Summary:

- Intel reported solid results, could beat analysts’ estimates, and analysts are getting more optimistic.

- Due to increased tensions around the world, companies and governments push for a semiconductor production in Europe and the United States – and Intel could profit.

- Intel is still undervalued, and the stock could probably double in value in the next few years.

Justin Sullivan

Since my last article about Intel Corporation (NASDAQ:INTC) in August 2023 – in which I called Intel maybe the best AI investment – the stock increased about 13% in value and clearly outperformed the broader market, which declined about 2% in the same timeframe.

And we can certainly make the argument that Intel is on the right path and making good progress to turn the business and stock around. Year-to-date, Intel gained 44% and clearly outperformed the S&P 500 (SPY), which gained about 14%. Not only does the stock increase and gain in value, but the fundamental business also seems to improve and analysts as well as management are getting more optimistic – especially following the last earnings release.

Analysts Getting More Optimistic

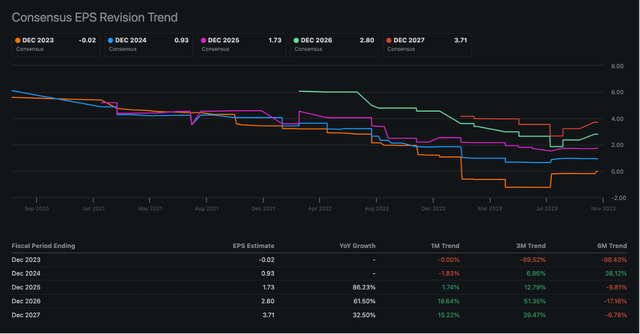

The turnaround is visible in many different metrics. One example is the consensus earnings per share revision trend. As analysts seem to get more optimistic again, the trend of constant lower EPS estimates was reversed in the last few quarters. Estimates for earnings per share are still low, but we see analysts now expecting higher earnings per share again – especially for fiscal 2023, but also for the years to come.

Intel: Consensus EPS Revision Trend (Seeking Alpha)

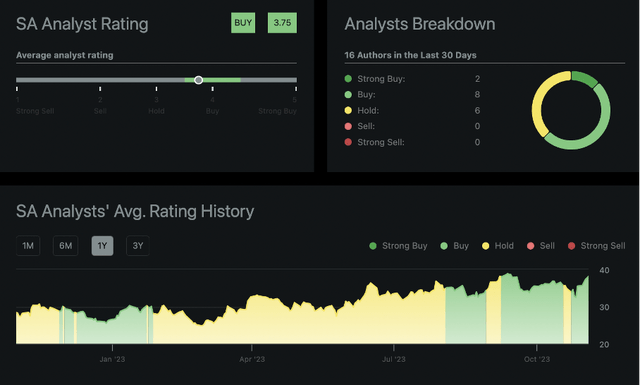

Aside from analysts getting more optimistic about earnings per share in the years to come, more analysts on Seeking Alpha are also turning bullish and instead of the “Hold” rating that Intel had for several quarters in the past, the average rating is “Buy” again.

SA Analyst Rating for Intel (Seeking Alpha)

Of course, the best time to buy would have been when Intel was trading close to $25 several months ago. As always when talking about investor sentiment, the best time to be greedy is usually when others are fearful and when analysts and investors are not bullish about the stock. I don’t want to praise myself too much for calling the bottom around $25 – I have already been bullish about Intel when the stock was more expensive than it is today, and I saw Intel as a “Buy” way too early.

Quarterly Results

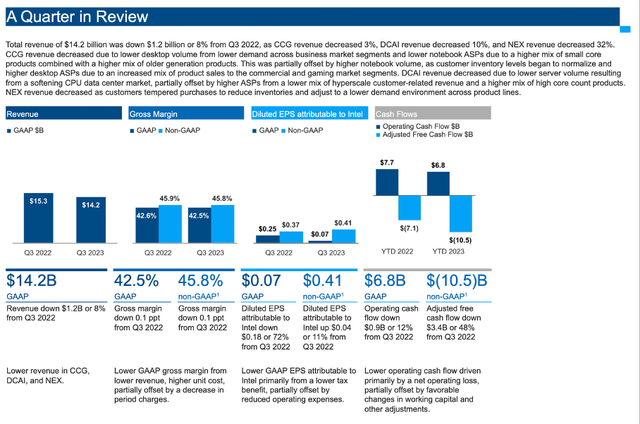

Aside from analysts getting more optimistic, Intel could beat analysts’ estimates in its third quarter earnings – which made analysts more optimistic again. Not only could Intel report revenue about $500 million higher than analysts estimated, earnings per share were also $0.19 higher than analysts estimated (at least on a non-GAAP basis).

