Summary:

- Home improvement giant The Home Depot will announce its third-quarter results on November 14 before the market opens.

- In this update, I explain why the company could beat estimates on Tuesday. However, as a long-term investor, I think it’s much more important to focus on the big picture.

- Therefore, I’ll outline my thoughts on HD stock’s dividend – especially in light of the current rather enticing yield on long-term government bonds.

- In addition, I’ll share my updated valuation of Home Depot stock and conclude with whether I think the stock is now a buy near its 52-week low.

Tim Boyle

Introduction

My regular readers know that I am long-term bullish on the major U.S. home improvement retailers The Home Depot, Inc. (NYSE:HD) and Lowe’s Companies, Inc (LOW). However, in my first article on HD stock in August 2022, I made it clear why I am not ruling out short-term pain and why the investment requires patience. In my last article, published in May 2023, I discussed four key implications of interest rates for the two home improvement retailers.

I still only have a fairly small position in HD stock (about 0.8% of my total portfolio value) and haven’t bought the stock in a while. However, with the stock under renewed pressure due to the sharp rise in long-term interest rates (the 30-Year Treasury briefly yielded 5.1% in late October) and the company reporting its third-quarter earnings next week on November 14 (pre-market), it’s a good time to re-evaluate.

In this update, I’ll take a look at what investors can expect from Tuesday’s upcoming earnings release and, more importantly, whether I think the stock is a buy given the fact that it’s now trading relatively close to its 52-week low. To put the current share price of $288 in perspective, I will present an updated discounted cash flow valuation (including sensitivity analysis), taking into account the recent sharp increase in the risk-free rate, and a multiples-based valuation approach from a variety of angles. I will also share my thoughts on Home Depot’s dividend and elaborate on why investors should look beyond the mere fact that HD stock currently yields 185 basis points less than the 30-Year Treasury.

Did Home Depot Beat Earnings Before And What To Expect From Q3 Earnings?

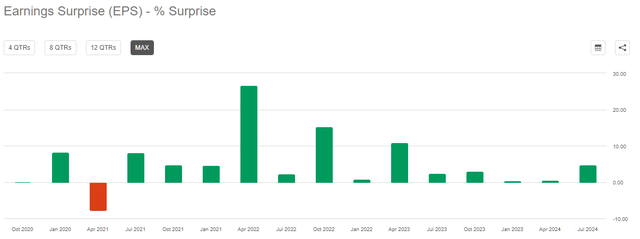

The Home Depot has a history of beating the consensus estimate for earnings per share (EPS). In the last sixteen quarters, estimates have only been missed once, in the first quarter of fiscal 2020, which ended on May 3, 2020 – in the middle of the early phase of the pandemic:

Figure 1: The Home Depot, Inc. (HD): Earnings per share surprises on a quarterly basis (Seeking Alpha)

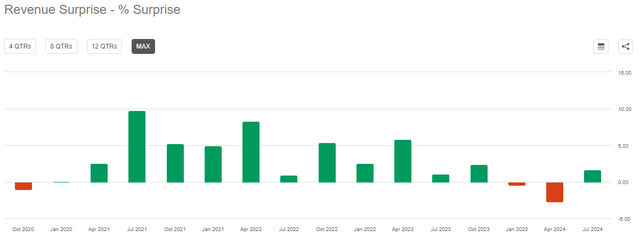

However, on average, the company has beaten analysts’ EPS consensus by more than 5%, which is a sign that management is rather conservative in its forecasts and is executing very well. Of course, one could argue that earnings per share are quite easy to manage, but the company has also beaten estimates for quarterly sales in 13 out of 16 quarters, or by +2.9% on average:

Figure 2: The Home Depot, Inc. (HD): Revenue surprises on a quarterly basis (Seeking Alpha)

