Summary:

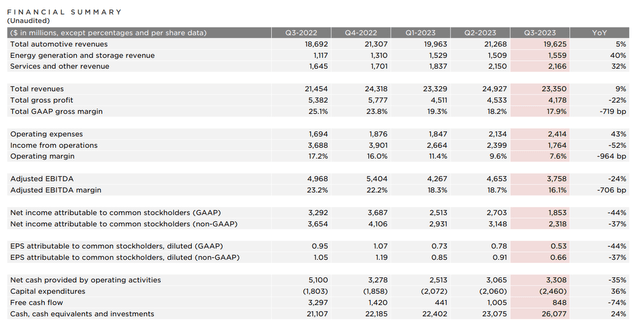

- Tesla, Inc. Q3 2023 earnings disappointed investors and analysts, with sales and EPS below estimates.

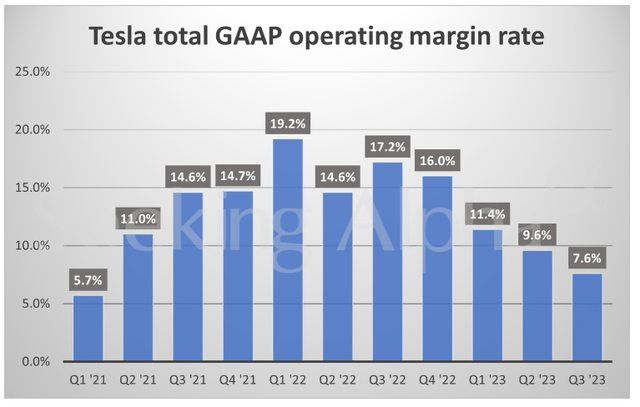

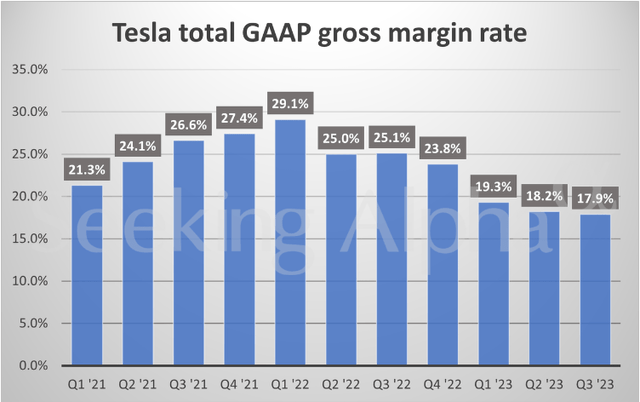

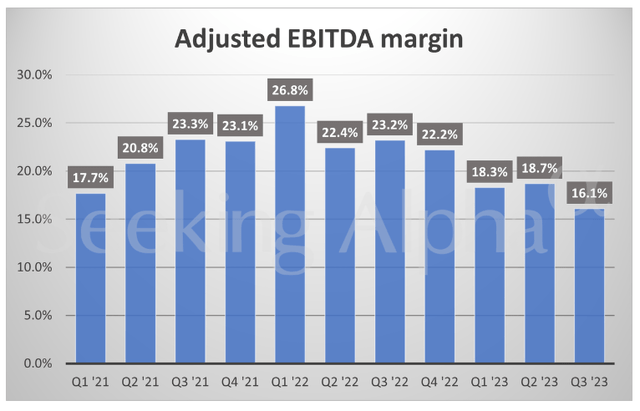

- Operating profit margin, gross profit, and adjusted EBITDA margins have been falling for several quarters.

- Demand for EVs is not growing despite discounts, and the Cybertruck announcement may take even longer to generate positive cash flows.

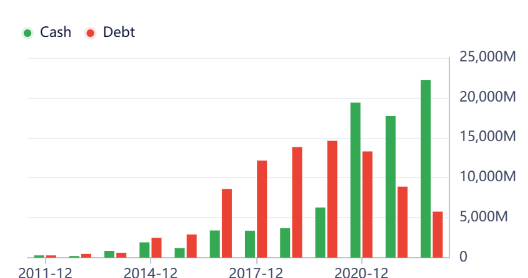

- The company has ample liquidity reserves.

- Tesla is ridiculously overvalued, given the fact the company is no longer a growth star.

