Summary:

- Exxon plans to become a leading supplier of lithium for electric vehicles by 2030, drilling its first lithium well in Arkansas’ Smackover Formation.

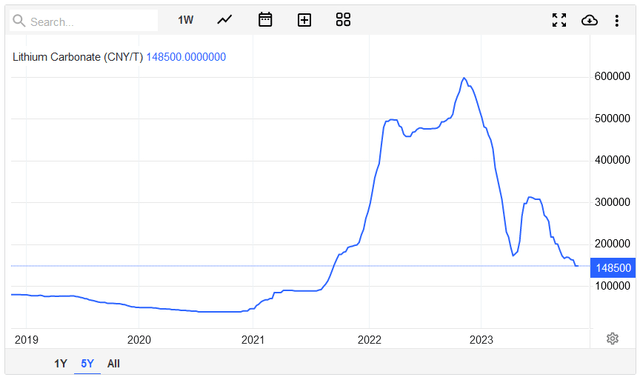

- The price of lithium carbonate has fallen by about 70% this year, impacting lithium producers like Albemarle and Livent.

- Exxon’s plan to mine and produce lithium could generate $1.5-$2.5 billion annually, but there are risks in scaling up the technology.

- Regardless, even at full production, XOM’s estimated Smackover lithium revenue is a rounding error compared to Exxon’s FY2022 revenue of $398.7 billion.

PhonlamaiPhoto

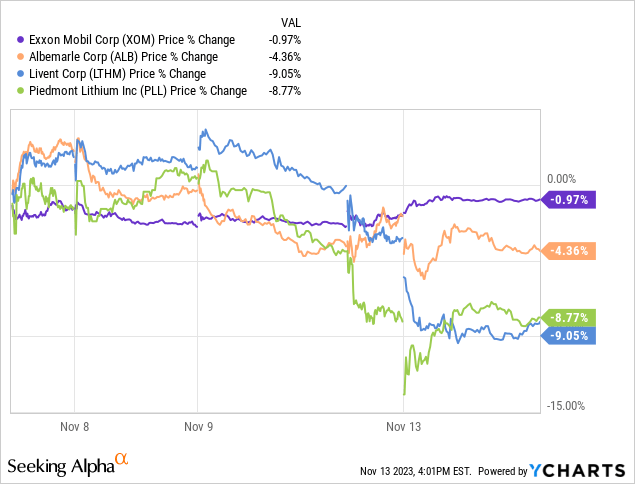

Back in May the Wall Street Journal reported that Exxon (NYSE:XOM) had quietly accumulated 120,000 gross acres in Arkansas’ Smackover formation for more than $100 million (see Exxon Joins Hunt For Lithium). But Exxon’s investment wasn’t to explore or produce oil and gas, it was to mine lithium. Today (Monday Nov. 13), Exxon announced it will drill its first lithium well in the play and intends “to be a leading supplier for electric vehicles by 2030.” Today, I’ll take an overview of the news to see if Exxon’s master plan in the lithium market will actually move the needle for XOM shareholders. Meantime, the announcement certainly seems to have moved the needle (downward …) for one the biggest lithium producers, Albemarle (ALB), as well as companies that have big aspirations in the space: Livent Corp (LTHM) and Piedmont Lithium (PLL):

However, it should be noted that the bottom had already fallen out of lithium prices this year. So whether or not the negative stock price movements in the chart above were solely due to Exxon’s lithium announcement is certainly debatable. That said, it likely didn’t help sentiment in the space.

Indeed, the graphic above shows that the price of lithium carbonate has fallen from CNY$500,000/tonne (US$70,000 at the current 0.14 exchange rate) at the start of the year to the current CNY$148,500 (US$20,790) – or about 70%. As a result, Albemarle stock is down 47% year-to-date while Livent is down 32%.

