Summary:

- Cisco’s recent acquisition of Splunk positions the company strategically in the cybersecurity space, enhancing its competitive edge in a rapidly evolving market.

- Despite challenges in revenue growth, CSCO’s proven ability to maintain high profitability and increase free cash flow showcases its resilience and adaptability in the face of market dynamics.

- Meticulous valuation models, incorporating both analyst projections and segment-specific market growth, highlight the substantial upside potential for Cisco, reinforcing its appeal as an investment opportunity.

- Acknowledging potential risks, the article affirms a “Strong Buy” rating for Cisco, expressing confidence in the company’s capacity for sustained growth and resilience in the dynamic technology sector.

- The conclusion sets a targeted fair price of $78.2, reflecting the optimistic outlook derived from the valuation models.

Alexander Koerner

Thesis

Cisco Systems, Inc. (NASDAQ:CSCO) has demonstrated poor revenue and net income growth over the past six years, resulting in a lackluster stock performance. However, after carefully considering analysts’ expectations and my own estimates, I have concluded that Cisco is significantly undervalued. I believe its fair value could range anywhere from $78.2 to $82.6, representing a potential upside of over 40% if the current stock price of $53 adjusts to the suggested fair value.

Furthermore, despite sluggish revenue growth, Cisco has maintained its status as a highly profitable company by effectively increasing its cash flow. This strategic move has positioned Cisco as a more profitable entity.

The associated risks are minimal, and with the recent acquisition of Splunk, Inc. (SPLK) Cisco is poised to strengthen its presence in the cybersecurity market. Considering these factors, I strongly recommend a “Buy” rating for Cisco, with a set price target of $78.2.

Overview

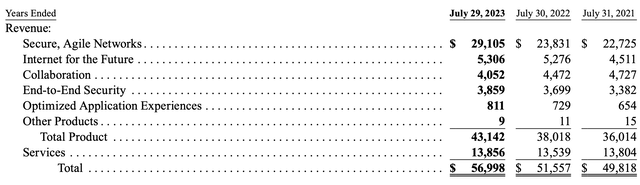

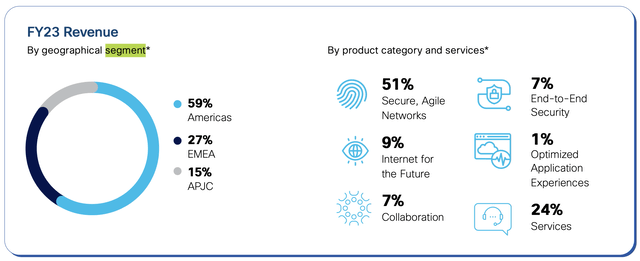

Cisco currently categorizes its revenue into six sources. However, effective in Q1 2024, Cisco will revamp its segment display, grouping them into Networking, Security, Collaboration, Observability, and Services.

Revenue by Segment (Cisco Annual Report FY 2023)

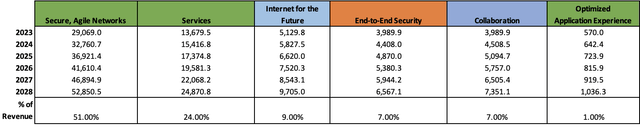

In the table below, it’s evident that Cisco heavily relies on its “Secure, Agile Networks,” contributing approximately 51% of its total revenue. Following closely is the Services segment, contributing 24% to the overall revenue. Subsequently, we observe IoT accounting for 9%, End-to-End security and Collaboration both contributing 7%.

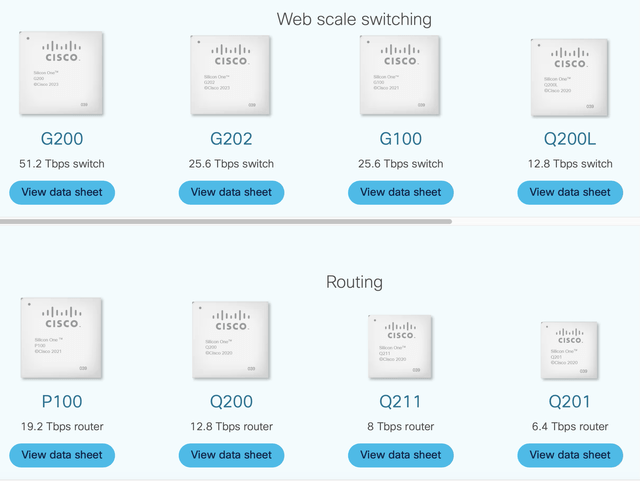

It’s noteworthy that Cisco engages in chip production, primarily supporting its router and switches business. Additionally, a significant portion of Cisco’s segments revolves around cloud solutions.