SimonSkafar

Tesla, Inc. (NASDAQ:TSLA) has recently reported its Q3 2023 earnings results. These disappointed many investors and market analysts because both the electric vehicle (“EV”) maker’s sales and EPS were below estimates. The net profit was also substantially lower compared to the same period a year ago. TSLA stock has corrected somewhat since the report’s publication, but is still trading quite high, in my opinion. The Cybertruck announcement does not paint a very good picture, either. I was right in my previous rather pessimistic view of Tesla’s stock, it seems. Even my earlier thesis on Tesla’s wonderful prospects for its energy and storage business seems to be quite exaggerated now. But let me explain all this in some more detail.

Tesla’s earnings

A lot has already been written about Tesla’s earnings release. So, I will just touch on the key points.

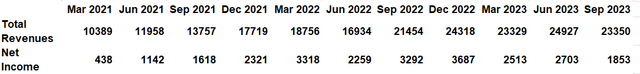

In short, the adjusted earnings per share totaled 66 cents vs 73 cents per share expected, whilst the revenues totaled $23.35 billion vs $24.1 billion expected.

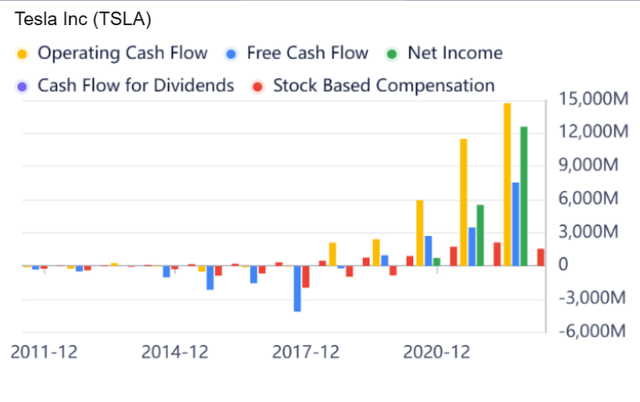

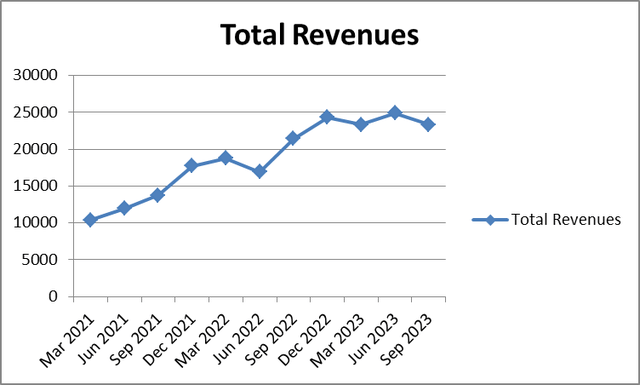

All that does not look inspiring. But let us have a look at Tesla in charts and we can really see that Tesla’s efficiency is not rising, indeed.

This is especially true of its operating profit margin. But other indicators, including the gross profit and the adjusted EBITDA margins, have been falling for a few quarters as well.

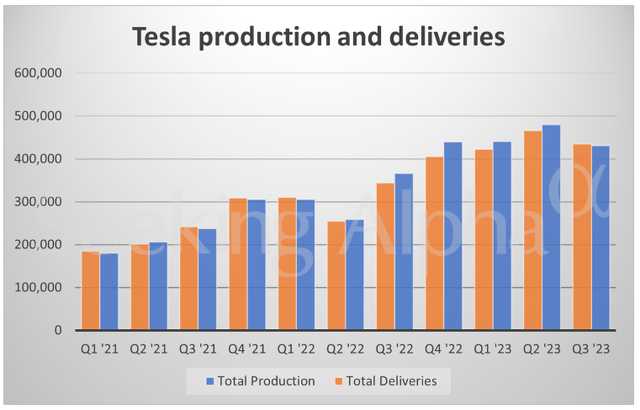

You might be saying that the automotive revenues have been quite stable for several quarters. But both the total deliveries and the total EV production have decreased in the last quarter QOQ. At the same time, the last reported period was the first one since Q2 2022 when the total production and deliveries saw a substantial decline.