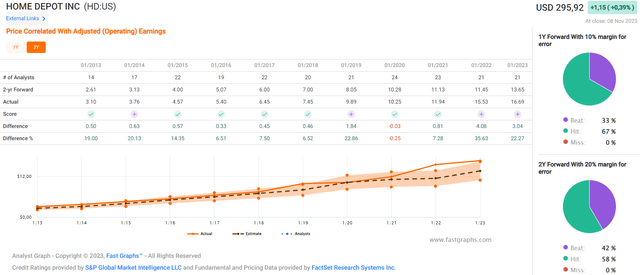

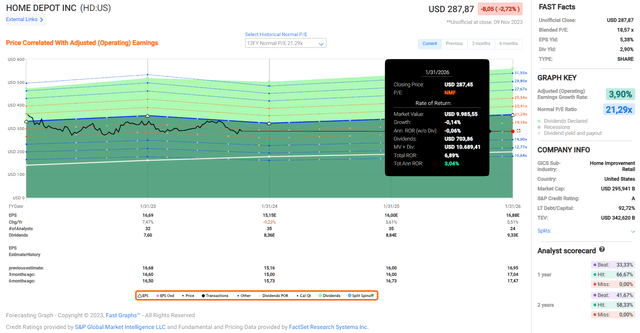

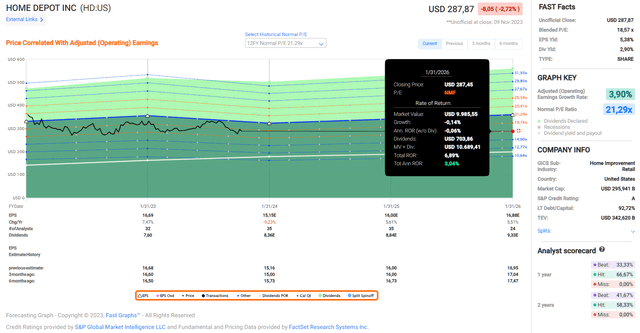

I don’t think the solid track record is solely due to the pandemic-related tailwind – after all, it was clear pretty early on that the combination of lockdown measures and higher disposable income (which was further boosted by stimulus checks) would benefit HD (and of course LOW). Furthermore, the company’s track record is also solid from a long-term perspective. Even on a two-year basis (as shown by the FAST Graphs analyst scorecard in Figure 3), analysts have regularly underestimated the company’s earnings power. Over the past ten years, management has beaten earnings per share estimates 58% and 42% of the time, respectively:

Figure 3: The Home Depot, Inc. (HD): Analyst scorecard on a two-year forward basis (FAST Graphs)

Given this data, it is only reasonable to expect management to report another earnings beat on Tuesday. The analyst consensus for earnings per share is currently $3.78, down 11% year-over-year. Net sales are estimated at $37.7 billion, down 3% from the third quarter of fiscal 2022. Revisions to EPS and revenue estimates have remained virtually flat over the past three months, while there were quite pronounced negative revisions in May. However, this is hardly surprising as the company reported a miss on same-store sales and lowered its full-year sales and EPS guidance during the first quarter earnings call.

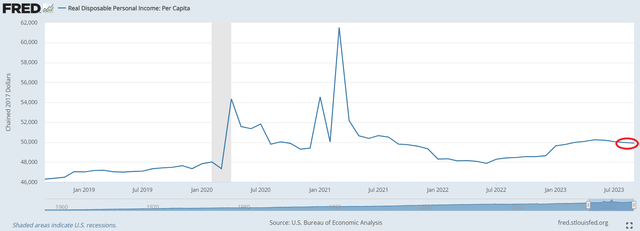

With this in mind, one could conclude that it is overly risky to buy HD stock ahead of the earnings release. However, given the fact that consumer confidence has continued to rise since the July 2022 low, I think it is likely that management under-promised a bit in the FQ1 2023 earnings announcement. Apart from that, the slight decline in real disposable income per capita in the third quarter of HD’s fiscal year (confirmed by the rise in several CPI category indicators) could point to at least “perceived” higher inflation and hence potentially weaker quarterly sales performance at HD.

Figure 4: Real disposable personal income on a per-capita basis (U.S. Bureau of Economic Analysis, Real Disposable Personal Income [DSPIC96], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DSPIC96, November 8, 2023)

It shows once again that it doesn’t make much sense to overanalyze things, especially as a long-term investor. Personally, I think a jump in the share price is more likely than a fall due to the expected earnings beat, but I honestly don’t think it makes much difference whether the stock is bought at today’s price or at a slightly higher price after earnings. Considering that The Home Depot is a very well-established home improvement retailer with a strong economic moat that is very profitable and regularly generates solid excess returns on invested capital, it is difficult to argue against the quality of the investment per se (see my previous articles).

