Summary:

- Over the last twenty years, Alphabet has internally built and exogenously acquired a series of globally dominant properties.

- In any given quarter, we should expect some of these properties to be performing well and some to be taking a breather, so to speak.

- And, in Q3 2023, we witnessed just this.

- I recently referred to Alphabet’s cloud business as The Third Supermajor, and, while I vehemently believe this should be how we think of it, Alphabet’s cloud business has certainly been underwhelming as of late.

- That said, while the cloud business has ebbed, Alphabet’s YouTube business has once again begun flowing. Today, we will consider the ebbs and flows of the Alphabet conglomerate, and, in short, I like Alphabet stock at these levels.

Shutthiphong Chandaeng

The Greatest Secular Growth Trend: Digital Ads

Over the last few years, I’ve been publicly articulating the idea that arguably the most attractive industry in which to allocate capital is the digital ad industry. In some sense, Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL), and more specifically Google, created this industry, imbuing, for the first time in a very meaningful way, machine learning and artificial intelligence into advertising, programmatically matching buyers and sellers of ads in an efficient, profitable manner.

Notably, Alphabet was the 23rd or 24th search engine to be released following the broad adoption of the internet in the 1990s, and its success was a result of its ability to index the internet’s information and most effectively employ AI/ML to create the best/most profitable results for all stakeholders.

I share this to highlight the idea that the digital ad revolution, which is still underway 20+ years later, is principally an AI/ML revolution, and it’s one that Google has been stewarding long before it became so en vogue within the collective consciousness of the market.

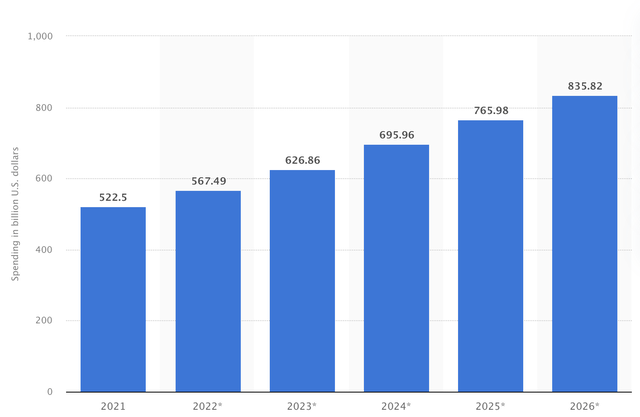

Global Digital Ad Industry Projections As Of 2023

Considering ~90% of Alphabet’s sales derive from digital advertising, the runway for growth of the digital ad industry is certainly heartening and suggests that its Search and YouTube properties specifically still have runway for growth ahead.

Before we continue and as a reminder, I’d like to briefly articulate the four pillars of my investment thesis for Alphabet:

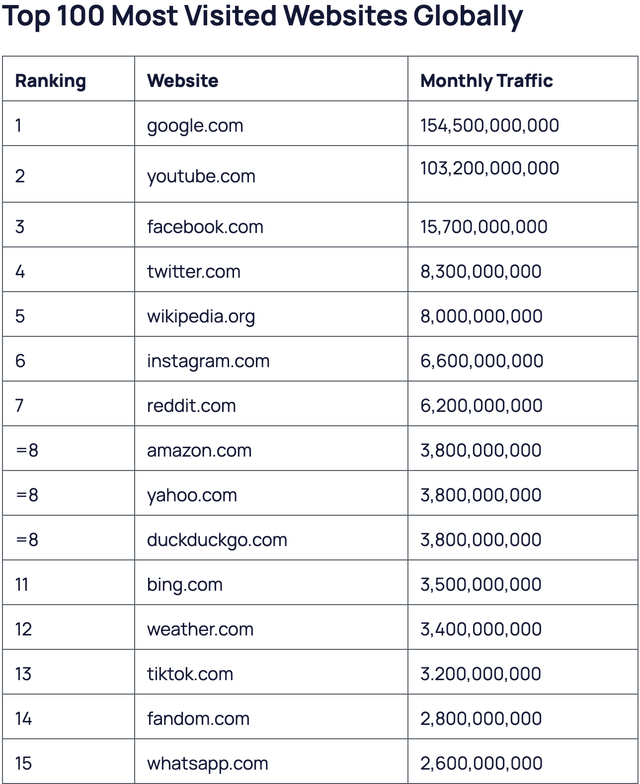

- YouTube is the second most visited website on earth, and its powerful network effects, in which content creators attract viewers who then attract more content creators who then attract more viewers, and so on and so forth, make it likely that it will remain so for decades to come. YouTube’s monetization only really began in earnest in the late 2010s, and, alongside the growth of the digital ad industry, likely has a good runway for growth still ahead. Additionally, YouTube is an international phenomenon, and, as more of earth digitally industrializes and as more of earth reaches the middle class, YouTube’s viewership and sales growth will continue to grow each year.

- Like YouTube, Google Search has a virtual monopoly and has become synonymous with searching for information in the minds of consumers. This brand moat is akin to Kleenex becoming synonymous with tissues and developing a free cash flow generative franchise based on what might be the ultimate commodity (face tissues, a product that you and I could create within 24 hours, with just access to the internet. I share to illustrate the power of brand moat, which I believe to be the ultimate economic moat).

- GCP will be seen as the third Supermajor cloud computing platform, alongside AWS and Azure. The Supermajor analogy refers to the idea that data is the new oil, and the Supermajors of the oil revolution were Exxon, Royal Dutch Shell, and Chevron: three vertically integrated leviathans akin to AWS, GCP, and Azure.

- Lastly, each of these businesses possess a series of moats, e.g., embedding/switching costs, network effects, brand, and economies of scale.

With these ideas as our platform, let’s begin our review of Alphabet’s Q3 2023 and the business generally.

To start, I’d like to explore a topic that Alphabet’s management team has been focused on: Alphabet Retail.

Why Is Alphabet So Focused On Retail?

In this section, I will highlight why Alphabet discusses its retail business with such focus.

I’ll start with our performance for the quarter and then give color into the three key priority areas for ads. Google AI, Retail and YouTube that we’ve identified on past calls as opportunities for long-term growth in advertising. Google Services revenues of $68 billion were up 11% year-on-year.

Philipp Schindler, Chief Business Officer, Alphabet Q3 2023 Earnings Call

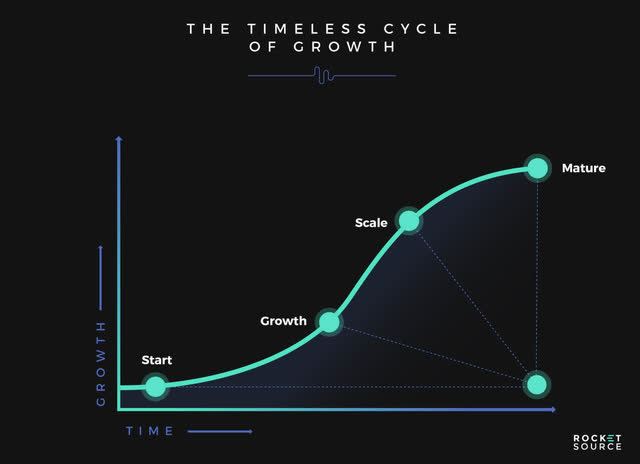

Interestingly, and with essentially no fanfare whatsoever, we’ve been experiencing a second “search engine ads” s-curve event.

S-Curve Concept Depicted

What do I mean by this?

As you know, Google was founded in 1999, and, within about 10 years, it generated tens of billions of dollars in high margin digital ad sales.

It was and has been one of the greatest feats of value creation mankind has ever seen.

Many have lamented not purchasing Google in those early days; however, I am here to tell you that we likely have another chance to do so today, to some degree.

