Summary:

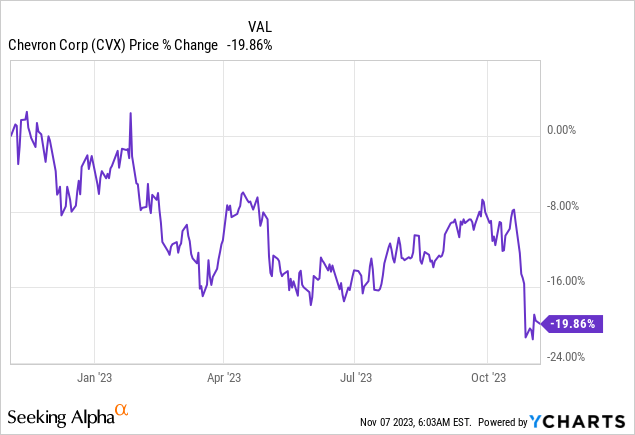

- Chevron’s shares sold off after the energy producer announced the acquisition of independent oil firm Hess in October. Share price weakness lasts to this day.

- Saudi Arabia’s and Russia’s oil supply cuts are favorable for energy producers and should support product pricing.

- The Chevron-Hess deal boosts Chevron’s free cash flow, shale production output, and profitability (synergy realization), making it an attractive investment opportunity.

- Shares are in a buy-the-drop situation and are cheap based off of earnings.

Mario Tama

Chevron’s (NYSE:CVX) shares sold off after the energy producer announced the acquisition of independent energy company Hess (HES) in October. I believe investors are overreacting to the deal (which is good for Chevron) and the company’s third-quarter results were quite good as well. In my opinion, recent OPEC+ oil supply cuts represent favorable tailwinds for energy markets and should support energy product pricing.

Chevron’s Q3’23 earnings card showed strong free cash flow that was supported by a strong pricing environment and robust demand in end-markets. Considering that investors appear to be overreacting to the Chevron-Hess deal and that shares of Chevron are now much more attractively valued, I believe the risk profile is attractive for dividend and non-dividend investors alike.

Previous rating

Before OPEC+ countries like Saudi Arabia and Russia extended their supply cuts through the end of the year, I rated Chevron a sell due to the potential of an earnings recession: Don’t Buy Into The Earnings Contraction.

However, Saudi Arabia and Russia just confirmed that they will extend voluntary production cuts until the end of the year which should support petroleum prices. Strong free cash flow in Q3’23 and the market’s apparent overreaction to the Hess deal imply that the risk profile has significantly improved.

Investors are overreacting to cash flow-accretive Chevron-Hess deal

Chevron announced in October that it will acquire independent energy company Hess in a $53B deal, paying $171 per share for its latest acquisition target (representing a premium of 10%). Including assumed debt, the entire deal is worth $60B. Chevron is buying Hess in order to strengthen its shale assets as the energy firm has an especially strong position in the Bakken basin in North Dakota which complements Chevron’s existing shale asset footprint in the Permian.

Chevron is also gaining access to the lucrative Guyana oil project off the coast of South America: following the close of the transaction Chevron will own a 30% stake (which is equivalent to 11 billion barrels of oil) in the project, allowing the company to grow its output as well as its free cash flow in the years ahead. The Chevron-Hess deal was the second such deal in a short period of time as Exxon Mobil (XOM) also acquired a shale-focused energy company: in October, Pioneer Natural Resources Company was acquired by Exxon Mobil for $58B.

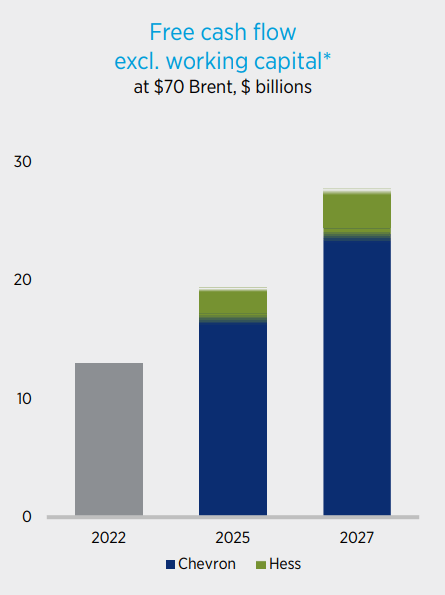

The Hess deal is strategically and financially favorable for Chevron because it boosts the company’s free cash flow prospects, increases the firm’s shale production output by 40% and results in significant synergies that improve Chevron’s profitability. The transaction is expected to be cash flow accretive by FY 2025 and Chevron has said that the deal will have a favorable impact on the dividend as well.