A Word On HD Dividend Against The Backdrop Of Sharply Risen Risk-Free Rates

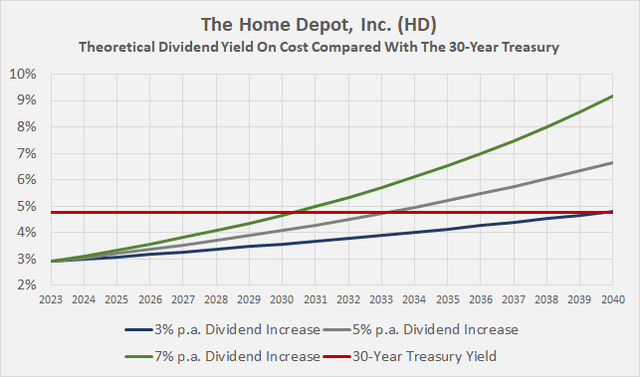

From a historical perspective, HD’s current dividend yield looks quite attractive. A dividend yield of 2.9% is significantly higher than the five-year average of 2.3% but is of course dwarfed by the current risk-free interest rate of long-term government bonds. Nevertheless, investors should not directly compare a stock’s dividend yield with a bond yield for several reasons.

The dividend yield (on cost) typically increases over time, provided one invests in high-quality companies with shareholder-friendly management and board of directors. I think this is certainly the case with The Home Depot, which is extremely efficiently run, has a well-thought-out footprint, and has oligopolistic tendencies. In this way, stock investors who rely on dividend income (now or in the future) have inherent inflation protection (see my article here on a common misconception). If a company is able to reliably grow its dividend above the rate of inflation, it means that the purchasing power of income actually increases over time – something that is not possible with traditional bonds.

Even assuming a rather conservative dividend growth rate of 3% per year (HD’s long-term dividend CAGR is in the high teens), the yield on HD shares purchased today would exceed the yield on the current 30-year Treasury after 16 years (Figure 5, blue). The cumulative income (before taxes – keep in mind that dividends are potentially taxed more favorably compared to bond coupons) would be about the same after thirty years, but it’s important to note that stock investments carry no reinvestment risk.

In a more optimistic scenario, assuming HD’s dividend grows by 5% a year (Figure 5, gray), investors will earn 35% more cumulative income over 30 years than those investing in the 30-Year Treasury.

Figure 5: The Home Depot, Inc. (HD): Theoretical dividend yield on cost compared with the current yield on the 30-Year Treasury (own work, based on company filings and data from treasury.gov)

Moreover, common stocks are the only ones among the conventional asset classes that are “productive”. So if the company’s fundamentals remain intact, earnings grow and the company does not pay out all its earnings, the share price should also rise, leading to more or less significant capital gains in addition to dividend income.

However, it’s important to keep in mind the pronounced volatility of stocks and the associated necessary risk capacity (financial side) and risk tolerance (psychological side), as well as the in-principle discretionary nature of dividend payments. Of course, I don’t want to be misunderstood as an opponent of bond investments.

HD Stock – A Solid Buy Under $300?

Starting with a valuation from an earnings-per-share perspective, HD stock currently trades at 18.5 times blended earnings, taking into account the most recently reported earnings and the consensus for the upcoming quarter. That’s certainly not cheap for a company that ultimately operates a middleman’s business, but given HD’s high profit margins, excellent return on invested capital, and the fact that it operates in what can be considered an oligopoly, I think some premium is justified. It’s also worth remembering that Home Depot’s earnings have grown at an average annual rate of 11% over the last 20 years, which equates to a PEG (price-to-earnings growth) ratio of 1.7 – again, not cheap, but not really expensive either. If we assume that the market continues to award HD stock a premium earnings multiple, an investment at a price of $288 today would mean an annualized return of 8% if analyst estimates are correct (which is not an unrealistic expectation given the extremely solid track record, see above):

Figure 6: The Home Depot, Inc. (HD): FAST Graphs chart, based on adjusted operating earnings per share (FAST Graphs)

That said, I remain somewhat cautious about expecting HD stock to continue to trade at a significant premium – after all, the average earnings multiple at which the stock changed hands between 2002 and 2015 was around 17, and let’s not forget that low or even zero interest rates have provided a tailwind in the past. If analyst estimates for Home Depot’s earnings over the next two years prove to be reasonably accurate and the market multiple contracts to a value of 17, HD stock would represent more or less “dead money” if one were to buy it today for $288 (Figure 7).

