Summary:

- Shareholders’ constant optimism about Tesla, Inc. and faith in CEO Elon Musk mitigates the consequences of negative news.

- Tesla’s margins are shrinking, and its brand identity is deteriorating due to aggressive price cuts and competition.

- Tesla’s growth rates are converging with the auto industry, and its future success is uncertain due to market normalization and macroeconomic challenges.

Khosrork/iStock via Getty Images

The bubble on electric vehicle (“EV”) companies burst some time ago, yet Tesla, Inc. (NASDAQ:TSLA) continues to trade at high multiples – even if far below those of 2021. In any case, enthusiasm for charismatic CEO Elon Musk has not waned over time, and his audience remains fully confident in whatever he says. After all, for a man with such media impact and success, it is hard not to give such approval.

In any case, justifying anything when the data says anything else can turn out to be a mistake and an unpleasant surprise once it is understood that the reality is quite different from expectations.

The purpose of this article is not to criticize Tesla or Elon Musk, but to highlight a phenomenon that I have not observed in any company so far, namely the constant optimism of shareholders. Faith in Elon Musk manages to mitigate the consequences of news that is objectively negative and should bring down even the most solid company:

- Is the CEO selling millions of shares? Clearly, he needed liquidity.

- Are margins on cars sold shrinking dramatically as well as market share? Not important, Tesla is not a car company anyway.

- Is China becoming a difficult market to operate in? Elon Musk will find a way to outperform the competition.

- Is Tesla worth as much as the major automakers combined? It is justified, Tesla is the future.

I could go on but I think I have made my point. In short, to date I have not been able to find a piece of news that has seriously worried the shareholders, since there is always a justification. Since I have no short exposure to this company, I hope they are right in the end, but my impression is that shareholders – not all of them, of course – have invested in Elon Musk rather than Tesla. Separating the two is essential to have an objective view that is not conditioned by esteem for a public figure.

Are the margins contracting? Not a problem in the long run

Obviously, when we invest in a company we hope that profit margins will increase or at least remain constant. In fact, the market often punishes companies that disappoint expectations in terms of profitability: Meta Platforms, Inc. (META), for example.

With Tesla, this simple reasoning does not apply entirely, since if the company sees profit margins decline from quarter to quarter, it represents only a momentary and unnecessary problem for those with a bullish thesis. Moreover, I have noticed that those who worry about compression are criticized for short-sightedness, since Tesla is an investment for the long term. In other words, focusing on short-term issues makes little sense, but that only applies to Tesla.

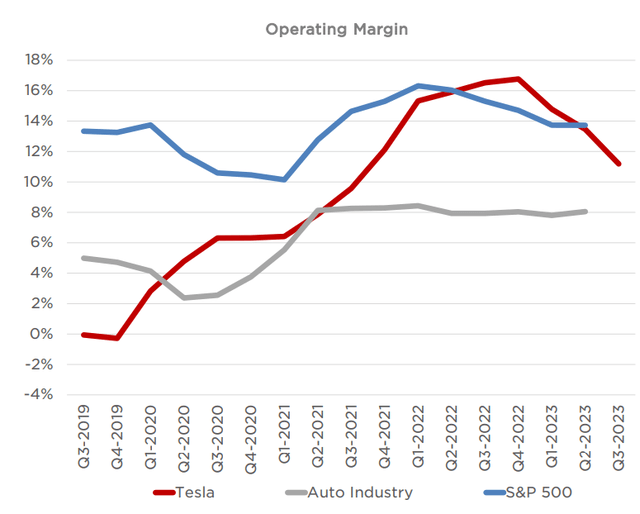

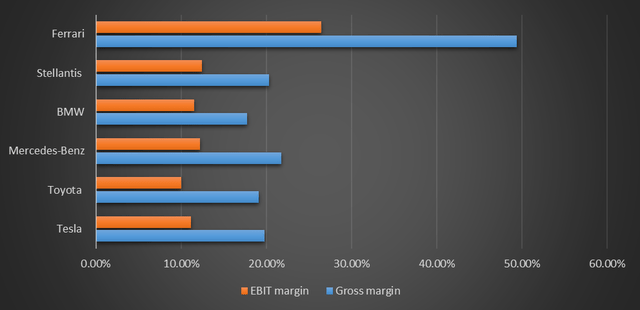

Undoubtedly, what really set Tesla apart from other automakers was its far higher margins, but as we can see this advantage is gradually crumbling. It has been since the beginning of the year that the operating margin has been plummeting while the auto industry margin has remained unchanged. Competition is not the same as a few years ago, and convergence has been inevitable.

