Summary:

- Meta Platforms, Inc.’s generative AI advancements offer promising growth prospects.

- Meta’s numerous social commerce endeavors over the past several years have yielded valuable shopping data that can now be leveraged to develop generative AI-powered products.

- While Meta’s growth prospects through generative AI are indeed bountiful, there are also certain risks investors should acknowledge.

Galeanu Mihai

With the artificial intelligence, or AI, revolution in full swing, investors are keen to observe how Meta Platforms, Inc. (NASDAQ:META) will deploy generative AI across its platform, and more importantly, how it could improve revenue growth prospects. The social media giant has introduced various AI-powered services for both consumers and advertisers lately, leveraging its enormous treasure of user data. While the company faces several risks that could subdue growth prospects, the stock is attractively priced at its current valuation. Nexus is upgrading Meta stock to a “buy.”

In the previous article about Meta, we discussed how changes to Meta’s recommendation algorithms have enabled it to collect more data on its users’ interests and content consumption trends, and that this data will prove to be valuable in terms of training its own AI models. We also discussed some of the risks associated with its approach to building complex AI models in comparison to the approach taken by rival Alphabet/Google (GOOG). Now, let’s discuss some of Meta’s key deployments of generative AI across its platform.

Meta’s generative AI endeavors

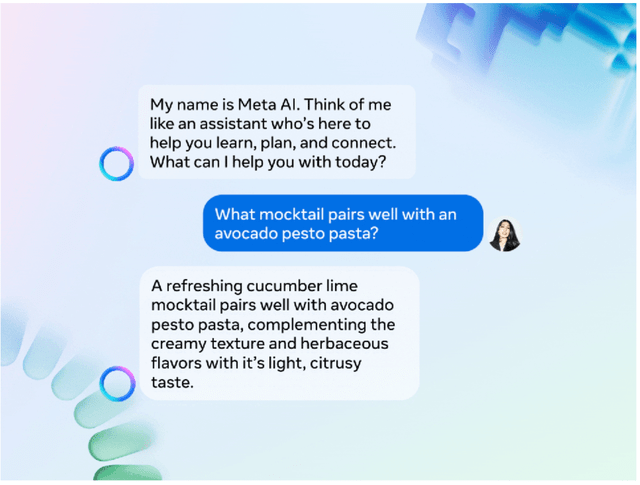

A few weeks ago, Meta platforms rolled out the Meta AI assistant, which users can interact with and ask questions on WhatsApp, Messenger, and Instagram.

The Meta AI assistant is aimed at encouraging greater engagement across the Family of Apps, which can be conducive to more commercial activity on the various platforms such as Instagram, which is already a popular social commerce destination for shoppers.

If Meta can successfully induce consumers to use the Meta AI assistant to start their commercial activities, it can allow Meta to better connect consumers with the right merchants. This could potentially even open up a new monetization avenue for Meta, whereby it could charge commission fees to merchants to whom Meta directs customers through its conversational AI feature.

Note that “chats with AIs, including messages mentioning the Meta AI assistant and their responses, are not end-to-end encrypted,” enabling Meta to read and store chat information. Meta has built the AI assistant in a manner that allows it to continuously learn about each user’s preferences and become better and better at serving each user more efficiently, making the Meta AI assistant a sticky platform feature as users will find it increasingly convenient to initiate their commercial activities through the assistant, and the platform at large, given that Meta is already well-familiarized with their unique preferences. Moreover, the chat histories with Meta AI will also be used for training other AI models and developing new AI features to keep users increasingly engaged.

The Meta AI assistant also enables users to create images using text prompts, powered by Meta’s image creation model, Emu. This can help further enhance the shopping experiences across its platforms as users can start describing what they are looking for, which subsequently enables Meta to better connect these consumers with the right merchants through visual means.

Aside from shopping, Meta AI assistant will also be able to help and guide users with other activities, such as planning a trip with friends in group chats, which can drive other forms of commercial engagement like travel bookings through Meta’s Family of Apps, again conducive to more forms of revenue for Meta shareholders.

If the level of commercial activity through Meta’s platforms successfully increases through the Meta AI assistant, it could indeed entice more merchants to advertise their products/ services through the Family of Apps to stay top of mind among consumers, conducive to more advertising revenue for shareholders.

