Summary:

- Roku’s eulogy has been read prematurely many times over the last decade or so.

- Notwithstanding, today, it operates from its greatest position of strength in its corporate history, substantiating data for which I will share with you in this review.

- It’s worth asking: How has little Roku defeated the Goliaths of the business world, such as Apple and Comcast?

- Today, I will illustrate the implementation, the proverbial slingshot, that Roku is using to achieve its dominance of the TV OS industry in the U.S. and in its nascent international markets into which it’s begun expanding.

- In short, with ~$2B in net cash, a return to free cash flow generation, and an identifiable strategy that has afforded it the dominance of the TV operating system industry, I continue to believe Roku is worth investors’ capital, and I believe it could have 100% upside from here to fair value.

Arturo Holmes/Getty Images Entertainment

Acceleration

Since going public, Roku’s (NASDAQ:ROKU) business has experienced a staggering evolution, in tandem with which its key performance metrics have experienced almost unbelievable improvements.

We are executing well as the shift to TV streaming continues and delivered a strong quarter. We grew our scale with net adds of 2.3 million active accounts, an acceleration from the previous quarter. We drove strong engagement with streaming hours surpassing 100 billion for the first time on a trailing 12-month basis. And The Roku Channel remains the top 10 streaming app with engagement comparable to Paramount Plus, Peacock, and Max, according to Nielsen.

I specifically and intentionally chose the adjective “unbelievable” because Roku has grown at breathtaking rates while its franchise and core markets have been targeted by not just large companies, but companies among the largest and most successful companies mankind has ever seen.

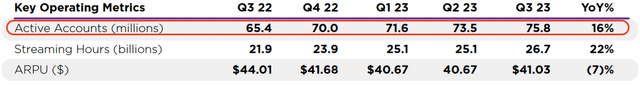

Roku Accelerates Its Net Active Account Adds Sequentially

Roku Q3 2023 Shareholder Letter

Quite interestingly, Roku has not just improved over the last decade, but also it’s accelerated its progress and pace of improvement. While competition has intensified its focus in recent years, Roku has gradually shifted the center of gravity of the TV industry to its platform. It’s been quite incredible to witness frankly. It’s been Harvard Business Case Study worthy to be sure.

In Q3, Roku grew Active Accounts to 75.8 million globally. Sequential net adds of 2.3 million accelerated quarter over quarter (QoQ). In the U.S., we are approaching half of broadband households. A consumer focus on value drove YoY growth in overall TV unit sales in the U.S.

Roku TV unit sales grew significantly faster than the industry, and in Q3, the Roku operating system (OS) was again the #1 selling TV OS in the U.S.

We continued to achieve YoY share gains across the full range of TV screen sizes, but particularly in the larger-screen segment (oWen the primary TV in the home), which had the largest increase.

These competitors, against whom Roku has competed and won as the data above indicates, include Comcast, Amazon, Apple, and Alphabet. Again, these are among the most dominant and largest businesses mankind has ever seen.

Naturally, the question that we should ask following this stunning feat of progress in the face of such immense competition is, “How?”

How on earth has Roku used what has amounted to a tiny slingshot in the way of resources to continue to win against the Goliaths of the business world?

In the next section, we will explore my answer to this question. I’ve worked on Roku quite a bit to arrive at this answer, and I’ve not seen it delineated in the way I’ve delineated anywhere else on the internet (admittedly, I’ve spent essentially no time looking elsewhere and instead have focused on Roku’s quarterly reports and earnings call transcripts in search of the answer).

David Defeats Goliath

In the US, for example, our active account base is bigger than the larger three pay TV providers combined, which is awesome. I think when we started Roku, people would have thought that would never happen. We’re the number one TV streaming platform in the country by hours streamed.

We built both of these positions while competing with very large competitors. So I think we’re well positioned to continue to monetize your activity engagement on our platform, no matter where the viewers attain their streaming subscription credentials. So, I just think we’re in a great position and these pay TV companies are trying to figure out how to make the transition to streaming. But it’s going to be very tricky and very difficult for them to do that.

As I noted in the previous section, Roku’s business has substantially evolved over the last decade or so; specifically, it has evolved substantially since it IPO’d in 2017.