At this point, Tesla defenders might point out that the margin problem is only momentary and mainly dependent on a worsened macroeconomic environment: in my view, there is a bigger problem, and it concerns brand identity.

Tesla pioneered the EV revolution and started out as a brand for the middle- and upper-income segment of the population. Until a few years ago, it actually maintained that status; however, as competition increased, it began a series of aggressive price cuts:

- Tesla recently introduced a rear-wheel-drive Model Y priced at $43,990, the lowest price for the Model Y in the United States to date.

- Tesla also cut prices on Model S and Model X, with reductions of up to 19%. In addition, lease pricing also dropped significantly.

The strategic choice to broaden the customer base is almost always detrimental to margins, as brand exclusivity is lost and premium vehicles – which Tesla makes the most money on – lose their appeal. The sale of the long-awaited Model 2, which will cost just over $20,000, will only accentuate this process that began months ago. Wanting to operate in all price ranges was in my opinion a poor choice and is gradually eroding Tesla’s competitive advantage.

Chart based on Seeking Alpha data

After the continuous price cuts, the result is that Tesla already can no longer differentiate itself from competitors; in fact, they all have higher EBIT margins except Toyota Motor Corporation (TM). As for Ferrari N.V.’s (RACE) inclusion in the list, it is obvious that it is not a direct competitor, but I wanted to mention this company’s margins to give you an idea of what it means to have a competitive differentiation advantage, what Tesla could have aspired to before it decided to compete in one of the most competitive markets in the world.

If you look at the performance of any automotive company operating across multiple price ranges, you will notice that none has proven to be a good investment over a 10-15-year time frame. The reason is very simple: there is too much competition and the consumer looks first at the price of the car and then the brand. This has always been the case, and the only exceptions are companies that sell cars at a price that few can afford, such as Ferrari. In that case, the customer will not look at the price but simply at the status symbol of the brand.

At this rate, I expect Tesla will become a classic car company with low margins and poor performance.

For those who believe that the Cybertruck is the solution to every problem, this will probably not be the case. While it is true that demand for the latter has been abundant – more than a million reservations – the company cannot meet it entirely. To date, Tesla is able to produce about 125,000 Cybertrucks each year, and only by 2025 the production will perhaps double. Moreover, since it does not yet generate positive cash flows, the Cybertruck from a financial point of view will only be a burden for Tesla in the next 18 months or so.

So, as also stated by CEO Elon Musk, it is best to temper expectations:

So, I just want to temper expectations for Cybertruck. It’s a great product, but financially it will take, I don’t know, a year to 18 months before it is a significant positive cash flow contributor. I wish there was some way for that to be different, but that’s my best guess. The demand is off the charts. We have over 1 million people who’ve reserved the car. So it’s not a demand issue, but we have to make it and we need to make it at a price that people can afford, insanely difficult things.

This is not to say that the Cybertruck will be a failure, but that its success should not be taken for granted just because it has encountered strong demand from the start. Achieving an adequate level of production will be extremely difficult, as well as making it cash flow positive. Of course, this is all at the expense of margins.

Overall, I do not see how Tesla in the long run can aspire to higher margins, given that it has now entered a highly competitive market where no company can really prevail over another since customers are price-sensitive. The Cybertruck may prove to be a success in 2-3 years, but when you produce a Model 2 that competes with a Toyota in terms of price, brand deterioration in premium models is inevitable.

Are auto sales not growing like they used to? Not important, Tesla is not an automotive company

Tesla’s main bullish theses paint it more as a tech company rather than an automotive company, which makes me rather puzzled.

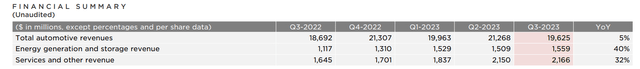

According to the latest quarterly report, 84% of revenues come from the Automotive segment; therefore, objectively Tesla is an automotive company and that is indisputable. We can argue that in 10 to 15 years the Services and Energy/Storage segments may become so significant that they will overshadow the Automotive segment, but for the moment that is not the case. While it is true that the market is forward-looking, it is clear that discounting in the current price an assumption that may be realized in 10-15 years seems rather risky. With due differences, it is like discounting in the current price of Meta that the Metaverse will be a success in a decade: no one would consider such a thing reasonable, but the same reasoning is not applied to Tesla.

As of today, Tesla is an automotive company and will be the same in the coming years, which is why the comparison must be made with its current industry benchmark, not what it will be a decade from now.

