Summary:

- Amidst a slowdown in ad spending in H2 2022, Meta’s valuation plummeted 77% from peak to bottom, as management was taunting its Metaverse.

- The lack of focus on its core business, coupled with distractions from unproven ventures, spooked investors for a valid reason. In Q3, Reality Lab experienced a 42% YoY revenue drop.

- During the ongoing ad spending recovery, Meta has reported a stellar Q3, with revenue growing by 23% and operating margin expanding by 2000 basis points.

- Now, Meta is embracing AI as the next big growth driver, a move I appreciate as it complements its core business rather than disrupts it.

- With its focus back on track, Meta now presents a compelling value to investors, despite its 155% price appreciation. However, I still prefer Google.

Kelly Sullivan

Just a couple of quarters ago, Mark Zuckerberg took Meta Platforms, Inc. (NASDAQ:META) shareholders on a wild ride with his ambitious venture, what I like to refer to as an “all-in” bet, at least judging by his speech, on the Metaverse through their Reality Labs.

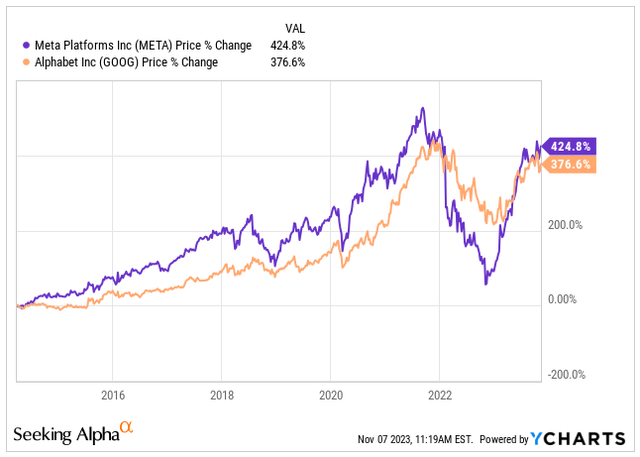

Amidst the slowing economy, rising rates, and a slowdown in the overall ad spending during the latter half of 2022 and the first half of 2023, the stock plummeted from its all-time highs of around $380 to a low of $88.

This nearly 77% decrease in the stock price, from its peak to its lowest point, is what I consider a destruction of shareholder value.

Of course, not all of this decline can be attributed to the bet on virtual reality with cartoon characters, but a significant portion can. For comparison, Google (GOOGL), which was also affected by the ad slowdown, experienced a much milder decrease of around 45% during the same period.

You might be wondering about the current state of Reality Labs. Well, the segment reported year-to-date revenue of $825 million, a decrease of 42.4% compared to the previous year with operating losses of $11.47 billion. The management further anticipates substantial YoY growth in operating losses due to ongoing product development efforts in augmented reality/virtual reality and investments aimed at further scaling the ecosystem.

As an investor in Meta I always enjoy seeing meaningful investments in future growth, but this situation does not sit well with me, considering the poor outlook for Reality Labs.

As of the Q3 earnings report, the focus of Meta Platforms has shifted away from the Metaverse, now placing a prominent emphasis on another buzzword – AI or Artificial Intelligence.

In fact, after reading the transcript of the earnings call, AI was mentioned precisely 47 times. This marks a significant shift in Meta’s priorities, making AI a primary focus for the company at this moment.

However, it’s essential to remember that Meta’s core business still revolves around advertising. Despite the shift in focus towards AI, the ad business remains central to Meta’s operations and will continue to be integral in the future. The company plans to enhance its ad business with AI features, and amidst the recovery in ad spending, Meta has experienced a remarkable quarter.

The question remains: should we anticipate another rollercoaster ride of shareholder value destruction, as seen with the Metaverse venture, or is Mark Zuckerberg and his team back on track, concentrating on what truly matters – the ad business?

49% of World’s Population uses Meta’s Products at least once a Month

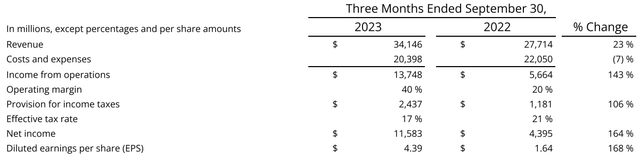

Amidst the recovery in ad spending, Meta had a great quarter, with revenue rising 23% to $34.15 billion compared to the same quarter last year.

What is even more significant is that, after refocusing on its core ad business and reducing its headcount by 24% YoY, along with a significant cut in marketing expenses, Meta managed to bring down its operating expenses by 7%. This had a positive impact on the operating margin, which grew by 2000 basis points.

That’s what I call efficiency.

Having said that, EPS increased by 168% to $4.39, easily outperforming analysts’ expectations for the quarter by $0.76.

This earnings report demonstrates that Meta is a great company with excellent leadership, offering products used by an average of 3.14 billion users daily, showing a 7% YoY growth. However, it also highlights the potential risks if the management gets sidetracked.

As Meta gradually shifts away from its Metaverse dream, which, in my opinion, people and hardware are not yet ready for, the company is emphasizing AI as the next frontier for development and growth in interaction.