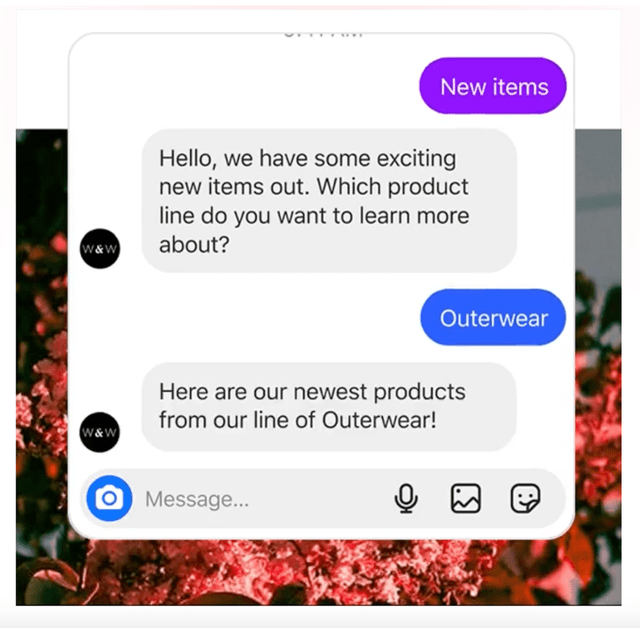

Furthermore, Meta’s recently-introduced AI Studio enables developers to build their own tailored chatbots aimed at enabling merchants to facilitate e-commerce and customer support through AI-powered, automated conversations, significantly advancing the business messaging capabilities through Meta’s Family of Apps.

Instagram Direct Messaging for Business (Instagram)

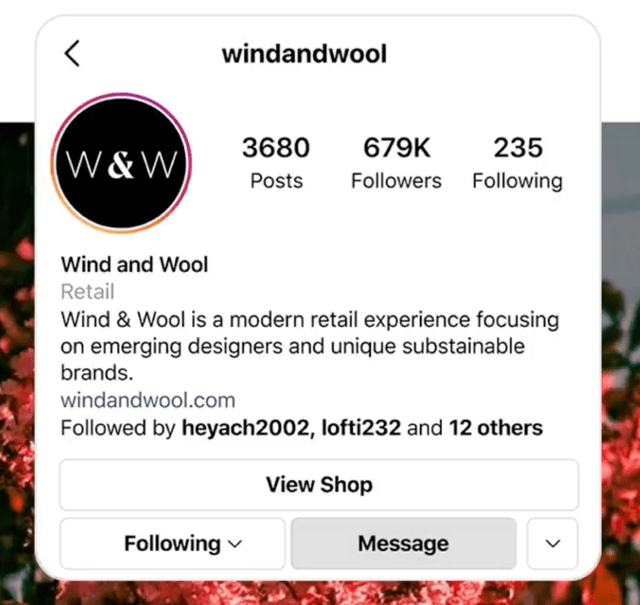

Business messaging through WhatsApp, Messenger and Instagram is already one of Meta’s greatest strengths, as it enables consumers interested in advertised products to reach out to the merchants directly through the “Click-to-message” ad features.

Instagram ‘Click-to-message’ ad (Instagram)

More importantly, it enables merchants to build relationships and close deals with interested consumers more easily through sharing more product information, suggesting related products, as well as highlighting special promotion offers. According to a 2022 study conducted by Forrester Research:

“At the composite organizations, orders resulting from a Meta Business Messaging interaction have values 20% higher than their average order values.”

On the Q3 2023 Meta earnings call, CEO Mark Zuckerberg shared:

“Business messaging also continues to grow across our services and I believe will be the next major pillar of our business. There are more than 600 million conversations between people and businesses every day on our platforms. To give you a sense of what this could look like when it’s scaled globally, every week now, more than 60% of people on WhatsApp in India message a business app account.

…

Today, most commerce and messaging is in countries where the cost of labor is low enough that it makes sense for businesses to have people corresponding with customers over text. And in those countries like Thailand or Vietnam, there’s a huge amount of commerce that happens in this way. But in lots of parts of the world, the cost of labor is too expensive for this to be viable. But with business AIs, we have the opportunity to bring down that cost and expand commerce and messaging into larger economies across the world. So making business AIs work for more businesses is going to be an important focus for us into 2024.”

Meta’s endeavor to enable merchants to build their own customized AI-powered chatbots should indeed lead to greater adoption of business messaging solutions as merchants seek to convert more ad impressions into sales through automated sales conversations without needing to hire more sales agents to handle inquiries. This should be conducive to more ‘click to message’ advertising revenue for shareholders.