Weight of each of Cisco’s Segment in total Revenue (Cisco Annual Report FY 2023)

Cisco “AI” (Cisco Investors’ Relations)

Secure, Agile Networks, Services, and optimized Applications

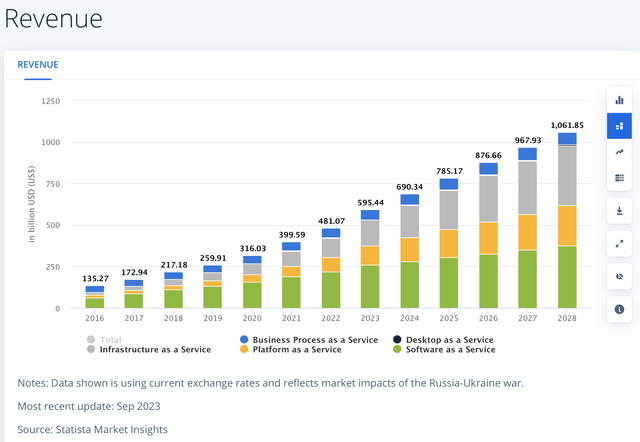

I’ve chosen to group these three segments together as they all pertain to the burgeoning cloud market, projected to experience a robust CAGR of approximately 12.27%.

This combined sector represents around 76% of Cisco’s revenue. Within this unified segment, Cisco endeavors to streamline workflows while also marketing routers.

Revenue Projections Public Cloud Market (Statista)

Internet for the Future

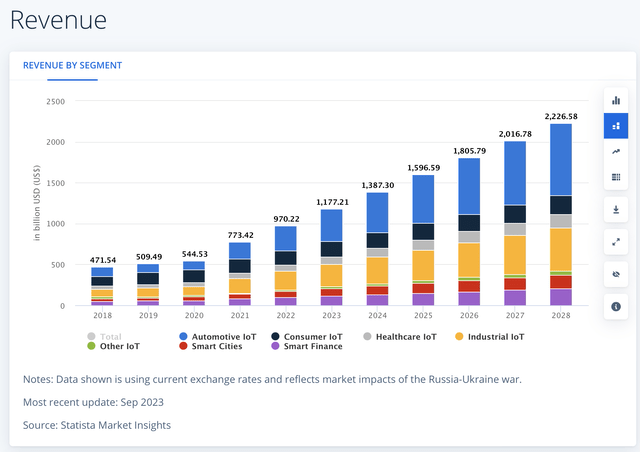

This market encompasses Cisco’s IoT operations, signifying a network of interconnected devices facilitated by technology for communication, both within the cloud and among the devices themselves.

Forecasts predict a substantial CAGR of 13.6% for this market.

IoT Market Revenue Projections (Statista)

End-to-End Security

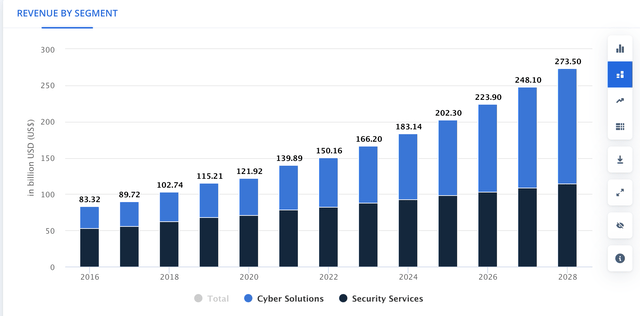

This segment offers a cloud cybersecurity platform. In the realm of cybersecurity, the market is poised to witness significant growth, projected at an overall rate of 10.48%. It is essential to note that this growth can be segmented into two distinct categories: cyber solutions and security services. Among these, cyber solutions take the lead with an expected Compound Annual Growth Rate [CAGR) of 17.16% through 2028.