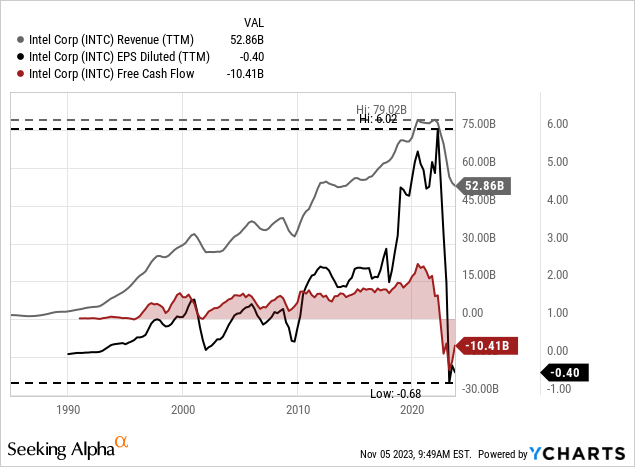

However, Intel beating estimates should not disturb us from the fact that the business is still reporting a declining revenue. Net revenue declined from $15,338 million in the same quarter last year to $14,158 million this quarter – resulting in 7.7% year-over-year decline. And Intel still had to report an operating loss for the quarter: Although it was a small loss of only $8 million and therefore a better result than in the same quarter last year in which the company reported an operating loss of $175 million, a company like Intel should not have to report any losses. On a GAAP basis, Intel’s bottom line was profitable again (which was not always the case in the last few quarters) and reported diluted earnings per share of $0.07. Year-over-year however the company had to report a decline of 72% compared to a profit per share of $0.25 in the same quarter last year.

When looking at non-GAAP results, earnings per share grew 10.8% year-over-year from $0.37 in Q3/22 to $0.41 in Q3/23. Non-GAAP operating margin also increased from 10.8% in the same quarter last year to 13.6% this quarter. And finally, Intel also reported an adjusted free cash flow of $943 million. While this is not an impressive number for Intel it is much better than the negative $6.3 billion the company had to report in the same quarter last year.

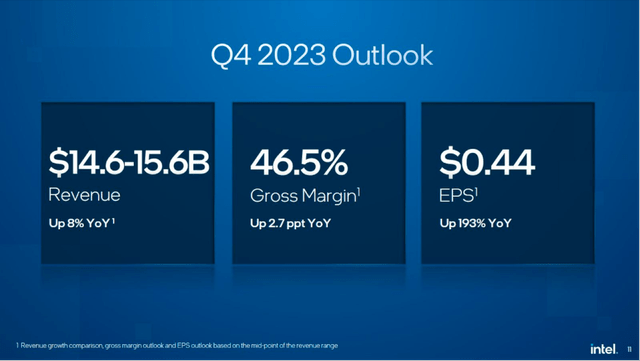

For the fourth quarter of fiscal 2023, management is expecting revenue as well as earnings per share to grow again on a year-over-year basis. And fourth quarter guidance for revenue as well as earnings per share is much higher than analysts’ consensus. Analysts previously expected only $14.35 billion in revenue and $0.32 in earnings per share.

Taking just the numbers by themselves, Intel certainly did not report great results. Revenue is still declining in the high-single digits, the company is hardly profitable and free cash flow is not coming even close to what the company could report a few years ago. But results were obviously better than investors have feared, and the company’s guidance is indicating management getting more optimistic and therefore the stock jumped.