Source: Chevron

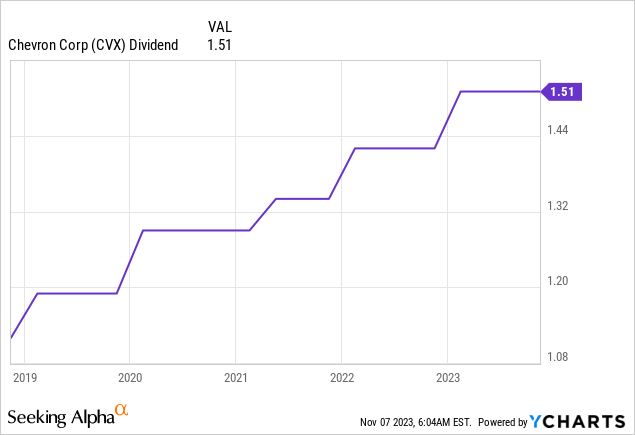

Subject to the approval of Chevron’s board of directors, the energy producer will seek an 8% increase in the dividend in the first quarter of FY 2024 which implies an annualized dividend of $6.52 per-share. Since Chevron’s share price cratered after the deal was announced and has fallen to just $147, the forward dividend yield would be 4.4%. The current dividend is $1.51 per-share quarterly and has risen consistently over time…

Chevron is now a capital return play

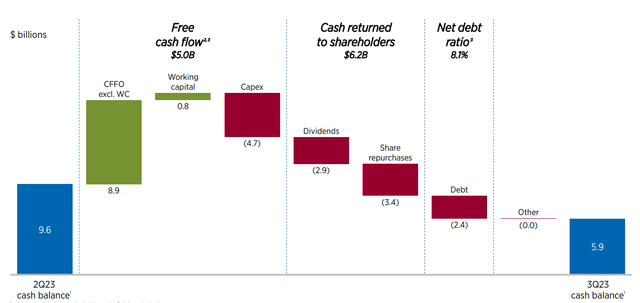

The acquisition of Hess is meant to improve Chevron’s position in the shale business where the energy company has been chiefly focused on its Permian production growth so far. At its core, Chevron is a capital return play that not only pays a nice dividend, but the energy producer is very free cash flow-profitable even without Hess. Chevron reported $5.0B in free cash flow in the third-quarter and the energy firm returns a ton of its free cash flow to shareholders in dividends and stock buybacks: total shareholder cash returns in Q3’23 amounted to $6.2B, including $3.4B in stock buybacks.

Source: Chevron

The Hess acquisition is projected to accelerate Chevron’s profitability as well as free cash flow growth. Chevron expects that its free cash flow will double by FY 2027, in part because the company projects will harvest $1.0B in synergies (in corporate and G&A) on an annualized basis going forward.

Source: Chevron

Chevron’s valuation is now cheap

Chevron’s earnings potential is now attractively valued since the firm’s share price slumped after the announcement of the Hess deal and I believe investors, especially those focused on dividend income, are dealing with a buy-the-drop opportunity here.

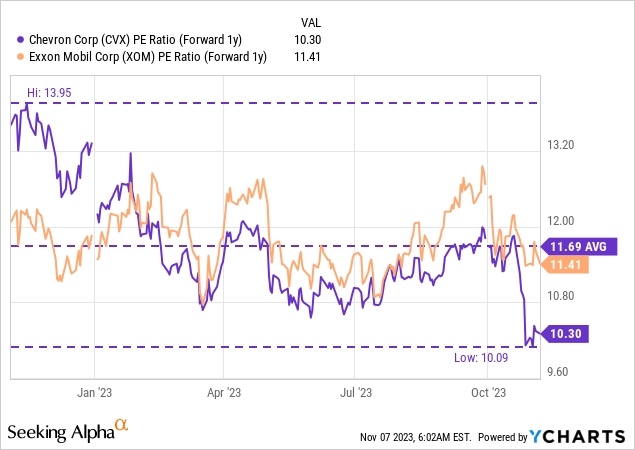

Chevron is expected to generate $14.27 per-share in EPS next year, implying a P/E ratio, on a FY 2024 earnings basis, of 10.3X. Shares just fell to a new 1-year low and currently have a 10% earnings yield. For context, Exxon Mobil is trading at a P/E ratio of 11.4X. I upgraded Exxon Mobil recently as well due to the Pioneer Natural Resources acquisition and its associated doubling of production in the Permian basin: Why The Pioneer Deal Is A Game-Changer.

Risks with Chevron

The biggest risk for Chevron, as I saw it the last time, was the potential for an earnings recession related to weakness in petroleum markets. However, the Chevron-Hess deal has changed the picture dramatically, as did the confirmed production cutbacks from OPEC+ countries. While a decline of petroleum prices always represents earnings and free cash flow risks for producers, the acquisition of Hess is adding new cash flow and earnings growth to Chevron. Therefore, I believe risks associated with Chevron have decreased following the acquisition announcement.

Final thoughts

In my opinion, the market has overreacted to Chevron’s acquisition of Hess because the addition of new shale assets is beneficial for Chevron and its shareholders. The company also expects the transaction to be cash flow-accretive in FY 2025 and the firm already guided for a significant increase in its distribution in Q1’24. The Guyana project stake of 30% is a key asset of the transaction and the potential for $1.0B in synergy effects makes the earnings potential even more attractive. Shares of Chevron are undervalued following the price drop and I believe the risk profile is now favorable for (dividend) investors!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CVX, XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.