Summary:

- Vale remains resilient in the face of global economic challenges, benefiting from a robust iron ore market.

- Strong Q3 results demonstrate efficiency and cost-reduction efforts.

- The company’s share buyback program reflects confidence in long-term value creation and potential earnings growth.

CUHRIG

Introduction

On April 25, I wrote an article titled Vale: The Correction Before The Surge. In that article, I highlighted that despite cyclical headwinds, Vale S.A. (NYSE:VALE) remains in a good spot to benefit from long-term secular tailwinds.

The company is currently facing tremendous headwinds related to cyclical economic weakness, which could push shares lower to $12.

At those levels, I’m interested in buying Vale as I believe that the company benefits from a number of tailwinds, including long-term growth in iron ore, outperforming growth in high-quality iron ore, Brazil’s improving ties with China and its emerging market peers, Vale’s progress in expanding its energy transition business, its attractive valuation, and healthy balance sheet.

Since then, Vale shares have risen by 5%, which brings the total return to 8%, including dividends.

This performance happened despite a global economic slowdown, especially in China’s construction sector.

In this article, I’m revisiting the risk/reward of the stock and explaining why Vale could see much higher prices in the years ahead if it gets support from rebounding global growth expectations.

So, let’s get to it!

Vale Is Surprisingly Strong

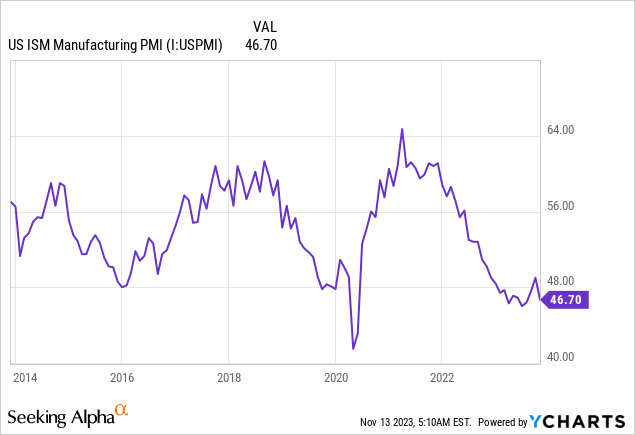

The global economy is not doing so well. We’re seeing a slowing trend in China’s construction sector, Europe’s economies are close to a recession, and manufacturing sentiment in the U.S. has been in contraction territory for more than ten straight months.

Vale, being the world’s leading iron ore producer, is one of the first victims when investors and traders start to bet on slower economic growth.

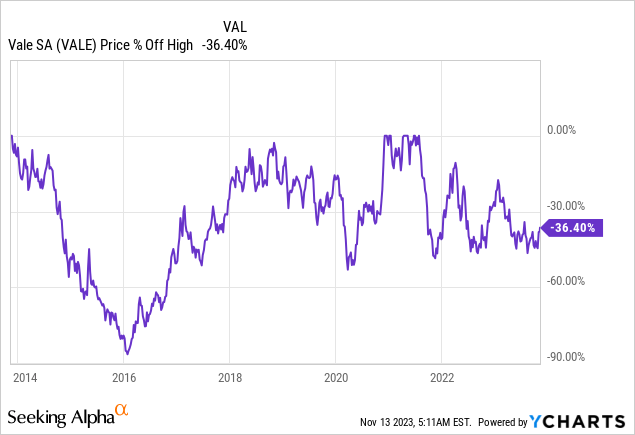

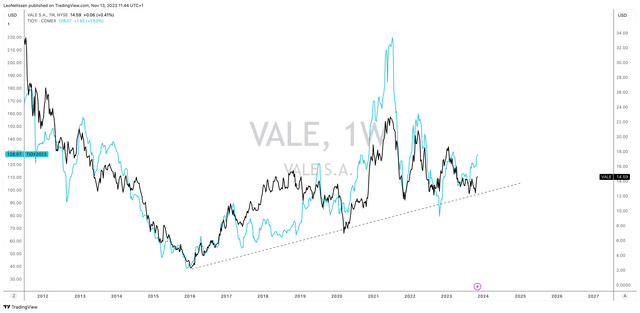

After peaking in 2021, the stock is currently trading 36% below these highs, excluding dividends.

Nonetheless, the stock has refrained from moving lower despite ongoing economic weakness.