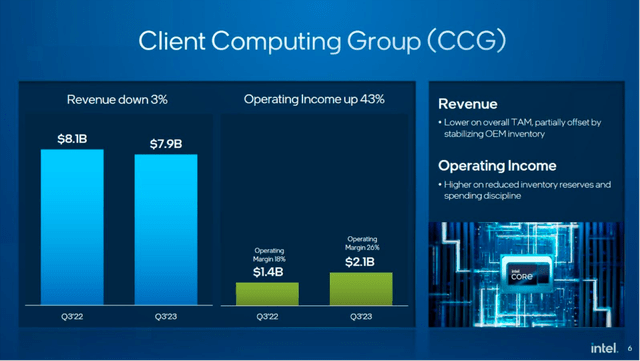

Client Computing Group Improving

When looking at the different business segments it is especially the Client Computing Group that has to be mentioned. The segment is important as it is still responsible for more than 50% of the company’s revenue and was clearly the main driver of operating income for Intel. Revenue for the segment still declined 3.2% from $8,128 million in in the same quarter last year to $7,867 million this quarter. But while revenue for the segment declined, operating income increased from $1,447 million in Q3/22 to $2,073 million in Q3/23 – resulting in 43.3% year-over-year growth. And while revenue for Desktop PC is still lagging, revenue from Notebook could increase 2.2% year-over-year.

Management commented during the last earnings call:

Moving to third quarter business unit results. CCG delivered revenue of $7.9 billion, up 16% sequentially and ahead of our expectations for the third consecutive quarter. Customer inventory levels are healthy, and the market remains on track to our January consumption TAM signal of roughly 270 million units for 2023. CCG’s operating profit doubled sequentially to $2.1 billion on higher revenue, sell-through of reserved inventory and stronger ASPs driven by strength in our commercial and gaming products in the quarter.

And although it is a good sign that the computer market is improving again, we should not ignore the bigger picture and look at the economic and political forces at play.

Semiconductors and Risk of International War

Unless living under a rock for the last few years, everybody should be aware that the political situation all around the world did certainly not get better in the last few years. A few weeks ago, Ray Dalio published another essay claiming that the world is moving closer and closer towards international war. In the essay he wrote:

While Israel, Hamas, Ukraine, and Russia are in hot wars, thankfully the major powers (the US and China) are not, though they remain at the brink of one. It appears that we are at a very critical juncture in which we will soon see if the Israel-Hamas war spreads and how far it spreads and, longer term, whether the great powers are forces for peace (and will back away from the brink of direct conflict) or get involved (and cross the brink).

And Dalio was going on:

Primarily for those reasons, it appears to me that the odds of transitioning from the contained conflicts to a more uncontained hot world war that includes the major powers have risen from about 35% to about 50% over the last two years since I wrote my book Principles for Dealing with the Changing World Order.

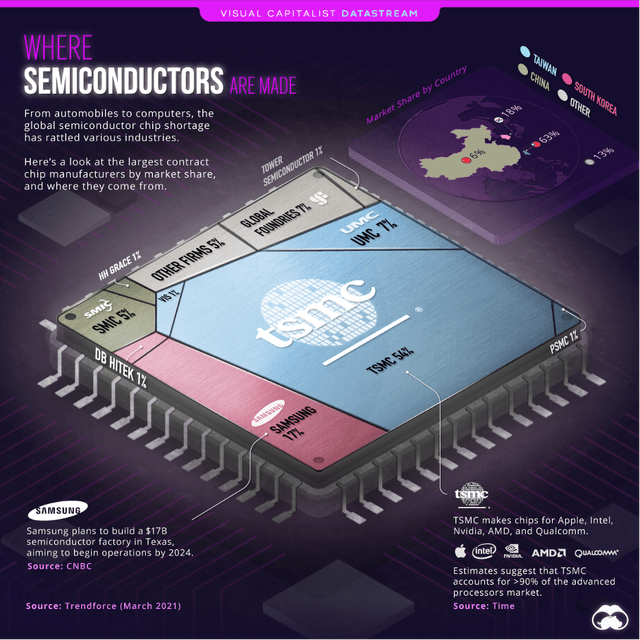

And one of the major problems many western economies – including most European countries and the United States – are facing is the global semiconductor production being dominated by one company and one country: Taiwan Semiconductor Manufacturing Company Limited (TSM) from Taiwan. The following chart from VisualCapitalist – despite numbers and market shares being from 2021 – is showing the problem. TSM is responsible for more than 50% of semiconductor production and Taiwan, South Korea and China produce almost 90% of global semiconductors (with Taiwan alone being responsible for 63%).

