Summary:

- Exxon Mobil substantially underperformed the broader U.S. stock market this year, which was not fair in my opinion.

- The acquisition of Pioneer Natural Resources is expected to build long-term value for shareholders.

- According to my valuation analysis, the stock is substantially undervalued.

Michael M. Santiago

Investment thesis

My latest bullish thesis about Exxon Mobil (NYSE:XOM) aged well because the stock notably outperformed the broader U.S. market over the last quarter. Today, I would like to reiterate the “Strong Buy” rating for XOM and explain why I am still bullish. The valuation is still very attractive, with a 20% upside potential under very conservative assumptions for my dividend discount simulation. The management made a strong strategic move by acquiring Pioneer Natural Resources (PXD), which is highly likely to build long-term value for shareholders. I also like that the management not only focuses on revenue growth but also prioritizes structural cost savings.

Recent developments

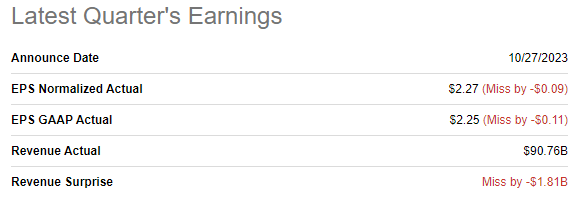

The latest quarterly earnings were released on October 27, when XOM missed consensus estimates by a narrow margin. Revenue decreased YoY by 19%, which is not surprising to me given the spike in energy commodity prices in 2022 caused by the Russia-Ukraine war, which commenced in February 2022. The bottom line followed the revenue decline as the adjusted EPS shrank from $4.45 to $2.27.

Seeking Alpha

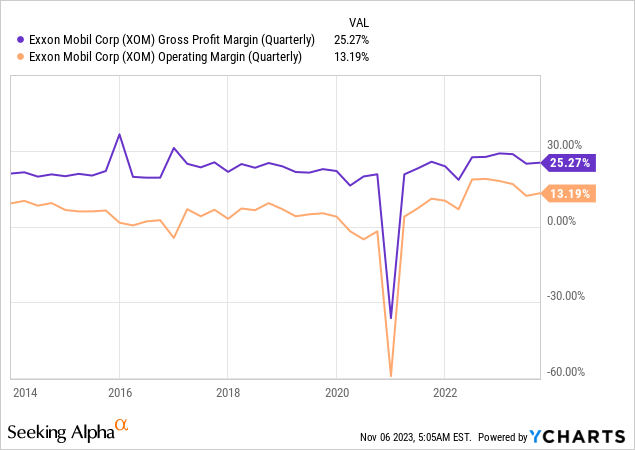

Despite experiencing a notable revenue decline in 2023, profitability metrics are still strong. Seeking Alpha Quant assigns XOM the highest possible A+ profitability grades, which is a bullish sign. It is also important to underline that the current levels of the gross and operating margins are substantially higher than during the late stages of the previous oil and gas supercycle, which started cooling-off in early 2014. That said, from the secular standpoint, the management did well in improving the operating efficiency of the company.

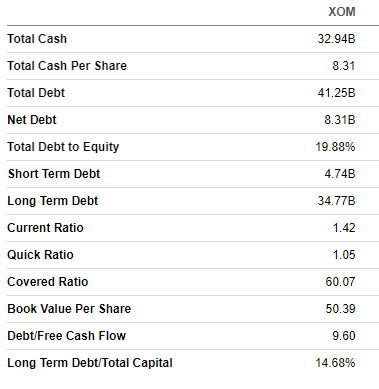

During last year’s massive tailwinds for energy commodity prices, XOM did extremely well in absorbing positive factors. The balance sheet improved significantly as now the leverage ratio is below 20%, and the covered ratio is around 60. The company had a staggering $33 billion cash cushion as of the last reporting date, and its liquidity ratios are in excellent shape.