Other news

The most problematic part of the story is that the demand for EVs is not growing in spite of all the numerous discounts. But CEO Elon Musk aims to deliver the 1.8 million EVs in 2023. Tesla’s CEO is willing to offer further discounts in order to reach this target. In my view, it might not be reasonable to have the “whatever it takes” approach to delivering a fixed number of vehicles by a certain date, given the fact numerous price cuts have already been made, whilst the company’s margins are at the lowest in 2 years.

A lot of news agencies also reported Tesla’s announcement on Cybertruck. By the way, most of the rise in the company’s operating expenses was due to “Cybertruck, artificial intelligence initiatives, and other projects.” In his earnings call, Musk said he expected that it would “take a year to 18 months before [Cybertruck] is a significant positive cashflow contributor.”

During the conference call, Musk said that Tesla will end up producing around 250,000 Cybertruck units per year. But Tesla’s CEO also added the corporation would reach that output sometime in 2025. According to Musk’s projections, “it will take a year to 18 months before [the Cybertruck] is a significant positive cashflow contributor.” However, the company still has not released prices or key specifications that would affect Cybertruck’s demand and profits. So, it is highly likely that Cybertruck would take even more time to generate positive cash flows for Tesla.

Recap of my previous article

The article “Tesla stock is a sell before the next recession” was published in May this year. In that article, I was quite skeptical of the company’s ability to generate substantial net profits due to the company’s price wars with other EV makers. I also noted that despite the numerous price cuts the company was still unable to generate sufficient demand in the key regions it wanted to expand in. But the Q1 2023 earnings reported at the time were substantially better compared to the 3Q 2023.

1Q 2023

Earnings per share: 85 cents adjusted vs 85 cents expected by analysts

Revenue: $23.33 billion vs $23.21 billion expected by analysts.

3Q 2023

Earnings per share: 66 cents vs 73 cents per share expected by analysts

Revenue: $23.35 billion vs $24.1 billion expected by analysts.

Unfortunately for Tesla’s shareholders, the revenues were roughly the same, whilst the EPS decreased significantly. So, it seems that I was right in my skepticism of the most popular carmaker (by market cap) in the U.S. stock market. This is worrying for a high-growth company like Tesla. Investors are normally willing to overpay for high-growth companies’ stocks because of the skyrocketing revenues and profits. However, in the earlier work on Tesla, I noticed that the corporation’s EPS seemed to peak at the time.

Company’s fundamentals

My main point is that Tesla is still valued as a growth star. But the fundamentals are not there. In my view, this is mainly because Tesla has been actively growing its revenues in the last three years. So, Mr. Market decided to value the company as a beautiful growth star.

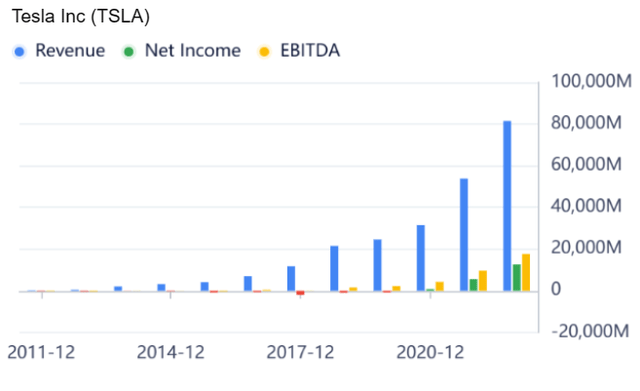

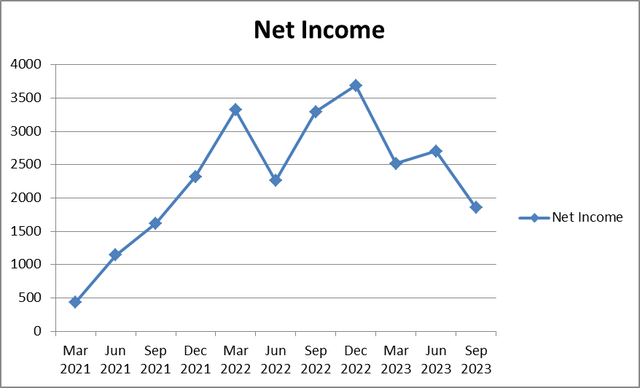

On the surface, Tesla’s indicators look great. For example, Tesla’s annual net income has been rising since 2020 at a good pace.