One reason is the surprising resilience of the iron ore market.

Goldman Sachs (GS) is now calling for a “clear deficit” in the market, which should support producers like Vale.

“Rather than facing a surplus for this year, the iron ore market is now set for a clear deficit,” Goldman’s report added, as noted by the outlet.

Factors contributing to the iron ore deficit include reduced supplies from key producers in Australia and Brazil.

Goldman revised its global iron ore supply estimates for 2023 down from 1.557 billion tonnes to 1.536 billion tonnes.

[…] Low inventory levels in China, the world’s largest iron ore consumer, have further exacerbated the situation, with potential risks heightened ahead of the Chinese New Year.

On the flip side, Goldman analysts pointed to the recent surge in fiscal expenditure by Beijing as a potential indicator of positive domestic growth sentiment.

This increase in spending is likely to bolster the construction industry, which in turn could drive up the demand for iron ore, a critical component in steel manufacturing.

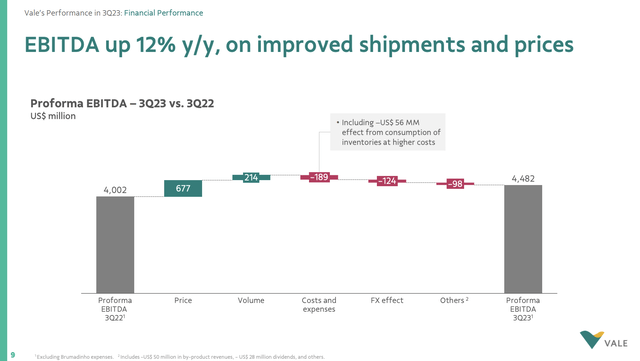

Resilience was also confirmed by Vale. At the end of October, it reported its 3Q23 earnings.

As we’ll discuss in this article, the quarter showed strong results, with S11D operating at a high rate, increased pellet feed production, and improved portfolio average quality.

Despite one-off issues, Q4 output is expected to be solid. Copper sales and production exceeded expectations, although nickel production guidance was adjusted due to changes in mining methods and maintenance.

In Q3, the company delivered a robust EBITDA result of $4.5 billion, showing a nearly $0.5 billion increase compared to the same period last year.

Vale S.A.

This growth was attributed to higher realized prices, with iron ore prices increasing by 13% and copper prices by 16% year-on-year.

Moreover, iron ore findings and pellet sales increased by 4.4 million tonnes year-on-year, taking advantage of favorable market conditions. The company managed to reduce the production-to-sales gap in Q3, contributing to the positive performance.

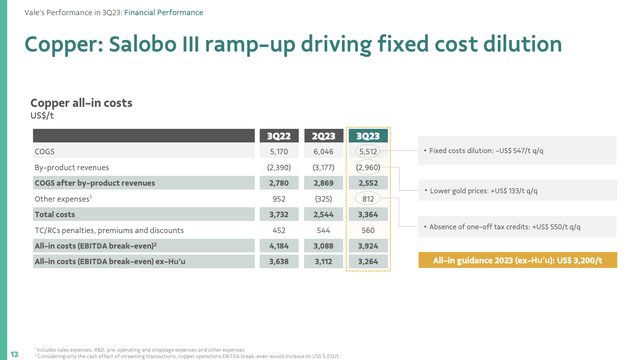

In the copper segment, gains were observed from higher production, supporting a reduction in unit COGS (cost of goods sold). All-in costs, excluding the company’s Huayou project, increased slightly to about $3,300 per tonne.

Vale S.A.

At the nickel operations, COGS ex-third-party feed increased to about $23,300 per tonne due to higher maintenance costs. Unit COGS is expected to decline in Q4 with the end of the maintenance period and increased production in North Atlantic operations.

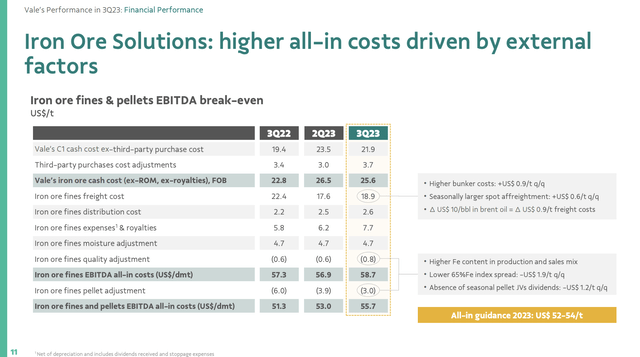

Even more important, iron ore EBITDA breakeven for all-in costs slightly increased to $55.70 per tonne in the quarter. This increase was caused by external factors, including increased freight costs, exposure to the spot market, and lower market premiums in the steel industry.