Figure 7: The Home Depot, Inc. (HD): Forecasting graph, based on adjusted operating earnings per share and a multiple contraction to 17x earnings (FAST Graphs)

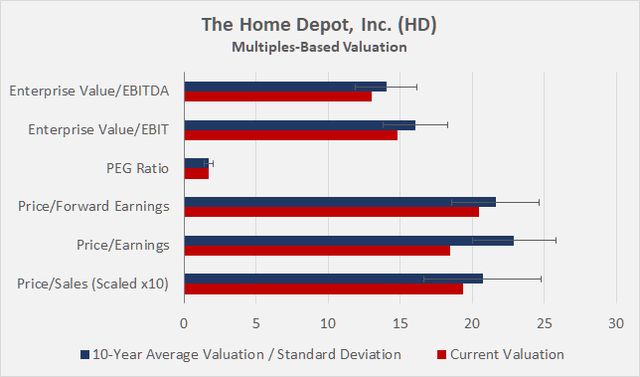

Similarly, taking into account the prevailing interest rate environment over the past ten years, Figure 8, which compares various valuation multiples with their long-term averages, suggests that HD shares are fairly valued today:

Figure 8: The Home Depot, Inc. (HD): Multiples-based valuation (own work)

From a discounted cash flow (DCF) perspective, HD stock does not look like a bargain either. Personally, I think an equity risk premium of 4.0% is reasonable for an investment in a company like The Home Depot. Given that a long-term risk-free rate of 4.75% can currently be locked in for 30 years, my cost of equity for HD stock is 8.75%. Figure 9 shows the results of a DCF calculation, suggesting that it is slightly overvalued today (fair value of $266). The valuation is based on the short-term free cash flow estimates according to FAST Graphs/FactSet. However, stock-based compensation (SBC) has been deducted from these figures, as management will ultimately need to spend free cash flow to offset the dilution from performance shares granted. That being said, SBC at The Home Depot need not be over-interpreted given that it only represents approximately 2.1% of unadjusted operating cash flow (fiscal 2017 to fiscal 2022 average).

Figure 9: The Home Depot, Inc. (HD): Discounted cash flow analysis (own work, based on company filings and own calculations)

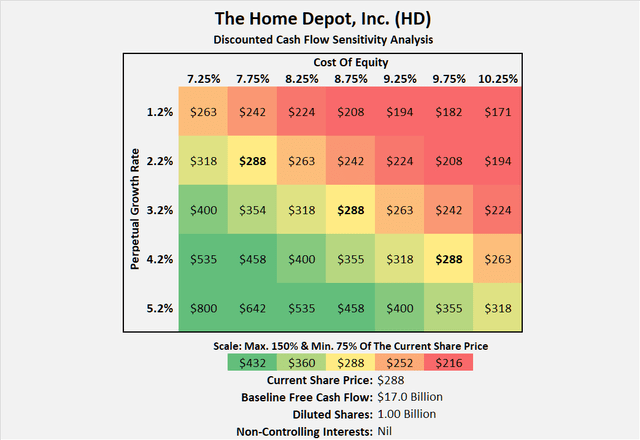

However, considering that the DCF model is significantly dependent on cash flows far in the future (weighting the terminal value at 56% of the sum of discounted cash flows), it makes sense to perform a sensitivity analysis. Admittedly, such an approach does not take into account the short-term estimates, but I would argue that this is a “false precision” anyway given the significant weight of the far in the future cash flows.

With a baseline free cash flow of $17.0 billion for fiscal 2023, the market currently expects The Home Depot to grow its free cash flow in perpetuity at a rate of 3.2%, assuming a cost of equity of 8.75%. As shown in Figure 10, the valuation of HD stock is highly sensitive to the implied growth rate.