When it IPO’d, it was largely the Roku Dongle and licensed TV OS sold to its “value oriented” TV partners who sold TVs at razor thin margins.

Roku scantly generated sales from high margin digital ads.

It had launched The Roku Channel, Roku’s own TV streaming app, just a month before it IPO’d, and Roku barely had a library of licensed content to show on the channel. It certainly had no original content.

Additionally, the entire TV streaming industry was far more nascent.

In short, Roku’s Flywheel, which, today, has begun to create substantial gravitational pull on the Roku TV OS platform broadly, was not spinning because it was largely nonexistent.

Bears looked at this mostly one-dimensional platform and questioned how it could one day be consistently the best-selling TV OS in the U.S.

Today, however, this flywheel, which I’ve postulated has been and will be core to Roku’s ongoing domination of the Connected TV industry, is more robust and more rapidly spinning than ever.

It is this flywheel that is central to Roku’s accelerating business momentum.

Defining The Flywheel

Over the last decade, Roku has gradually launched new line of business after new line of business, from The Roku Channel to Roku’s Premium Large Screen TVs, which it produces itself and which it just recently launched.

Each line of business has been strategic. None has been randomly fielded. Each line of business has vertically integrated into Roku’s entire ecosystem and created a virtuous cycle for the company designed to capture market share and build momentum for the business.

This is the “flywheel,” so to speak, which, as it spins, creates business momentum and ultimately serves to capture market share. This is the underlying mechanism (its slingshot, as it were) for Roku’s ability to win against its aforementioned large competitors, and I believe it’s vastly more difficult to execute than most realize, hence its large competitors have been unsuccessful in stymieing Roku’s business progress.

It is specifically defined as follows:

- The flywheel starts with sales of TV operating systems (which create active account growth) ->

- Digital advertising growth (measured by ARPU) and enhanced content curation on Roku’s TV OS platform then create more financial resources (gross profits) ->

- More financial resources then allow Roku to enhance its The Roku Channel App ->

- The Roku Channel evolves & strengthens and locks in users, which creates higher ARPU and more financial resources for Roku ->

- Original content evolves & strengthens and more licensed content is added as a result of greater financial resources ->

- More financial resources enhance Roku’s AI/ML capabilities, which enhances its ability to tailor content to idiosyncratic user behavior both on The Roku Channel and on the Roku OS broadly ->

- Customer NPS increases with a better menu of content native to the ROKU TV OS, creating incentive for WMT, TGT, AMZN and Best Buy to sell the best TV OS to consumers ->

- Sales of TV operating systems (account growth) ->

- And the cycle repeats, ultimately creating consolidation in the TV OS industry.

CEO Anthony Wood has often remarked that the TV OS industry would consolidate into the hands of just a few big winners.

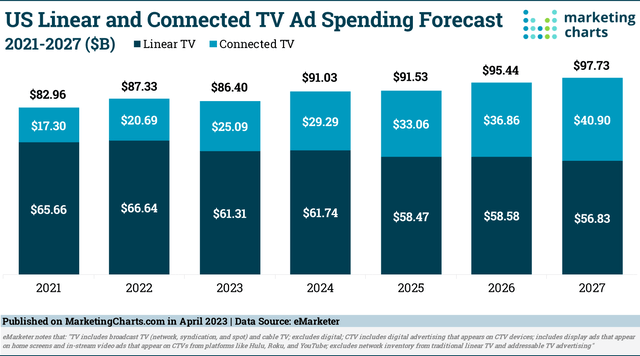

We get asked about market dynamics a lot. We founded Roku on the belief that all TV, including advertising, is going to be streamed and we’re, obviously, seeing that happen. We’re well into that transition, but there’s still a long way to go. Traditional TV ads in the US, as everyone probably knows, is a $60 billion a year business. It’s all going to move to streaming and there’s going to be multiple winners.

Our platform, obviously, has significant scale, engagement, first-party data, unique ad products. And like we said before, in the U.S., our scale is approaching half of broadband households, that makes us a tremendously important platform to be involved in for everyone in the ecosystem.

