Summary:

- Lucid Group’s stock performance has been very disappointing. Although buyers tried to defend the $5 level since June 2023, they eventually gave in to intense selling pressure.

- The company’s third-quarter earnings report showed a significant reduction in an already low production outlook, justifying the sellers’ thesis.

- Investing further in Lucid at this point requires a giant leap of faith. I’m no longer sure whether it’s still worth it for holders.

- With LCID now firmly in the penny stock status, it could stay there for a long time, given its weak fundamentals and unconstructive price action.

Justin Sullivan

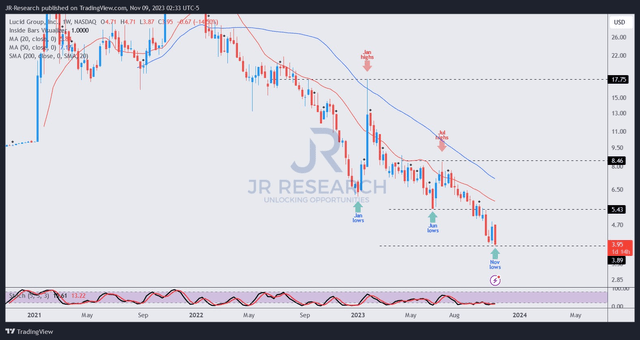

To say that I wasn’t fooled by Lucid Group, Inc. (NASDAQ:LCID) stock performance over the past few months is an understatement. I had anticipated its June 2023 lows to hold firmly, leading me to upgrade LCID in my early July 2023 update. However, LCID topped out at the $8.40 level in the same month. I then saw another opportunity for dip-buyers to consider in September 2023 as short-selling activity increased. While LCID attempted to hold its September lows for three weeks, buyers never regained the confidence needed to move the needle.

Accordingly, when LCID sellers broke below the $5 level decisively, it has turned LCID into a penny stock since then. It also induced significant technical selling as buyers couldn’t defend that critical support zone. As such, these investors likely sold first and asked questions later.

The company’s recent third-quarter or FQ3 earnings release validated the steep selloff from early October, as management delivered another underwhelming report. It cut its production guidance from 10K to between 8K and 8.5K for a midpoint metric of 8.25K. As such, Lucid lowered its production outlook by nearly 18% as it dealt with the increasingly challenging headwinds buffeting the EV market.

Tesla’s (TSLA) Q3 earnings report corroborated these concerns, leading to a sharp decline in its operating margin as the Elon Musk-led company attempted to sacrifice profitability to defend its volume. However, Tesla didn’t raise its year-end deliveries guidance, suggesting it could be worse if the company didn’t leverage its pricing levers.

Even Ford (F) and General Motors (GM) had to defer EV investments, suggesting the broad industry headwinds of high interest rates and macroeconomic uncertainties have started to rear their ugly heads. As such, more intense competitive headwinds could squeeze out pure-play makers like Lucid, given its narrowly focused luxury segment. Therefore, it remains to be seen whether Lucid might need to reduce its outlook further in 2024, notwithstanding its confidence.

The company has started its AMP-2 production facility in Saudi Arabia, deepening its partnership with the Kingdom. With the Saudi PIF as Lucid’s cornerstone backer, I assessed the market likely doesn’t expect Lucid to face bankruptcy fears. While it has a robust balance sheet comprising nearly $5.5B in liquidity, it’s expected to burn through almost $6B in free cash flow between 2024-25 as it ramps up the CapEX spending on its Gravity SUV. As such, Lucid desperately needs to stop lowering its production forecast to improve its gross margin trajectory, although it’s not entirely within management’s control.

Hence, investors must acknowledge that investing further in Lucid at the current juncture requires a massive leap of faith, although I’m no longer sure whether it could be repaid.

LCID price chart (weekly) (TradingView)

With LCID valued at a forward revenue multiple of more than 9x, it’s hard to argue that LCID is attractive. The premium could entail the PIF’s involvement as its cornerstone investor, owning more than 60% of its outstanding shares.

However, I believe the short-sellers have gotten their bets spot on, even though buyers have attempted to hold the $5 level since June 2023. I acknowledge that the risks of an unanticipated short-covering surge cannot be ruled out, given its more than 25% short interest as a percentage of float in mid-October.

However, given its fundamental challenges as a cash-burning luxury EV maker, I no longer think that’s sufficient to continue betting on a speculative mean-reversion recovery on LCID.

In addition, LCID has returned to its downtrend bias after falling through the $5 level. While a short-term bounce is anticipated, I believe it’s time for investors to move on from this no-moat EV maker finally.

Rating: Downgraded to Sell.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!