Cybersecurity Market Revenue Projections (Statista)

Collaboration

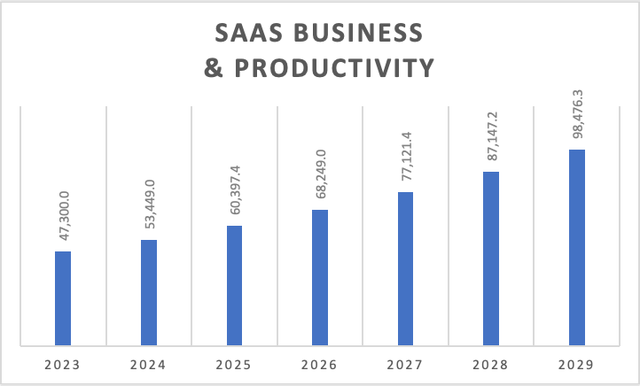

True to its name, this segment from Cisco offers a consolidated collaboration platform designed to accelerate workflows and decision-making. Nestled within the broader market, the business and productivity subsegment is poised to grow at a commendable CAGR of 13%.

Financials

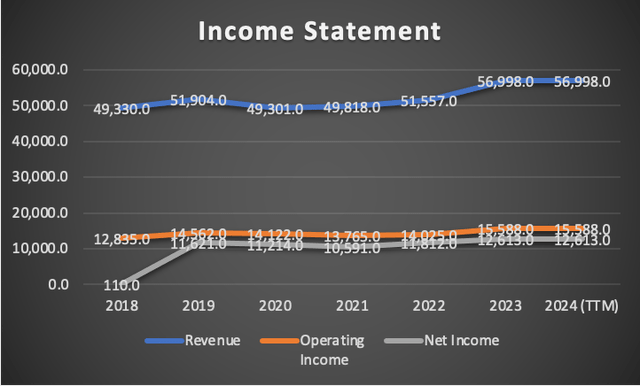

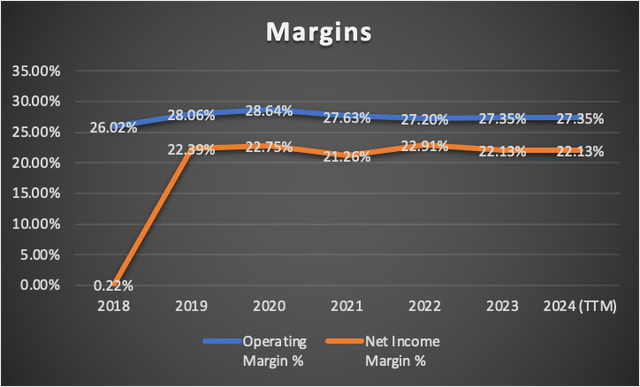

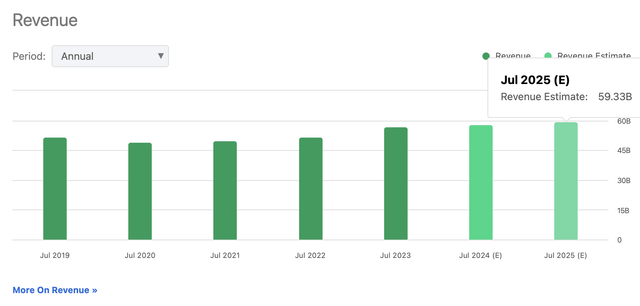

Cisco has struggled to achieve substantial revenue growth. The chart below illustrates that Cisco’s revenue has increased at a modest annual rate of 2.19%, a figure considered notably low. Both net income and operating income have mirrored this growth rate, evident in Cisco’s commendable margins, with an operating margin standing at 27.33% and a net income margin at 22.1%.

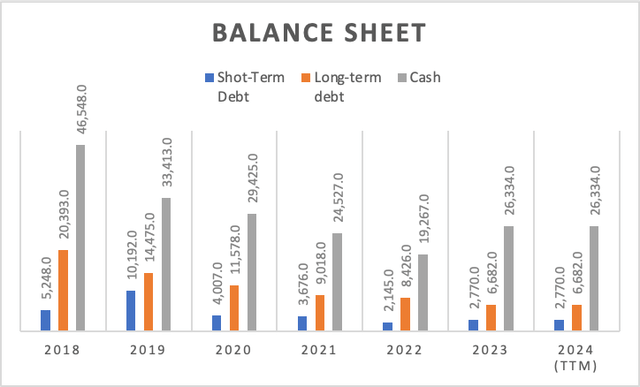

In a strategic move, Cisco has steadily reduced its debt burden over the years, albeit at the cost of dipping into its cash reserves. In 2018, Cisco held $46.5 billion in cash but also carried approximately $25.5 billion in debt. Fast forward to the current fiscal year 2024, on a TTM basis, Cisco’s debt has reduced to $26.3 billion, accompanied by a reduction in debt of around $17 billion. Simultaneously, cash reserves have diminished by approximately $20.2 billion, closely aligning with the reduction in debt.

