Summary:

- AMZN exceeds expectations indeed, based on the stellar FQ3’23 performance across AWS and e-commerce segments, naturally contributing to the stock’s impressive rally.

- FQ4’23 may bring forth another excellent quarter for AWS as well, based on its recently signed deals in September being way higher than its FQ3’23 deal volume.

- However, investors must also note Mr. Market’s growing concerns about the uncertain macroeconomic outlook, with COST already reporting a decelerating growth trend in the US.

- We believe that there may be more volatility in the near-term, especially due to the growing fear index in the stock market, with the SPY similarly retesting its support levels of $400s.

- Therefore, while we may rate the AMZN stock as a Buy, investors may want to wait for another pullback for an improved margin of safety.

Imagesrouges

We previously covered Amazon.com, Inc. (NASDAQ:AMZN) in August 2023, discussing its turnaround story from the FY2022 debacle, when the e-commerce company reported negative profit margins.

The combination of its drastic cost optimization efforts, returning advertising spend, and AWS’s outperformance in the FQ2’23 quarter had led to our Buy rating, further aided by the booming Generative AI market.

In this article, we will be discussing AMZN’s stellar FQ3’23 performance across AWS and e-commerce, with Mr. Market naturally cheering the excellent top and bottom line performance, as reflected in the stock’s impressive rally.

We shall discuss further.

AMZN’s AWS Investment Thesis Proves To Be Robust Indeed

For now, we are not surprised that Mr. Market has cheered at AMZN’s AWS results, since it marks the potential end of the enterprise cost optimization cycle, thanks to the robust demand for Generative AI service.

In the latest quarter, the company reported AWS revenues of $23.05B (+4.1% QoQ/+12.2% YoY) and operating income of $6.97B (+30% QoQ/ +29% YoY), resulting in drastically improved margins of 30.2% (+6 points QoQ/ +3.9 YoY), compared to FY2019 levels of 26.2% (+2.2 points YoY).

We may see FQ4’23 bring forth another excellent quarter for AWS as well, based on the AMZN management’s optimistic commentary in the FQ3’23 earnings call (highlighted in bold for clarity):

And while we still saw elevated cost optimization relative to a year ago, it’s continued to attenuate as more companies transition to deploying net new workloads. We’re seeing the pace and volume of closed deals pick up and we’re encouraged by the strong last couple of months of new deals signed.

For perspective, we signed several new deals in September with an effective date in October that won’t show up in any GAAP reported number for Q3 but the collection of which is higher than our total reported deal volume for all of Q3. (Seeking Alpha)

With these numbers, it appears that AMZN may very well hold on to its market-leading share in the global cloud segment, building upon its Q2’23 share of 32%, compared to its direct competitors, Microsoft Corporation’s Azure (MSFT) at 22% and Google (GOOG), (GOOGL) at 11%.

While market analysts have reckoned that MSFT may potentially jeopardize AWS’ leading share, we believe that the Generative AI market is big enough to accommodate multiple winners.

We are not overly concerned about MSFT’s and GOOG’s high growth trend in the cloud segment as well, at revenues of $24.25B (+1% QoQ/ +19.3% YoY) and $8.41B (+4.7% QoQ/ +22.5% YoY) in the latest quarter, respectively.

This is because AMZN continues to boast the largest cloud backlog of $133B (+0.6% QoQ/ +27.5% YoY), with a weighted average remaining life of 3.5 years. These numbers imply that its cloud prospects remain stellar in the intermediate term, despite Larry Summers, the former US Treasury Secretary, predictions of a hard landing.

This is compared to MSFT’s backlog of $19.47B (-9.6% QoQ/ +12.6% YoY) and GOOG’s at $64.9B (+7% QoQ/ +23.8% YoY) in the latest quarter.

As a result, we maintain our optimism about AMZN’s excellent AWS prospects, with it likely to continue being a bottom line driver moving forward.

AMZN’s Valuations Suggest That The Stock May Be Cheap Here

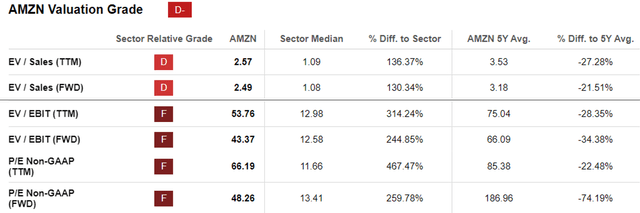

AMZN Valuations

For now, AMZN trades a notably cheap FWD EV/ EBIT valuation of 43.37x, compared to its 1Y mean of 53.76x and 3Y pre-pandemic mean of 75.70x, though still with a notable premium compared to the sector median of 12.58x.

The management also guided an FQ4’23 operating income of $9B at the midpoint (-19.4% QoQ/ +229.6% YoY).

Combined with its FQ3’23 operating income of $11.18B (+45.5% QoQ/ +343.1% YoY), FQ2’23 of $7.68B (+181.3% QoQ/ +131.6% YoY), and FQ1’23 at $2.73B (+8.3% QoQ/ -20.9% YoY), it appears that the e-commerce giant may be able to generate a robust FY2023 operating income of $32.81B (+168% YoY).

Based on its FQ3’23 share count of 10.55B, AMZN may very well record an exemplary estimated FY2023 EBIT per share of $3.10 (+158.3% YoY), much improved compared to its FY2019 levels of $1.44 (+16.1% YoY).