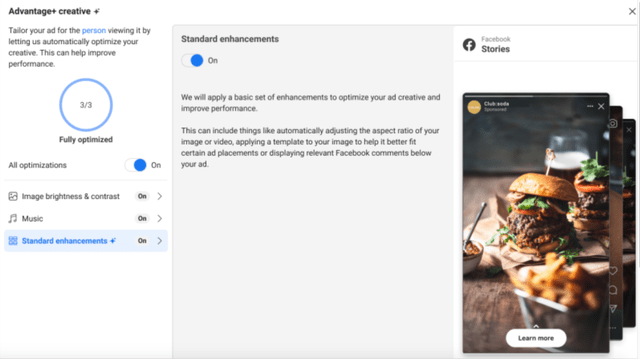

Aside from automated chatbots, Meta has also been offering other AI-powered ad-solutions that automate the advertising process on its Family of Apps. Moreover, before the hype around AI even began late last year, Meta introduced Advantage+ shopping campaigns in August 2022, which automates the creation of ads to help advertisers reach relevant audiences more easily.

Example of Advantage+ Creative set up (Meta)

On the last earnings call, CEO Mark Zuckerberg shared:

“Our AI tools for advertisers are also driving results with Advantage+ shopping campaigns, reaching a $10 billion run rate and more than half of our advertisers using our Advantage+ creative tools to optimize images and text in their ads creative.”

These AI-powered tools essentially strive to leverage the massive amount of data that Meta holds on its users, such as how people tend to interact with ads through likes, comments and shares, as well as what type of imagery leads to higher click-through-rates.

This is where Meta’s social commerce endeavors over the past several years starts to pay off, because by facilitating e-commerce transactions through its own platforms, Meta possesses deep insights into what works and doesn’t. Some of Meta’s social commerce ventures include Facebook Marketplace, Facebook Shops, Instagram Shops and WhatsApp Business Catalog.

Meta has indeed been succeeding at inducing more shopping activities on its platforms. For instance, a 2022 research piece found that “of all Instagram users, 70% open the app to shop.” Subsequently, these endeavors have created a treasure of commerce data that can now be used to build powerful generative AI features which enable advertisers to achieve higher conversions for their ads.

One of the generative AI tools Meta is currently working on is “Background Generation,” enabling advertisers to create image backgrounds for their ads simply using text prompts. Note that rival Google also offers this capability through its “Product Studio” service. As competition intensifies, Nexus believes this generative AI feature will eventually evolve into the automated production of real-time background images in the moment when a user discovers an ad, specifically personalized for that user to induce conversion.

Meta certainly sits on a lot of valuable user data to produce such personalized ad experiences, including insights into what type of ad images have induced a particular user to click through in the past, what type of content a user likes to watch on Reels, and what type of pages/accounts a user follows. Meta could feed this data into its generative AI features to automatically produce background images for ads that lead to higher conversions, conducive to more advertising revenue for shareholders.

Now while Meta’s growth prospects through generative AI are indeed bountiful, there are also certain risks investors should acknowledge.

Meta stock risks

Competition will be intense: Amazon and Google are also introducing similar generative AI-powered shopping features, and there is the risk that they could offer more superior experiences than Meta. For instance, one of Meta’s initiatives includes automatically adjusting the product headlines and description texts presented in ads in a personalized manner for audience members, in order to drive higher conversions.

Google has introduced a similar feature, and could be better at automating relevant text, simply due to the nature in which people search for products on Google compared to Facebook/ Instagram. Google is primarily used as a search engine whereby users can type out questions or can use longer phrases when engaging in commercial activities. This enables Google to adjust the product headlines/ descriptions in real-time to match the phrases used in the user’s query, conducive to higher conversions.

Example of automatically created product descriptions and headlines based on user query (Google)

On the other hand, the search engines on Instagram and Facebook are not built for handling long-phrased commercial queries, so Meta does not currently have the same level of text-based data offering insights into how shoppers search for products (though this could change as Meta rolls out Meta AI assistant and other conversational tools).

More broadly, Meta will need to prove that its own AI models and features facilitate a better shopping experience than competing services. If Google and Amazon turn out to deliver more powerful AI models and solutions that offer more seamless e-commerce experiences, then consumers may end up shopping on these platforms instead, which would undermine Meta’s ability to grow advertising revenue for shareholders.

Moreover, while Meta sits on massive amounts of data for fueling its generative AI endeavors, rivals Google and Amazon also benefit from enormous datasets to build their own AI features. So even if Meta’s new generative AI-powered ad solutions lead to higher conversion rates, what ultimately matters is whether these conversion rates will be higher than the ad solutions offered by its main advertising rivals. Investors should keep a close eye on how the new generative AI-powered ad solutions from these tech giants improve conversion rates for advertisers, as this will determine revenue growth prospects going forward.

