Summary:

- Rivian delivered a strong Q3’23 earnings report and raised its production guidance for FY 2023.

- The EV company outperformed rival Lucid Group, which cut its production forecast and reported a large decline in revenues Y/Y.

- Rivian’s revenues and gross margins are improving, and its free cash flow is showing a favorable trend. The company also ended Amazon exclusivity.

- Shares are the most attractively priced in the group for U.S.-based, large-cap, pure-play EV companies.

Kevin Dietsch/Getty Images News

Rivian Automotive (NASDAQ:RIVN) delivered an impressive earnings sheet for the third quarter on November 7th that included not only a decent EPS beat, but the firm also raised its production guidance for FY 2023 and announced that commercial van deliveries are also going to be available to non-Amazon customers. The earnings sheet showed that some EV companies, like Rivian, are seeing strong production growth and executing much better than others, such as Lucid Group (LCID). Lucid cut its production guidance again on November 7th and reported a much weaker revenue volume for its high-priced electric vehicles. As Rivian executes its EV strategy well and decouples from the competition, I believe Rivian currently presents the deepest value in the large-cap, U.S. electric vehicle market!

Previous rating

In October I recommended Rivian’s shares after the EV company announced that it was going to issue $1.5B in convertible senior notes to finance the production ramp of its R1 production line (including both the truck and the SUV version) which caused a significant stock sell-off: Buy The Panic (Rating Upgrade). Shares have decreased about 7% in value since my last recommendation from October. I am upgrading my rating from buy to strong buy due to Rivian raising its production guidance for FY 2023 and improving free cash flow.

Raised FY 2023 production guidance, third-quarter accomplishments

Rivian delivered a much better earnings sheet than EV rival Lucid for the third quarter which lowered its FY 2023 production forecast from “more than 10 thousand” to a new range of 8,000-8,500 electric vehicles.

On the other hand, Rivian raised its production outlook for FY 2023 by 2,000 units to 54,000 electric vehicles, showing an increase of 4%. It was the second consecutive raise in the firm’s guidance as Rivian previously raised its outlook by 2,000 units. I indicated that I saw upside potential in Rivian’s production volume in FY 2023 given the strong rate of production growth in the first three quarters of the current fiscal year. I still estimate that Rivian’s actual production volume will exceed 56,000 units.

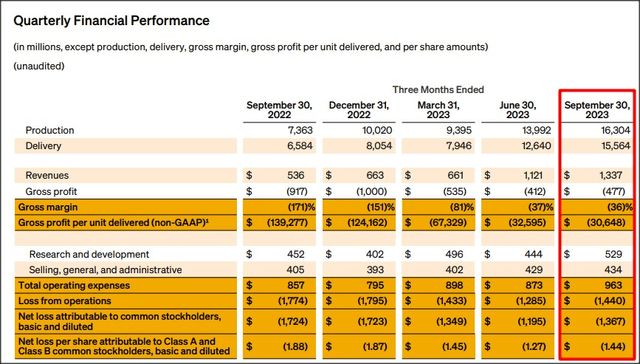

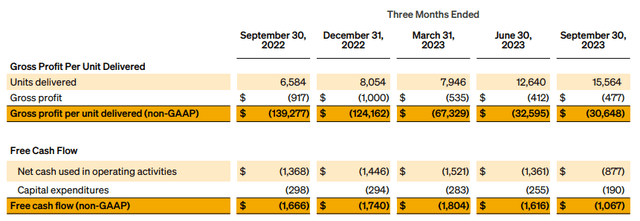

Rivian’s revenues are on a massive upswing and the EV company achieved a new revenue record in the third quarter as well: Rivian reported $1.34B in revenues, showing 149% top-line growth year over year. At the same time that the EV maker is ramping up production, Rivian’s gross margins are improving rapidly: the electric vehicle maker reported a gross margin of -36%, showing a 135 PP improvement compared to the year-earlier period. Although Rivian is still losing money on every electric vehicle it sells, the EV company is clearly on the right track here.

Free cash flow improvement, favorable trend

Rivian is not yet profitable and is not expected to be until FY 2027. However, Rivian’s free cash flow is improving rapidly and although it was still negative at $1.1B in the September quarter, the trend is undeniably a favorable one for the company. Rivian’s free cash flow improved 36% year over year and at the current rate of improvement, I believe we could see a positive free cash flow in FY 2026.

