Summary:

- Amazon.com, Inc.’s strong Q3 earnings support its market cap of $1.4 trillion and bring the company close to its 52-week highs.

- The core business has minimal strength and profits, but AWS and advertising revenue make it a potentially good investment.

- Amazon’s advertising business is a bright spot, with $50 billion in annualized revenue and high margins, while AWS remains a strong second business for profits.

FinkAvenue

Amazon.com, Inc. (NASDAQ:AMZN) is an American multinational midstream company with a market cap of roughly $1.4 trillion. The company is back to within 5% of its 52-week highs, supported by its incredibly strong Q3 earnings. As we’ll see throughout this article, despite Amazon’s lofty valuation, Amazon Web Services aka AWS, and its advertising business might just make it a good investment.

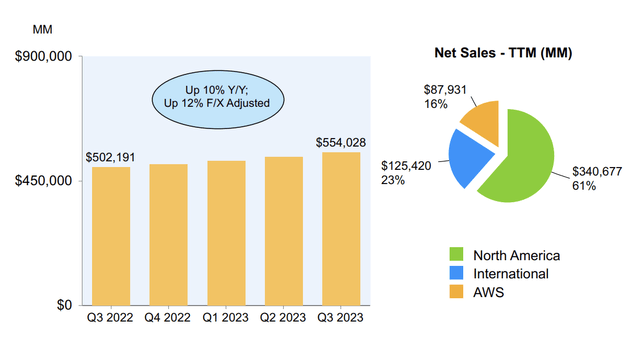

Amazon Net Sales

Amazon’s core business has minimal strength and minimal profits.

TTM revenue is more than half a trillion dollars, a staggering sum by any metric. North America remains the core of the company’s business, with sales there almost triple international sales. AWS remains essential to the company’s business, and represents its largest source of profits. That will likely continue.

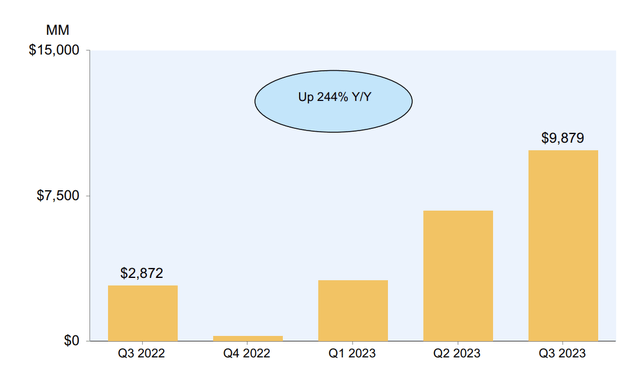

Amazon Income Generation

The company had a great quarter for income, perhaps finally providing that it can actually earn profits.

The company’s net income was almost $10 billion, giving the company an annualized P/E of ~37. For the company’s size and continued growth, it is relatively strong profit and well above where the company’s valuation has been off of historical earnings. That consistent income generation shows the company’s financial strength.

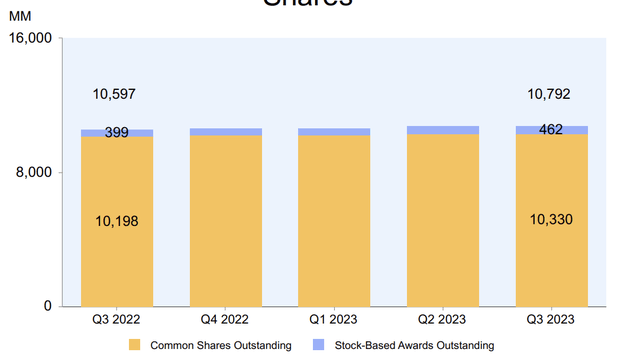

Amazon Outstanding Shares

One concern we do have is the company’s steady dilution to reward employees.

The company has 10.8 billion shares, up almost 150 million YoY, with more than 100 million shares / year expected to continue being issued to employees. The number of shares pending issuance has actually increased slightly YoY, showing that this expense will likely not go down anytime in the upcoming years.

In our view, this is a major downside to investing. 120 million shares / year in issuance is $17 billion a year in issuance and a direct cost to shareholders even if it’s not reflected in the company’s earnings. Even with the company’s recent quarter of higher earnings, it’s almost 50% of the company’s annual profits, almost doubling its P/E ratio.

