Summary:

- Disney delivered better-than-expected Q4 earnings and this is enough to fuel a short-term rally for the stock.

- Fiscal year 2024 will be a pivotal period for the DTC segment and the momentum in Parks would need to be sustained.

- Free cash flow would benefit from lower content spend, although there will be significant headwinds as well.

- I remain cautiously optimistic on Walt Disney stock, but I would need to see more progress being made before I rate DIS stock as a Buy.

FelixCatana

Disney Q4 Earnings

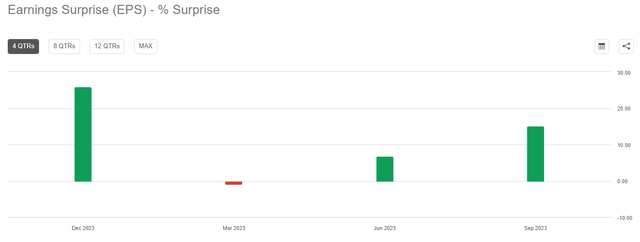

After two disappointing quarters, The Walt Disney Company (NYSE:DIS) finally delivered better than expected results. The initial market reaction is very optimistic, after the media giant delivered better than expected earnings.

Seeking Alpha

However, when considering the disappointing results earlier in the fiscal year, we are reminded that quarterly results contain a lot of noise and we shouldn’t simply extrapolate recent trends into the future.

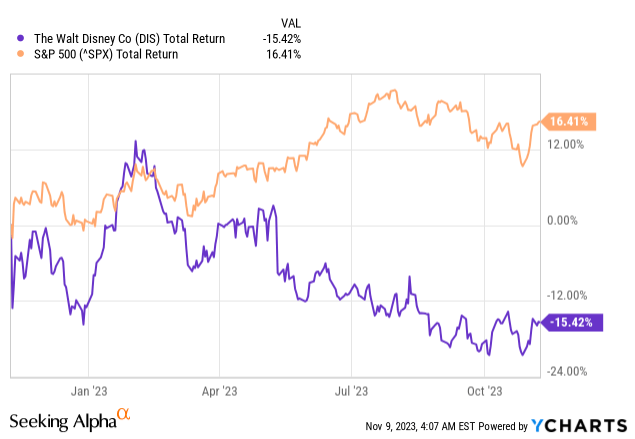

More importantly, it would take Disney a very long time to convince the market that it once again deserves a premium valuation and to erase the share price losses from the past year alone. Not to mention the roughly 40% drop since late 2019, when I first warned of all the pending risks for the business.

Overall, the fourth quarter was a very good one and I do expect short-term momentum in Disney’s share price to be sustained for some time.

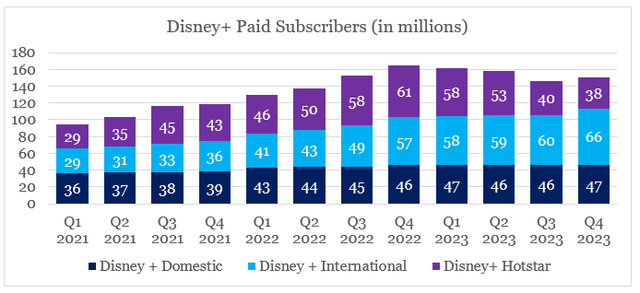

Disney+ Core Subscribers noted a significant increase during the quarter and the strategy of a unified app in the U.S. is likely to be very beneficial of paid subscriber numbers going forward.

We remain on track to rollout a more unified one-app experience domestically, making extensive general entertainment content available to bundle subscribers via Disney+.

Source: Disney Q4 2023 Earnings Transcript

Parks also performed well with a significant increase in both top and bottom line figures. Last but not least, DIS management now expects a further cost reduction on content spend of around $2bn.