A non-Amazon commercial van revenue stream may be opening up

Amazon made a deal with Rivian to buy 100,000 commercial vans from the EV start-up in order to build out its delivery fleet for its sprawling e-commerce empire. However, Rivian has said in its Q3’23 earnings report that its commercial vans are now also available to other customers. As such, Rivian’s commercial vans are going to be in direct competition with Ford’s e-Transit which is a best-selling model in the commercial market. As Amazon’s exclusivity for its commercial van solution ends, Rivian is creating a new, non-Amazon related revenue stream that is set to boost the company’s revenue potential going forward.

As an example, Ford’s e-Transit sold 2,617 models in Q3’23 and was the best-selling electric van in the U.S. I believe that Rivian could at least get a small share of the market with its rival EDV commercial van. If Rivian were to sell just 5,000 commercial vans per year, then Rivian, assuming an average sales price of $90 thousand, could generate an additional $450M in revenues that so far have not been considered in consensus estimates.

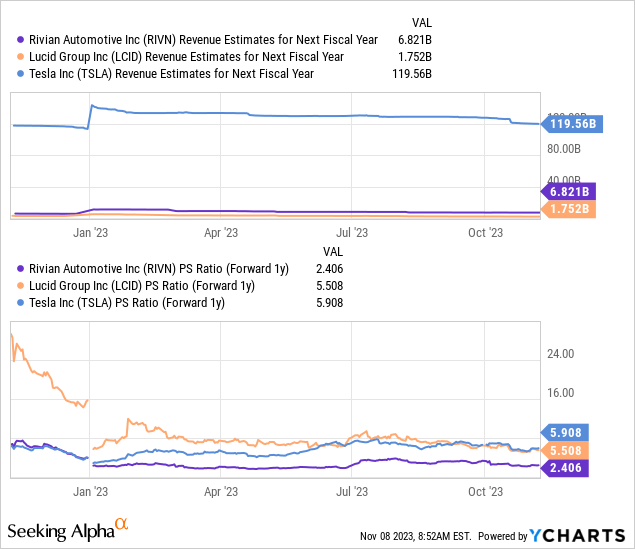

Rivian’s valuation, decoupling from EV rivals

From a production, growth and risk point of view, I believe Rivian currently represents the best large-cap value that long-term investors can buy in the electric vehicle industry.

Rivian is trading at a price-to-revenue ratio of 2.41X which makes it the lowest-valued, U.S.-based, pure-play electric vehicle company with a market cap of $5.0B or higher. The average P/S ratio for Rivian in the last year was 3.1X which I consider to be a reasonable benchmark since Rivian is seeing exceptional production and revenue growth. With a 3.1X P/S ratio, Rivian has approximately 29% upside revaluation potential and it would put the company’s fair value at around $22. However, Rivian has the potential to raise its fair value estimate through stronger revenue growth and moving closer toward profitability.

Tesla is the uncontested market leader in terms of both market cap and production/delivery volume, but Rivian is significantly cheaper than Tesla and the company’s production growth has been impressive: Tesla produced 25% Y/Y production growth in Q3’23 while Rivian’s production grew 121% in the September quarter. Rivian’s strong execution in terms of production shows that the firm is decoupling from its rivals, leading to higher revaluation potential, in my opinion.

Rivian’s revenue volume is still significantly lower than Tesla’s, but the rate of production growth also implies that Rivian has a lot more room to grow into a higher valuation.

Risks with Rivian

Rivian’s risks have decreased after the company reported third-quarter earnings and the company’s raised outlook stands in contrast to Lucid’s production guidance for FY 2023… which was once again cut. Rivian is seeing strong production growth which also limits risks for the EV company.

If Rivian’s revenue growth slowed or the company saw disappointing EDV sales in the commercial van market, then I would be willing to reconsider my strong buy rating. Expanding losses, higher free cash flow losses, and new price pressure in the EV market would also be reasons to consider the current rating. The same goes for a potential delay in Rivian’s profitability timeline (the company is currently expected to achieve profitability in FY 2027) which I consider to be Rivian’s biggest risk factor.

Closing thoughts

Rivian’s third-quarter earnings scorecard was much better than Lucid’s: Rivian raised its outlook for FY 2023 production to 54,000 EVs (Lucid lowered it), the EV company is seeing strong revenue momentum, losses narrowed and free cash flow improved quite drastically compared to last year. While Rivian is not yet profitable, I believe that the firm is on the right track. The availability of Rivian’s commercial vans to non-Amazon customers implies delivery and revenue upside as well and Rivian’s commercial van solutions are set to directly compete with industry-leader Ford’s e-Transit going forward. I believe Rivian represents, as of right now, the strongest value for EV investors that want to focus on the large-cap, U.S. electric vehicle market!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RIVN, TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.