Summary:

- American Airlines has become heavily shorted, but its stock price has fallen more than the industry average.

- American’s revenue performance lags behind Delta and United but is better than many low-cost carriers.

- Factors contributing to AAL’s revenue weakness include the dismantling of its partnership with JetBlue and its smaller global route system.

- American management has pushed a new distribution strategy that could be exacerbating its revenue weakness.

American Airlines Aircraft at DFW Airport

kameraworld/iStock Editorial via Getty Images

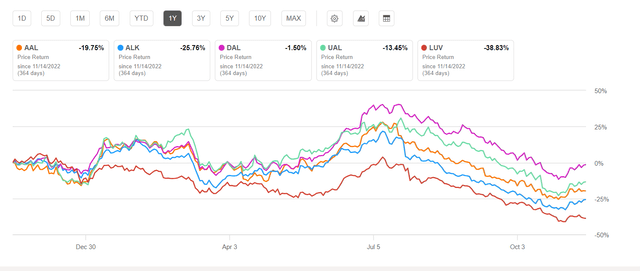

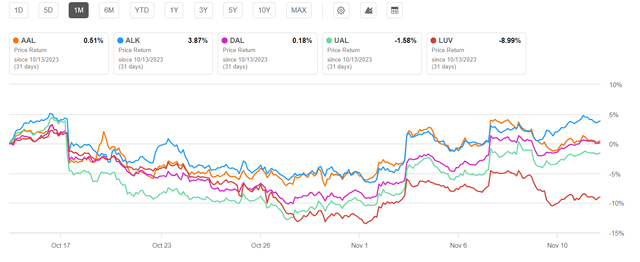

The negative sentiment about American Airlines (NASDAQ:AAL) has reached a fever pitch in recent weeks. AAL has become one of the most heavily shorted stocks (over 15%) even as its stock price has fallen even more than the industry which has seen major competitor stocks pull back recently. American’s latest earnings report indicated performance below Delta (DAL) and United (UAL) but also above a number of low cost carriers. AAL is heavily indebted and, though it is working to reduce its debt and reducing its capex, the company is at risk as interest rates increase and the economy softens. Let’s look at whether AAL’s stock is being excessively targeted with negative sentiment or whether there are factors that many investors are not seeing.

AAL vs industry 1 year chart (Seeking Alpha)

AAL vs industry 1 month chart (Seeking Alpha)