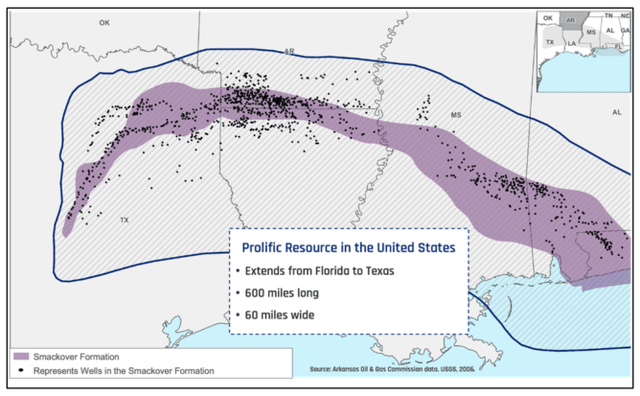

The Smackover Formation

The Smackover Formation (shown above) in southern Arkansas was a very productive source of oil following the Smackover discovery well in 1922 – although that discovery led to social unrest at the time. Today, the Smackover formation is the only commercial source of bromine in the United States. More important for investors, a 2022 report validated that:

… Galvanic Energy’s Smackover prospect as one of the largest lithium brine resources in North America, with sufficient lithium to produce enough batteries for 50 million electric vehicles.

Note: It was Galvanic Energy that sold the 120,000 Smackover acres to Exxon.

Exxon plans to cash in on this bountiful supply by mining and producing lithium under the brand name “Mobil Lithium.” Exxon will use conventional oil and gas drilling techniques to reach lithium-rich saltwater reservoirs at a depth of ~10,000 feet. The company will pump the lithium brine to the surface and use direct lithium extraction (“DLE”) technology to separate lithium from the saltwater. The lithium will then be processed into battery-grade material on site while the remaining saltwater will be re-injected back into the underground reservoirs. First production is estimated to be in 2027.

The U.S. was once the world’s largest producer of lithium, but today it’s now dependent on other nations (like China) for its supply of the metal. The Biden administration’s Inflation Reduction Act includes tax credits covering 10% of the cost of producing critical minerals – including lithium. This was likely a prime consideration in Exxon’s decision to move forward on the Smackover deal. After all, oil and gas companies love to be subsidized by the government – just look at how they are tripping over each other to cash-in on the CO2 sequestration theme … which, in my opinion, will turn out to be a huge and very inefficient boondoggle. But that’s a subject for another day.

Impact On Global Lithium Market

The impact of Exxon’s potential contribution to domestic lithium production is certainly positive from an economic and national security perspective. I say that because Fitch Solutions’ research unit BMI predicts a significant lithium shortfall in 2025:

According to BMI’s report, Chinese demand for lithium will grow by 20.4% year-over-year from 2023-2032. Conversely, China’s lithium supply will grow by only 6% over the same duration, meaning that China will be unable to meet even one-third of its lithium demand.

Now, back in July, the Wall Street Journal reported that Exxon planned to build one of the world’s largest lithium-processing facilities in the Smackover region – with a capacity to produce an estimated 75,000 to 100,000 metric tons of lithium annually by 2030. To put that into perspective, the lithium production from the entire planet produced 540,000 metric tons of the metal in 2021. That is, Exxon’s plans indicated the company will become a significant player in the lithium market if its plans come to fruition.

Not A Game-Changer

However, I should point out that even if Exxon is successful in its Smackover venture (and this is not assured, see the “Risks” section below), and can economically ramp-up lithium production to 100,000 metric tons annually, I estimate it would generate somewhere between $1.5-$2.5 billion annually (depending on market prices). So, even at the top of that range, it would equate to only 0.6% of the $398.7 billion in revenue Exxon generated in FY2022. In other words, “Mobil Lithium” is likely to be a rounding error on Exxon’s overall operations.

Risks

And there’s no guarantee that Exxon will be able to economically scale-up the DLE technology it plans to utilize to recover the lithium. To the best of my knowledge, DLE is not being used anywhere in the world to produce lithium at scale and delivering commercial volumes.