The same is true of the revenue rise as can be seen from the diagram above.

However, the quarterly revenues and earnings point to a not-so-rosy picture. Since the December 2022 quarter, the revenue growth has stalled. As concerns the net profit, it has been falling since December 2022.

This can be very well seen from the two diagrams below.

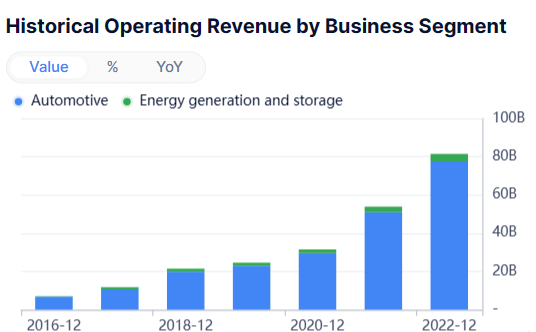

In my previous article, I also wrote about the company’s other business segments apart from the EV sector, namely energy generation and storage. But even though the energy and storage business had a 148% year-on-year growth in the third quarter, the last quarters paint a different picture. Year-on-year sales for the segment jumped to $1.529 billion in Q1 2023. But in the two subsequent quarters, the revenues were almost flat with $1.509 billion in Q2 and $1.559 billion in 3Q.

Not to mention that Tesla is an EV business that generates 85% of its revenues from car sales. The proportion of the automotive-to-energy generation and storage revenues can be well seen from the graph below. This is obviously not good for the company in terms of diversification.

GuruFocus

Tesla bulls might also point to the fact the company is enjoying ample liquidity reserves. However, credit rating agencies are not very positive about Tesla.

GuruFocus

Tesla is now rated Ba3 by Moody’s, the agency’s low investment-grade rating even though Tesla’s numbers point to a rating much higher than that.

According to Moody’s March 2023 release:

“The scorecard-indicated outcome using Moody’s Automobile Manufacturers methodology is A2, measured for the last 12 months ended September 30, 2022.” “On a forward-looking basis, the scorecard-indicated outcome remains A2.”

But the agency is so skeptical because of Tesla’s narrow product lineup, rising competition, and “corporate governance challenges, with considerable latitude exercised by CEO Elon Musk.”

Earlier on, I wrote about rising competition from Chinese EV-makers Tesla has to deal with. But a lot of investors’ enthusiasm, in my opinion, is due to the fact the company’s management is far too optimistic about Tesla’s future innovations and profits. The most obvious example is that of autonomous self-driving. Tesla’s fans have been waiting for Tesla to introduce its first fully autonomous car for several years already. However, this still has not happened yet. The point I am making is that investors seem to be making too many assumptions, thus keeping Tesla’s stock valuations at high levels.

Valuations

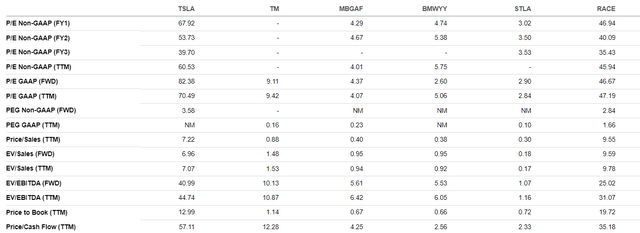

The valuations are also extremely high in spite of the recent stock price correction.

The table below summarizes Tesla’s key valuation multipliers and also compares these to those of other automakers.

The automakers above do not solely produce EVs. They also make traditional cars. But still, the table above gives an idea of how overvalued Tesla is.

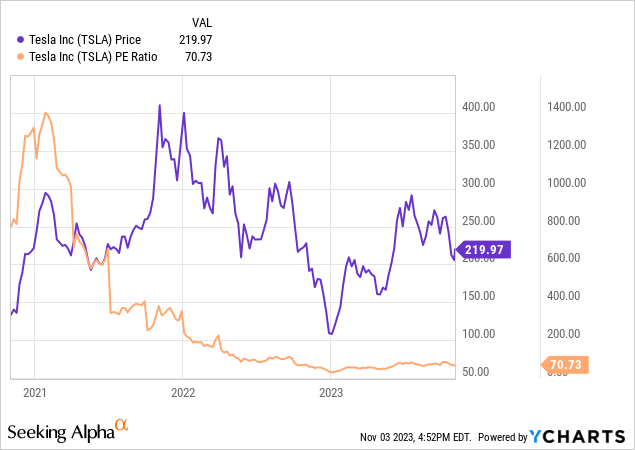

However, historically we can safely say that Tesla’s valuation ratios were even higher than they are now.