Algorithm issues: Meta is once again facing lawsuits from various U.S. states over the addictiveness of its Instagram platform. The complaint reads that:

“Meta did not disclose that its algorithms were designed to capitalize on young users’ dopamine responses and create an addictive cycle of engagement”

This isn’t the first time Meta has faced such complaints, as whistleblower Frances Haugen revealed in 2021 that Meta was aware of its algorithms developing “a toxic environment for some teen girls already experiencing negative feelings about their bodies.”

These legal actions against Meta could require the company to alter its algorithms in a way that subdues addictiveness and is less harmful to people’s mental health. In fact, Nexus Research would be supportive of such changes, as it would be a positive for society.

From an investor’s perspective, it becomes challenging to assess how well Instagram/ Facebook will be able to sustain its level of Daily Active Users (DAUs) going forward in the face of Meta being required to adjust its algorithms. If Meta can’t prove to strike the right balance between keeping users engaged on its platforms while respecting people’s mental health, then it could raise questions over its ability to drive healthy, advertising revenue growth going forward.

Meta Financials & Valuation

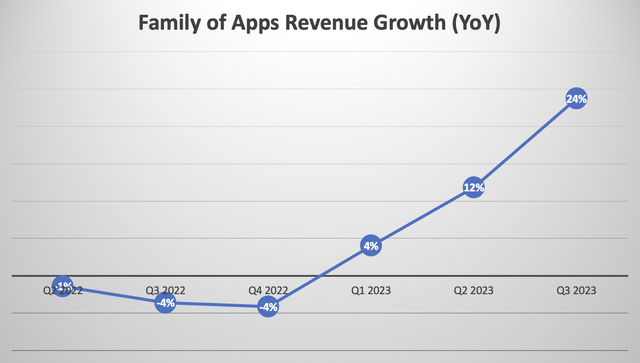

Revenue from Meta’s Family of Apps grew by nearly 24% last quarter on a year-over-year (YoY) basis.

Nexus, data from company filings

This impressive growth rate is reassuring to investors that Meta’s platforms and ad solutions remain valuable avenues for merchants to reach consumers.

The company gave revenue guidance of between $36.5 and $40 billion for Q4 2023. The mid-point of this guidance comes out at $38.25 billion, which would imply year-over-year revenue growth of almost 19% in Q4, and total 2023 revenue growth of just over 14%.

Looking ahead, the worldwide digital advertising market is expected to grow at a compounded annual growth rate of 13.9% until 2030, as per Research And Markets. While competition will be intense given Google and Amazon’s own generative AI advancements, as well as the potential rise of new competitors, Meta is well-positioned to capitalize on the digital advertising market growth through its new generative AI-powered ad solutions thanks to years of social commerce endeavors and its rich data treasure trove.

In fact, in a previous article, Nexus outlined how in some ways generative AI could be a threat to rival Amazon, including the conflict of interest of whether it will use its massive shopping-related data treasure to promote its own-branded products or third-party products, which could subdue merchants’ willingness to advertise, or even sell on Amazon. Meta and Google don’t share this problem, and could be better positioned to win in the era of generative AI advertising. Nonetheless, investors should still beware of smaller advertising rivals like TikTok taking more market share in era of AI.

Meta will need to spend heavily on innovation and infrastructure to stay competitive in the generative AI race, which is expected to pressure profit margins over the foreseeable future.

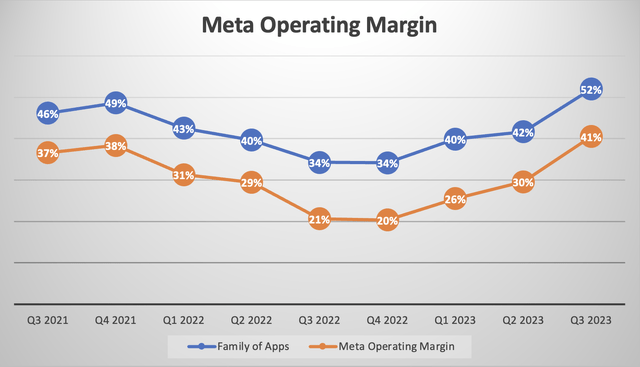

Last quarter, the operating margin for Meta’s Family of Apps expanded to 52%, taking the company-wide operating margin to 41%.

Nexus, data from company filings

While this margin expansion over the past few quarters has been encouraging, testament to the successful “year of efficiency,” Meta’s operating expenses are expected to rise going forward, subduing the prospects for further margin expansion.

