Summary:

- Google’s hesitancy to fully unleash its AI capabilities may indicate a struggle to adapt and compete in the AI space.

- The economic implications of AI innovations could disrupt Google’s traditional revenue and cost structures.

- Google’s perception as a low-risk investment may overlook the disruptive undercurrents of AI, posing risks to its stability and market valuation.

Justin Sullivan

At the forefront of technological innovation, Google (NASDAQ:GOOGL) (NASDAQ:GOOG) stands as a colossus with seemingly insurmountable advantages: a reservoir of talent, an ocean of data, and a ubiquitous presence on the consumer web. Yet, in the fast-evolving realm of artificial intelligence, these strengths are juxtaposed with a notable hesitancy to fully unleash their AI capabilities, unlike the swift and public advancements of entities like OpenAI. This contrast may not merely be a strategic delay but could signify a deeper struggle within Google to adapt and compete in the AI space.

Within Google’s walls, a complex web of internal politics and ethical concerns weaves a narrative of resistance to groundbreaking AI. This resistance, while often cloaked in the guise of ethical deliberation, may well stem from a fear of disruption – a disruption that threatens established roles and departments. This phenomenon, reminiscent of the ‘innovator’s dilemma,’ where existing success and structures inhibit adaptation to transformative technologies, is palpable in Google’s cautious AI journey.

To put it succinctly, what we may be observing is a classic scenario where the entrenched interests of employees, deeply invested in the prevailing search business model, are creating an undercurrent of resistance to the shift towards AI. This resistance is not necessarily born out of malice or negligence. Rather, it stems from a rational concern over the potential years of financial underperformance that such a pivot could entail. The stakes are high, and this naturally seeds doubt and inertia, not just among the rank-and-file but potentially up to the executive level.

Economic Implications and the Search Monolith

Google’s economic fortress has been built on the bedrock of its search business, a model now facing potential upheaval by advanced language models.

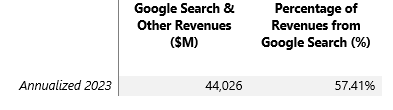

Author’s computations based on company financials

These AI innovations could not only divert the streams feeding Google’s revenue but also escalate operational costs. The shift in how people search and interact online poses a fundamental challenge to Google’s traditional revenue and cost structures.

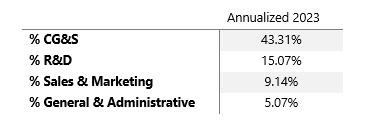

Author’s computations based on company financials

Historically, Google’s corporate architecture, under the umbrella of Alphabet, has thrived on the robust cash flow from its search operations. The incursion of AI innovations, capable of constricting this vital cash flow, presents a scenario where the core financial dynamics of the company could be redefined, challenging the very heart of Google’s business model.

Market Perception vs. Underlying Risk

In the capital markets, Google is often perceived as a bastion of stability and a low-risk investment. This perception, however, may overlook the disruptive undercurrents of AI. The assumption of safety in the familiar and established might be one of the most significant risks in an era marked by rapid technological shifts.

Google, with its formidable array of strengths, is at a crossroads in the AI race. To truly harness its potential in AI, Google must transcend internal resistance – a resistance rooted in the fear of disrupting the existing power hierarchy and operational norms. The challenge is not just in the technology but in the willingness to embrace change and risk destabilizing the status quo.

In light of these challenges, one strategic consideration could be the creation of a separate entity dedicated to AI, akin to IBM’s PC endeavor. This entity, unburdened by the legacy structures and revenue models of Google, could operate with the agility and risk tolerance necessary to innovate and compete in the AI space. Such a move could offer a parallel path for Google to engage in disruptive innovation, without the constraints of its existing corporate architecture.

Valuation & Risks

Google’s immediate challenge is to traverse the valley of underperformance that looms ahead. In the medium term, Google is likely to face a gradual erosion of its primary revenue sources, a decline that could be temporarily offset by reductions in operational expenses and R&D. Alternatively, if Google opts to aggressively pursue AI, it will initially encounter elevated costs, even if it keeps the revenue streak growing. This investment, however, is essential for Google to advance along the learning curve, eventually achieving a more favorable cost structure in the new technological paradigm.

Google’s predicament is akin to the ‘Kodak Dilemma,’ where a market leader in one era faces the risk of obsolescence in the next due to a failure to adapt. For Google, the parallel is with the advent of generative AI and web3 technologies. To avoid Kodak’s fate, Google must undergo a transformation, akin to the Ship of Theseus, continually renewing and reinventing itself.

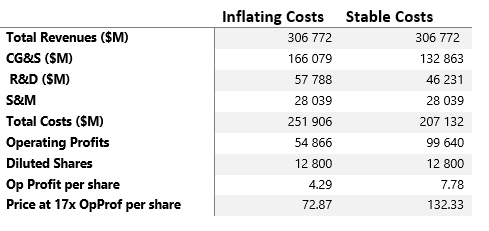

Consider two hypothetical scenarios for Google: one where business remains stable, and another where R&D and COGS (Cost of Goods Sold) increase by 25%. In the stable scenario, Google maintains its current cost structure, but in the scenario with inflated costs, there’s a significant impact on operating profits and, consequently, on the stock price. This impact could be likened to halving the operating costs and potentially the stock price, assuming market multiples remain constant – an optimistic assumption.