Vale S.A.

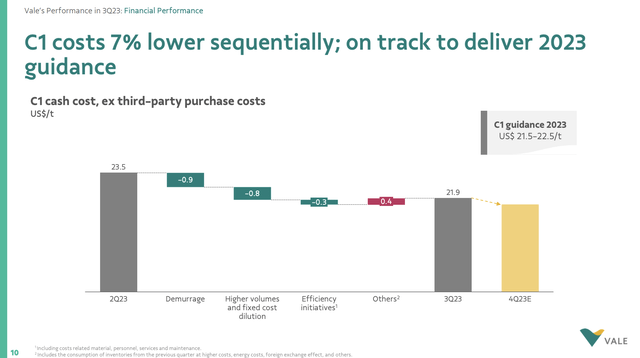

Iron ore C1 cash cost per tonne decreased by $1.60 quarter-on-quarter, driven by lower demurrage costs, higher fixed cost dilution with increased production volumes, and ongoing efficiency programs.

Vale S.A.

In other words, the company’s efforts to reduce costs are on track.

Good News For Shareholders

So far, so good. Despite headwinds, the iron ore market remains very strong, with prices well above pre-pandemic lows. The blue line in the chart below shows COMEX Iron ore futures.

TradingView (VALE, COMEX Iron Ore)

On top of that, as we just saw, the company remains efficient in its operations, which supports EBITDA and its bottom line.

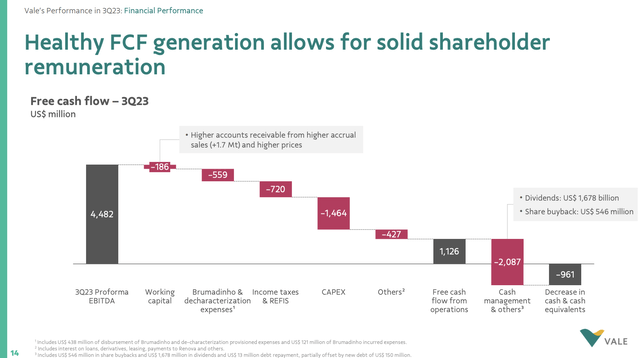

This resulted in strong cash generation.

3Q23 free cash flow from operations was roughly $1.1 billion, $350 million higher compared to the second quarter, although working capital increased due to higher iron ore sales and prices.

Vale S.A.

As the chart above shows, the company spent $1.7 billion on dividends and bought back more than $500 million of stock. It has an investment-grade credit rating of BBB-.

On top of that, the Board of Directors approved a new share buyback program, allowing the repurchase of up to 150 million shares over the next 18 months. This strategic move follows the company’s belief in share buybacks as one of the most accretive ways to create long-term value for shareholders.

Valuation

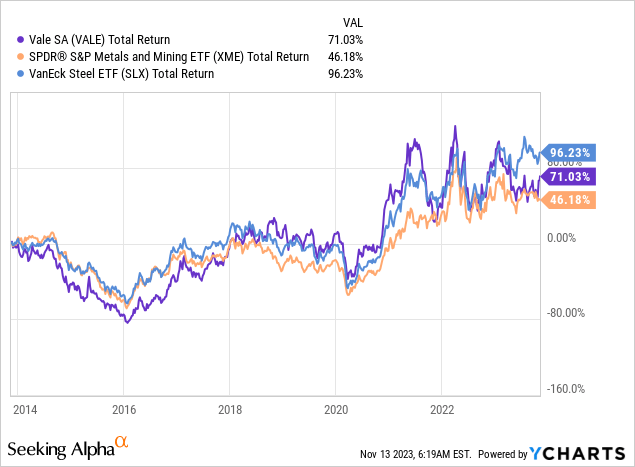

Unfortunately, the company has not outperformed its peers. Over the past ten years, NY-listed VALE shares have returned 71%, including dividends.

