Summary:

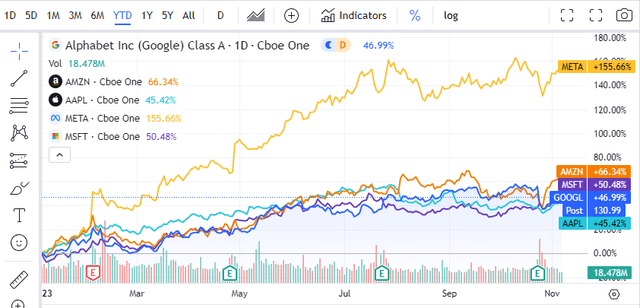

- Big tech stocks, including Alphabet, Apple, Amazon, and Microsoft, have seen double-digit percentage gains this year.

- Alphabet is considered the most undervalued in the group and has a strong balance sheet and consistent share buybacks.

- Despite a strong quarter, Alphabet’s stock has been downgraded due to concerns about its cloud business, but the company’s overall profitability and growth remain strong.

400tmax

The market has faced rising rates, macroeconomic uncertainty, and geopolitical tensions, yet big tech remains the place to be. On a YTD basis, Alphabet (NASDAQ:GOOGL), Apple (AAPL), Amazon (AMZN), and Microsoft (MSFT) have recognized double-digit percentage base gains while Meta Platforms have skyrocketed 155.66%. The only name mentioned that I am not a shareholder of is MSFT, and I wish I had found an entry point as the stock has been a monster. Now that Q3 earnings have concluded for the cohort, I have gone through the earnings reports and still believe that GOOGL is the most undervalued in the group. I firmly believe all five companies will continue to do well, but if I were going to add capital to just one, it would be GOOGL. Big Tech has proven resilient in difficult times, and when the Fed pivots, I believe it will benefit from the cost of capital declining as businesses will be more inclined to consider expansion. GOOGL has a fortress balance sheet and continues to repurchase shares at a rapid pace. As profitability continues to grow and earnings expand, I think more earnings beats are on the horizon, and GOOGL will continue back toward all-time highs,

Alphabet hasn’t been a winner post-earnings, which is proving an opportunity for a catch-up play

Since earnings were released, GOOGL has been in the doghouse. Over the past month, shares of AMZN have climbed 13.08% while shares of GOOGL declined -4.89%. This is one of the things that’s perplexing as GOOGL delivered a strong quarter, yet the market isn’t rewarding them. GOOGL delivered $1.17 of EPS while the street was looking for $1.07, but analysts were hung up on what was considered weak cloud numbers rather than looking at the business in its entirety. Shares of GOOGL were downgraded by investment firm Monness, Crespi, while other analysts downgraded shares of GOOGL and slapped a neutral rating on them.

This is another knee-jerk reaction, and I blame it on the attention that AWS and Azure get. It’s almost as if the entire decision to downgrade shares of GOOGL was predicated on a business segment that’s not even their core business. There was nothing to be disappointed about with Q3 earnings, and I will provide my reasoning as to why I am overly bullish on shares of GOOGL at these levels.

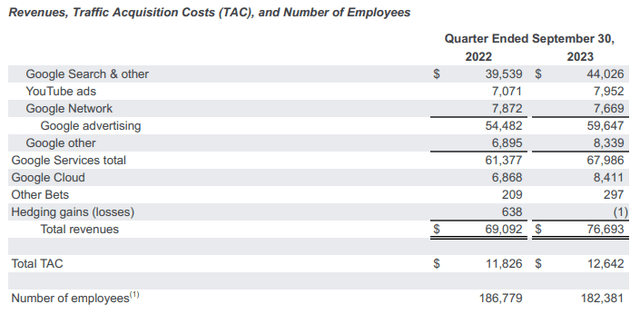

In Q3 2023, GOOGL’s revenue increased by 11% ($7.6 billion) YoY to $76.69 billion. To put that in perspective, GOOGL generated $25.56 billion in revenue per month in Q3. Google Cloud, which was the sore spot for analysts, increased 22.47% YoY as it generated $8.41 billion in revenue. GOOGL’s core business of advertising increased by 9.48% YoY as it added $5.17 billion in revenue. Google Search watched its revenue increase by 11.35% YoY while the YouTube ad business grew by 12.46% YoY. All of Google Services, excluding cloud and other bets, increased by 10.77% YoY as they added $6.61 billion in revenue. Top-line growth is one thing, but businesses are in the business of turning a profit, and GOOGL excelled in profitability during Q3. Google Services increased its operating income YoY by 26.76% as it generated $23.94 billion. Google Cloud is also in positive territory, having generated $266 million in operating income compared to losing -$440 million in Q3 of 2022. While GOOGL’s other bets are still in the red and have other losses, their total operating income in Q3 2023 increased by 24.56% as they added an additional $4.21 billion YoY. This should be the real story behind Q3, not that Google Cloud wasn’t as good as some had hoped, but GOOGL was able to increase its revenue by 11% and its operating income by 24.56% YoY. There were thirteen weeks in Q3, and GOOGL generated $5.9 billion in revenue and $1.64 billion in operating income on a weekly basis, yet they got downgraded because of their cloud business. I think GOOGL got the short end of the stick on this one, as their business is firing on all cylinders.

