And Key Valuation Measures (Seeking Alpha Website October 28, 2023)

The stock price action wiped out the value of the premium and then some. This has been a fairly typical reaction to stock deals with a premium for some time in the industry. As of last Friday, which is shown above, the stock price is practically straight down.

There are some that would point to some issues that are particular to Chevron in the latest quarter. But my own experience is that this market does not need an excuse other than an acquisition involving stock to drive the price down. Other issues just add to the market urgency.

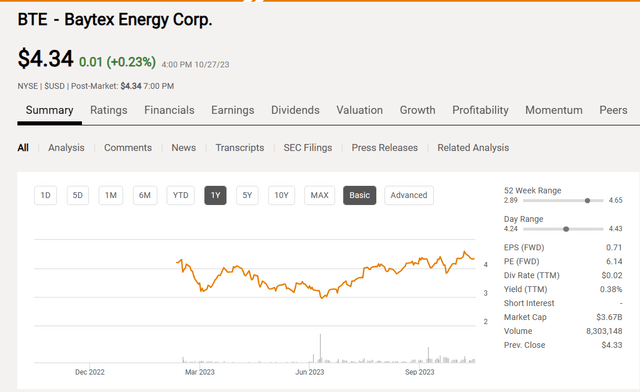

Earlier, Baytex Energy (BTE) acquired Ranger Oil (ROCC) and again you can see that same stock price slide.

Baytex Energy Common Stock Price History and Key Valuation Measures (Seeking Alopha Website October 28, 2023)

Clearly the stock floundered until the deal completed around June 20, 2023. Once the deal completed, the market came around to the idea that there were advantages to the combination (which also shows above).

However, this market has been adamantly opposed to all stock deals (or even significant use of stock in deals) for some time in the industry. That will change as the recovery from the 2015-2020 period proceeds.

But the industry insiders, as these two deals demonstrate, are the ones buying. That is the key difference between a market top and the recovery phase. We have unusually gone through a couple of periods of consolidation because this early phase of the oil and gas industry cycle has lasted a long period. That means this recovery has a ways to go as there is no speculative money doing unsound deals in sight.

But as long as consolidation continues, and the result is not a lot of production growth then commodity prices should continue to cycle in a range where the industry either makes money or makes more money.

Should this continue long enough, then as David Dreman writes in his book “Contrarian Investment Strategies: The Psychological Edge” the necessity of guarding against another downturn gets replaced by the need to “keep up with the Joneses” to bring about an eventual cyclical peak. After all, if a downturn has not occurred for a while (the thinking goes) then clearly there is less risk or no risk of a downturn (until it happens of course to begin the cycle again).

Underrating risk when it is not under your nose has long been a human characteristic.

Exxon Mobil Deals And Organic Projects

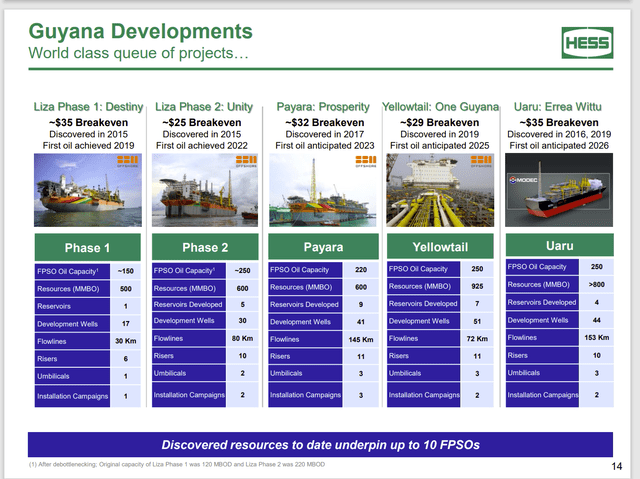

Exxon Mobil has a major organic deal in the form of the Guyana Partnership. The partnership had been exploring Guyana for a couple of decades before the first discovery was made. Once that discovery was made, many followed to turn this into a major project.

Hess Corporation Detail Of Approved FPSO Projects (Hess Corporation Presentation At Barclays CEO Energy Power Conference September 7, 2023)

Keep in mind that Chevron was willing to pay roughly $60 billion to acquire Hess and obtain a share of this project. In contrast, Exxon Mobil and the partners explored until they found the discovery and then were able to build the first two FPSO’s at rock bottom prices. In this case, Exxon Mobil likely has the lower cost deal. This is especially true when the construction began for the first and probably second FPSO during the 2015-2020 period when prices were likely “rock-bottom”.

What Chevron has going for it, is that this project is likely to become huge that it will be significant for both Exxon Mobil and Chevron in the future. In the past it has been estimated that this project could represent as much as one-third of the Exxon Mobil production by the end of the decade. Few discoveries are that large and as profitable as shown above by the low breakeven. That could make it worth every penny that Chevron is about to spend even though Chevron is probably paying more to get an interest in the project at this stage. Chevron in effect lowered risk for a higher payment at a later stage. Both strategies are acceptable to the market as a rule provided a company like Chevron is not perceived to have paid too much.