The Roku Channel, as Charlie will talk more about, it’s a top 10 streaming app on our platform and represents nearly 3% of all TV streaming in September, not just on Roku, but across everywhere, which is comparable to the engagement of apps like Paramount Plus, Peacock, and Max.

The big question for investors has been, in light of Mr. Wood’s endlessly sung refrain, “How will the TV OS industry consolidate as Mr. Wood has projected it would? What are the tangible mechanisms that could create consolidation akin to game developers choosing to port their games into Windows OS, thereby consolidating the PC gaming industry onto Windows?”

- I believe I delineated the underlying mechanisms that are consolidating the industry before our eyes.

- It’s vastly harder than it would seem, hence Roku’s competitors have been unsuccessful in assailing Roku’s seemingly inexorable progress.

And this is Anthony again. Maybe I’ll just point out an important component of our Roku Channel business model, which I think a lot of people understand, but maybe not everyone, which is that Roku’s big strategic advantage is that we’re the platform that a large number of people use to watch television. So, approaching half the broadband households in the United States, when they turn on their TV, the UI that they see is the Roku user interface.

And so, one way we use that is to help recommend content to our — we use it to recommend content that’s in The Roku Channel to viewers. Obviously, we use it to recommend all kinds of content, but we also insert and make sure that we promote content that’s in The Roku Channel in our user interface when they’re deciding what to watch.

And so, that position in the viewer journey is a big competitive advantage and allows us to grow the scale and engagement in The Roku Channel with much smaller content budgets than other companies that have similar scale have to spend in order to reach that sort of — in order to achieve that kind of reach. And so, it’s a big competitive advantage in our business model.

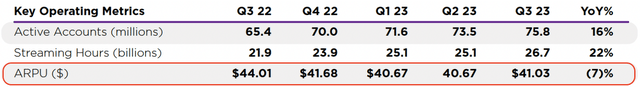

Why Was Roku’s ARPU Down?

- ARPU = Average Revenue Per User

Roku Q3 2023 Shareholder Letter

Roku’s ARPU growth has been struggling in recent quarters. It is objectively a weak point relative to my contention that its business has been strengthening in an almost unbelievable fashion over the last few years.

In Q3, ARPU was approximately $41 on a trailing 12-month basis, down 7% year-over-year, but up quarter-over-quarter for the first time since Q3 of last year.

We expect ARPU to benefit in future periods from a recovery in the ad industry.

That said, I believe the weakness is entirely explicable:

As Roku expands internationally, its new international accounts produce far less revenue per user, as Roku gradually monetizes its users over time via showing more ads. So Roku’s rapid international account growth dilutes the equation average revenue per user as users expand rapidly, with those users being either scantly monetized or not monetized at all.

Overall, just looking at the international, we are doing really well in Latin America. In Mexico, we are the number one selling TV OS. We launched The Roku Channel, which continues to grow in reach and engagement. And we are beginning to monetize in Mexico. And again, the improvements that we’re doing in engagement and the improvements we’re doing with the distribution with our TV partners and with our player devices, we see continued growth in Mexico. And we have more than 10 TV partners in Mexico, and they’re all growing their market share, and that’s helping us to get the number one selling TV OS in Mexico.

Additionally, the ad industry has been in something of a state of paralysis recently, so this has put downward pressure on ARPU as well.

As Roku focuses on monetization of its international accounts and as the digital ad industry recovers from its current slowdown, Roku’s ARPU should begin growing once again, though this will be something I monitor in the quarters and years ahead.

The Roku Channel

I’ve mentioned The Roku Channel to you a few times already today; however, I wanted to devote an entire section to it, as I believe this is one of the more exciting aspects of the Roku business model and Roku flywheel.

We get asked about market dynamics a lot. We founded Roku on the belief that all TV, including advertising, is going to be streamed and we’re, obviously, seeing that happen. We’re well into that transition, but there’s still a long way to go. Traditional TV ads in the US, as everyone probably knows, is a $60 billion a year business. It’s all going to move to streaming and there’s going to be multiple winners.

Our platform, obviously, has significant scale, engagement, first-party data, unique ad products. And like we said before, in the U.S., our scale is approaching half of broadband households, that makes us a tremendously important platform to be involved in for everyone in the ecosystem.

