Summary:

- PayPal Holdings, Inc. stock price has declined by 11% in the last quarter, which provides even better buying opportunities.

- The company has several strong competitive advantages, which will highly likely allow the company to build more value for shareholders.

- My valuation analysis suggests the stock is more than two times undervalued.

Justin Sullivan

Investment thesis

My initial bullish thesis about PayPal Holdings, Inc. (NASDAQ:PYPL) did not age well since the stock price declined by 11% over the last quarter, which is underperformance compared to the broader U.S. market. Investor sentiment deteriorated mainly due to profitability metrics compression, which indicates that the company is losing its competitive edge to bears. However, revenue is still growing even in this harsh environment, and the management appears focused on delivering profitable growth. I consider the management’s target to achieve high-quality growth to be doable given the company’s strong reputation and global presence.

PayPal is also well positioned to leverage its data wealth amid the secular shift to machine learning to improve decision-making. My valuation analysis suggests the stock has the potential to double in price, which by far outweighs all the risks and uncertainties. That said, I reiterate my “Strong Buy” rating for PayPal.

Recent developments

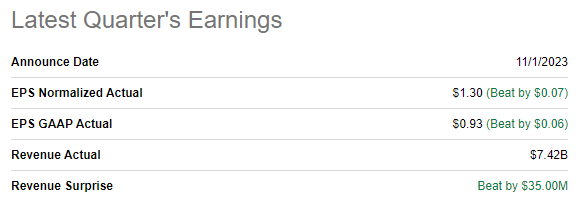

The latest quarterly earnings were released on November 1, when the company topped consensus estimates. Revenue grew YoY by an impressive 8.4%. Despite revenue growth, profitability metrics narrowed. The operating margin shrank YoY from 17.1% to 16.0%.

Seeking Alpha

According to the latest earnings call transcript, there were several unfavorable factors that weighed on the profitability. The management cited challenges in achieving the expected growth in its branded checkout services, with a notable deceleration after an initial rapid acceleration. The softening dynamics in branded checkout growth likely contributed to a decline in the transaction revenue. Pressures on the take rate for branded checkout also undermined profitability. Transaction margin compression also took place, according to the management. To me, from the secular standpoint, pressure on the company’s operating profits is an indication of the intensifying competition. On the other hand, the company’s capacity to deliver volume growth reflects its strong positioning among competitors and adaptability to the changing landscape.

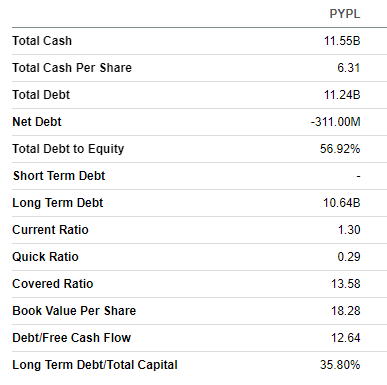

But despite profitability demonstrating strength, PYPL’s profitability is still very strong and has an “A-” grade from Seeking Alpha Quant. Wide profitability metrics allowed PYPL to generate over $2 billion in levered free cash flow [FCF] during Q3. This allowed the company to improve its financial position, as the company now has $11.6 billion in cash and cash equivalents. The leverage level is moderate, and the major part of the debt is long term. All in all, the company’s balance sheet is strong and provides the company with opportunities to finance innovation and growth.

Seeking Alpha

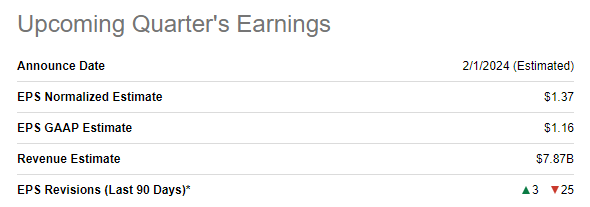

The upcoming quarter’s earnings are scheduled for release on February 1. Quarterly revenue is expected by consensus at $7.87 billion, which means almost a 6.6% YoY growth. The adjusted EPS is expected to follow the top line and expand from $1.24 to $1.37.

Seeking Alpha

Despite the bottom line challenges PayPal is facing, I am still confident in the company’s future prospects. The company’s data and scale are formidable assets as we are amid the beginning of the artificial intelligence [AI] era. As the digital payments industry becomes more complex and competitive, the integration of AI becomes crucial in the company’s strategy. PayPal’s wealth of data equips the company to unlock vast AI and data-driven capabilities, which is highly likely to provide the company with a competitive edge. I like that management recognizes these trends and is ready to invest in innovation to keep up with the evolving technological landscape and build shareholder value.