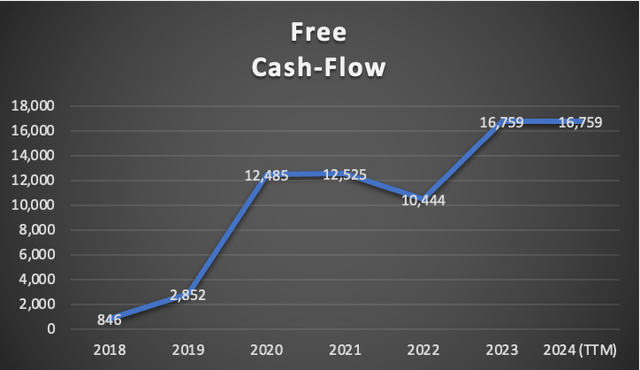

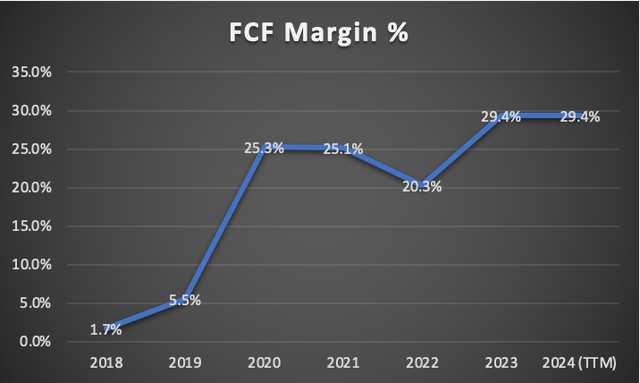

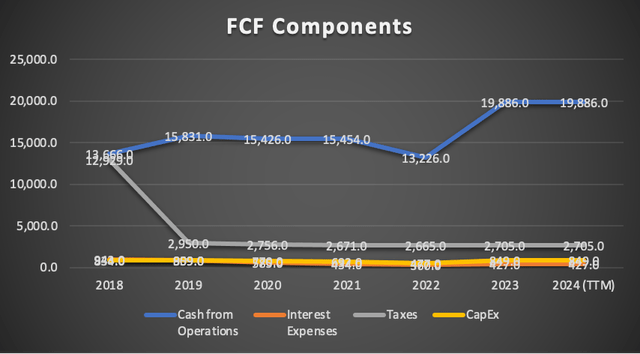

The free cash flow has witnessed a remarkable surge, soaring by about 498% since 2019 and currently standing at $16.7 billion. The FCF margin, mirroring the strength of the net income and operating margin, is an impressive 29.4%. As depicted in the “FCF Components” chart, this surge is primarily attributed to reduced taxes and increased cash flows from operations.

In summary, while Cisco may not have achieved robust revenue growth in the high single digits, its sharp increase in cash flow, coupled with a balanced reduction in debt and bolstered by a robust balance sheet, positions the company to potentially recover the $20 billion in cash that dissipated from 2018 to 2024.