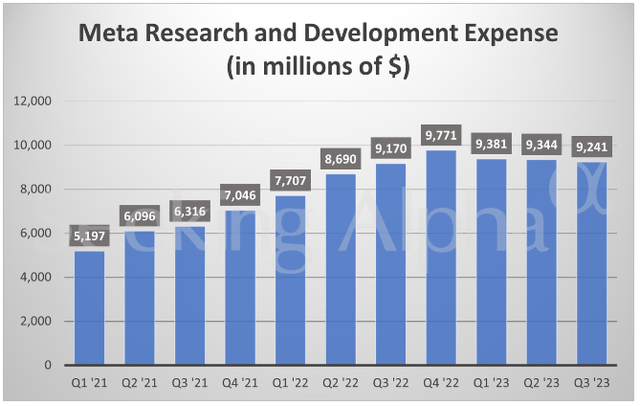

Despite R&D expenses decreasing by around 5.4% from their peak, Meta is heavily investing in launching numerous new consumer AI experiences that are expected to become significant components of family of apps and in the coming years.

Regarding investment priorities, the management anticipates AI to be the most significant area of investment in 2024, both in engineering and compute resources. However, the company plans to avoid hiring a large number of new employees. Instead, they aim to deprioritize several non-AI projects across the company to redirect resources toward AI initiatives.

To provide an overview of Meta’s AI initiatives:

- They introduced an Assistant accessible across all messaging experiences and smart glasses, allowing users to ask questions, access real-time information, and generate photorealistic images, similar to Chat-GPT or Bard.

- Meta launched the Studio platform, enabling users to create and interact with various AIs for assistance with tasks and entertainment.

- They introduced Emu, an image creation model that produces high-quality images and stickers rapidly.

- Meta released an early alpha version of business AIs, enabling every business to have an AI interface for customer sales and support.

- They revealed plans to launch creator AIs next year, enabling every creator to engage with their fans and build their community with the help of AI.”

Now, that’s a lot of initiatives for Meta, but most of them support the existing fundamental business, driving engagement and traffic in the family of apps. This, in turn, boosts ad revenue growth, rather than disrupting and revolutionizing the way the company operates.

However, what I still find unnecessary and costly for Meta is its hardware business segment. During the quarter, Meta held its annual Connect conference and discussed Quest 3, the first mainstream mixed reality device, and the next generation of Ray-Ban Meta smart glasses, the first smart glasses with Meta AI built-in.

While Meta’s hardware devices may be appealing to many—personally, I like the Quest 2 VR glasses and the games you can play on them—what I believe Meta lacks is the unique engineering skills and desirability that Apple (AAPL) can build around its products.

With the release of Vision Pro, slated for early next year, I think Meta will fall far behind in its hardware sales. I believe this should not be the company’s priority moving forward.

Consider Google’s search partnership with Apple. Google pays Apple annually around $20 billion to be its default search engine. With the release of Vision Pro, I believe Meta should take a similar path and enter into strategic partnership with Apple to build its apps for their VR sets, making them highly sought after.

Fair Valuation for the Quality

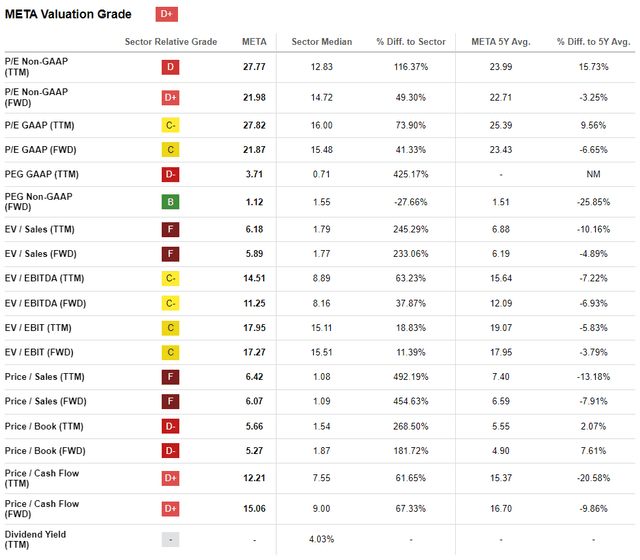

Despite its impressive 155% stock price gain in 2023 and the ongoing recovery in its core business, Meta is currently trading at what I consider a reasonable valuation.

Its Forward PE ratio stands at 21.87x its FY24 earnings, which is 6.7% lower than its 5-year average.

Similarly, the company’s Forward EV/EBITDA is around 7% lower than its historical averages.

For comparison, Meta is trading at a slight discount compared to the next biggest ad business, Google.

Google’s Forward PE is 22.69x, and its Forward EV/EBITDA is at 12.56x.

I recently wrote an article on Google explaining why I am buying it aggressively, which you can access here.

Despite my positive view on Meta at its current valuation, I lean towards Google due to the close proximity of their valuations and similar growth outlook.

Following the meaningful recovery in EPS in 2023, I anticipate both businesses to achieve a 12% CAGR in their EPS between 2024 and 2030.

Valuation Grade (Seeking Alpha)

Conclusion

After a disastrous period of shareholder value destruction in H2 2022 due to their bet on the Metaverse, Meta appears to be back on track with an ongoing recovery in its core advertising business.

The company has managed to increase engagement and boost its margins significantly by making meaningful cuts in operating and marketing expenses.

Looking ahead, Meta is positioning AI as the next major growth driver. In my opinion, focusing on AI is a smarter strategy than the Metaverse, as it doesn’t require disrupting their core business; instead, it complements their efforts to drive engagement.

I anticipate that Meta’s management will continue to work diligently to enhance shareholder value in the future.

However, given their very close valuation to Google and similar growth profiles, I am currently leaning more towards investing in Google at this stage.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.