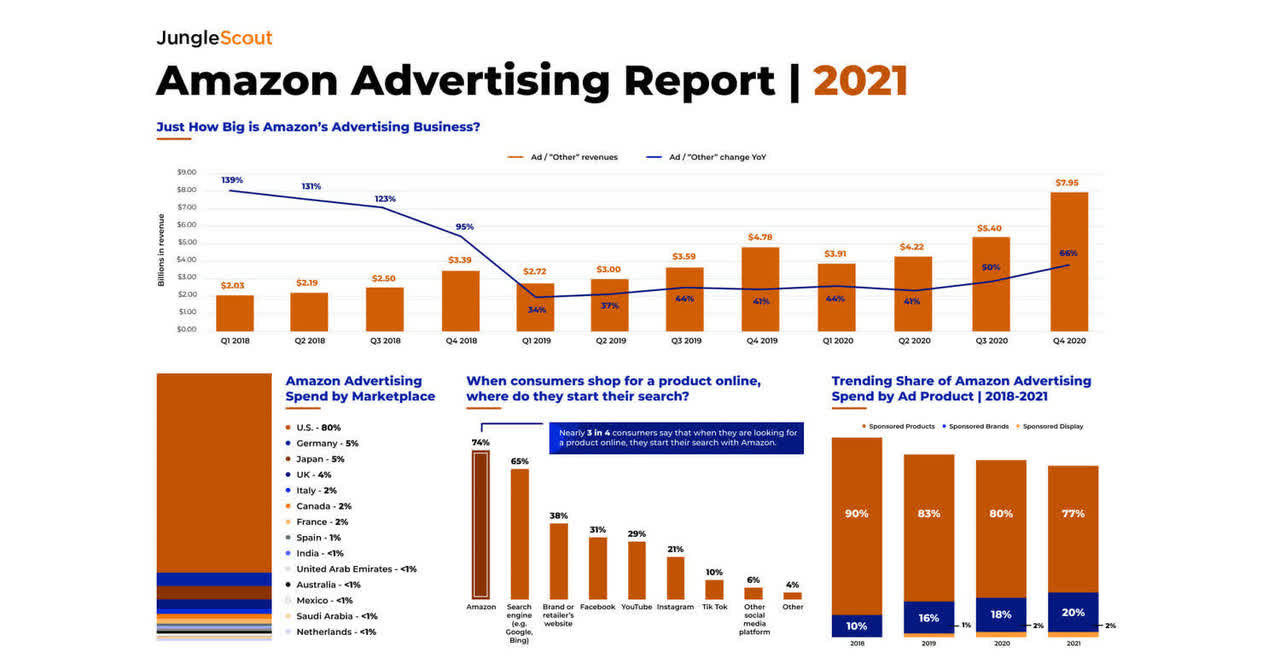

Amazon Advertising

The brightest spot in the company’s portfolio in our view, the one that justifies an investment the most, is the company’s advertising revenue.

Amazon’s ad business has grown to $50 billion in annualized revenue in the most recent quarter, a 26% YoY jump. It makes sense, these days many customers go straight to Amazon.com to look for the item they want to buy instead of Google-ing it and purchasing it on one of many different websites that show up.

So, if you’re an advertiser, why pay for a Google ad to redirect a buyer to your website, when you can direct them straight to where you sell the product and away from the competition. We expect the business to continue its aggressive double-digit growth, which comes with high margins, and is incredibly exciting to see.

Amazon AWS

The company’s AWS is seeing massive competition, with Google (GOOG) Cloud and Microsoft (MSFT) especially providing large offerings.

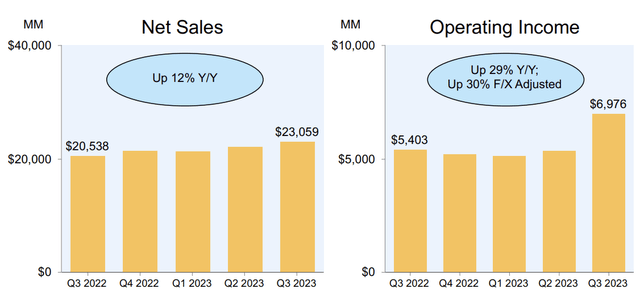

Despite that, the continued growth in scale of the overall business, continues to support the company. Net sales were up 12% YoY and with large fixed costs, the company’s operating income jumped up. The company’s operating income grew by 29% YoY, 30% on a constant-currency basis, and we expect it to continue its growth.

AWS is less exciting than the ad business in our view, which is already 60% of the size and growing even faster. However, it’s a strong core second business to drive profits and revenues.

Thesis Risk

The largest risk to our thesis of Amazon potentially being fair value is anti-trust lawsuits. Amazon’s alleged anti-trust behavior enables it to save on costs and price better than its competitors while driving them out of business. It’s currently under antitrust lawsuits and what happens there remains to be seen, but it’s anyone’s guest.

Our View

We’ve recommended against Amazon numerous times before.

The company has a large amount of scale, but it faces anti-trust risk, and growing competition. In a higher inflation environment, the company’s customers become more cost conscious and could instead choose to shift to other cheaper companies. The company’s core business growth rate has slowed down dramatically.

However, the company has two major catalysts.

The first is clearly its ads business. The company’s business here is already 60% the size of AWS to give a sense of scale. The company is the most popular place on the web that customers stop at on their path to finding a new item and that scale means it can provide better ads than many other large tech giants. As a result, we expect growth to continue.

We expect this business to continue growing rapidly, providing large scale profits.

The second is the company’s AWS business. Amazon’s incredibly strong ability to provide customers with reliable and scale continues to set it apart. Google Cloud and Microsoft Cloud are working to catch up, albeit with some artificial intelligence competition. As more and more companies realize the benefits and global compute demand grows, we expect benefits.

Amazon’s overvalued nature is still its biggest risk. That’s especially true when accounting for share buybacks. However, we expect that to resolve itself. We recommend cautiously opening a small position now and wait for continued income growth to justify the valuation. Let us know your thoughts in the comments below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.