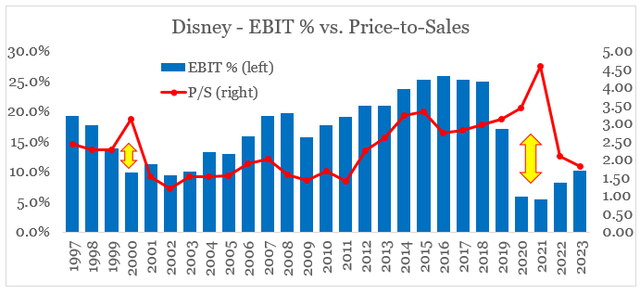

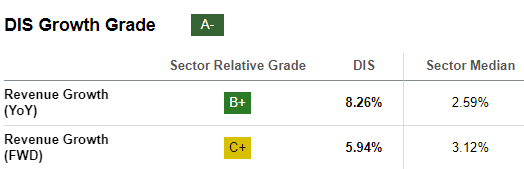

All that creates the necessary conditions for fiscal year 2024 to be a strong one for Disney and its shareholders. On top of improving business fundamentals, the disastrous share price performance in recent years has now resulted in the gap between Disney’s operating margin and its price-to-sales multiple to disappear.

prepared by the author, using data from SEC Filings and Seeking Alpha

As a result of all that I am turning slightly optimistic on Disney, but there’s still a long way to go before I could rate the company as a buy with the expectation for it to outperform the broader market.

What Has Happened During Walt Disney’s Fourth Quarter?

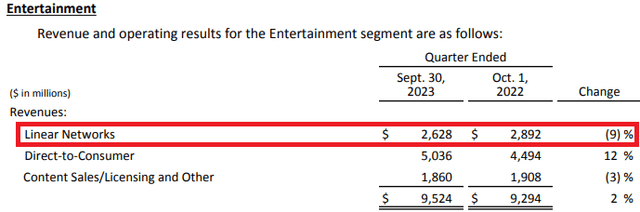

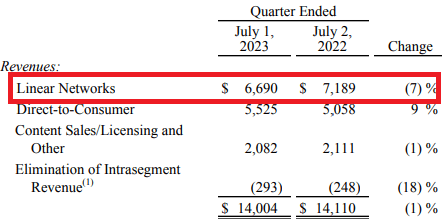

Before turning to the positives of this quarter which I highlighted above, it should be mentioned that a notable decline in the company’s linear business during the quarter highlighted the need for the DTC business to break-even and the heavy reliance on Disney’s Parks and Experiences.

For the fourth quarter, revenue of Linear Networks fell by 9% which shows the ongoing trend for the industry.

Disney’s Q4 2023 Earnings Release

Although this was the first quarter when Sports (ESPN) was split out of the segment, the 9% decline we saw above is even higher than the 7% during the previous quarter.

Disney’s Q3 2023 Earnings Release

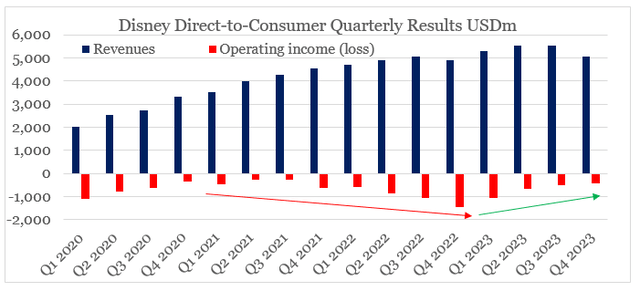

As linear segment is likely to continue its decline, the pressure for the Direct-to-Consumer (DTC) segment to perform will continue to increase. While Parks are doing the heavy-lifting in terms of profitability, the DTC segment would need to not only break-even, but also achieve significant and sustainable returns on capital.

Disney appears to be making good, albeit slow, progress on this front. After narrowing down the quarterly losses in the segment, investors are now looking forward for the company to finally achieve profitability sometime in FY 2024.

prepared by the author, using data from Earnings Releases

To achieve that, Disney+ Core Subscribers would need to continue to increase as the company has already implemented significant price increases. That is why, sustaining the Q4 increase in paid subscribers will be crucial for the next fiscal year.

prepared by the author, using data from Earnings Releases

Unfortunately, this is unlikely to happen in the next quarter as price increases are implemented and the summer promotion is over.