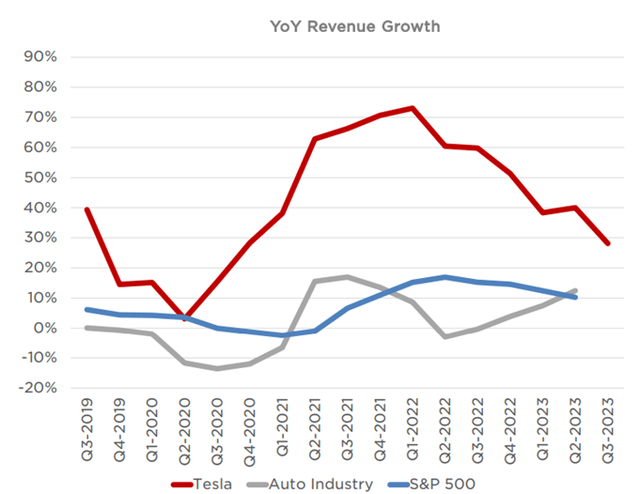

Compared to the auto industry, Tesla continues to grow its revenues faster, but it is evident that something is changing: starting in Q2 2022, the two growth rates began to converge.

Compared to Q3 2022, Tesla’s revenues grew by 9%. Not bad, but I expect more from a company with a P/E of 69x.

The much-discussed Energy/Storage and Services segments experienced strong growth, 40% and 32% respectively, but on a quarterly basis the improvements were marginal. Should these be the segments that in a few years will make Tesla less dependent on the Automotive segment?

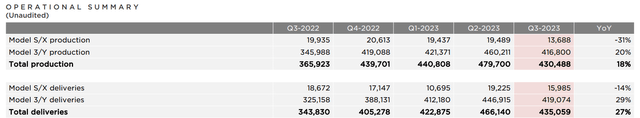

Regarding the production and sales of the various models, the recent results are not surprising and support my thesis of deterioration in brand perception.

Models in the premium range, i.e., Model S/X, suffered a major slump in both production and deliveries: -31% and -14%, respectively. In contrast, the cheaper models, namely Model 3/Y, saw an increase in both production and deliveries: +20% and +29%, respectively.

My view is that this trend will continue, and even if total deliveries continue to increase, the gradual deterioration of margins will make profit growth stagnant. With the introduction of Model 2, I expect that both Model S and Model X will suffer a major backlash. Tesla may be able to keep selling more and more vehicles and increase its revenues, but if margins deteriorate, the overall effect will be negative.

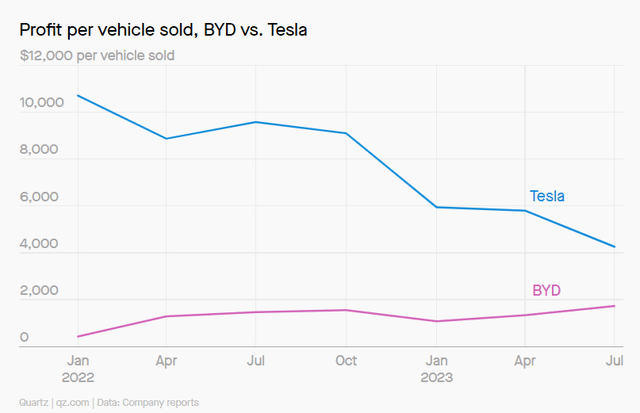

What’s more, competition in China is becoming fierce and the Chinese government has every intention to support local companies. BYD Company Limited (OTCPK:BYDDF) has closed the gap in the number of fully electric vehicles sold and is closing the gap in profit per vehicle sold.

Sales volumes are falling in favor of the Chinese automotive industry, and this is an issue to monitor since more than one-fifth of sales come from China.

Finally, the potential difficulties that the automotive industry may face in the coming months/years make the future more uncertain. As a very cyclical industry, it certainly does not benefit from an economic slowdown. Interest rates are high everywhere and it is not as easy as in the past to buy a car.

Tesla expects 1.8 million deliveries in 2023, which implies about 476,000 deliveries in Q4 2023: given the current macroeconomic environment, that seems too high an expectation to me.

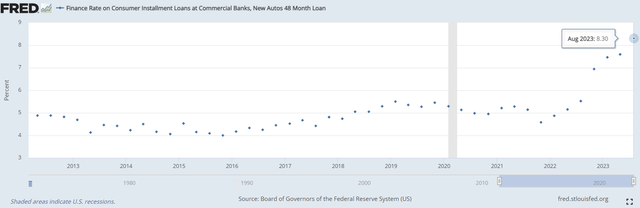

Federal Reserve Bank of St. Louis

Getting a loan to buy a car is much more expensive than in the past, and this will reduce demand for the entire industry. Since rising interest rates have a lagged effect on the economy by about 12 to 18 months, I expect 2024 to be a complicated year for any automotive company, including Tesla of course.