Valuation

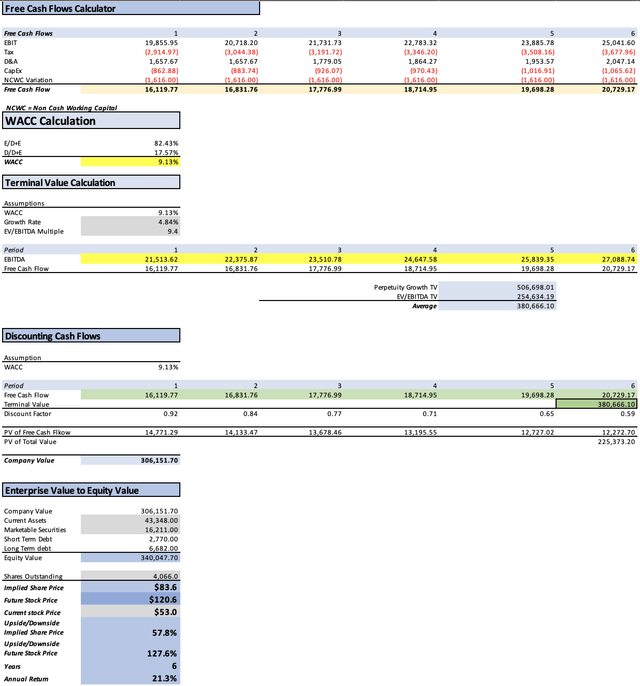

In this valuation assessment, I will employ two DCF models. The initial model incorporates analysts’ revenue and EPS estimates for FY 2024 and FY 2025. It also considers the anticipated 5-year EPS growth rate and the expected revenue growth rate.

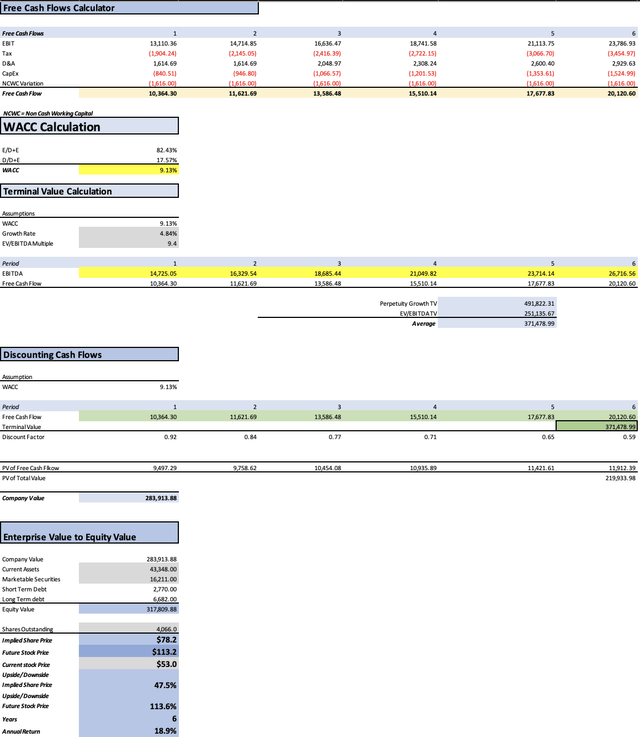

The second model adopts the assumption that each of Cisco’s segments could grow at the projected growth rates for the respective markets in which these segments operate.

In the table provided below, all the variables necessary to calculate the WACC are outlined. Additionally, the CapEx, Depreciation & Amortization (D&A), and Interest expenses are computed using margins linked to revenue.

These models aim to provide a comprehensive understanding of Cisco’s valuation, leveraging both expert projections and a granular analysis of segment-specific growth rates.