The Permian

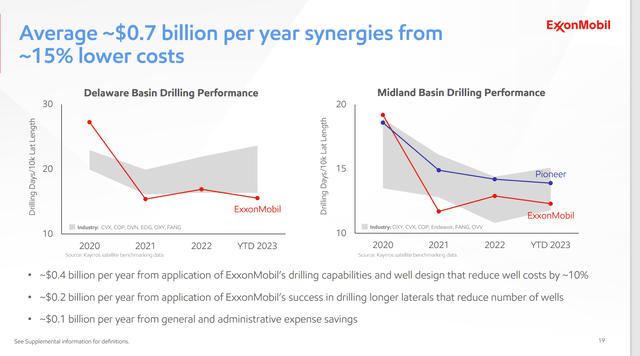

Meanwhile, Exxon Mobil bought its way into more Permian acreage through the acquisition of Pioneer (PXD) just like Chevron did in Guyana. As an aside, note that Exxon Mobil stock dropped on this announcement as well. Here, the reason is that Exxon Mobil believes it can improve operations to make this investment considerably more valuable. This is a slightly different strategy.

Exxon Mobil Permian Drilling Performance Advantage (Exxon Mobil Third Quarter 2023, Earnings Conference Call Slides)

The deal begins with the advantage shown above and it likely increases as technology progresses. Technology is moving forward so fast, that some questionable deals turn into bargains within five years. That is likely going to be the case here where the bargain gets better and it was not questionable to begin with. The Pioneer acquisition is likely a bargain and Exxon Mobil will make it more of a bargain as technology advances.

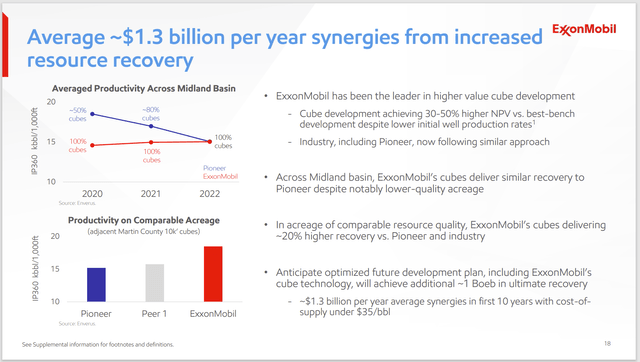

Exxon Mobil Productivity Advantages In The Permian (Exxon Mobil Earnings Conference Call Slides Third Quarter 2023)

These two slides combined should be demonstrated to shareholders in the form of superior profitability. The upside is that secondary recovery for unconventional is becoming a reality and could materially add to recovery factors (profitably) by the time Exxon Mobil is ready to consider that.

Exxon Mobil management has long talked about raising the recovery of unconventional wells because that recovery lags seriously behind conventional. As a fairly young method to produce oil, the unconventional business probably has years of improvement ahead. Meanwhile the company begins that process with known advantages shown above while working to increase those advantages in the future.

Denbury Acquisition

The Denbury acquisition (DEN) jump starts the company’s entrance into the carbon capture business. Denbury already had some serious carbon dioxide movement capabilities because it specializes in secondary recovery.

Denbury struggled for years with a huge debt pile and only recently exited reorganization. There is every chance that the company assets need a fair amount of upgrades and maintenance due to the fact that the company was cash constrained. The risk of course is that Exxon Mobil paid too much for the situation. However, it is likely that any mistake in that area is small compared to the investments required going forward.

The Future

The flurry of a second round of acquisitions in the industry can be confusing to investors because acquisitions tend to occur early in a recovery and then near a market top. In this case, it is very likely that insiders still see the whole industry as cheap and are therefore still making acquisitions. There are notable insiders that are selling like John Hess. But it still appears that the majority of companies (and insiders) are doing the purchasing.

That, combined with a lack of production growth should mean that the recovery will continue for some time into the future. Generally, cyclical tops are marked by an influx of speculative and inexperienced money that funds unsound projects (usually high cost) and unsound acquisitions. Right now that appears to be lacking.

Therefore, companies like Exxon Mobil likely have a lot of good years ahead. The acquisitions made should produce faster growth than was the case in the past. Guyana is also poised to become a source of material growth.

Exxon Mobil is poised to become a growth and income play in the future as the dividend will likely rise faster than production once the initial acquisition and assimilation (optimization as well) costs are out of the way. In particular, Guyana has switched from a cash drain to a cash flow producer. That will happen with the acquisitions as well. This company is a strong buy for income and growth investors who require a higher level of safety.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XOM, HES, BTE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation of the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits their own investment qualification.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Long Player believes oil and gas is a boom-bust, cyclical industry. It takes patience, and it certainly helps to have experience. He has been focusing on this industry for years. He is a retired CPA, and holds an MBA and MA. He leads the investing group Oil & Gas Value Research. He looks for under-followed oil companies and out-of-favor midstream companies that offer compelling opportunities. The group includes an active chat room in which Oil & Gas investors discuss recent information and share ideas. Learn more.