As I noted, with essentially no fanfare whatsoever, there’s been a second search engine ads s-curve event, akin to what we witnessed from Google materializing right before our eyes over the last five years.

Here is the data that underpins this assertion:

- Amazon’s (AMZN) digital ad sales have grown from $2.5B quarterly, when I first began writing about the line of business in 2018, to $12B quarterly today. This has been a genuine Google-like ads growth event, simply stunning in its pace and scale.

- MercadoLibre (MELI) recently announced that it was generating 1.6% of $10B in GMV in digital ad sales in Q2 2023, which represents an annualized digital ad run rate of about $700M. This line of business was growing at 62% in Q1 2023.

- Coupang (CPNG) recently reported that its ad business is growing at “over twice the growth of its overall business,” which is growing at 20% presently.

This data illustrates why Alphabet has been so focused on its retail ads business:

- It represents a giant opportunity,

- And it does not have a monopoly in this realm: MACS (Meli, Amazon, Coupang, and Sea) are taking market share rapidly from this next leg of growth for digital ads, acting as centralized search engines for shoppers.

There are unique centralized search engines found on these ecommerce platforms, behind which there are vertically integrated, highly autonomous fulfillment networks.

Turning to YouTube…

YouTube: The Second Most Visited Website In The World

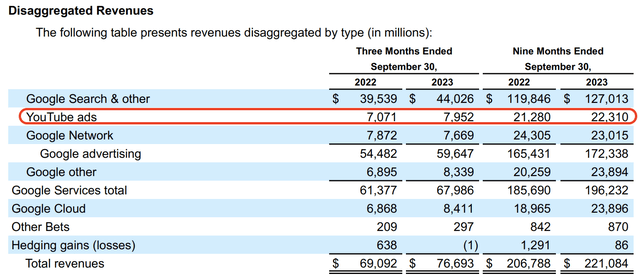

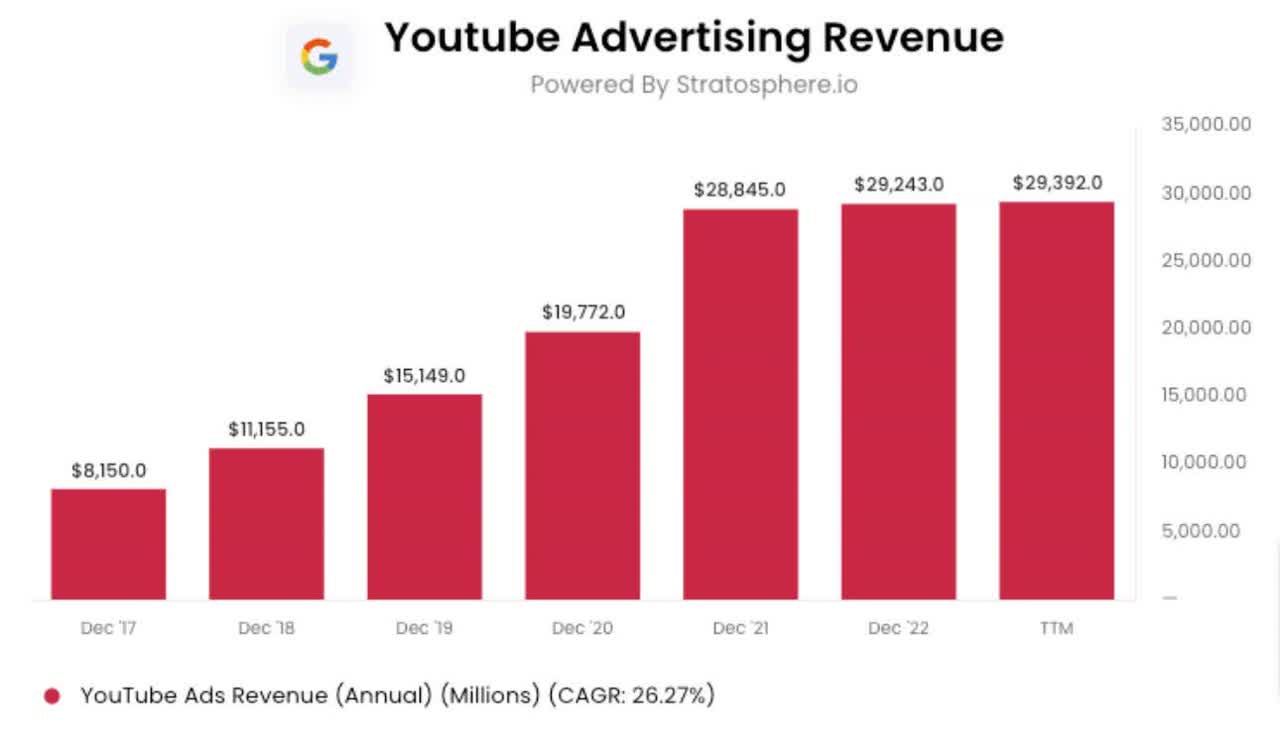