Seeking Alpha

Having such a fortress balance sheet makes XOM well-positioned to fuel long-term growth. The company has already made steps toward it since XOM recently announced its acquisition of Pioneer Natural Resources. The deal is valued at a staggering $60 billion, which will be an all-stock transaction. While there are apparent substantial acquisition risks linked to integration difficulties when two large companies merge, I believe that the potential benefits for XOM outweigh all the risks.

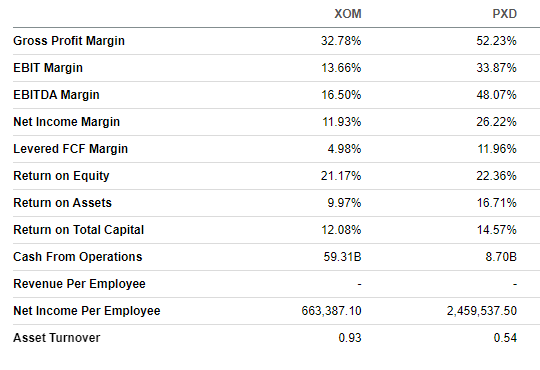

First of all, PXD looks like a high-quality business when I look at the company’s profitability metrics. Despite operating at a much smaller scale, PXD outperforms XOM across the board regarding profitability metrics. Having such strong profitability is a strong indication of the high quality of Pioneer’s assets and the efficient way they are operated.

Seeking Alpha

Second, the deal expands and diversifies XOM’s inventory portfolio. According to the official press release, the merger means that now the company will have 16 billion barrels of oil equivalent resources in the Permian basin. The management expects Permian production volume to increase to 2 million barrels of oil equivalent per day [MOEBD] in 2027. To add context, in 2022, Exxon’s production volume in the Permian was about three times lower.

All in all, I think that the merger is poised to generate value for shareholders because PXD’s highly profitable assets, together with XOM’s vast scale and massive expertise across the whole vertical of the oil and gas industry, look like a very promising combination. From the quantitative perspective, PXD’s TTM EBITDA was $9.36 billion, which means that the minimum upside potential for XOM’s EBITDA margin due to the acquisition is 2.7%, ignoring potential synergy effects. Improving inventory quality and quantity is crucial because I have a high level of conviction that we are currently in the early stages of the new traditional energy supercycle. I have described reasons why I think so in more detail in my recent coverage of Coterra Energy (CTRA), so let me not repeat it here.

Apart from building up inventory with high-quality assets to fuel revenue growth over the long term, I also like the management’s strong commitment to controlling the costs side of the equation. According to the latest earnings call, the company achieved $9 billion in structural cost savings since 2019, and there is still room for improvement, as the CEO, Darren Woods, stated.

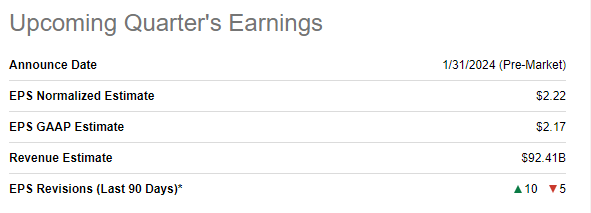

From the near-term perspective, it also seems that the temporary bumpy road for oil and gas companies is in the rearview mirror. The upcoming quarter’s earnings release is scheduled for January 31, 2024. The revenue decline is expected by consensus to decelerate as energy commodity prices start to moderate, and comps will be slightly easier to match in Q4. The YoY gap in the adjusted EPS is also expected to narrow due to the decelerating pace of revenue decline.

Seeking Alpha

Overall, I like the management’s approach to improving both sides of the profitability equation. The management made a strong strategic move by acquiring PXD, in my opinion. The deal will support the company’s long-term revenue growth for the new energy supercycle. The management also keeps an eye on costs, which is also crucial to avoid significant drawdowns in profitability in case of temporary headwinds to energy commodity prices.

