Summary:

- PepsiCo is expected to benefit from a greater consumer propensity to spend on food and beverages, especially among millennials and Gen Z.

- The company is considered a blue-chip stock with a strong performance and a history of increasing dividends.

- PepsiCo’s strong financial performance, exploration into alternate markets, and stable revenue base make it well-positioned for future growth.

Fotoatelie

Thesis

PepsiCo. is one of the most well-known food & beverage companies with a market capitalization of US$ 222.22 billion. The company operates in over 200 countries & territories and has numerous household brands like Lay’s, Pepsi-Cola, Mountain Dew, Quaker, etc. Over the previous FY, the company’s stock price grew by 6.5%. Having survived the COVID year without much financial distress, the company is expected to grow further with a greater consumer propensity to spend on food and beverages, especially among the millennials & Gen Z. With a major portion of sales of PepsiCo coming from the USA, this will reflect in stronger revenue growth for PepsiCo which would translate to a higher net income and free cash flows.

In addition, PepsiCo is also making headway into using its product Diet Pepsi, which could expand its sales among the more health-conscious consumers. Until this point, beverages consisted of 42% of the sales of PepsiCo. But, with consumers becoming more health-conscious and diabetes becoming a bigger problem, the sales of soft drinks could go down. As a result, PepsiCo is aiming to evolve with the market and cater to health-conscious consumers to offer them healthier alternatives without any loss of taste.

At this crucial juncture, it could be a decisive time for PepsiCo and its financials, where we can witness rising profitability and sales for the food & beverage giant.