The Roku Channel, as Charlie will talk more about, it’s a top 10 streaming app on our platform and represents nearly 3% of all TV streaming in September, not just on Roku, but across everywhere, which is comparable to the engagement of apps like Paramount Plus, Peacock, and Max.

The Roku Channel represents Roku’s ability to successfully launch new products and services and monetize those products and services over time.

The Roku Channel is an app, like Netflix or Disney+, and its product is ad supported TV, just like the ad supported TV you pay Comcast or your cable provider to watch.

Interestingly, Prime Video (AMZN) and Netflix (NFLX) recently launched ad supported tiers, essentially following in Roku’s footsteps.

As Roku grows its financial resources, I believe The Roku Channel will strengthen to the extent that it genuinely rivals Amazon and Netflix in terms of content quality, though this may take 3, 5, and 10 years. That said, it’s clear that Roku has the momentum to continue to build the financial resources necessary to achieve a true competitive positioning with these larger, more mature rivals, and the above Nielsen data substantiates as much.

Catching Up With Charlie Collier

In late 2022, Roku hired the former CEO of Fox Entertainment.

Over the last year, I’ve been highlighting the idea that the CEO of Fox Entertainment decided to abandon his throne and essentially play second fiddle at Roku. He had his kingdom at Fox. Why would he essentially downgrade his position outside of just monetary pursuits (to be sure, he’s being paid very well at Roku)?

My belief has been that it’s far less about the money for Mr. Collier and far more about a combination of the money and the gravitational pull Roku has created within the entertainment and TV industry.

To this end, each quarter, I look forward to hearing from Mr. Collier, who is now prominently featured on each Roku earnings call. Here was the most notable commentary from Mr. Collier on Roku’s Q3 2023 earnings call:

Look, we’ve done a lot of curation on The Roku Channel and we feel really good about our opportunities there, Michael, to continue to grow. Really our focus is on bringing the right mix of content to The Roku Channel, content that our customers love and watch across what is really that curated mix of licensed content, the fast channels and original content.

And to sort of summarize our priorities for you, Roku Original Content is a key part of our strategy and I’m proud of the team and our efficient and impact driving efforts. But the foundation of Roku’s content spend is third-party licensed content that we service for viewers through Roku’s unique UI advantages. Our position as the platform is extremely powerful, probably, I would say, more powerful than I anticipated even coming in when we first spoke. And we have great programming overall, and the numbers and the engagement growth prove that our content mix is working well.

The Roku Channel has grown streaming hours 50% year-on-year. And so, just like, I did at AMC and other places I’ve led, we’re very serious about managing the library and we frequently tweak it.

In fact, we review The Roku Channel’s content and the content performance often, simply to ensure that viewers have the best possible experiences. That’s the job, to adjust the mix of offerings and do so to the benefit of audiences. And that process has helped us grow and the engagement is growing consistently. And we see continued growth ahead across all key content categories, starting with that direct license, as I mentioned, including the fast channels, and even sports and focused in budget originals.

So, we’re on strategy, Michael, and see growth ahead. We will continue to release new content and new partnerships on The Roku Channel. And I’m pleased with the team and our process and our progress.

I see Mr. Collier as the ultimate asset for Roku. He’s like Roku’s Swiss Army knife:

- Using his Rolodex, he can drive ad budgets to Roku.

- Using his experience at Fox, he can help Roku create compelling original content and curate compelling licensed content for The Roku Channel.

Generally, I believe it was a brilliant hire by Mr. Wood, and I think it will pay dividends for many years to come.

Concluding Thoughts: The Opportunity Ahead

But as broadcast and linear entertainment impressions continue to decline on Roku — as a reminder, by the way, global hours on Roku grew 22% year-over-year, while linear hours in the US declined 15%. So, the gap is significant. So, as this continues, I believe CTV in general and Roku specifically will continue to be planned and bought earlier in the process.

In closing, Roku has executed so very exceptionally over the last decade, and its business has never been stronger nor more poised to capture the rapid growth of the Connected TV ad industry, the total addressable market of which is depicted in the chart above.

Thank you for reading, and have a great day.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ROKU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.