Of course, we never know what will happen in the years to come and while I also see massive tensions between China and the United States, I don’t see them at the brink of war. Nevertheless, governments in the United States and Europe obviously realized the major risk that is going hand in hand with the Western world being dependent on Asian countries for its semiconductor production.

This is explaining huge investments – including Germany spending about $10 billion in government funding for an Intel manufacturing site in Magdeburg, Germany. And the United States passed the CHIPS and Science Act with investments of $280 billion more than a year ago with a similar goal: to bolster production capacity of semiconductors in the United States and decreasing the dependence on Asian companies and countries.

And in my opinion, not going the way to become a fabless business like Advanced Micro Devices (AMD) did during the last decade was a good strategic decision by Intel. There is the potential for Intel Foundry Services to become a major contributor to overall revenue as more and more companies might relocate semiconductor production back to the United States (or Europe) and Intel could profit. Once again, we don’t know what might happen, but if the western economies are cut off from Taiwan and its chip production, Intel could be the major profiteer.

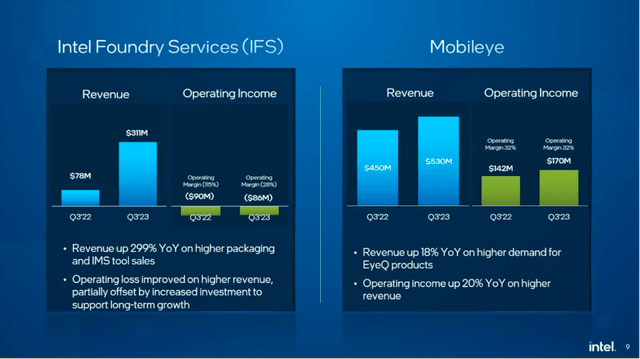

When looking at the last quarterly results for Intel Foundry Services, we see that revenue increased from $78 million in the same quarter last year to $311 million this quarter. The segment is still not profitable but that is not to be expected of a rather young segment. CFO David Zinser commented during the last earnings call:

Intel Foundry Services revenue was $311 million, growing 4 times year-over-year and 34% sequentially on increased packaging revenue and higher sales of IMS tools. IFS operating loss was $86 million as ramping factory and operating expenses offset stronger revenue in the period.

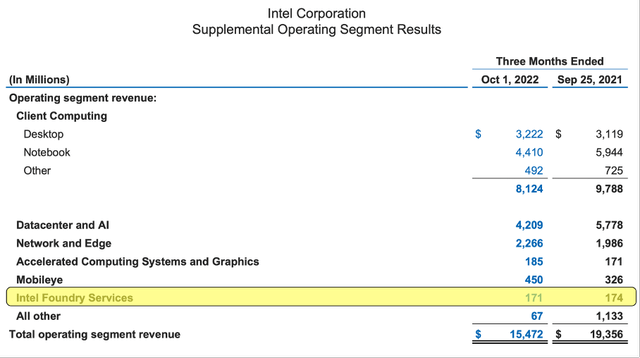

When looking at the numbers and reading the statements made during the earnings call, it seems like Intel Foundry Service is growing with a high pace. However, when looking at the numbers in the last three years we see a mixed picture with revenue for Intel Foundry Service fluctuating heavily from quarter-to-quarter. And what is especially irritating: When looking at the results reported in Q3/22, we see completely different numbers than Intel is reporting right now for the same quarter last year – $171 million vs. $78 million – while these numbers should be identical as we are talking about the same quarter.

But despite all the confusion about the numbers, management seems to be optimistic for the segment. During the last earnings call, Pat Geisinger announced several new customers and indicated that Intel is making progress in its contract negotiations with another major customer (and he is excepting the commercial contract negotiations to conclude before year-end).

Only time will tell if Intel’s strategy was the right step. Although we can be quite optimistic at this point, we should not forget how expensive it is and the billions of cash Intel was spending so far – and still has to spend.