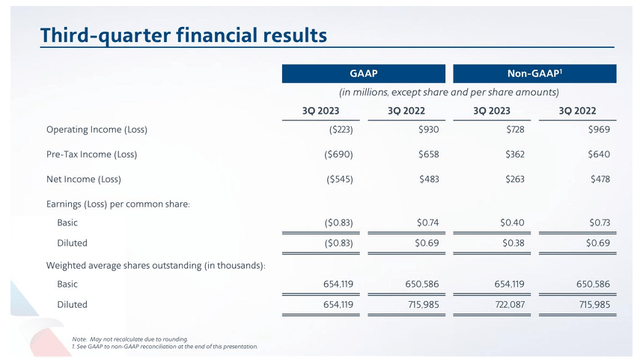

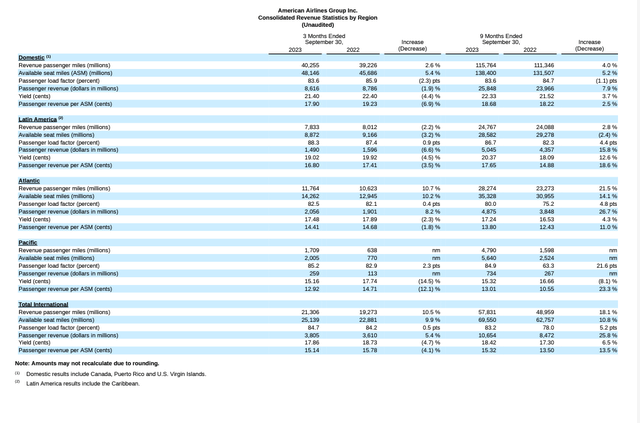

Middle of the Pack Third Quarter Numbers

The most notable feature of AAL’s recent financial results is that its revenue performance lags peers Delta and United but also is better than many of the low cost carriers. Notably, in the third quarter, AAL reported domestic unit revenue – revenue per available seat mile or RASM – of down 6.9% compared to down 4% for DAL, down 2% for UAL, and down 6.4% for Southwest (LUV). American’s system RASM change of negative 6.3% trailed DAL and UAL which both obtained substantial benefit from their international systems and fell just 1% on a system basis. AAL trailed DAL and/or UAL in every one of the three global regions – transatlantic, Latin America and transpacific. While domestic weakness is clear with the low cost carriers – which are almost entirely domestic-only – due to the end of domestic revenge travel post-Covid, rising interest rates, and reduced consumer savings and increased credit card spending, American is unique among the big 3 in its susceptibility to domestic revenue weakness, looking more like a low cost carrier than a network/global carrier. American’s revenue weakness appears to go deeper than just the domestic market. Several key factors are likely at play.

AAL 3Q2023 results (AA.com)

AAL revenue by region 3Q2023 (AA.com)

AAL revenue by region 3Q2023 (AA.com)

First, American lost a court ruling that sought to determine the legality of the Dept. of Justice’s objection to the Northeast Alliance -NEA – that American had with JetBlue (JBLU). The NEA was a result both of American’s attempts to find a solution to the Dept. of Transportation’s complaints that pre-dated Covid that American was not fully utilizing its takeoff and landing slots at New York’s Kennedy and LaGuardia airports. AAL and JBLU were granted approval by the DOT to swap slots and coordinate schedules but the DOJ filed suit arguing that no two U.S. domestic airlines are allowed to have the level of cooperation that AAL and JBLU had which included revenue sharing. AAL’s intent was to use JBLU’s larger domestic presence at JFK airport to help feed AAL’s international flights where it has long struggled to compete with direct competitor Delta and cross-town rival United at Newark, both of whom had much larger international operations from NYC than American.

The judge’s ruling supported the DOJ’s position and AAL and JBLU were required to dismantle not just the anticompetitive aspects of the Northeast Alliance but also portions of cooperation such as simple codesharing (the display of one airline’s code on another airline’s flights) as well as loyalty program cooperation since AAL and JBLU did not receive approval for those activities. Although AAL and JBLU continued to honor tickets that were sold under the program before it was terminated, it is certain that both airlines allocated aircraft to routes which no longer were financially viable outside of the arrangement. In addition, American lost valuable feed to several of its international routes making it likely that it had to sell more discount seats at the last minute in order to replace the seats it expected to sell under the NEA. While the sudden termination of the NEA is certain to have negatively impacted AAL, it is a one-time imbalance that the company can correct and I believe they will in the next few quarters. Indeed, AAL is transferring some routes such as JFK airport to Doha, Qatar which it is moving to its Philadelphia hub.

Second, while Delta and United have both indicated that they expect the strong transatlantic travel which buoyed both carriers’ results in the third quarter to normalize going into 2024, their results this year were boosted significantly because of transatlantic revenge travel and the strong dollar which flooded Europe with American tourists to levels that hasn’t been seen in years. American’s transatlantic revenues were just two-thirds of Delta and United’s similarly-sized roughly $3 billion in the third quarter. DAL and UAL both have more diverse route systems in Europe and thus were able to better deploy resources to capture premium demand. In addition, Delta and United’s primary European joint venture partners are in continental Europe while American’s primary joint venture partner is in the UK with a secondary and smaller presence in Spain. Delta and United were simply more capable to serve the markets that generated the best revenues across the Atlantic.