Seeking Alpha

Catalyst

Greater Intent to Splurge Across Demographics

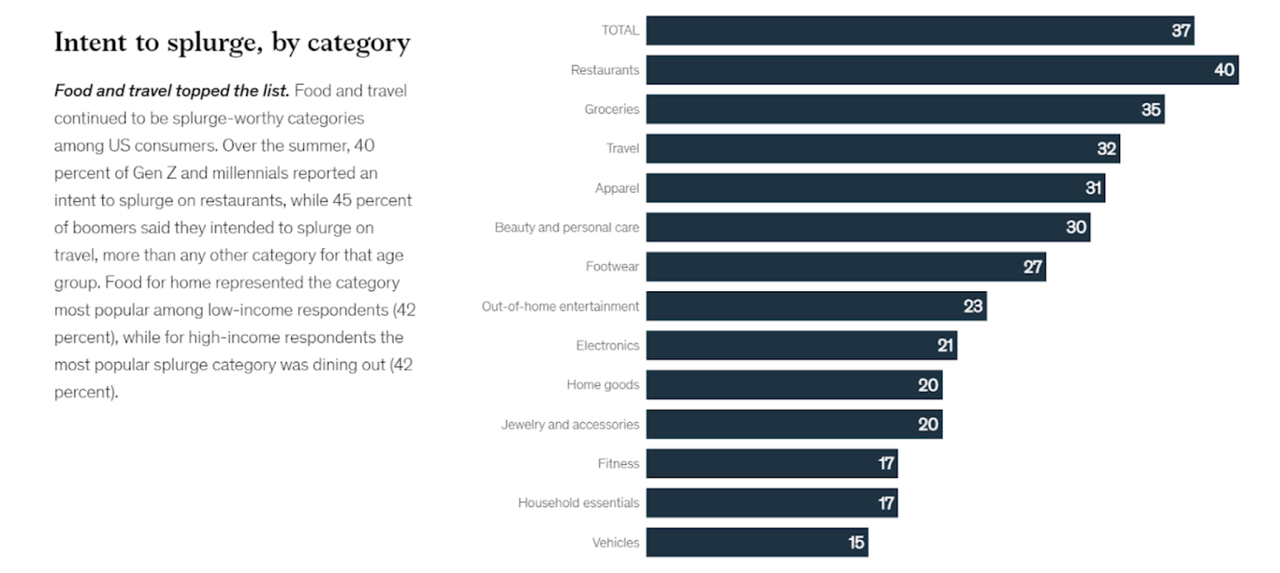

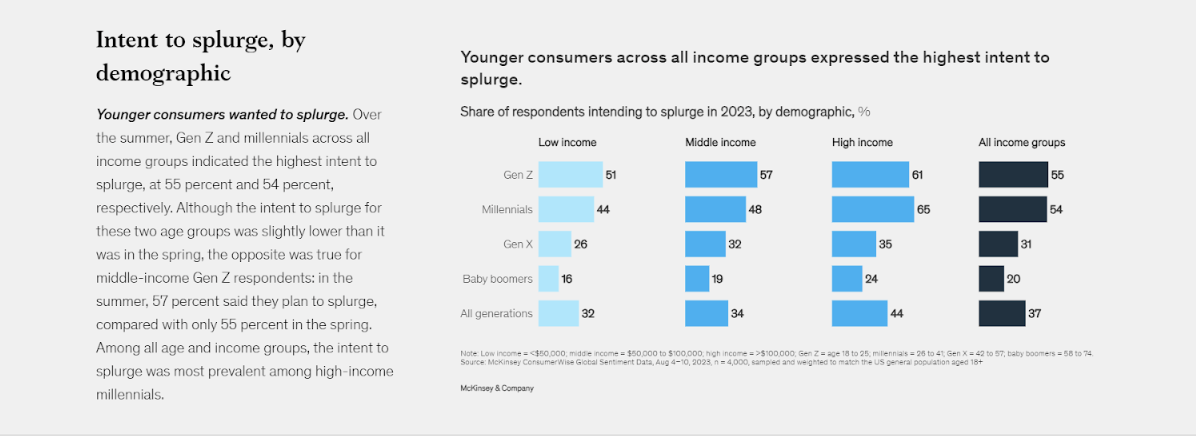

A report by McKinsey pointed out that the younger population (GenZ & millennials) have a much greater intent to splurge across income groups. The following graph illustrates the share of the population from each demographic intending to splurge.

McKinsey & Company

On closer examination, the McKinsey report also points out that the category which is the target of the splurging is food & travel.

This only illustrates that PepsiCo is likely to benefit from this trend in consumer expectation with the increase in sales. With increasing intention to splurge among consumers, the products of PepsiCo are likely to increase because the majority of the spending will be going towards the products that PepsiCo produces.

The greater intent to splurge on food & beverages would mean that it would increase the potential sales that PepsiCo can make. The annual report of PepsiCo shows that 57% of net revenue comes from the USA. With the expansion of the market, we can say that the revenue and the operating profit are likely to increase at a faster rate. Historically, the revenue of PepsiCo has grown at 5.97% CAGR. In the future, the growth is likely to increase at an even faster pace.

There is further reason to believe that PepsiCo will gain further from the preference of consumers, especially because the consumers are moving towards brand names rather than private labels. Previously, due to inflationary pressures, consumers had departed from the brand name products to reduce their expenditures. However, in recent times, this trend has seen a reversal. Since there are mainly two prominent brand names in the USA, PepsiCo and Coca-Cola, we can say that PepsiCo is currently positioned to benefit significantly due to increasing investment into not only the current portfolio in the American food segment but also by aiming to make more headway into the macro snacks category, thereby diversifying their product basket, mentioned in the Consumer Analyst Group presentation.

However, one of the major causes of worry could be if the increasing trend in consumer spending patterns on food & beverage does not materialize due to numerous reasons like a recession. In response, PepsiCo management stated that their brands have historically performed well and remained resilient. They will further aim to introduce greater variety in their portfolio and keep their products affordable. I personally believe that this claim has validity because PepsiCo’s performance during the COVID year is a testament to the fact that their profitability did not experience any decline, even though consumer spending was expected to decline due to severe contraction in the GDP.

