Summary:

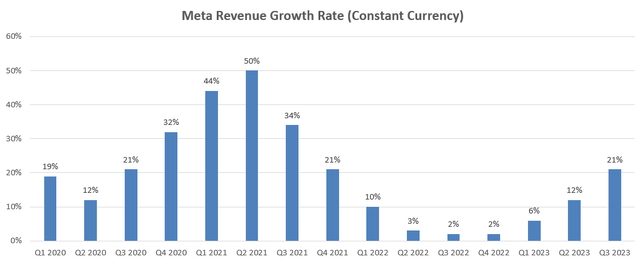

- Meta reported over 20% growth in advertising revenue in Q3 FY23.

- The company anticipates a 16% increase in capital expenditure for the next fiscal year.

- FTC regulatory issues pose near-term risks for Meta, leading to a ‘Sell’ rating for investors.

panida wijitpanya

Meta (NASDAQ:META) reported its Q3 FY23 earnings on October 25th, delivering over 20% growth in advertising revenue. However, the company’s management anticipates a 16% increase in capital expenditure for the next fiscal year, and the FTC regulatory issues could pose near-term risks for Meta. I maintain a ‘Sell’ rating for Meta and recommend investors avoid it.

Q3 FY23 Review and Outlook

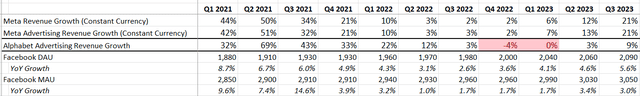

They achieved a 21% revenue growth in constant currency, and the operating margin expanded to 40% in Q3 FY23. Facebook’s daily active users increased by 5.6% year over year, and monthly active users increased by 3%. It’s worth noting that the total headcount declined by 24% year over year after several rounds of layoffs, as I discussed in my initiation article. The margin expansion was primarily driven by reduced spending in marketing & sales, as well as general and administrative expenses. The lower marketing spending and reduced headcount costs contributed to their 24% year-over-year drop in marketing & sales expenses.

The table below compares Meta’s advertising revenue growth with Alphabet’s (GOOGL) revenue growth rate on a quarterly basis. Meta did experience double-digit revenue growth starting from Q2 FY23, partially due to their lower comparable during the period from Q2 FY22 to Q4 FY22, when their revenue only grew by 2-3%.

Meta, Alphabet Quarterly Earnings

Facebook’s daily and monthly active users were growing at 8-9% in FY18 and FY19, then surged to double digits in FY20. Nowadays, their user base growth has started to moderate to low-to-mid-single digits. I believe their platform has become saturated and is approaching its peak of popularity. If their user base only grows at a low-single-digit rate, Meta has to deliver a much higher total number of ad impressions and average price per ad. Increasing the total number of impressions without growing the user base could result in a poor customer experience for their users.

Additionally, Meta is banking on their investment in AI to help increase the relevance of their digital ads to individual users, thereby raising their average price per ad. I think it might be possible for Meta to increase the average price per ad in the future, as generative AI does have the potential to provide more personalized ads to users. Assuming low-single-digit user base growth and mid-single-digit price growth, they can still achieve around high-single-digit revenue growth in the future.

As of September 30, 2023, they have $61 billion in cash on their balance sheet with $18 billion in debts, indicating a very strong balance sheet. For the full-year guidance, they project a full-year revenue of $133 billion at the midpoint, representing a 14% year-over-year growth. They anticipate FY23’s total expenses to be in the range of $87-89 billion, slightly lower than their previous range of $88-91 billion. I believe their FY23 guidance is quite robust, indicating strong top-line growth and well-executed expense control measures they have implemented in the past. However, several issues are emerging.