This is especially true of the company’s P/E ratio.

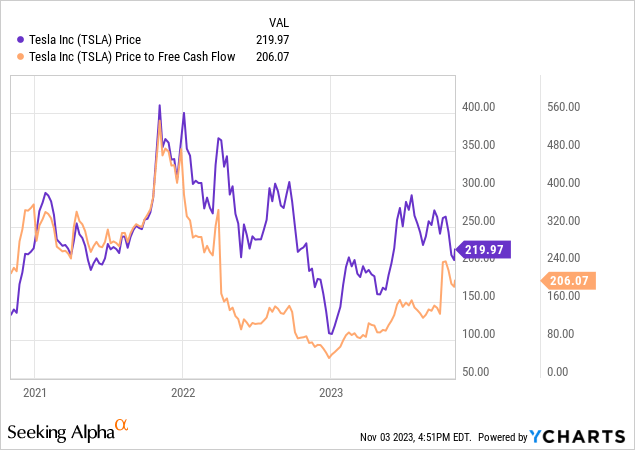

The situation with the price-to-free cash flow ratio is less obvious than that. But still, the company’s all-time high of $560 was at the end of 2021.

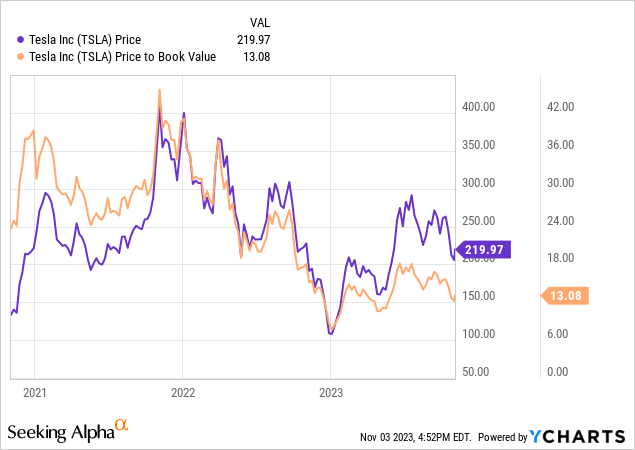

The P/B ratio is also ridiculously high, given the fact a “normal” P/B is usually between 1 and 3. However, in 2021, it was even higher than that.

Tesla’s valuations are not at their all-time highs. But still, they are not at their all-time lows. I would say that the company’s stock is far too expensive.

Below I summarized some key risks for both TSLA’s bulls and bears.

Upside risks

- Some of Tesla’s innovations can eventually materialize and start generating incredible profits.

- The stock is highly popular among investors. So, any piece of good news can make TSLA soar.

- The company is not heading for bankruptcy any time soon. Just the opposite is true. Tesla has ample cash reserves and its debt is reasonable compared to the liquidity it holds.

Downside risks

- The stock’s volatility is a clear downside risk. It can soar to all-time highs, but it can also fall materially. In 2021, the stock used to cost $400 per share, whilst at the beginning of 2023 it was almost $100 per share.

- Elon Musk gives far too optimistic forecasts. This is especially true of Tesla’s autonomous driving story.

- The fact the company’s storage business has not recently recorded too much growth is also a downside risk.

- The valuations are high.

- It is likely the global economy will enter a recession.

- The monetary conditions are very tight and fewer people can afford to buy a new car.

Conclusion

Tesla is a very popular company managed by a charismatic and innovative CEO. But all this is already taken into account by the general market. The company’s revenue and profit growth has stalled. Matters could get even worse, given the tight monetary conditions, high competition, and the fact Tesla is far too focused on electric vehicles. At the same time, in spite of the obvious risks, the stock valuations are still ridiculously high compared to most automakers. I would not personally rush to buy TSLA shares. I will rate Tesla, Inc. stock as a HOLD just because the company is in pretty good financial shape thanks to ample amounts of liquidity.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.