A Blue-Chip Stock in the Consumer Staples Sector

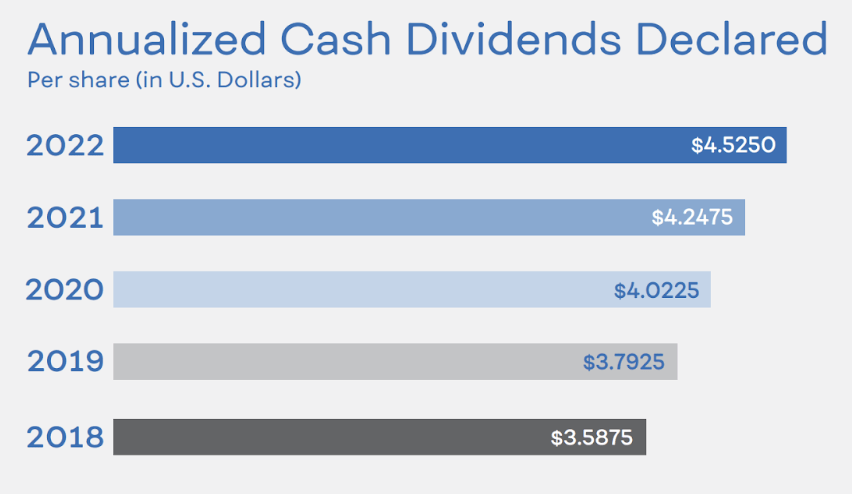

In addition to the positive prospects, PepsiCo can also be considered a blue-chip stock. This is not only because of its strong demonstrated performance but also because it pays out handsome dividends. In 2023, it announced a 10% increase in its annualized dividend payout with its 51st consecutive annualized dividend per share increase.

PepsiCo Annual Report FY22

The figure above shows a consistent increase in the dividend payout of PepsiCo.

Strong Performance & Explorations into Alternate Markets

As previously explored, PepsiCo has a strong presence in multiple geographies and product spaces. Moreover, we have to note that it operates in the consumer staples sector. All these factors combined provide the food & beverage giant an effective cushion against any adverse demand shocks. This was witnessed in FY 2020 when its sales were not adversely impacted and continued its strong performance, even registering an increase in sales. This only highlights that PepsiCo is very well-placed to weather shocks and can easily withstand any kind of adverse shocks.

Apart from this, the company is also aiming to leverage its brand value into alternate markets, like reducing sugar content in certain beverages and offering more healthy options, enabling it to reach a wider consumer base and move along with the trends. This was previously mentioned in the Economic Times article. When we look at India, which is one of the most prominent markets of PepsiCo, a report by Avendus Capital says that India’s health-focused food market is expected to hit a value of $30 billion, which essentially translates to a 2x increase in per capita spending on healthy food. With a wider portfolio, PepsiCo can achieve a more stable revenue base and also reach wider markets, especially consumers who are facing health issues like diabetes, cholesterol, etc.

Financials

Demonstrated Strong Financial Performance

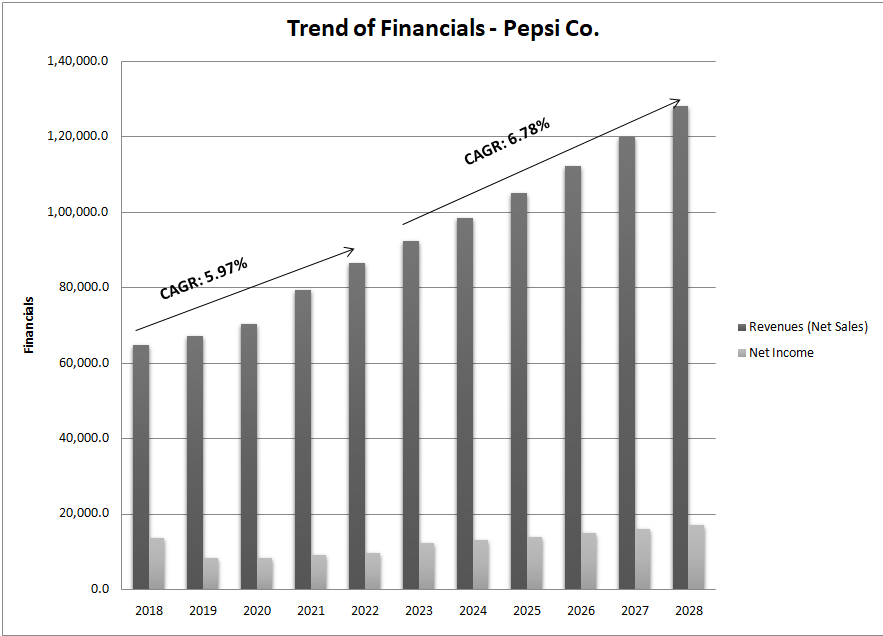

A summary view of the financials of PepsiCo shows that it is continuously going towards an uptrend in terms of revenue, net income, cash flows, etc. In addition to this, returns analysis also illustrates that the company’s stock is also generating relatively low volatility. Recent news showed that organic revenue growth was up to 8.8%, and the management expects a 10% organic revenue growth in Q3 of FY23, free cash flows increased by 35.8%

Based on the values that we have observed in the graph of revenue and net income, we have noticed that the revenue has shown consistent growth since 2018, and net income has been consistently positive as well, highlighting the future prospects of PepsiCo.

