Summary:

- Visa is a great dividend stock with capital appreciation and growth potential, and 82% of US adults own at least one credit card.

- Visa has a low payout ratio, conducts share buybacks, and offers safe dividends with a dividend safety score of 99.

- Despite expecting slower growth in 2024, Visa offers double-digit upside to its price target and has strong financials and long-standing partnerships.

- Visa continues to expand its business into Latin America and renew long-standing partnerships with large brands such as Costco and U.S Bank.

- One reason management projects slower growth could be the large amount ($1 trillion) of credit card debt for Americans that will likely cause a slowdown in transactions.

Dmytro Skrypnykov

Introduction

Credit card companies like Visa (NYSE:V) are great dividend stocks to hold. They offer capital appreciation plus growth. On top of that everyone at some point in their life will probably own and use one, maybe even on a daily basis. According to the U.S. Government Accountability Office, 82% of U.S. adults have at least one credit card in their wallet. Additionally, my girlfriend has been asking me for months to cover one of these as she really wants to hold one in her portfolio.

Specifically, she prefers Visa but also has been looking into possibly investing in some of its peers. Before I started to write this article, I looked into my wallet to see how many Visa cards I currently own. The answer is three out of five, more than half. These companies are part of our everyday lives and we use them without even thinking about it. Those are some of my favorite businesses to invest in, something that everyone uses and never gives it any thought. Many of those are also considered boring, but yet they’re some of the most profitable & stable companies. In this article, I get into why I think Visa is a great choice for dividend investors.

Why Visa?

Visa like its peer Mastercard (MA) works as a payment processor. Other peers like American Express (AXP) & Discover (DFS) work as processors and issuers. So every time you swipe your card, there are various fees associated with these transactions. This is how these companies make money. Probably why Buffett holds AXP, MA, and V in his portfolio. These businesses have also been around for ages. Visa was founded in 1958 and went public during the Great Financial Crisis in 2008. I think this speaks volumes to the company’s quality business model to go public during one of the worst recessions in history.

There are different fees associated every time these cards are used. Processing fees, which a business pays every time they accept credit card payments, which most do nowadays. There’s also an interchange, assessment, and payment processor fee. Have you ever been in a place of business and tried to swipe your American Express card and couldn’t? Ever wondered why that place of business didn’t accept it?

It’s because AXP typically has higher fees while V has the lowest amongst its peers. One reason is AXP holds more responsibility for being a processor and issuer, so that’s probably a good reason to charge a higher fee. I assume businesses prefer not to incur higher transaction fees, especially if it’s a business that conducts multiple transactions. The bigger and busier the business, the more fees they rack up.

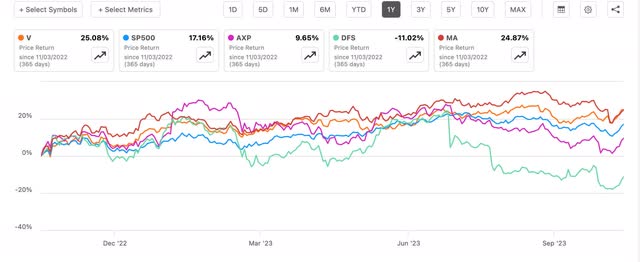

So while many dividend stocks have been punished over the last 6 months to a year, especially lower-yielding ones, Visa and its peers are up during the same time, with the exception of DFS which is down over 11%.

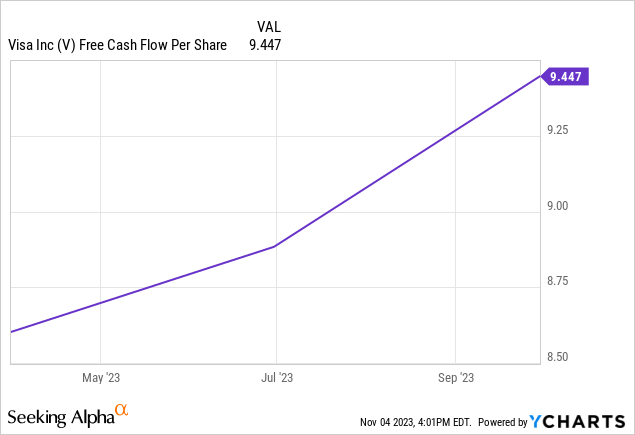

One reason is that investors know these do well in high interest rate environments. Below is V’s free cash flow per share growth since the start of interest rate hikes in March of last year.