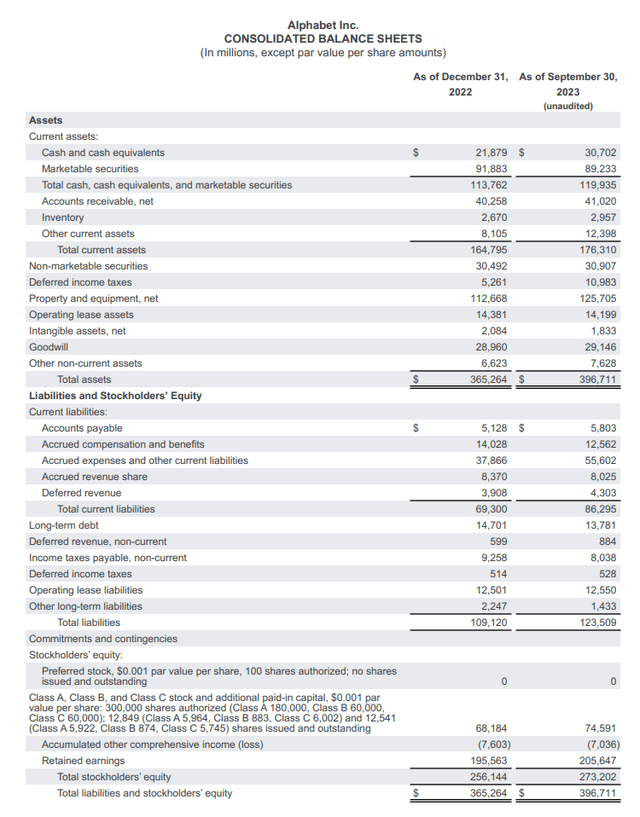

GOOGL doesn’t just have a fortress of a balance sheet, it’s arguably the best balance sheet I have seen. GOOGL has $30.7 billion sitting in cash, and another $89.23 billion in marketable securities, which brings its cash on hand to $119.94 billion. GOOGL also has another $30.91 billion sitting in non-marketable securities under its long-term assets. From a debt perspective, GOOGL has $13.78 billion in long-term debt, a small fraction of its cash. GOOGL’s on-hand war chest grew by 5.43% YoY and generated $1.07 billion in interest income in Q3. How many companies generate over $1 billion monthly on their cash? I am not sure why individuals are bearish on GOOGL as it is a financial powerhouse that only grows as time progresses.

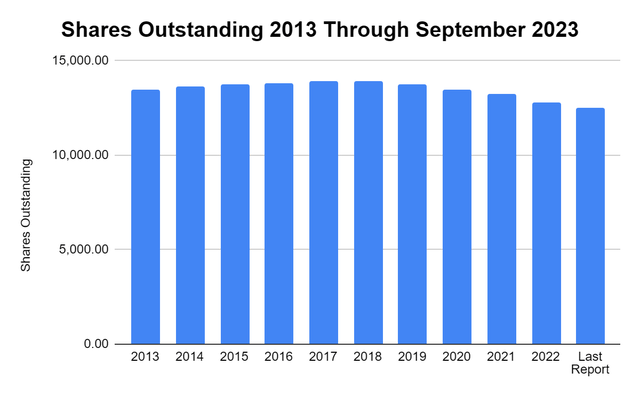

As GOOGL grows its top and bottom line and amasses more cash in its coffers, they are also rewarding shareholders through buybacks. Since the end of 2017, GOOGL has repurchased 1.39 billion shares, which is the equivalent of 10% of its shares. GOOGL has taken a page out of AAPL’s playbook, and its board authorized GOOGL to repurchase up to an additional $70B worth of shares in addition to the remaining capital left on its repurchase plan. As GOOGL continues to operate one of the largest profitable printing presses, more capital will be returned to shareholders through buybacks, which will help expand their EPS and valuation.

Steven Fiorillo, Seeking Alpha

Why I feel that GOOGL is the best value play in big-tech

This is a difficult statement for me to make because the metrics for META are also powerful. There are three things I am looking at, price to free cash flow [FCF], future earnings, and the financials. AAPL, MSFT, AMZN, META, and GOOGL are all great companies, and I would be a buyer of all of them for the long-term, but after looking at the data, I feel GOOGL is the best value play in the group.

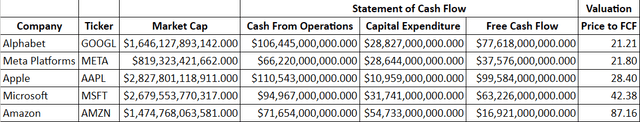

I am a huge fan of FCF because it represents a company’s cash after accounting for cash outflows to support operations. I like to use this metric rather than net income because FCF is a measure of profitability that excludes the non-cash expenses and includes spending on equipment and assets. It’s also a harder number to distort or manipulate due to how companies account for taxes, and other interest expenses. This also is the pool of capital companies utilize to pay back debt, reinvest in the business, pay dividends, buy back shares, and make acquisitions. In the TTM, GOOGL has generated $106.45 billion in cash from operations, and its FCF has come in at $77.62 billion. Today, GOOGL is trading at 21.21x its FCF while AAPL trades at a 28.4x multiple, MSFT at a 42.38x multiple, and AMZN at an 87.16x multiple. The only other big tech company that trades at a similar multiple is META at 21.8x its FCF. I am giving GOOGL the advantage because they are generating more than double the FCF that META is, which is.