That said, last year Imperial Oil (IMO) – which is majority owned by Exxon – formed a strategic agreement with E3 Lithium (ETL:CA)(OTCQX:EEMMF) on a lithium project in Canada. E3 Lithium owns proprietary technology to extract lithium from lithium-rich brine and the goal is to scale-up E3’s recovery technology to commercial volume. At this time, it’s not clear to me if Exxon’s plans on utilizing E3’s technology in the Smackover play, but it would not surprise me. If so, I suspect Exxon/Imperial Oil may make a run at the company. However, the market doesn’t appear to think that is the case given ETL:CA stock was down 1% yesterday.

Summary and Conclusions

In my opinion, there’s no reason for investors to jump into Exxon stock based on the Smackover lithium narrative. That’s because the primary investment thesis for Exxon continues to be organic production growth in Guyana and the Permian – including the recent agreement to acquire Pioneer Natural Resources (PXD). Moreover, in public, Exxon was a long-time corporate global warming skeptic even while their own in-house scientists knew the score (see Exxon Disputed Climate Findings For Years. Its Scientists Knew Better). In 2012, then Exxon CEO Rex Tillerson finally admitted man-made global warming was real, but he brushed warming fears off as being “overblown” and that societies would “adapt.” It addition, XOM spent years and tens of millions of shareholder capital on algae research that has gone absolutely nowhere (other than to polish its “green” credentials).

Exxon recently added another member to its Board of Directors – one Dina Powell McCormick. McCormick’s resume is rather impressive – she spent 16 years at Goldman Sachs and is fluent in Arabic. However, she also served in both the Bush and Trump administrations – as the first United States Deputy National Security Advisor for Strategy in the latter. Call me a cynic, but one can only wonder if McCormick had a role in advising Trump on climate policy.

The bottom line: There are certainly legitimate reasons to invest in Exxon (Guyana and the Permian), but doing so because you believe that Exxon will be a major player in powering EVs instead of gasoline and diesel powered cars and trucks is not one of them.

Exxon, despite over-paying for Pioneer (see Chevron Buys Low, Exxon Buys High – a Seeking Alpha Editor’s Pick), and another weak quarterly dividend increase ($0.04 to $0.95/share, or only 4.4%), is a Hold given the current relatively high oil and gas commodity price environment, and its potential for strong production growth going forward. Better alternatives are Chevron (CVX), which I rate a Buy given the recent stock beat-down on yet another TCO project delay and cost escalation, or ConocoPhillips (COP), which remains my favorite O&G producer. As compared to Exxon, both CVX and COP have better management, are much more efficient, and are superior generators of dividend income.

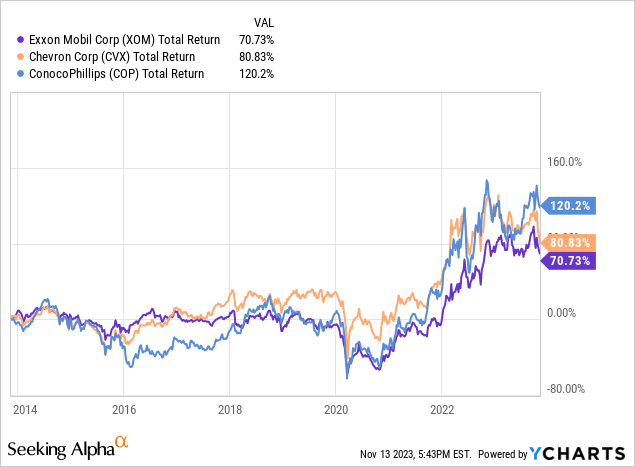

I’ll end with a 10-year total returns chart of Exxon, Chevron, and ConocoPhillips:

As can be seen, COP has been the leader of the U.S. “big three” and until the recent sell-off in Chevron stock, it too was significantly ahead of Exxon (see COP: Beating Its Big Brothers). I see no indication that the next decade will be much different than the last – lithium or no lithium.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CVX, COP, XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am an electronics engineer, not a CFA. The information and data presented in this article were obtained from company documents and/or sources believed to be reliable, but have not been independently verified. Therefore, the author cannot guarantee their accuracy. Please do your own research and contact a qualified investment advisor. I am not responsible for the investment decisions you make.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.