Seeking Alpha

One of the factors in favor of these strong financial figures is the sector in which PepsiCo operates – consumer staples – which is susceptible to seasonality but is relatively immune to the effects of recessions.

When we look at their cash position, we see that the free cash flow has fluctuated and recently dropped in 2022. However, in 2023 (from TTM), it is expected to rise back again to almost the 2021 level. We note a similar picture for the operating cash flows, and in 2023, it is expected to reach the highest level of $12.135 billion. Investing cash outflow is expected to increase in 2023 to almost $5.12 billion, which indicates greater investment in fixed assets by the company.

Valuation

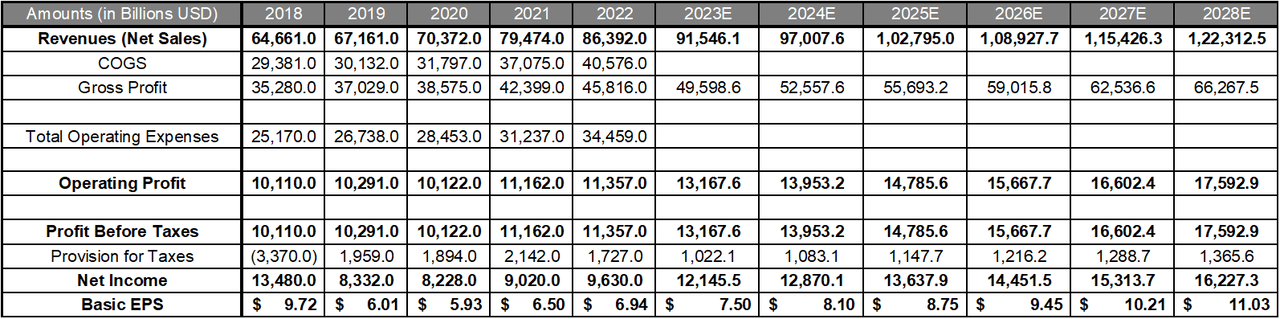

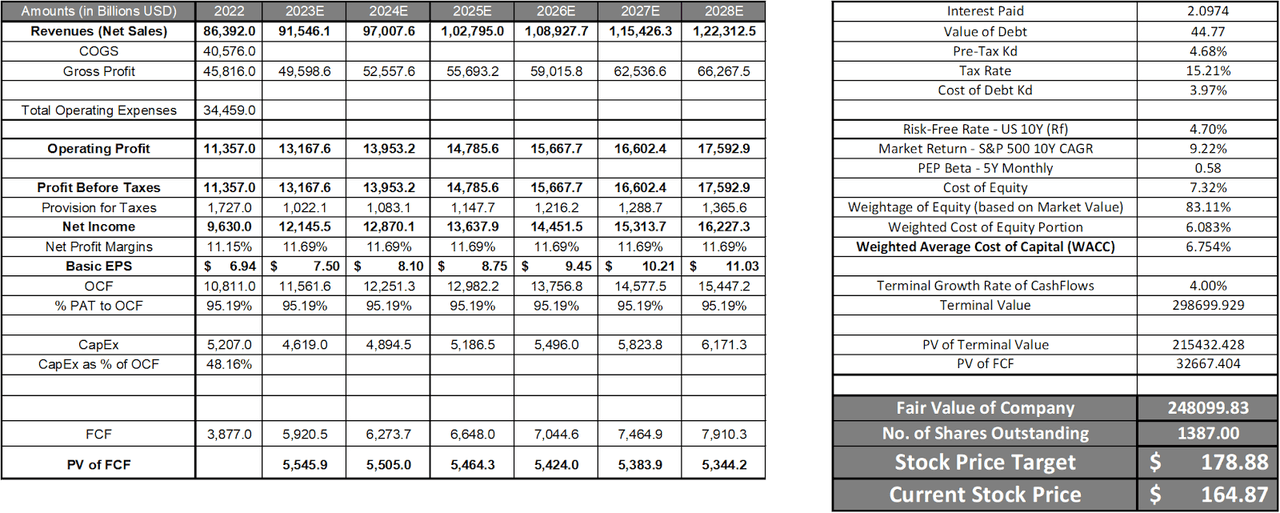

In order to undertake the valuation of PepsiCo, I have undertaken a DCF Valuation. The summary of the analyses is given in the chart below, combined with the 52-week High/Low and the analyst forecasts. The method of calculation of each of the valuation methods has been explained further.