Figure 10: The Home Depot, Inc. (HD): Discounted cash flow sensitivity analysis (own work, based on company filings and own calculations)

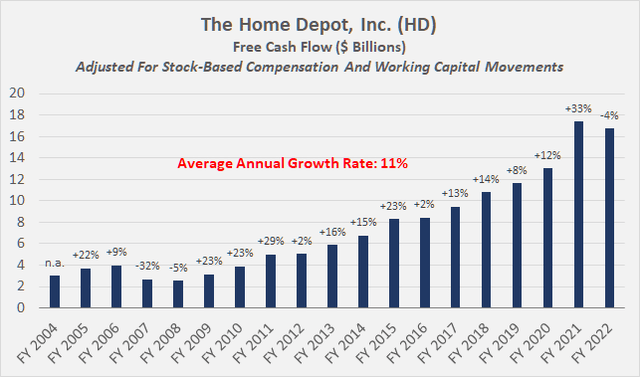

Given the long-term average free cash flow growth rate of 11% (average for fiscal 2004 to fiscal 2022, Figure 11), a perpetual growth rate of 3.2% naturally sounds very conservative. However, keep in mind that home improvement retailers have benefited massively from the low-interest rate environment and generally low inflation after the Great Recession, as well as from consolidation. I highly doubt that a low double-digit (or even high single-digit) free cash flow growth rate can be sustained in perpetuity.

Figure 11: The Home Depot, Inc. (HD): Free cash flow, after adjustments for stock-based compensation and working capital movements (own work, based on company filings and own calculations)

Conclusion

The Home Depot, the U.S. home improvement heavyweight with current annual sales of around $155 billion, will release its third-quarter results on Tuesday, November 14, before the market opens. Given the company’s solid track record in the past and management’s tendency to under-promise and over-deliver, I think an earnings beat on Tuesday is very likely – also given the fact that forecasts were cut earlier this year and macroeconomic fundamentals don’t look too bad. However, it’s too easy to get carried away and overanalyze things.

In the long run, buying HD stock a few percent more expensive or cheaper doesn’t make much of a difference. Considering that The Home Depot is a very well-established home improvement retailer with a strong economic moat that is very profitable and regularly generates solid excess returns on invested capital, it’s hard to argue against the quality of the investment itself.

From a dividend perspective, it is also important not to simply compare the current dividend yield with the rate on long-term government bonds (or high-quality corporate bonds). It is reasonable to assume that HD will be able to continue to grow its dividend at a healthy rate, so the generated income should eventually surpass that generated with a long-term bond investment. This is an important consideration from the perspective of maintaining (or better increasing) the purchasing power of one’s dividend income. In addition, one should consider the potentially more favorable tax treatment of dividend income as well as the lack of reinvestment risk when investing in stocks.

From a valuation perspective, I think it would be an overstatement to call HD stock overvalued at below $300. Shorting the stock at this level would be a sizable bet on the collapse of the U.S. housing market as interest rates continue to rise, loan defaults soar and existing homeowners suffer from persistently weak disposable income. As I have stated in my previous articles on home improvement retailers as well as homebuilders Lennar Corp (LEN, LEN.B) and KB Home (KBH), I believe the long-term fundamentals are intact and I cannot envision such a strong negative scenario.

Although my position in HD is still quite modest at only 0.8% of my total portfolio value, I am not looking to add to my position ahead of earnings. I’m in no rush to add to my position given the jittery environment, and I know that from a long-term perspective, buying at a slightly higher or lower price won’t make much of a difference. I believe that the stock market currently offers better opportunities elsewhere (pharmaceuticals, tobacco stocks, and selected defense companies), but I could see myself increasing my exposure to home improvement retailers before the end of the year. I therefore rate HD stock as a moderate buy.

Thank you for taking the time to read my latest article. Whether you agree or disagree with my conclusions, I always welcome your opinion and feedback in the comments below. And if there’s anything I should improve or expand on in future articles, drop me a line as well. As always, please consider this article only as a first step in your own due diligence.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of HD, LOW either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The contents of this article, my previous articles, and my comments are for informational purposes only and may not be considered investment and/or tax advice. I am a private investor from Europe and share my investing journey here on Seeking Alpha. I am neither a licensed investment advisor nor a licensed tax advisor. Furthermore, I am not an expert on taxes and related laws – neither in relation to the U.S. nor other geographies/jurisdictions. It is not my intention to give financial and/or tax advice, and I am in no way qualified to do so. Although I do my best to make sure that what I write is accurate and well researched, I cannot be held responsible and accept no liability whatsoever for any errors, omissions, or for consequences resulting from the enclosed information. The writing reflects my personal opinion at the time of writing. If you intend to invest in the stocks or other investment vehicles mentioned in this article – or in any investment vehicle generally – please consult your licensed investment advisor. If uncertain about tax-related implications, please consult your licensed tax advisor.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.