Apart from being well positioned to compete and innovate from the technological perspective, let us also not forget the company’s massive scale. According to marketsplash.com, PayPal is accepted in over 200 countries worldwide, and among the top 1,000 retailers, a staggering 72% accept PayPal. The extensive reach reflects the company’s adaptability to diverse markets and underlines its trustworthiness. Having a strong reputation and presence is crucial in an industry that processes customers’ money.

The management’s focus on high-quality and profitable revenue growth, highlighted during the latest earnings call, also adds optimism to me. As the management sharpens its focus on the sustainability of growth, it will likely add a sense of stability and resilience for investors. The decision to sell Happy Returns to UPS aligns with the management’s plans to focus on more profitable activities and also looks consistent to me.

According to statista.com, the total global digital payments transaction value is expected to compound by 11.8% annually by 2027. I consider this a solid secular tailwind. As a strong player in the global digital payments ecosystem, PayPal is well-positioned to succeed in absorbing industry tailwinds.

Valuation update

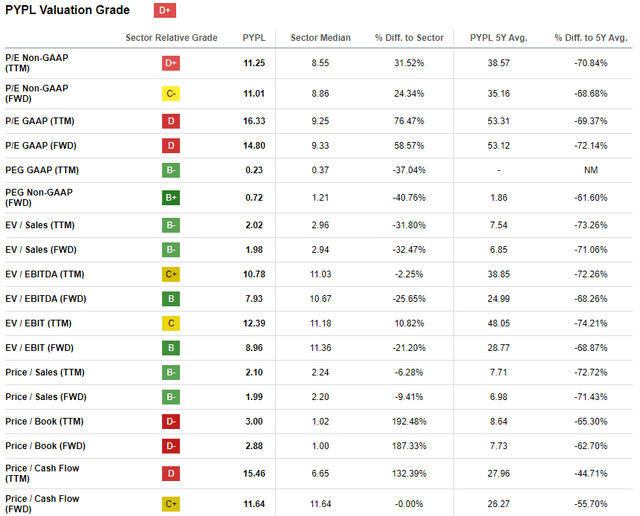

The stock price declined by 27% year-to-date, significantly underperforming the broader U.S. market. Current valuation ratios are multiple times lower than historical averages across the board, which indicates substantial undervaluation. I ignore comparison with the sector median because of PayPal’s massive scale and strong brand, which apparently deserves a premium compared to industry peers.

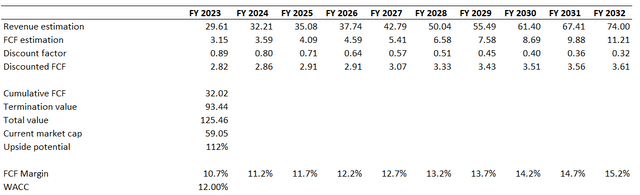

I also want to update my discounted cash flow [DCF] simulation. The TTM FCF ex-stock-based compensation [ex-SBC] margin improved to 10.7%, which I incorporated into my base year. I expect the metric to expand by 50 basis points yearly. Given the Fed’s hawkish stance this time, I prefer to use a more conservative 12% WACC compared to the 10% the previous time. Revenue consensus estimates forecast an 8% CAGR for the next decade, which I consider fair enough to use for my simulation.

According to my calculations, the business’s fair value is approximately $125 billion. That said, there is an above 100% upside potential, and my target price is $116.

Risks update

The most significant company-specific risk that I see is the leadership transition in the company. Dan Schulman, who has been PYPL’s CEO since 2014, is expected to retire at the end of 2023. While the new leader might add fresh ideas and growth drivers, the transition of the CEO is always a risk as it increases the level of uncertainty regarding the company’s strategic priorities and initiatives.

The digital payments industry is becoming more competitive as many tech giants like Apple (AAPL), Google (GOOG), and Meta Platforms (META) enter the market with their offerings. Global digital payments leaders like Visa (V) and Mastercard (MA) are also very strong competitors. The ability of PayPal to differentiate itself and maintain its market share amid such intense competition is a significant risk for investors.

Bottom line

To conclude, PayPal is still a “Strong Buy” for me. Given fairly conservative assumptions, the stock is massively undervalued, and I see more than a 100% upside potential. My analysis suggests that PayPal is well-equipped to be competitive, even given that hyper scalers like Apple and Google are also expanding to the digital payments field. The company’s strong brand and trustworthiness among the largest merchants are also formidable assets.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.