Author’s model

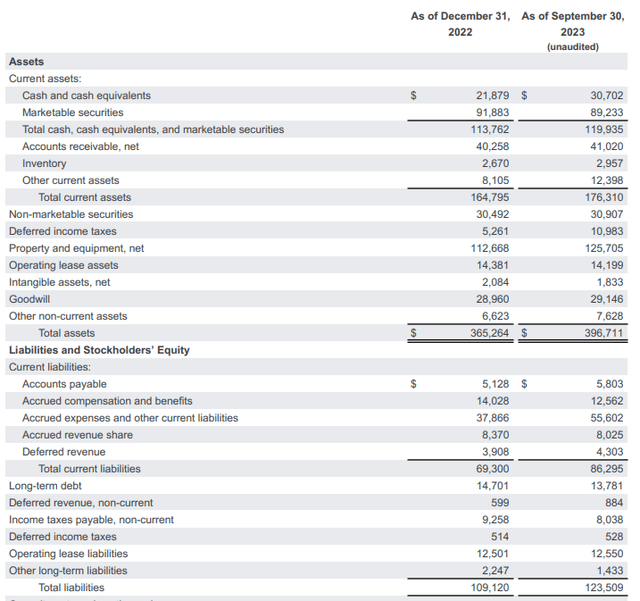

On the brighter side, Google’s robust balance sheet, characterized by low debt, substantial cash reserves, and strong credit, positions it well to embrace change. This financial strength could enable Google to marshal its resources and capabilities effectively in the AI arena, potentially disproving any warnings of its decline.

Google financials

From an investment perspective, Google’s shares face potential volatility. If Google hesitates on the AI front, a cost-cutting strategy may not suffice to sustain investor confidence, especially if growth stagnates and market multiples are adjusted downwards. Conversely, embracing AI will likely lead to increased costs, which could alarm investors and temporarily benefit bearish positions. A single disappointing earnings report could fuel a narrative of Google’s decline, leading to a devaluation of its shares.

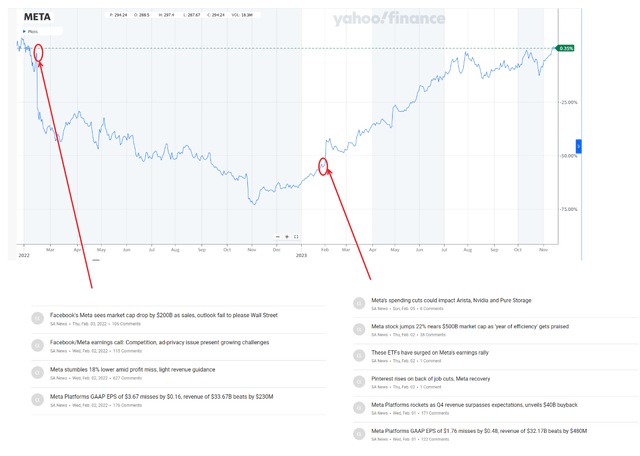

In this context, the prudent investor might consider a cautious approach towards Google, observing whether the company demonstrates both the resolve and competence to navigate the AI landscape. Patience is advised, as even a successful transition could entail short-term turbulence, a pattern observed in other tech giants. Meta is a great analog of how perceptions change in 12 months.

Author Compilation based on SA and Yahoo Finance

All-in-all, this is not a short idea. While I would refrain from shorting Google, it’s evident that the company is currently navigating through what may be its most precarious phase since its public inception. This period demands careful and strategic navigation.

I expect Google to approach a period of significant upheaval. My projection is that the company’s stock price may well approach the $72.83 mark, as indicated in the inflating costs scenario. This juncture could serve as a critical point for reassessing the company’s strategic direction. Despite the challenges, Google’s prospects for emerging successfully from this turbulent phase remain favorable, considering its robust balance sheet and the evident strength of its talent pool, as highlighted by OpenAI’s recruitment efforts. It’s conceivable that Google could emerge as a key player in developing groundbreaking AI applications, potentially crafting a new internet interface that captivates the global audience. On the other hand, Google might gradually shift its focus away from its traditional search business, channeling its resources into other burgeoning sectors within its vast portfolio.

However, the current Price-to-Sales (P/S) ratio of approximately 5.68 seems to inadequately reflect the risks associated with the potential decline of the company’s primary revenue source. From an investor’s perspective, a substantial discount would be warranted to justify entering a position. As a preliminary measure, adjusting the sales multiple to around 4, while still higher than the figure in the inflating costs scenario, would suggest a more realistic stock price, possibly around $90. This adjustment would better align the valuation with the potential risks and uncertainties that lie ahead for the company.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This text expresses the views of the author as of the date indicated and such views are subject to change without notice. The author has no duty or obligation to update the information contained herein. Further, wherever there is the potential for profit there is also the possibility of loss. Additionally, the present article is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Some information and data contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. The author trusts that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.