Steven Fiorillo, Seeking Alpha

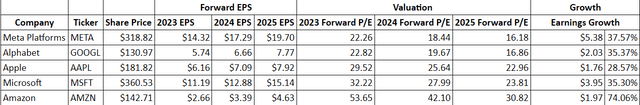

Next, I looked at the earnings estimates for each company. GOOGL and META both look like steals at these valuations. GOOGL is trading at 22.8sx 2023 earnings and 16.86x 2025 earnings. GOOGL is expected to grow its EPS by 35.37% from the end of 2023 through 2025. META and GOOGL are a tie in my eyes on this metric, and I think that GOOGL is super interesting due to the additional $70 billion authorized on top of the remaining buybacks, which could provide a boost to its EPS and make these metrics look cheaper in the future. I wouldn’t be opposed to adding to META or GOOGL at these levels.

Steven Fiorillo, Seeking Alpha

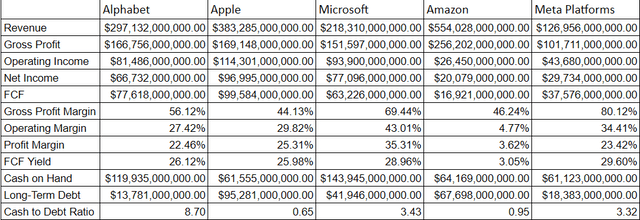

The last aspect I compared for these companies was their financials. I created a table that shows their profitability, margins, and cash-to-debt ratios. These are phenomenal businesses, and it’s incredible what they have accomplished. Everything is based on the TTM numbers and the current state of cash and debt. GOOGL has generated $166.76 billion in gross profit, $81.49 billion in operating income, $66.73 billion in net income, and $77.62 billion in FCF in the TTM. They are operating at a 56.12% gross profit margin, have an operating margin of 27.42%, a profit margin of 22.46%, and an FCF yield of 26.12%. GOOGL comes in 3rd place for revenue, 3rd place for operating income, 3rd place for net income, and 2nd place for FCF yield. GOOGL has the best cash-to-debt ratio at 8.7x followed by MSFT with 3.34x. GOOGL has the 3rd best gross profit margin, and came in 4th for operating and profit margins. GOOGL had the 3rd largest FCF yield of the group.

Steven Fiorillo, Seeking Alpha

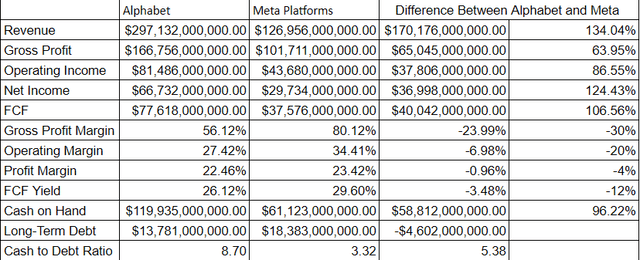

One could make a case for META being a better value play today, but I am giving the edge to GOOGL. At the end of the day, I am paying for profitability, and I am able to pay 21.21x for GOOGL’s $77.62 billion in FCF compared to 21.8x for META’s $37/68 billion in FCF. META has better margins and a slightly lower forward P/E, but I am taking GOOGL’s scale of profitability over META’s margins. GOOGL generates 86.55% more operating income than META and 124.43% more net income. On an FCF metric, GOOGL generates 106.56% more FCF than META while having an additional 96.22% more cash on hand. Both are incredible companies, and I am a shareholder of both. Still, I am giving the edge to GOOGL because their additional profitability allows them to allocate more capital toward their business and buybacks. META’s margins aren’t that much larger on a profitability level to overlook the massive difference in sheer profits.

Steven Fiorillo, Seeking Alpha

Conclusion

I am shocked that GOOGL was rewarded with downgrades after a sensational quarter. Google Cloud isn’t their primary business, but because it didn’t meet some of the analyst’s expectations, they decided to overlook the rest of the underlying businesses and downgrade shares. GOOGL saw its Q3 revenue grow by 11% and its operating income increase by 24.56% YoY. After comparing GOOGL to the rest of big tech I think it’s the best bang for the buck as it trades at 21.21x its FCF and 16.86x 2025 earnings. GOOGL just authorized an additional $70 billion in buybacks on top of its remaining authorization and the additional capital being returned to shareholders is an added bonus as it can help expand future earnings. At the end of the day, you’re paying for a business that is still growing, has a 22.46% profit margin, and generated $66.73 billion in net income over the TTM. I think the market got this one wrong and GOOGL goes higher from here.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL, META, AAPL, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.