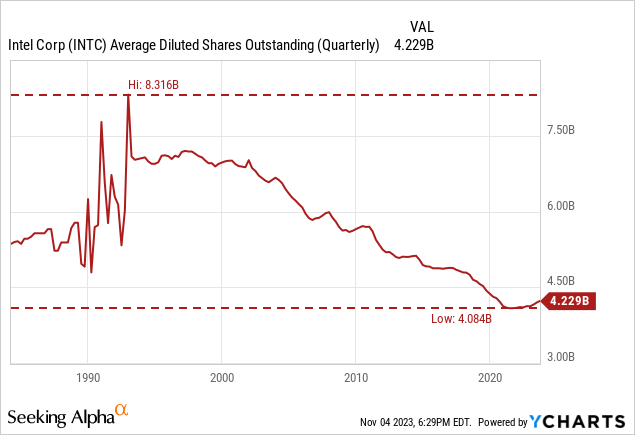

Problem: Increasing Shares Outstanding

And Intel did not only spend huge amounts of cash in the last few years, the number of outstanding shares also increased. The company therefore reversed a long-lasting trend of decreasing the number of outstanding shares. But in the last few quarters, the number of outstanding shares increased from 4,084 million about three years ago to 4,229 million right now.

Although we should not make this a bigger deal than it is, constantly increasing shares are nothing I like to see for a mature business like Intel. My demands for a high-quality business include that the company is able to finance its operations without constantly increasing the number of outstanding shares.

Intrinsic Value Calculation

And an increasing number of outstanding shares also has a negative impact on the intrinsic value. When a company is constantly diluting the number of its shares, the (calculated) value of a share must be lowered. And this is automatically reflected in most intrinsic value calculations we use – the price-earnings ratio or the discount cash flow calculation for example.

Usually, I would talk about the price-free-cash-flow ratio. However, Intel is still reporting a negative free cash flow and therefore calculating this metrics doesn’t make much sense. And basic (as well as diluted) earnings per share were also negative when using the TTM numbers and therefore we can’t calculate a P/E ratio either.

We could use the estimated earnings per share for fiscal 2024 – currently $1.89 – and calculate a forward P/E ratio. Using these estimates would lead to a forward P/E ratio of 20 – and such a P/E ratio is neither cheap nor expensive.

Instead, let’s us a discount cash flow calculation to determine an intrinsic value for the stock. In my opinion, we have several reasons to be optimistic and assume free cash flow will improve again in the next few years. Despite our optimism about growing free cash flow, we will calculate with moderate assumptions and assume $5 billion in FCF in 2024, $10 billion in 2025 until we reach $20 billion in 2027 (the free cash flow Intel reported before it all collapsed). And for the years to come, we assume 5% growth for Intel. In my opinion, Intel won’t take until 2027 to reach previous FCF levels again, but let’s be cautious.

When calculating with these assumptions as well as a 10% discount rate and 4,229 million outstanding shares we get an intrinsic value of $76.76 for Intel and therefore the stock would be trading with a 50% discount right now.

Must Still be Cautious

We can see a turnaround and many positive signs when looking at the stock price. However, we must also acknowledge that the stock is technically still in a downtrend and facing several resistance levels on its way up and towards higher prices.

I would still argue that one of the decisive areas in the chart is around $42. Here we can find strong resistance levels for Intel. Not only can we find the 50-months moving average at that price level, but also several lows which were set between 2018 and 2022 and now create a strong resistance level for the stock.

It could happen that Intel will bounce off that resistance level and the stock will go lower again. And especially considering the potential of a bear market might led to declining stock prices for Intel. It is often the case that a bear market is dragging many individual stocks down with it – even undervalued stocks that don’t deserve it. But if Intel should be able to climb over $42 an important step is achieved on the way to higher stock prices.

Conclusion

I still remain confident that Intel is one of the better bargains in this market and that the company is still a resilient business with a wide economic moat around it. And I remain confident that the stock will climb higher in the coming quarters and years. And the plan to list the Programmable Solutions Group as a standalone business on the stock exchange might also help Intel in the years to come.

And while Intel is not such a great bargain anymore as it was close to $25, we can be more confident about the business being on its way towards a turnaround and I still expect the stock at least to double in the next few years. Finally, while Intel does not seem to be at the forefront of AI, it will be an important player and profit more from the trend than many are realizing right now. Geisinger certainly believes this:

We are on a mission to bring AI everywhere. We see the AI workload as a key driver of the $1 trillion semiconductor TAM by 2030. We are empowering the market to seamlessly integrate and effectively run AI in all their applications.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.