We anticipate core Disney+ subscribers in fiscal Q1 will decline slightly versus Q4 due to the expected temporary uptick in churn from the recent US price increases, as well as from the end of the summer promotion. However, we expect to see sub growth rebound later in the fiscal year.

Source: Disney Q4 2023 Earnings Transcript

This time around, the increase in churn rates is likely to be more meaningful to the past price increases as competition intensifies and consumers are feeling more pressure from rising costs of living.

On the pricing side, we did take Disney+ prices up for the premium service, the non-advertiser supported by about 27%. It’s still really early to tell, but we had taken those prices up significantly a year earlier and churn was de minimis.

Source: Disney Q4 2023 Earnings Transcript

Nonetheless, the next quarter will be very important in assessing the impact on higher prices on customer growth.

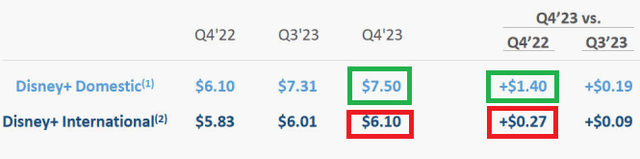

The mix between domestic and international subscribers will also be important as the latter group is still characterized with much lower ARPU (Average Revenue Per User).

Disney Q4 2023 Earnings Presentation

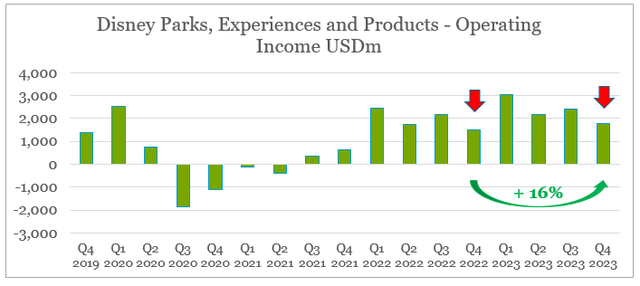

After lapping the seasonally low quarter for Parks, the Q1 of fiscal year 2024 will be a very important quarter for the segment. The seasonally high Q1 will need to offset any potential weakness in DTC and Linear during the period and given the 16% yoy increase in profits (31% on a like for like basis, using the new segments), it appears that this would be an easy task.

prepared by the author, using data from Earnings Releases

Overall, the weakness in Parks following the pandemic is already behind us, but the wild card here would be consumer strength. As inflation bites and high interest rates put pressure on consumer spending, the probability of a recession in 2024 is also exceptionally high. This puts the recent recovery in Parks at significant risk during the next fiscal year.

More Progress Is Needed On Cash Flow

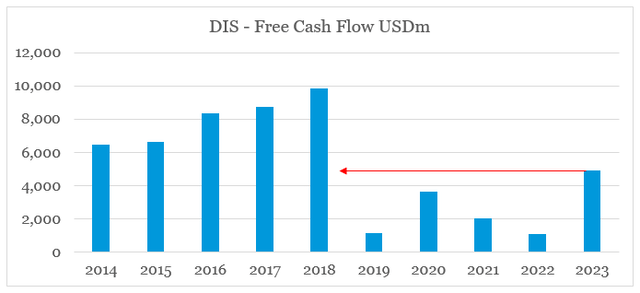

The current fiscal year saw significant progress on the free cash flow side. After years of low profitability, coupled with high content spend and capex, Disney’s free cash flow is now on track to reach levels before the company went all-in on its DTC strategy.

prepared by the author, using data from SEC Filings

Even after this significant increase during FY 2023, Disney now trades at a free cash flow yield of just slightly above 3%, which is hardly an attractive proposition for a business expected to grow at almost 6%.

