Summary:

- Amazon’s robust quarterly earnings indicate potential for a stock re-rating.

- The eCommerce business is producing strong earnings, AWS is growing its operating margins aggressively.

- Advertising Services are producing underrated organic sales growth for Amazon.

4kodiak/iStock Unreleased via Getty Images

Amazon (NASDAQ:AMZN) reported strong earnings for the third quarter and beat estimates handsomely. The eCommerce enterprise produced impressive triple-digit operating income growth in 3Q-23 while the eCommerce business in North America turned around nicely.

Furthermore, AWS’s operating income margin grew to 30% in 3Q-23 due to growing enterprise spending.

Favorable macro tailwinds in terms of inflation could support Amazon’s operating income growth moving forward, as could the growth of its advertising services business. Amazon’s stock remains a buy.

My Rating History

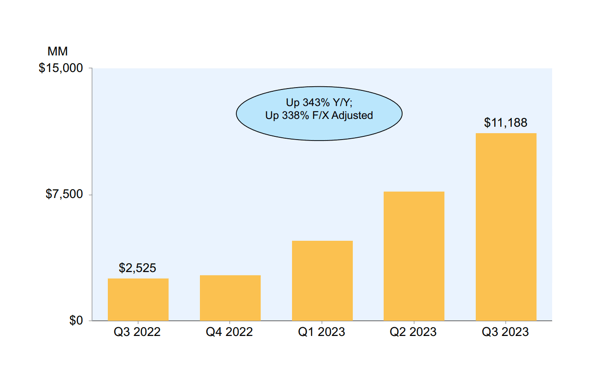

A comeback of the eCommerce business and an improving economic backdrop were two pillars of my buy thesis for Amazon. Taking into account that Amazon delivered expanding operating income margins in AWS and 343% YoY operating income growth, I think that Amazon will remain a growth company/stock with potential to surprise moving forward.

The advertising services business is also underrated, it seems, and I think that Amazon’s profit momentum is undervalued.

3 Major Takeaways From Amazon’s Third Quarter

Amazon reported 3Q-23 profits of $0.94 per share, smashing the average estimate of $0.58 per share by a handsome margin. It was the third profit beat this year and the largest, by dollar size, since 4Q-21.

Earnings (Yahoo Finance)

Amazon third quarter was an impressive one, as has been acknowledged by other analysts.

Amazon produced $143.1 billion in sales in 3Q-23, reflecting a YoY increase of 13% and I think three major takeaways from the earnings release should be discussed.

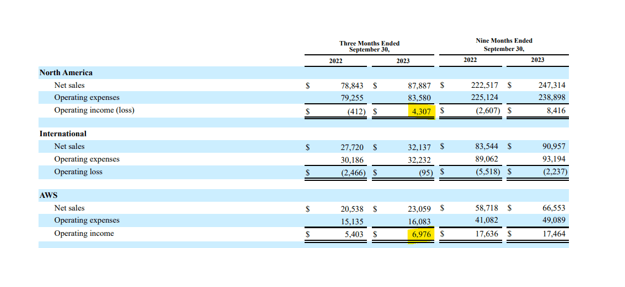

The first takeaway from Amazon’s 3Q-23 release was that the eCommerce continued to rebound. The U.S.-focused eCommerce segment produced 11% YoY sales growth and it was quite a profitable quarter as well: It produced $4.3 billion in operating income compared to an operating loss of $412 million last year.

Strong economic growth obviously helps Amazon a lot here: The U.S. economy advanced at a 4.9% annualized rate in the third-quarter. Inflation is still being an issue for consumers, though not as big of an issue as it was last year. A gradual decline in inflation is something that I potentially see as a catalyst for growth in Amazon’s eCommerce sales moving forward.

The second takeaway was that AWS, Amazon’s increasingly global cloud operation, produced a boat load of profits. AWS produced $6.98 billion in operating income in 3Q-23, reflecting 29% YoY growth.

AWS’s net sales however, went up only 12% in 2Q-23, so the segment’s profitability is improving much faster than sales, reflecting growth in enterprise spending and progress in terms of cost-cutting. AWS’s operating income margin expanded to a whopping 30% in the last quarter, up from 24% in the prior quarter.