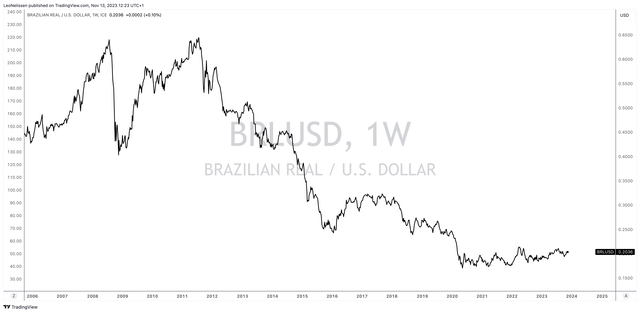

A big part of this underperformance is due to the poor performance of the Brazilian Real. Over the past ten years, the BRL/USD currency pair has been in a steady downtrend until the pandemic.

TradingView (BRL/USD)

Emerging markets had a hard time due to low commodity prices.

Since early 2020, we’ve been in a more favorable environment for commodities.

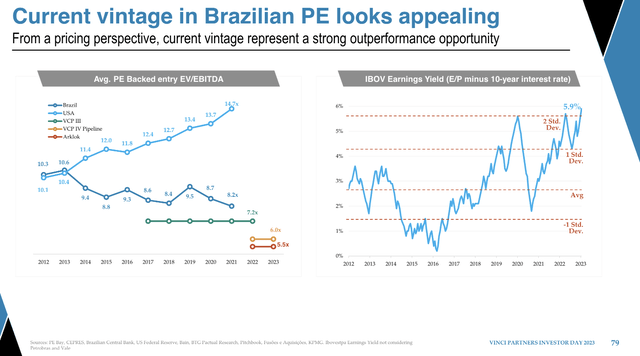

In a recent report, Vinci Partners (VINP) notes how attractive Brazil has become. The IBOV earnings yield (inverted P/E ratio minus the 10-year interest rate) is at a multi-decade high, which is very attractive in an environment where most developed markets are trading at lofty valuations.

VINCI Partners

I believe that the moment economic growth indicators bottom and inflation risks rise again, we could see a violent rotation into value investments, emerging markets, and Vale (these three things are related).

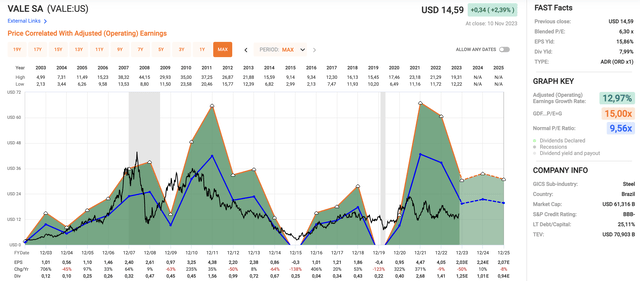

Even in this environment of low expectations for miners, VALE seems to be significantly undervalued.

- VALE is currently trading at a blended P/E ratio of 6.3x.

- Going back 20 years, the normalized P/E ratio is 9.6x.

- This year, EPS is expected to decline by 50%, followed by 10% growth in 2024 and an 8% decline in 2025. These numbers need to be taken with a grain of salt. Commodity fluctuations have a major impact on earnings expectations. Rising metal prices could easily cause the company to report significant growth in the years ahead.

- Based on current (subdued) estimates, the stock has a fair value of roughly $19 per share, which is roughly 30% above the current price.

FAST Graphs

Although VALE is highly volatile and not out of the woods, I’m bullish on the company’s future and believe that it is trading at an attractive price.

My Buy rating is a long-term rating.

While I do not rule out further corrections if economic growth keeps declining, I have little doubt that the stock is in a great place to deliver significant shareholder value in the years ahead – especially if we see a rotation into emerging markets.

However, do not buy VALE if you primarily buy lower-volatility dividend growth stocks.

Takeaway

Despite global economic challenges, Vale remains resilient, capitalizing on a robust iron ore market.

Strong Q3 results display efficiency and cost-reduction efforts.

Meanwhile, the company’s strategic share buyback program reflects confidence in long-term value creation and the potential to significantly boost per-share earnings in the years ahead.

Trading at a compelling valuation, Vale presents an enticing opportunity for patient investors, particularly with potential growth amid a shift toward emerging markets.

While short-term volatility may persist, the long-term outlook suggests significant shareholder value in the years ahead.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.