On the last earnings call, CFO Susan Li shared:

“We expect full-year 2024 total expenses to be in the range of $94 billion to $99 billion. We continue to expect a few factors to be drivers of total expense growth in 2024. First, we expect higher infrastructure-related costs next year. Given our increased capital investments in recent years, we expect depreciation expenses in 2024 to increase by a larger amount than in 2023. We also expect to incur higher operating costs from running a larger infrastructure footprint. Second, we anticipate growth in payroll expenses as we work down our current hiring underrun and add incremental talent to support priority areas in 2024, which we expect will continue to shift our workforce composition toward higher-cost technical roles.

…

We anticipate our full-year 2024 capital expenditures will be in the range of $30 billion to $35 billion, with growth driven by investments in servers, including both non-AI and AI hardware, and in data centers.”

Even once Meta has built out an adequate infrastructure footprint, operating costs are expected to remain high given that the new generative AI-powered features will be a lot more compute intensive than its traditional social media features. Over time, Meta will indeed strive to improve cost efficiency and profit margins. However, Zuckerberg did reveal on the earnings call that for the foreseeable future, they will be more focused on driving engagement with its generative AI features as opposed to cost efficiency:

“To the question about efficiency and costs, I think initially, it’s most important to focus on getting to product market fit.”

Hence, Meta’s data center compute costs are expected to remain elevated for the time being as the social media giant experiments with and promotes new features.

Furthermore, talent wars will certainly heat up as the generative AI race intensifies, which will drive payroll expenses higher as the social media giant strives to attract the best software engineers and data scientists through lucrative compensation packages.

Additionally, keep in mind that Meta continues to spend heavily on its “Reality Labs” segment to build out the metaverse, and is on track to spend over $15 billion on this venture in 2023. The prospects for returns from these heavy investments are still highly debated, but what is certain is the drag effect on operating margins. The operating losses from Reality Labs lowered Meta’s operating margin by 11 percentage points last quarter. Zuckerberg has made clear that the metaverse remains a high-priority investment area for the company.

Therefore, operating expenses are likely to remain elevated for the foreseeable future, undermining the outlook for operating margins. So it’s safe to say that the year of efficiency is over.

As per Seeking Alpha’s data on Meta stock valuation, shares currently trade at around 18x 2024 earnings, which is well below Meta’s 5-year average forward PE of 22.71x.

Furthermore, its forward Price-Earnings-Growth [PEG] ratio, which measures how reasonably the stock is valued relative to its projected growth rates, stands at 1.11.

A PEG ratio of 1 is indicative of a fairly valued stock. Though unsurprisingly, growth stocks rarely trade at fair value, and instead tend to trade at a certain premium to its fair value. The extent to which a stock trades at a premium to its fair value depends on factors such as how confident the market is in a company’s long-term growth prospects, the executive management team, the competitive strength of its products/ services, market share, and balance sheet strength.

For context, the 5-year average for Meta’s PEG ratio is 1.51, which means the market has historically assigned a 50% premium to fair value given the company’s market position and promising growth prospects for advertising revenue.

Although lately the stock has been trading much closer to fair value amid various uncertainties, not least being the chief executive’s decision to invest heavily in the metaverse with unclear prospects for returns on investments.

Meta’s forward PEG ratio of 1.11 is significantly below the ratios of its two main advertising rivals, Google and Amazon, which trade at 1.44 and 1.92, respectively.

With Meta trading at close to fair value, the investment risk is considerably lower as one is not paying too much of a premium for the stock based on expected growth. In fact, with a PEG ratio close to 1, Meta stock is relatively better positioned to outperform in the event of higher-than-expected growth rates.

Nexus is upgrading the stock to a “buy” based on its attractive valuation and its generative AI- related growth prospects, though investors should remain cautious of the aforementioned risks and excessive metaverse-related spending dampening future earnings growth potential.

(Please read disclosure section for more information on the author’s position on Meta stock.)

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

While Nexus has a ‘buy’ rating on Meta stock, Nexus wants to be transparent with its readers as to why it doesn’t own the stock.

Meta platforms, and social media companies in general, have become infamous for deliberately designing algorithms that induce addictiveness and harm people’s mental health, leading to cases of anxiety and depression. Nexus refuses to profit from such harmful business practices.

Current and future ratings on the stock simply reflect whether Nexus believes the stock will go higher or lower based on business developments and growth prospects. Nexus Research aims to continue offering an unbiased assessment of Meta’s business in all future articles to enable Seeking Alpha readers to make well-informed investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.