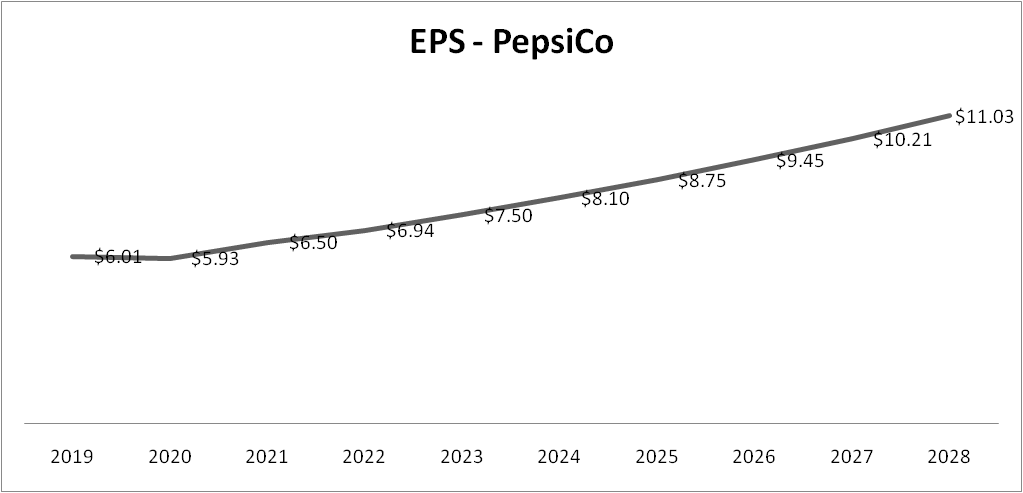

Below is an image of a DCF Valuation performed on PepsiCo. Based on estimates of Seeking Alpha, the revenue of PepsiCo. is expected to grow at 6.78% CAGR, which is faster than the rate at which it has been growing in the last five years and has kept profit margins at historical levels. As we have already explored before the basis of this estimate could be that the consumers are likely to spend more on consumer staples.

I have assumed the terminal growth rate as 4% which is slightly higher than the GDP growth rate of the USA because the corporation is actively exploring newer and emerging markets. The beta value is from Yahoo Finance which is based on 5 years of monthly returns regressed on the S&P 500 returns. The value is reflective of the stability of the company even in the face of major economic crises like during the covid.

Risks

Russia-Ukraine War Disrupting Global Demand & Supply Chain

The currently ongoing war between Russia and Ukraine could act as a disruption to the demand for PepsiCo’s products and its supply chain. The previous revenue and operating profit allocation shows that Europe has 15% of the revenue and 10% of the operating profits. The disruption in this part of the world could lead to major fall in demand, reducing PepsiCo’s profitability. The annual report of the company says that the conflict could have ripple effects on the labor markets and the financial markets and could also adversely affect the assets and holdings of the corporation. In short, it would be hard to measure the exact extent of the resulting damage from the conflict, but it definitely cannot be ignored.

For example, a report stated that in the wake of the Russia-Ukraine war, PepsiCo would halt the production of PepsiCo beverages in Russia along with other FMCG companies. However, if they choose to stay back during the war, it could also mean that they would be able to benefit tremendously once the war ends and they are able to resume production.

Adverse Reputation Due to Poor ESG Performance

The company has a poor reputation when we bring into the limelight its performance in the ESG sector. The company has had a poor run when looking at meeting the emission reduction targets. Continuing on this trajectory could mean that the operating profit of PepsiCo could reduce by as much as 26%, a report by Planet Tracker stated. For example, despite having the net zero target by 2040, PepsiCo lacks a comprehensive roadmap.

Conclusion

Overall, my recommendation for the stock would be a BUY because the qualitative analysis of the company in terms of its positioning in the market and the financial modeling reveals that buying the stock would be a good bargain. Looking at the catalysts, we can see that the sales are likely to continue on their historical exponential growth because of the greater propensity of the consumers to spend on food & beverages. In addition, the stock is also highly valued for the generous dividend that it provides. Therefore, even from the perspective of a long-term value investor, the stock would be a good bargain.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.