Summary:

- The Home Depot, Inc. is scheduled to report Q3 earnings next Tuesday, November 14th.

- Revenue and earnings per share are expected to be strong at $37 billion, and $3.78, respectively.

- However, I am more interested to hear about the company’s near-term guidance following the latest consumer confidence data releases.

- If Home Depot does reduce its guidance and shares fall, it may be a great buying opportunity.

patty_c

Overview

The Home Depot, Inc. (NYSE:HD) is scheduled to report its Q3 earnings on Tuesday, November 14th, before the market open. Wall Street is expecting Home Depot to report strong earnings; current EPS estimates for the quarter range between $3.50-$4.00 ($3.78 average) sourced from 30 analysts and compiled by Seeking Alpha.

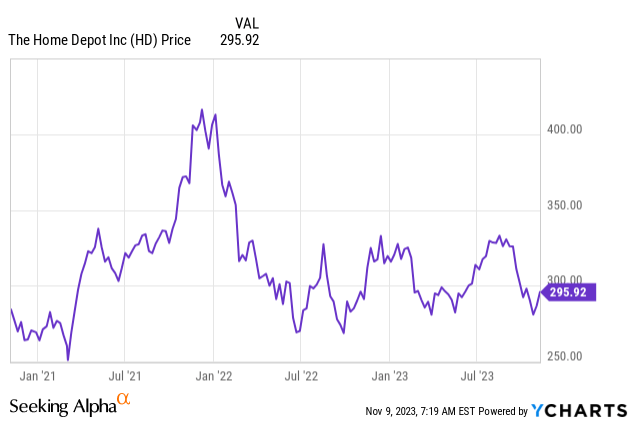

Most people at this point are aware of the elephant(s) in the room Home Depot is currently facing: mortgage rates at multi-decade highs and consumer confidence dwindling. The company is heavily exposed to the U.S. economy, which year-to-date has remained unquestionably resilient. And although Home Depot’s share price is slightly down this year, overall it’s held up given the potential headwinds it faces in the near-term.

Home Depot’s 3-Year Share Price Hasn’t Changed Much

Will Home Depot Reiterate Its Full-Year Guidance, Again?

Last quarter, management at Home Depot confidently reaffirmed its 2023 guidance, with sales expected to decline 2%-5% and diluted earnings-per-share-percent-decline of 7%-13% from 2022. The company also issued a $15 billion share buyback program.

However, things have changed since August in my view. One example would be consumer behavior. Back during the Q2 earnings call in August, Home Depot CEO Ted Decker made the following comments when asked if the industry has seen a bottom:

“The overall economy and the consumer in particular have remained incredibly resilient. As we all know, the economy continues to grow with a number – another great GDP print for the second quarter. And fears of a recession or at least a severe recession have largely subsided, and the consumer is generally healthy. There’s PCE spending, continues to grow, albeit at a slower rate. So while there’s a lot of positives in the macro and with the consumer, we still see enough uncertainty really largely driven by this PCE shift and where that ultimately lands…We just thought there was too much uncertainty to take, for example, revise our guidance from earlier in the year. But having said all of that, long answer, when we do get through this period of moderation, we remain incredibly bullish on the sector. We couldn’t feel better about the macro for housing and home improvement and our prospects and ability to keep taking share in this huge and still largely fragmented market.”– CEO Ted Decker. Source: Seeking Alpha

Since this earnings call, consumer confidence has continued to fall, especially around future expectations. According to the Conference Board, a non-profit that publishes regular indicators for the United States economy, the Expectations Index — which is based on consumers’ short-term outlook for income, business, and labor market conditions—fell slightly to 75.6 (1985=100) in October, after declining to 76.4 in September. The Expectations index is still below 80—the level that historically signals a recession within the next year. Consumer fears of an impending recession remain elevated, consistent with the short and shallow economic contraction we anticipate for the first half of 2024.

Remember, markets are typically forward-looking. The data continues to point towards a recession, and some may argue that might not be reflected in markets. Ted Decker appeared confident about U.S. consumer spending trends on the last earnings call, so I’ll be interested to hear if he still feels that way. If not, Home Depot might consider revising its earnings guidance due to weakening consumer trends coupled with the highest mortgage rates in two decades. The surge in mortgage rates can deter potential homebuyers and impact housing-related expenditures, affecting Home Depot’s core business. Additionally, waning consumer confidence may lead to reduced discretionary spending on home improvement projects. As economic indicators influence the housing sector, a cautious outlook becomes imperative, prompting Home Depot to recalibrate earnings expectations to navigate potential challenges arising from these unfavorable market conditions.

-

Dependence on Housing Market: Home Depot’s revenue is closely tied to the housing market. High mortgage rates can deter potential homebuyers, leading to a slowdown in housing transactions and, consequently, reduced demand for home improvement products.

-

Reduced Homeownership Incentives: High mortgage rates diminish the affordability of homeownership, potentially leading to a decline in new home purchases. This, in turn, affects Home Depot’s customer base, as homeowners often invest in renovations and improvement projects.

-

Consumer Confidence Impact: Low consumer confidence can result in reduced discretionary spending. Home Depot relies on consumers’ willingness to invest in home improvement projects, and a lack of confidence may lead to postponed or canceled projects.

-

Cyclical Nature of Business: Home Depot’s business is cyclical, with its success closely linked to economic factors influencing housing and consumer behavior. Economic downturns or uncertainties often translate into decreased consumer spending on non-essential home improvement.

-

Impact on Big-Ticket Purchases: Home improvement projects often involve significant expenses. High mortgage rates and low consumer spending can discourage customers from undertaking major renovations or purchasing big-ticket items, impacting Home Depot’s sales of high-margin products.

-

Competitive Environment: In a challenging economic environment, consumers may prioritize cost savings, potentially turning to lower-cost alternatives or delaying purchases, impacting Home Depot’s competitive position.

-

Economic Indicator Sensitivity: Home Depot’s performance is sensitive to broader economic indicators. Economic challenges, including high mortgage rates and low consumer spending, can create headwinds for the company’s growth and financial performance.

Conclusion

While most would consider Home Depot a great company and solid long-term investment, it’s hard to justify additional upside at the moment. Despite near-term headwinds arising from the housing market’s highest mortgage rates in two decades and declining consumer confidence, The Home Depot, Inc. remains a robust and enduring long-term investment. The company’s strong market position, resilient business model, and past performance suggest its ability to weather challenges and adapt to evolving economic conditions. Home Depot’s commitment to innovation, customer service, and its capacity to navigate changing market dynamics positions it favorably for sustained growth. While short-term uncertainties loom, the company’s fundamentals and long-term potential make it an attractive investment for those with a patient and strategic outlook over the next 12 months and beyond.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.