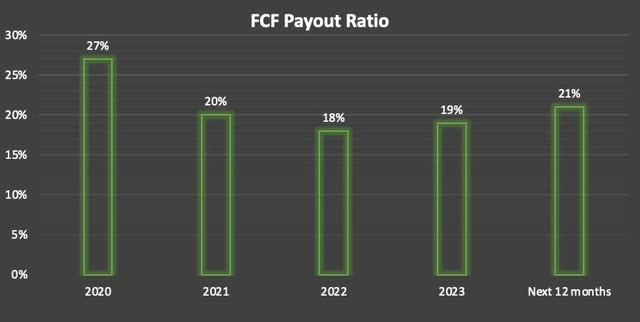

As a dividend investor, this is my primary metric to look at when analyzing a stock. Of course, there are other things to look at, but growing FCF is something I like to see. Also, I like to see a lower payout ratio. 40 to 60% is the general rule of thumb but even lower is better. And Visa has a very low one. One reason I think Buffett enjoys these companies is that they are not CAPEX intensive and their business models are easy to understand. I’m a huge fan of him if you can’t tell because of his simple investing strategy.

Businesses that have low capital expenditures with growing cash flows are perfect investments in my opinion. Especially ones that pay a growing dividend along with it. It also helps when they run into sudden downturns. Looking at the chart you can see Visa’s payout ratio was slightly elevated during 2020, but even then it was in no danger. Post 2020, the company has maintained an even lower payout ratio, averaging 19%. In the next 12 months, this is expected to slightly increase to 21%, although still conservative. So if the company is not CAPEX intensive and has a very low payout ratio, the logical thing to do is conduct share buybacks.

Swipe Of Buybacks & Safe Dividends

With all the excess cash the company has had, it’s only right it rewards its shareholders by returning it via share repurchases. Earlier last month, the company announced a $25 billion, multi-year repurchase plan. In Q4 they bought back a total of 4 million shares and returned more than $12.3 billion to shareholders in 2023 alone. Furthermore, they announced a 15.6% increase in their dividend from $0.45 to $0.52. Honestly, what’s not to like about Visa?

Simply Safe Dividends gives them a dividend safety score of 99 while Quant gives them the grade of A so the dividend is very safe. Since its last stock split in 2015, the company has increased the dividend by 333%! Before then, the company grew its dividend by 357% from $0.1050 to $0.48. Furthermore, they have not reduced the dividend since going public back 15 years ago. I think it’s safe to say we will see this stock joining the dividend aristocrats club in the foreseeable future.

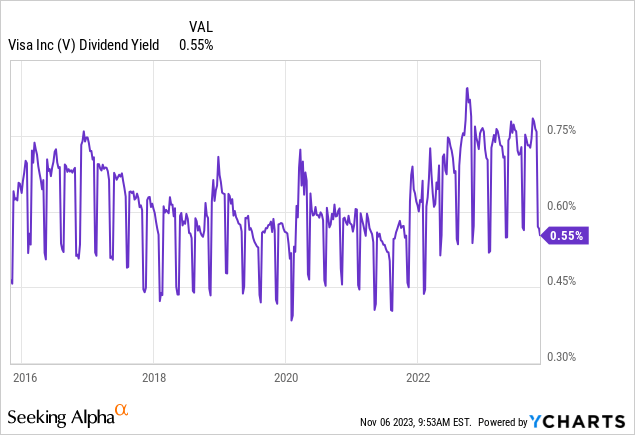

I typically look for a starting yield of at least 2% for my holdings; Visa is an exception because of the growth and capital appreciation it offers. Plus, I think sub 1% yielding stocks are a great compliment to those who have a large portion of their portfolio invested in higher-yielding ones such as Business Development Companies & REITs like myself. Additionally, higher-yielding stocks often come with higher payout ratios. Stocks with lower yields and payout ratios typically offer a balanced approach to returning cash to its shareholders and funding future growth. As you can see, Visa’s dividend yield has been below 1% since 2016, temporarily spiking when the stock dropped to $177 in September of 2022.

Forward-Looking Growth

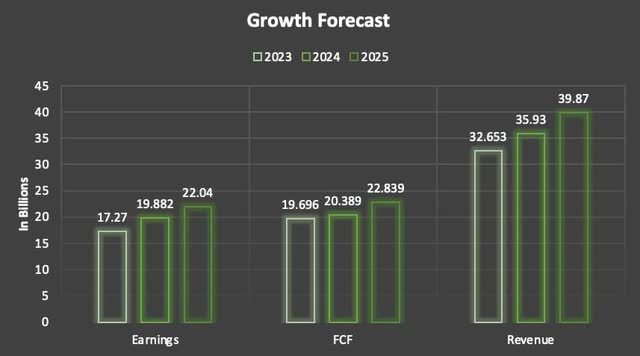

During Q4 earnings management stated that they expect 2024 growth to be slower than year 2023. Earnings are projected to grow 15% from $17.27 billion to nearly $20 billion in 2024. Revenue is projected to grow 10% from $32.6 billion to roughly $36 billion. Free cash flow is expected to post low single-digit growth of 3.5% from $19.7 billion to roughly $20.4 billion over the same period. Looking further out into 2025 all three financial metrics are expected to post double-digit growth of roughly 11% in each. So, as you can see management’s slower growth still consists of double digits in two out of the three financial metrics.