Third, American is in the process of reallocating resources on its domestic system. Some of its hubs, especially Chicago, were slow to recover post-Covid and American reallocated a number of resources to other locations. One of its bets was on Austin, the fast-growing Texas capital that has been the go-to relocation spot especially for disgruntled Californians. American added dozens of routes but set off a competitive battle with Southwest Airlines, the largest carrier at AUS. AAL just recently announced that it was pulling down more than a dozen routes from AUS after the peak winter holiday season, undoubtedly to reallocate resources to its northern hubs in New York and Chicago during the spring and summer. In addition, AAL has focused its growth on its hubs at Dallas/Ft. Worth and Charlotte and its Austin experiment undoubtedly pulled some traffic from its DFW hub; AA became known for selling low-fare connections via AUS. Again, while some of AAL’s network strategies have been problematic, it is likely that they will be corrected in the coming months.

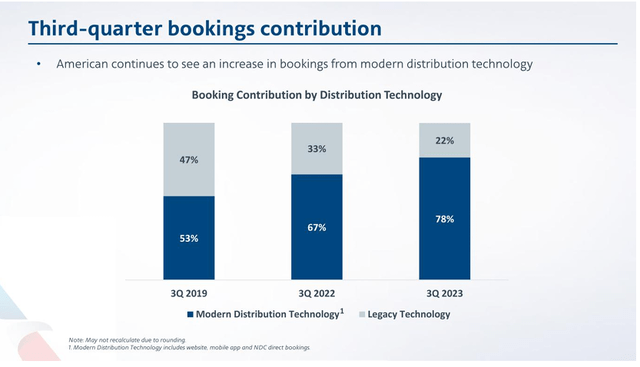

One final likely reason for AAL’s revenue weakness is more complicated. Several years ago, American, which pioneered the world’s first airline computerized reservation system, made clear that it was transitioning to new technology systems that would shift more distribution power from travel agents and external content providers back to American. The Cranky Flier, an airline industry blog, explains what AAL is trying to do. (note that Cranky Flier also operates a premium travel concierge service that uses a traditional computerized reservations system and is being negatively impacted by AAL’s moves).

For decades, the Global Distribution Systems (GDSs) like Sabre — the largest in the US — have been the brains behind air travel sales. They take real-time availability from airlines along with the airlines’ filed fares and build itineraries using the prices in the market. That gets presented to agencies who then ticket in the GDS. The information gets communicated to the airlines.

NDC turns this model on its head and makes the airline the brains. The idea is that the GDS or any intermediary can request current pricing from the airline on demand. It’s the airline that does the calculations and spits back options. Then the request to ticket goes to the airline where it is handled with the ticket number being communicated back. The GDS becomes a mere vessel for aggregating offers.

Cranky Flier says that AAL not only rushed implementation of the NDC technology but closely tied its automated distribution system changes to a significant reduction in AAL’s sales force. CF explains that many small and medium sized travel agencies and businesses have seen their travel services shift from being personalized and relational to becoming automated and rigid.

AAL 3Q2023 distribution technology (AA.com)

American is the only carrier that has included a slide in its earnings presentation about a switch to new technology, indicating that it believes it is involved in a generational change in how it operates. While United has said it is considering similar changes, it is moving much slower and is undoubtedly going to avoid the mistakes that American is making. In addition, AAL receives a much lower percentage of corporate travel than Delta, the industry leader in premium travel, and United, and so American is apparently simply automating what its sales team has been unable to achieve – greater penetration of the premium travel market. While American could have greatly miscalculated the financial impact of its rapid implementation of NDC technology, it is likely in a transition process rather than a full-scale meltdown of its revenue model. Among its revenue shortfalls, I consider its NDC push as the most difficult to quantify.

American Can Thank a Few Positives

First, crude oil prices have been softer than expected. Not too long ago, $100/bbl oil seemed like a possibility. Now, crude oil is below $80/bbl due to what many believe is China’s shift to purchasing Russian oil, leaving excess supplies of Middle East oil on the market. Airlines and other transportation companies are the beneficiaries. While no U.S. airlines have revised their fuel cost guidance, it is very possible that a rare decrease in guided fuel prices could be seen if current oil prices remain for another couple weeks.