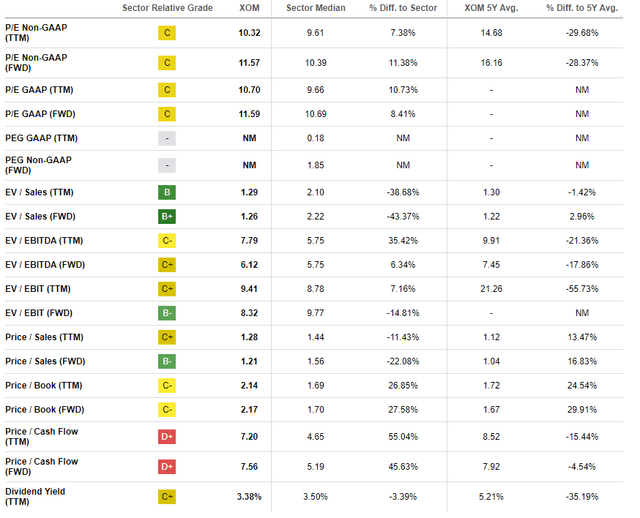

Valuation update

The stock price increased slightly more than a percent year-to-date, significantly underperforming the broader U.S. market. The oil and gas behemoth slightly underperformed the Energy sector (XLE) in 2023 as well. Seeking Alpha Quant assigns the stock a low “C-” valuation grade, which might indicate overvaluation. Indeed, XOM’s valuation ratios are mostly higher than the sector median, but the discrepancies do not look dramatic to me, given Exxon’s vast scale and the fact the company is vertically integrated. What is more important to me is that the current multiples look very attractive compared to five-year averages.

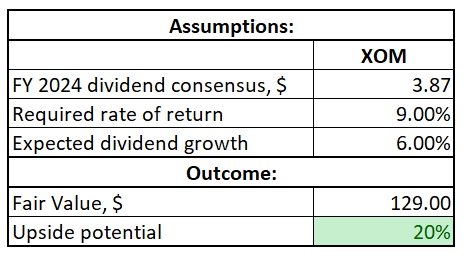

I want to proceed with by simulating the dividend discount model [DDM]. I use a 9% WACC as a required rate of return, as I did previously. For FY 2024, consensus dividend estimates forecast a $3.87 payout, which I incorporate into my DDM calculations. I project a 6% dividend CAGR, which I consider very conservative. I think so because over the last decade of low energy prices, which included a global pandemic lockdown, XOM delivered a decent 4.3% dividend CAGR.

Author’s calculations

According to my DDM simulation, the stock is about 20% undervalued, with a target price of almost $130. Please note that the dividend growth assumption is very conservative. That said, I believe that XOM is attractively valued.

Risks update

Oil and gas prices are substantially volatile and significantly affect investors’ sentiment about energy companies, especially giants like XOM. For potential investors, it is crucial to understand that oil and gas prices heavily depend on numerous unpredictable factors affecting the supply-demand equation. Geopolitical events and decisions made by a limited group of people who are in charge of the oil industries of its largest exporters significantly affect the market’s expectations about the potential imbalance in supply or demand.

As a company that owns and operates an extensive network of facilities, including refineries, chemical plants, and drilling operations, XOM also faces substantial operational risks. All these facilities require ongoing maintenance to ensure safe and efficient operations. Failure to do so will likely lead to operational disruptions and safety hazards. This might result in costly downtime and can also lead to potential financial and reputational damage for XOM related to litigation and penalties.

Bottom line

To conclude, XOM is a “Strong Buy”. The stock is very attractively valued and offers a solid above 3.5% forward dividend yield. The company demonstrates stellar profitability, and its recent announcement to acquire PXD is also a positive sign for investors. XOM expanded its inventory portfolio with high-quality and highly profitable assets, which will highly likely bring numerous synergies for the combined business. I also like the management’s strong commitment to drive down costs by improving its operational efficiency.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.