| TABLE OF ASSUMPTIONS | |

| (Current data) | |

| Assumptions Part 1 | |

| Equity Value | 44,353.00 |

| Debt Value | 9,452.00 |

| Cost of Debt | 4.52% |

| Tax Rate | 17.66% |

| 10y Treasury | 4.80% |

| Beta | 0.94 |

| Market Return | 10.50% |

| Cost of Equity | 10.16% |

| Assumptions Part 2 | |

| EBIT | |

| Tax | 2,705.00 |

| D&A | 1,631.00 |

| CapEx | 849.00 |

| Capex Margin | 1.49% |

| Assumption Part 3 | |

| Net Income | 12,613.00 |

| Interest | 427.00 |

| Tax | 2,705.00 |

| D&A | 1,631.00 |

| Ebitda | 17,376.00 |

| D&A Margin | 2.86% |

| Interest Expense Margin | 0.75% |

| Revenue | 56,998.0 |

Analysts’ Estimates

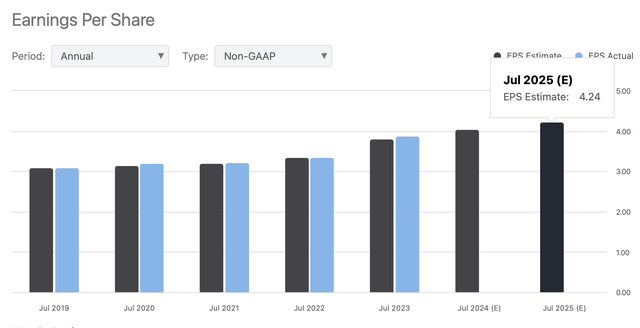

In this valuation model, the objective is to determine Cisco’s fair value assuming the attainment of analysts’ revenue and EPS targets for FY 2024 and FY 2025, set at $57.93 billion and $59.33 billion, and $16.5 billion and $17.23 billion respectively (derived by multiplying the EPS targets of $4.05 and $4.22 by the 4.06 billion shares outstanding).

Analysts also anticipate a 4.72% revenue growth and a 3-5 years EPS growth of approximately 4.84%. These projections will be factored in to estimate revenues for FY 2025 to FY 2029

Revenue Estimates (Seeking Alpha)

| Revenue | Net Income | Plus Taxes | Plus D&A | Plus Interest | |

| FY 2024 | $57,930.0 | $16,507.00 | $19,421.97 | $21,079.63 | $21,513.62 |

| FY2025 | $59,330.0 | $17,239.84 | $20,284.22 | $21,941.89 | $22,375.87 |

| FY 2026 | $62,171.9 | $18,074.25 | $21,265.97 | $23,045.02 | $23,510.78 |

| FY 2027 | $65,149.9 | $18,949.04 | $22,295.25 | $24,159.51 | $24,647.58 |

| FY 2028 | $68,270.6 | $19,866.18 | $23,374.34 | $25,327.90 | $25,839.35 |

| FY 2029 | $71,540.8 | $20,827.70 | $24,505.65 | $26,552.80 | $27,088.74 |

| ^Final EBITA^ |

As illustrated, should Cisco meet these growth expectations, the fair price per share is estimated at around $83.6, reflecting a substantial 57.8% upside from the current stock price of $53. Furthermore, considering a future stock price of $120.6, the anticipated annual returns of 21.3% signify a remarkable 127.6% upside from the present stock price. This model provides insights into the potential trajectory of Cisco’s value based on optimistic growth scenarios and could serve as a valuable reference for investment decisions.

My Estimates

In this scenario, the focus is on projecting the revenue generated by each of Cisco’s segments, factoring in the anticipated market growth for each segment’s respective market.

Revenue by Segment (Author’s Calculations)

| Revenue | Net Income | Plus Taxes | Plus D&A | Plus Interest | |

| FY 2024 | $56,428.0 | $10,783.39 | $12,687.63 | $14,302.32 | $14,725.05 |

| FY2025 | $63,563.9 | $12,147.07 | $14,292.12 | $15,906.81 | $16,329.54 |

| FY 2026 | $71,604.7 | $13,683.65 | $16,100.05 | $18,149.02 | $18,685.44 |

| FY 2027 | $80,665.2 | $15,415.12 | $18,137.28 | $20,445.51 | $21,049.82 |

| FY 2028 | $90,875.2 | $17,366.25 | $20,432.95 | $23,033.35 | $23,714.14 |

| FY 2029 | $102,380.8 | $19,564.97 | $23,019.94 | $25,949.58 | $26,716.56 |

| ^Final EBITA^ |

The projections indicate that if Cisco manages to meet these growth estimates, the fair price per share is estimated to be around $78.2. This projection presents a noteworthy 47.5% upside from the current stock price of $53. Additionally, considering a future stock price of $113.2, the projected annual returns of 18.9% represent a substantial 113.6% upside from the present stock price.

While these results are marginally more conservative than the expectations set by analysts, the 47.5% upside remains highly attractive. This model provides a grounded perspective on Cisco’s potential value, grounded in a detailed analysis of segment-specific market growth. Investors may find this scenario useful for making informed decisions in light of slightly more cautious growth estimates.

Where is the Splunk acquisition in this valuation?

On September 21, Cisco made a strategic announcement about its acquisition of the cybersecurity company Splunk, positioning it as a significant move to enhance its competitiveness in this rapidly evolving space.

This substantial transaction involves a staggering $28 billion in an all-cash deal, representing a notable 30% premium over the stock’s current value. The completion of this acquisition is anticipated in FQ3 2024.