Is Tesla overvalued?

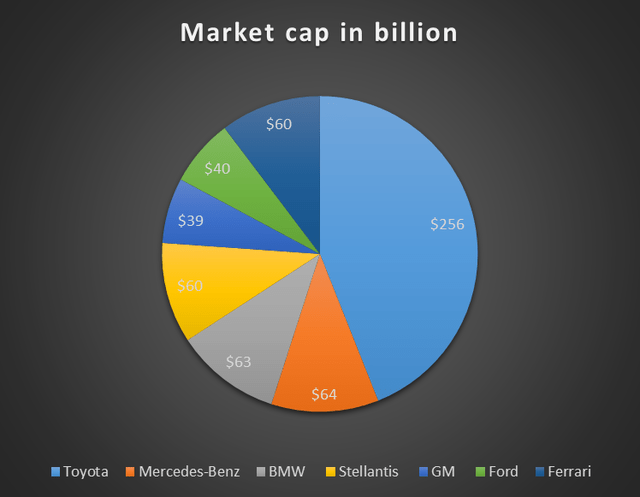

Since Tesla’s market capitalization is worth more than all of these automotive companies combined, it may be superfluous to create a discounted cash flow (“DCF”) model to figure out whether the company is overvalued or not. Regardless, I want to create it anyway, to show how much growth Tesla would need to experience to justify its current market capitalization.

In this model I will consider the following assumptions:

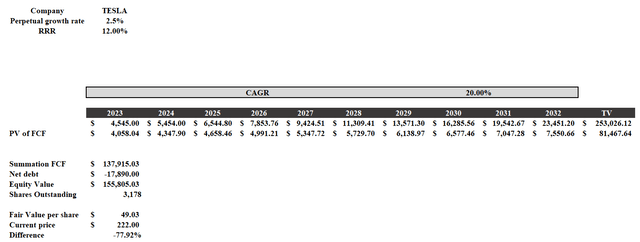

- Required rate of return of 12%. This is very conservative considering the stock has a beta of 2.25.

- Free cash flow 2023 of $4.54 billion based on analysts’ estimates. Thereafter, I considered high growth: 20% per year until 2032.

With these assumptions, this results in a fair value of $49 per share, a 78% difference from the current price. In short, no premium can justify the current price. To reach $222 per share, the CAGR would have to be 47%, with a free cash flow in 2032 of $145 billion: basically we will only see Tesla on the road, and the other car companies will be watching.

Here on Seeking Alpha, I have read of people who believe that for Tesla fundamentals do not matter, after all, as long as there are investors willing to buy at current prices there will be no crash. We see the same mechanism with Bitcoin, an asset with no intrinsic value – since it does not generate cash flow – but is trading at $36,000. I agree with this reasoning, but historically in the stock market all companies follow their fundamentals over the long term, and I do not think Tesla can be the exception.

Conclusion

Tesla is a good company with a phenomenal CEO. However, this does not justify the current price per share. My impression is that Elon Musk’s charisma is the main reason why many people have invested in Tesla, and this may make their valuations unobjective.

The fact that Tesla has pioneered the EV revolution has given it a strong advantage over its competitors. However, over the past few quarters, it is evident that something is gradually changing. As with any competitive market, after a boom phase driven by a pioneer, normalization subsequently occurs as other players enter the picture. While for Tesla the years of 30-40% growth in my view are over, for other companies there is ample room for growth dictated by their recent introduction into the EV market. Here are just a few examples:

- BMW Group sold 93,931 EVs worldwide in Q3 2023, an increase of 79.6% year-on-year.

- Mercedes-Benz sold 61,600 EVs worldwide in Q3, up 66% year-on-year.

Market normalization is already underway and Tesla’s decreasing margins are evidence of this. The same is happening in the East, where Chinese competitor BYD is growing faster than Tesla.

To make matters worse, there is also a macroeconomic environment that has deteriorated considerably from the years when Tesla was growing exponentially. Interest rates are among the highest in 20 years, and buying an electric car still costs much more than a gas car. In short, the scenario for the coming quarters does not look the best, but I could be wrong.

I conclude this article with a final food for thought for those with a long-term view: what would happen to Tesla if, in 5-10 years, Elon Musk was no longer the CEO?

The world’s best companies like Apple, Amazon, and Microsoft have continued their unstoppable growth even without their founders because their strength was their underlying business. A great company continues to be great even without its historical CEO: could we say the same for Tesla? I would like to read your comments on this.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Just my opinion.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.