Summary:

- Lucid’s Q3 revenues of $137.8 million were down almost 30% year over year, badly missing street estimates.

- The company’s cost structure is a major problem, with dramatically negative gross margin dollars and large operating losses.

- Lucid cut its 2023 Air sedan production forecast as it continues to struggle in the luxury EV market.

Wirestock/iStock via Getty Images

After the bell on Tuesday, we received third-quarter results from Lucid Group (NASDAQ:LCID). The electric vehicle maker has been one of the most disappointing in the space over the past few years, as it has struggled to grow both production and deliveries. As a result, shares have continued to head lower, and the latest set of results continue to show a company in major trouble.

For Q3, Lucid came in with total revenues of $137.8 million. This number was down almost 30% over the prior year period, badly missing street estimates for more than $195 million which would have been a very slight year-over-year decline. The company delivered over 1,450 vehicles in Q3, its best quarter of this year so far, but total Lucid revenue per vehicle delivered was under $95,000 in the period, down from almost $140,000 a year earlier. Lucid has been delivering cheaper variants of its flagship Air sedan, but the company has also had to discount vehicles a bit just to get sales where they are.

The major problem for Lucid continues to be its cost structure. In Q3, the company reported negative gross margin dollars of over $331 million. While that was meaningful progress on a sequential basis, the company produced over 620 fewer vehicles than it did in Q2. If you take the cost of goods sold and divide it by production, you get a figure that was more than $303,000 per vehicle, up almost $50,000 sequentially and nearly $90,000 from the year-ago period. Another massive operating loss was reported at more than three-quarters of a billion dollars, meaning that operating margins came in at negative 546.3%.

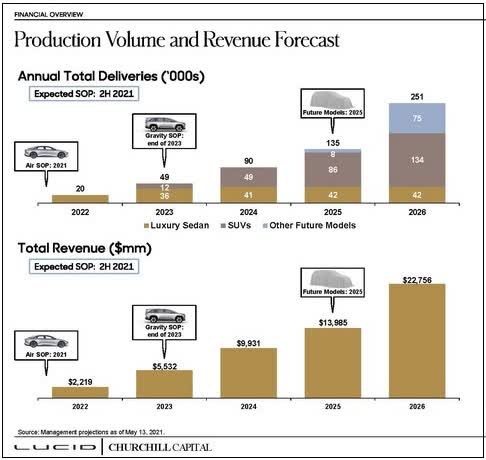

Lucid continues to struggle in the luxury EV market which is growing more competitive by the quarter and meeting headwinds as interest rates surge. Even Tesla (TSLA) is having major problems selling its two luxury vehicles without massive price cuts. Throw in the likes of Mercedes, Audi, etc., as well as an upstart like Polestar (PSNY) which itself is launching two new vehicles next year, and there just isn’t enough room for all of these names. Next week, Lucid will unveil its Gravity SUV, which will begin production late next year. This assumes no further delays, as the graphic below shows that Lucid’s long-term plans from its SPAC presentation have been missed quite substantially.

Lucid Original Guidance (Company SPAC Presentation)

With Lucid continuing to have issues on the demand side, management cut its 2023 production forecast. The new production outlook for 2023 is for 8,000 to 8,500 Air sedans, down dramatically from prior guidance of more than 10,000. Management says this is to “prudently align production with deliveries”, which is corporate speak for terrible demand. Lucid’s 10k forecast itself was very disappointing when originally issued, as the company’s original target when the company was going public was for the production of 20,000 vehicles in 2022. It will be interesting to see how guidance fares next year, given Lucid will likely need to cut prices further to drive meaningful delivery growth of the Air, as the Gravity likely won’t contribute much to the year’s figures.

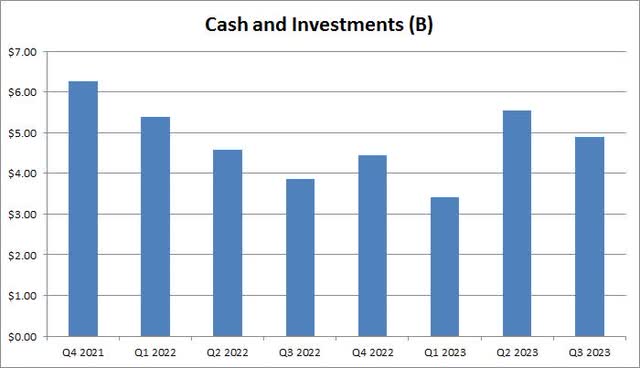

With Lucid’s losses being quite dramatic in recent years, the company has been burning through tons of cash. In the latest quarter, cash burn was more than $700 million, putting the nine-month total for this year at more than $2.65 billion. As the chart below shows, the cash balance is up over the past 12 months due to this year’s equity raise, and management says it has enough liquidity to get through the Gravity launch and into 2025. However, it would not shock me if we see another capital raise to fortify the balance sheet, especially if we don’t see demand pick up dramatically in the coming quarters.

Lucid Cash and Investments (Company Earnings Reports)

Given another terrible quarter on the record, I am continuing to rate Lucid shares as a sell. The valuation angle here continues to be a problem, as Lucid went into the Q3 report trading at about 5.5 times next year’s expected sales, compared to 5.8 times for EV leader Tesla (TSLA). That was before the massive revenue miss on Tuesday and the latest guidance cut, which will likely push Lucid’s analyst revenue estimates for next year down a bit. I would feel much more confident in Tesla at these valuation figures given its profitability and cash flow, plus its energy storage business. I should note that the average price target on the street for Lucid is about $6.50 currently, representing quite a bit of upside from here, but that number stood at nearly $24 a year ago.

For me to upgrade Lucid to hold, I need to see a few major items occur. First, I need to see deliveries ramp up to more material levels, and not just via price cuts or launching much cheaper Air variants. It would be nice to see guidance for next year be announced next week, but I think management will wait on that until the Q4 report. The second thing is to see a major reduction in net losses and cash burn, to show that this business has a chance of breaking even at some point. Finally, I’d like to see one more capital raise go through here, because even though there is a cash runway into 2025, launching another vehicle is likely to be expensive. It’s possible that we’ll see the Saudi Investment fund, already a huge Lucid investor, contribute more capital to help get the Gravity launch going.

In the end, Lucid announced another terrible set of results on Tuesday, which could have shares testing their all-time low in the coming days. Revenues badly missed street estimates again, as the company is now delivering cheaper Air variants as well as resulting in discounting to move metal. Major losses and cash burn are ongoing, and they are not likely to subside anytime soon as volumes remain low. While Lucid will unveil its new SUV next week, management cut production guidance for the Air sedan for this year due to demand troubles. With a valuation that’s close to Tesla on a price-to-sales basis, this stock just doesn’t work for me until major improvements are made.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.