Operating Income (Amazon)

Amazon’s entire operating income skyrocketed 343% YoY to $11.2 billion. Though the big leap in operating income is clearly a great result for Amazon’s 3Q-23, I think that the QoQ expansion of AWS’s operating income margins particularly deserves credit.

Operating Income Growth (Amazon)

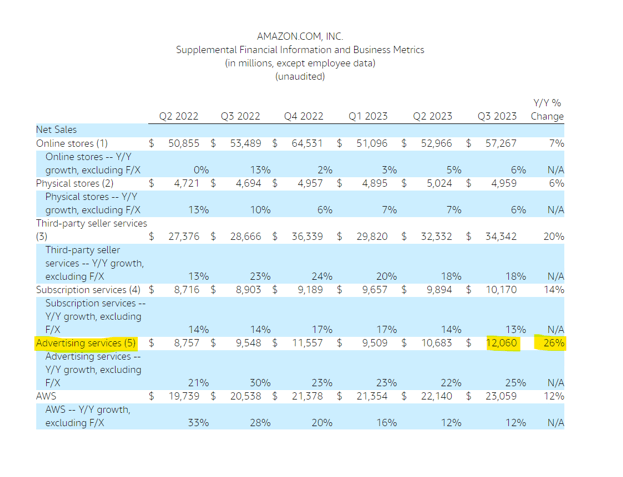

The third takeaway is that Amazon is building a giant advertising business. This itself is not news, but how well the business is performing may be news for some investors that are predominantly occupied with Amazon’s two main business, eCommerce and AWS.

Amazon runs its core eCommerce platform to sell products to customers as well as serve third-party sellers. What Amazon is also doing, however, is to collect a lot of data about customers’ purchase behaviors which is driving a giant data-collection machine in the background.

This data is harvested to provide not only business insights, but also to create a digital ad-focused revenue stream. This business does not get a lot of attention since it is relatively small when compared against eCommerce and Amazon AWS. But this digital advertising business is actually smashing it and growing much faster than even AWS.

Amazon’s advertising services grew sales 26% YoY in 3Q-23 to $12.1 billion. The segment is not only growing more than twice as fast as AWS, but now rakes in more money, on a net sales basis, than the entire Amazon subscription business. The monetization of customer data is a huge and potentially underrated sales opportunity for Amazon.

Advertising Services (Amazon)

Amazon Is A Bargain

Amazon is the leading eCommerce company in the United States. The market presently models $600.5 billion in next year’s sales, reflecting a decline of $25 billion compared to the time when I last covered Amazon.

The sales estimate implies a 12% YoY growth rate as well as a sales multiple of 2.4x. Amazon, in my view, will probably continue to grow its sales at double digits in the coming years.

Due to Amazon also improving its operating income profile, I think that the company’s growth potential is undervalued and that the stock has a considerable shot at a re-rating.

Revenue Estimate (Yahoo Finance)

Why Amazon Could See A Higher/Lower Valuation Multiple (Risks)

Amazon, to a certain extent, is dependent on a healthily growing U.S. economy and slowing inflation growth. The U.S. economy advanced at a 4.9% annualized rate in 3Q-23, so the macro tailwind is still favorable to Amazon.

A slowing economy, on the contrary, would probably hurt Amazon’s sales growth, both in consumer (eCommerce) and enterprise (AWS).

Though Amazon is diversifying its business and constantly trying out new products and services, I think that Amazon will, broadly-speaking, remain a bet on the growth of the U.S. economy and U.S. consumer spending.

My Conclusion

Amazon smashed estimates for 3Q-23 and produced its largest profit beat since 4Q-21. The eCommerce segment is widely profitable and AWS expanded its operating income margin to 30%, a 6 percentage point improvement over the prior quarter.

Due to favorable economic tailwinds and a focus on cost reductions, Amazon’s total operating income soared 343% YoY.

The stock is not expensive given Amazon’s potential in eCommerce, AWS and advertising services (as well as its other businesses) and I consider the risk/reward relationship positive for long-term investors.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.