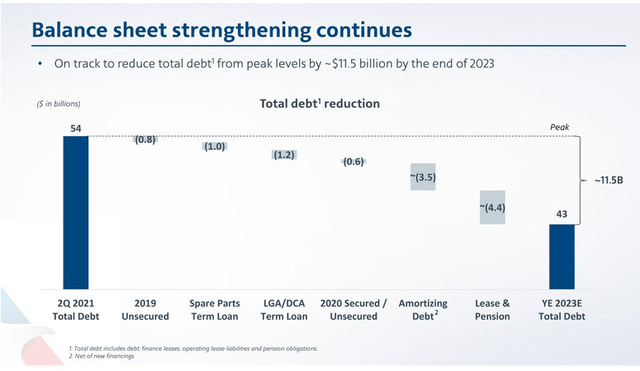

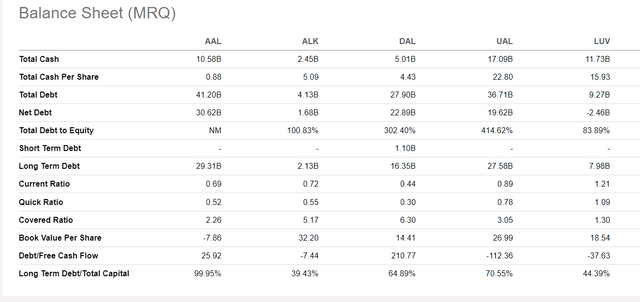

In addition, AAL continues to reduce debt which ballooned in the last decade as a result of stock buybacks which didn’t turn AAL’s stock price decline around, coupled with massive fleet spending. In fact, AAL’s debt reduction is possible because AAL has the youngest fleet of the big 4 airlines so has much lower fleet spending needs than other carriers. However, AAL’s weak earnings make it more difficult to continue reducing debt, particularly as debt service requirements increase in 2025.

AAL debt reduction 3Q2023 (AA.com)

AAL vs industry balance sheet (Seeking Alpha)

Part of AAL’s high costs in the third quarter were related to implementation of its new pilot contract, the latest among the big 3, led by Delta’s pricey contract agreed to in December 2023. Although American still must settle with its flight attendants which are also looking for hefty pay raises, AAL management has said it will match – but likely not exceed – pay raises given to Delta’s non-union flight attendants which include pay during flight boarding, a new concept for most U.S. airlines.

Finally, while AAL is demonstrating financial weakness compared to global airline peers Delta and United, American’s competitive position might not be as dire when viewed within the larger context of the industry. AAL’s former Northeast Alliance partner JBLU reported a loss as did JBLU’s proposed merger partner, Spirit (SAVE). Large portions of the airline industry are not doing well and there is a significant dividing line between the “haves” and “have-nots” with American landing in the middle, slightly skewed to the premium revenue-side by nature of its dominance of and strong presence in its southern U.S. hubs in strong regions of the country (Charlotte, Dallas/Ft. Worth, Miami, and Phoenix). Several low cost carriers are themselves being forced to slow their growth because of their own financial issues as well as supply chain and engine recall issues. United execs already tipped that they are likely to slow their growth in 2024 significantly from their elevated levels in 2023; UAL and DAL have led the industry in capacity growth. Southwest execs indicate they are not likely to put their Boeing MAX 7 aircraft, which are awaiting certification, in service until after the summer 2024. A combination of events means that airline capacity growth will likely be minimal meaning that fares will be stable if not stronger. Lower fuel prices could lead to a rebound of profits for a number of carriers including American.

I believe that, although American management has done a poor job of explaining its revenue weakness, it is suffering from multiple issues which will be resolved in the next several months. In addition, its cost issues are related to labor-contract implementation which will stabilize. Finally, American’s competitive situation is likely to improve as a weakened low cost and ultra-low cost sector leads to less downward pressure on fares.

Accordingly, I believe AAL stock should now be a buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.