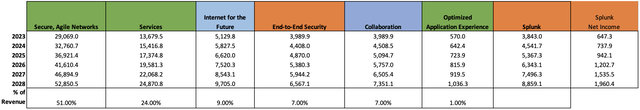

While the initial estimates for Cisco’s fair value were already robust, the inclusion of Splunk, despite elevating the valuation further, prompted the creation of a separate model. The calculated upside is now even more substantial, precisely at 76.2%.

For this assessment, Splunk’s revenue was projected based on the 18.18% growth rate anticipated by analysts, with net income set to increase at a parallel 27.67% rate as per analysts’ expectations.

| Revenue | Net Income | Plus Taxes | Plus D&A | Plus Interest | |

| FY 2024 | $56,428.0 | $11,430.72 | $13,452.43 | $15,108.70 | $15,575.09 |

| FY2025 | $63,563.9 | $12,884.95 | $15,163.87 | $16,820.14 | $17,286.53 |

| FY 2026 | $71,604.7 | $14,625.71 | $17,212.51 | $19,314.24 | $19,906.07 |

| FY 2027 | $80,665.2 | $16,617.84 | $19,556.98 | $21,924.66 | $22,591.38 |

| FY 2028 | $90,875.2 | $18,901.76 | $22,244.86 | $24,912.22 | $25,663.32 |

| FY 2029 | $102,380.8 | $21,525.36 | $25,332.48 | $28,337.55 | $29,183.75 |

| ^Final EBITA^ |

Author’s Calculations Author’s Calculations

The model suggests a fair price of $93.4, marking an impressive 76.2% increase from the current stock price of $53. Furthermore, the projection indicates that the stock could potentially reach $134.6 within the next six years, translating to an annual return of approximately 25.7%. This acquisition not only fortifies Cisco’s standing but also paints a promising picture for investors eyeing substantial returns in the foreseeable future.

Risks to Thesis

The primary risk to this optimistic thesis is the potential persistence of Cisco’s sluggish revenue growth, along with stagnant net income growth and cash flow. Such a scenario would significantly diminish the fair price suggested by the models presented.

A secondary risk involves the Splunk acquisition turning into a financial challenge, leaving Cisco burdened with a $28 billion debt while Splunk continues to incur losses, evident from its TTM net income of -250,500.

Another considerable risk associated with my DCF model is the possibility of Cisco choosing to increase its CapEx at its discretion. For instance, a substantial increase to, say, $10 billion in CapEx could halve the terminal cash flow, consequently lowering the overall valuation. It’s worth noting, however, that since 2014, Cisco has not exceeded $1.3 billion in CapEx.

Finally, something that should be observed attentively now that FQ1 2024 is coming on November 15, is the revenue growth of “Secure Agile Networks”, because in the caption from FY2023 I put on the “Overview” section, you can see that it was the segment that grew the most (by around 26%), and the others remained somewhat unchanged, and we need to remember that in my estimates I suggested Cisco needed to grow its revenue at a rate of around 12% annually. Either way, what matters in a DCF valuation is not revenue, but earnings, so if Cisco achieves to grow its revenue decently, that could give them enough margin to have better earnings.

Despite these risks, I find few immediate threats that could render this thesis unviable. Cisco’s track record demonstrates an ability to sustain high profitability and increase free cash flow even amid nearly stagnant revenue and net income growth. Based on these considerations, I confidently rate Cisco as a “Strong Buy” and set a target of $78.2, derived from the fair price determined by the second DCF in this analysis.

Conclusion

In conclusion, Cisco emerges as a robust investment opportunity, with a strategic acquisition like Splunk poised to bolster its standing in the cybersecurity domain. While acknowledging the risks associated with potential challenges in revenue growth and the financial dynamics of the Splunk acquisition, Cisco’s resilient profitability and ability to enhance free cash flow in the face of stagnant top-line growth instill confidence in its long-term prospects. The meticulous valuation models, accounting for both analyst projections and segment-specific market growth, underscore the substantial upside potential. Consequently, I am affirming a “Strong Buy” rating for Cisco, with a targeted fair price of $78.2. This valuation encapsulates the optimistic outlook considering both current market conditions and the transformative impact of the Splunk acquisition, projecting a promising trajectory for investors seeking sustained returns in the dynamic technology sector.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in CSCO over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.