One way the company plans to continue its steady growth is by renewing partnerships and expanding into other countries. They recently activated their brand with clients and partners at the Paris 2024 and Milano-Cortina 2026, Paralympic Summer & Winter games. Additionally, they continue to expand their processing penetration into Latin America, specifically in Colombia and Brazil. They also renewed several long-standing partnerships with large companies like U.S. Bancorp (USB) and Shopify (SHOP). Furthermore, retail giant Costco (COST) recently selected Visa Acceptance Solutions, including CyberSource, for all of their U.S. and Canadian e-commerce transactions.

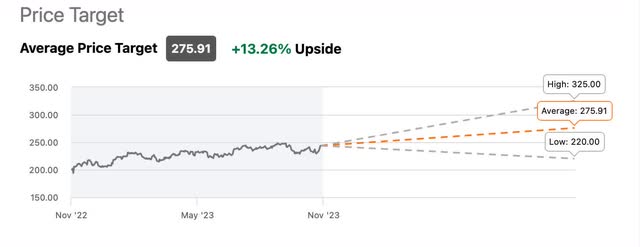

Valuation

Although the stock is up over 25% in the last year, it still offers a 13.5% upside to its price target of $276. Despite the strong showing in the last year, analysts still have it rated a strong buy. One reason for this could be the stock trades below its 5-year average forward P/E at 24.6x. The company’s dividend yield is also above its 5-year average so for investors with a long-term outlook, I believe now is a good time to dollar-cost average in. High-quality stocks such as V normally always trade at a premium. And this stock I view this as a forever hold so I think the current price of $243 at the time of writing is attractive.

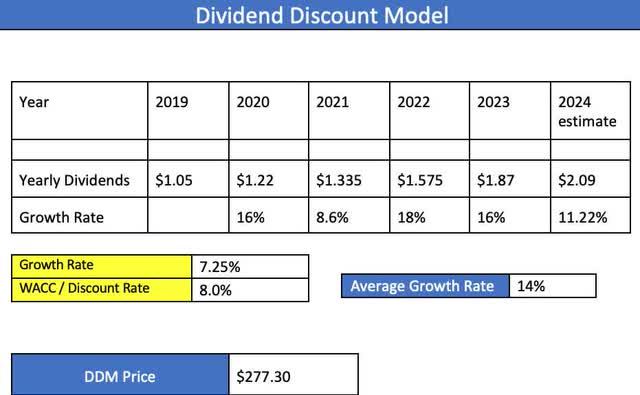

For dividend stocks, I prefer to use the Dividend Discount Model. Here you can see I decided to be a bit more conservative with an expected growth rate of 7.25%. Of course, you could make the case for a higher one seeing Visa’s double-digit growth over the last 5 years. But in my opinion, it’s always better to be a bit more conservative to manage expectations. This brings me to a price of $277.30, roughly $2 above analysts’ price target of $275.

Risks

Although the current macro environment has some benefits for Visa and its peers, it continues to be a risk as well. With American credit card debt reaching a new milestone of $1 trillion earlier this year, this will likely affect V going forward. This could be the reason management expects next year’s growth to be slower, or in their words, normal. Although as seen earlier, the projected growth is still impressive considering the macro environment. For FY23 Visa’s credentials were used an average of 757 million times a day and total transactions, including cash & payment (transactions) were $276 billion. With current interest rates and American credit card debt at an all-time high, this will continue to be a headwind as consumers spend less on credit cards, equaling fewer transactions.

Bottom Line

Although Visa is expecting slower growth in 2024 the company is still a great buy as it offers double digit upside to its price target. With its conservative FCF payout ratio and superior business model, Visa is a stock every dividend investor should have in their portfolio. As previously mentioned, 82% of U.S. adults own at least one credit card. And with their lower fees, Visa seems to be the company of choice for businesses. Furthermore, they recently announced a $25 billion buyback program and raised the dividend by nearly 16%. In my opinion, Visa is a forever hold, and with its strong financials and long-standing partnerships with large, well-known companies, this makes them an attractive choice for buy-and-hold investors.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Short position through short-selling of the stock, or purchase of put options or similar derivatives in V over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.