Seeking Alpha

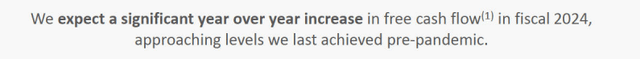

Having said that, the management feels confident in its ability to make significant progress on free cash flow during fiscal year 2024.

Disney Q4 2023 Earnings Presentation

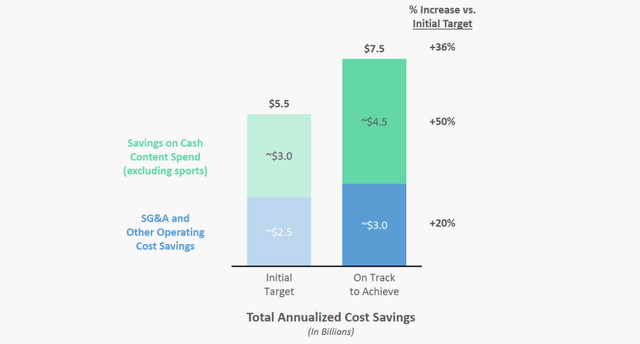

The $2bn reduction in content spend appears to be one of the key pillars behind this statement.

(…) we expect total content spend in fiscal 2024 to be approximately $25 billion, which is a decrease of $2 billion versus 2023.

Source: Disney Q4 2023 Earnings Transcript

It’s also behind the recently increased cost savings target with an additional SG&A and other operating cost savings of $500m when compared to Disney’s initial target.

Disney Q4 2023 Earnings Presentation

All else being equal, this $2bn worth of content spend savings could propel the free cash flow yield to above 4% at DIS’s current share price levels which would be a major tailwind for the stock.

This assumption is still questionable, given the stiff competition in the sector, wage inflation and the recent strikes – all factors that will continue to put pressure or content spend.

More importantly, however, the $2bn content spend tailwind will be partially offset by a roughly $1bn increase in capital expenditures needed for Disney’s Parks.

(…) fiscal 2023 CapEx totaled approximately $5 billion, roughly comparable to the prior year and in line with our most recent guidance. And we expect CapEx in fiscal 2024 to total $6 billion, an increase of approximately $1 billion versus fiscal 2023, driven by higher spend at Experiences.

Source: Disney Q4 2023 Earnings Transcript

All that creates a very mixed picture for Disney’s free cash flow for next year and although some optimism is justified, the company is unlikely to trade at attractive yields anytime soon.

Conclusion

Given the strong market reaction following Disney’s fourth quarter results and the current business momentum, DIS’s stock is likely to perform well in the coming months. DIS is also priced more in-line with its current margins which in my view is more than enough to rate the stock as a Hold. Having said that, linear industry declines and all the question marks around the DTC’s segment future margins will continue to put pressure on Disney’s share price. Free cash flow would most likely improve during FY 2024, but it is unlikely to be enough to justify a significantly higher valuation.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including a detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication and are subject to change without notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Looking for better positioned high quality businesses?

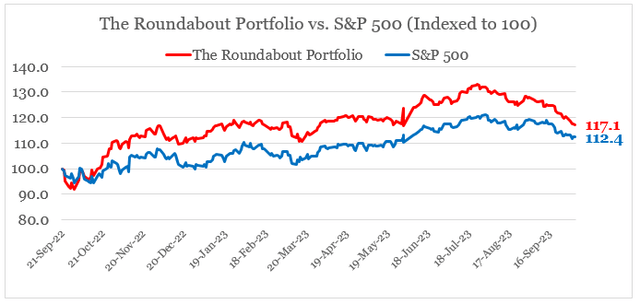

You can gain access to my highest conviction ideas by subscribing to The Roundabout Investor, where I uncover conservatively priced businesses with superior competitive positioning and high dividend yields.

Performance of all high conviction ideas is measured by The Roundabout Portfolio, which has consistently outperformed the market since its initiation.

As part of the service I also offer in-depth market analysis, through the lens of factor investing and a watchlist of higher risk-reward investment opportunities. To learn more and gain access to the service, follow the link provided.