We believe that the stock is trading near its fair value of $134.44 as well, based on its depressed FWD EV/ EBIT valuation of 43.37x.

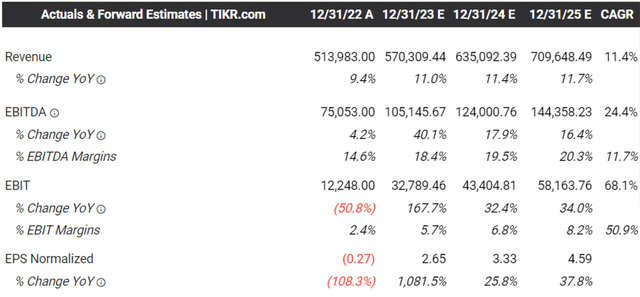

The Consensus Forward Estimates

The consensus still estimates that AMZN may generate an impressive top and bottom line growth at a CAGR of +11.4% and +24.4% through FY2025, compared to its normalized CAGR of +24.8% and +30.1% between FY2016 and FY2022, respectively.

The management has also demonstrated a laser focus on improving its profitability after the FY2022 debacle.

This is especially witnessed in AMZN’s improved overall EBIT margins of 7.8% in FQ3’23 (+2.1 points QoQ/ +5.8 YoY) and projected FY2023 margins of 5.7% (+3.3 points YoY), compared to its FY2019 margins of 5.2% (-0.1 points YoY).

Combined with the management’s increased focus on operating cost and capex optimizations, we are not surprised that the consensus estimates that the e-commerce company may be able to record a sustained expansion in its EBIT margins to 8.2% and FCF margins to 10.7% by FY2025.

This is compared to its FY2019 levels of 5.2% and 7.7%, respectively.

So, Is AMZN Stock A Buy, Sell, or Hold?

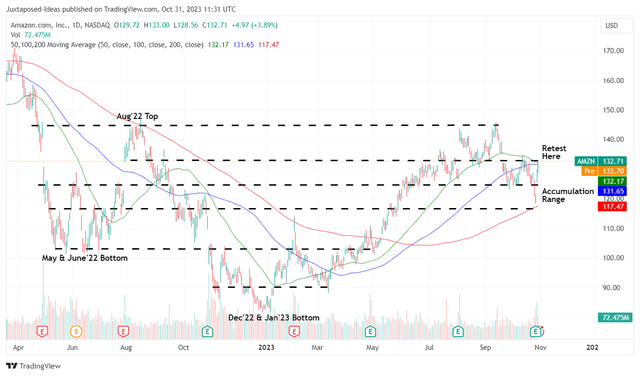

AMZN 1Y Stock Price

Based on the consensus FY2025 adj EPS estimates of $4.59 and AMZN’s impacted FWD P/E valuations of 48.26x (compared to its pre-pandemic mean of 68.41x), there appears to be an excellent upside potential of +66.9% to our long-term price target of $221.51.

However, the stock has drastically rallied by +10.9% since the recent earnings call, with it currently retesting its resistance level of $132.

We believe that there may be more volatility in the near term, especially due to the growing fear index in the stock market, with the SPY similarly retesting its support levels of $400s.

Therefore, while we may rate the AMZN stock as a Buy, investors may want to patiently wait for another pullback, before adding according to their dollar cost averages and risk appetite, preferably between its critical support levels of $115s and $125s for an improved margin of safety.

In addition, investors must also note Mr. Market’s growing concerns about the higher inflationary pressures for food/gas prices and elevated interest rate environment.

This is on top of the restart of the US federal student loan repayment from October 2023 onwards, with the same discount already reflected in AMZN’s depressed stock FWD valuations.

The management has also hinted at a similar trend in the FQ3’23 earnings call, perhaps explaining why the e-commerce giant has opted to hold two Amazon Prime Day events in 2023, with the first falling on July 11-12 and second on October 10-11:

During the quarter, we held our biggest Prime Day event ever with Prime members purchasing more than 375 million items worldwide and saving more than $2.5 billion on millions of deals across the Amazon store.

From a customer behavior standpoint, we still see customers remaining cautious about price, trading down where they can and seeking out deals, coupled with lower spending on discretionary items. (Seeking Alpha)

For now, the Prime Day has been a net positive to AMZN’s top and bottom lines in the latest quarter, with an expanding North American/ International Net Sales of $120.01B (+6.9% QoQ/ +12.6% YoY), operating income of $4.21B (+81.4% QoQ/ + 246.6% YoY), and margin of 3.5% (+1.5 points QoQ/ +0.9 YoY).

Nonetheless, investors may want to monitor its performance over the next few quarters, with another retailer, Costco Wholesale Corporation (COST) already reporting a deceleration in US comparable sales at +2.7% (excluding gas/ forex) and e-commerce at +3.5% in September 2023.

This is compared to August 2023 levels of +3.2%/ -2.2% and September 2022 levels of +8%/ +2.3%, respectively.

It also remains to be seen if the outperformance observed in AMZN’s AWS may be sufficient to balance the potential intermediate-term headwinds in the e-commerce segment.

As a result, investors may want to temper their expectations, especially since the Fed expects a normalized economy only by 2026. Patience may be more prudent for now.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, MSFT, GOOG, COST either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.