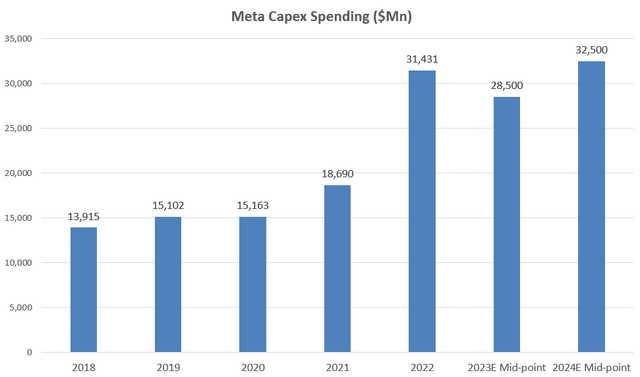

Issue 1: High Capital Spending in FY24

For the full year of FY23, they are guiding the total capital expenditure in the range of $27-30 billion, but it will increase to the range of $30-35 billion in FY24, marking a 16% year-over-year increase at the midpoint. They indicated that they have to accelerate investments in servers, data centers, and AI-related technologies.

I believe Meta has to allocate tremendous capital expenditures to AI-related solutions to sustain their digital advertising business. Additionally, Meta is exploring the next frontier for future growth and investing significantly in the metaverse, as I pointed out in my introductory article. Using the midpoint of their FY23 guidance, the capital spending will represent approximately 27% of total revenue, a remarkably high figure among big tech companies. For comparison, Alphabet only allocated 11% of revenue to their capital expenditure in FY22, and Microsoft (MSFT) spent just 13% of revenue on capital spending. It’s worth noting that both Alphabet and Microsoft have capital-intensive cloud infrastructure businesses while Meta doesn’t.

To me, Meta’s capital spending seems staggering. These high expenditures will lead to increased depreciation costs in the coming years. Furthermore, such substantial spending will limit their ability to generate high free cash flow.

Issue 2: FTC Regulatory Risk

The Federal Trade Commission (FTC) proposed changes to the agency’s 2020 privacy order with Meta after alleging that the company failed to fully comply with the order on May 3, 2023. Their proposal includes a blanket prohibition preventing Meta from monetizing youth data. Specifically, it prohibits Meta from profiting from data it collects, including virtual reality products, from users under the age of 18, according to the FTC. During the Q3 earnings call, Meta’s management indicated that they are contesting this matter. However, if they fail, it could have an adverse effect on their business.

Recently, the media reported that Meta paused ads for users under 18 years old in Europe starting from the week of November 6th, as it rolled out subscriptions for their social media platforms.

In my opinion, it is difficult to predict the outcome; however, these lawsuits or negotiations with regulators will likely take a long time to settle. The 2020 privacy order imposed a $5 billion civil penalty on Meta and expanded the required privacy program. This order created significant chaos and technological changes for Meta. Therefore, I don’t think investors should underestimate the consequences of these investigations, as they might trigger additional R&D expenses to meet regulatory requirements.

Valuation

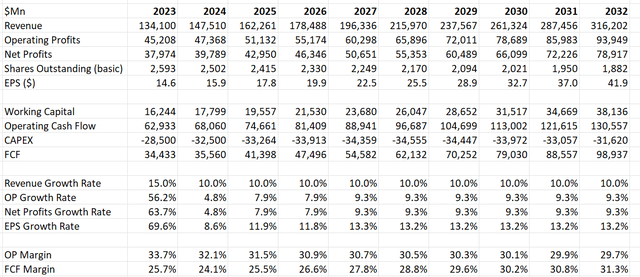

I am using the mid-point of their revenue and capex guidance for FY23 and FY24 assumptions in the model. I continue to believe their normalized revenue growth to be around 10%. As analyzed in my recent article on Alphabet, I estimate that the entire digital advertising industry is growing by around 8% over the next decade. As one of the industry leaders, Meta could experience slightly higher growth, and their metaverse could also generate some additional growth. Therefore, I think a 10% normalized growth rate is quite reasonable for Meta.

Meta DCF – Author’s calculation

All other assumptions are intact, and the fair value of their stock price is estimated to be $290 per share as per my estimates.

Takeaways

It’s encouraging to see Meta’s advertising business returning to double-digit growth; however, I am concerned about their surging capital expenditures and potential FTC investigations. The current stock price does not interest me, and I maintain a ‘Sell’ rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.