Over the last two years or so, I have been routinely highlighting the idea that YouTube’s ad sales have flatlined, illustrating that the digital ad industry has been in a downcycle. We can see this reality in the data below:

Stratosphere.io

This downcycle has been what caused Alphabet to trade into the double digits in late 2022 and early 2023, giving investors an incredible opportunity to accumulate shares at attractive valuation levels (in light of the company’s buy back, it too was accumulating shares on investors’ behalf at attractive valuations).

But, while YouTube’s sales stagnated, I remained confident and convinced that they’d resume growth at some point in light of the four pillar thesis I shared with you just a moment ago, and, indeed, we’ve seen YouTube return to growth at long last.

YouTube Sales Grow At 12% in Q3 2023

At ~$8B in Q3 sales, YouTube now generates about $32B in annualized sales, which represents healthy growth from the plateau at which it found itself in 2021, 2022, and half of 2023.

Considering my YouTube thesis pillar and in light of the growth of the digital ads industry broadly, I expect this growth to sustain for, in my opinion, years and decades to come.

Let’s now turn to a review of Alphabet’s cloud business before we conclude with a consideration of its valuation, which has been the central impediment to my making Alphabet a new Top Idea in recent years.

GCP: Checking In On The Third Supermajor

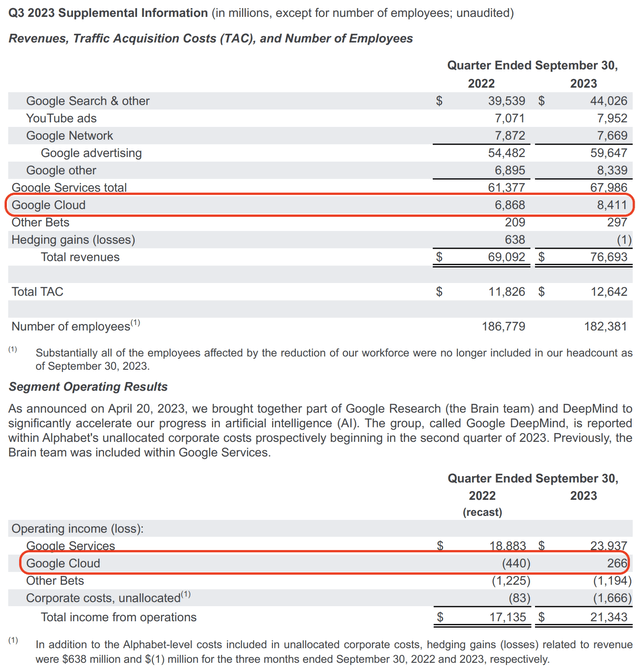

Turning to the Google Cloud segment. Revenues were $8.4 billion for the quarter, up 22%. GCP revenue growth remained strong across geographies, industries and products, although the Q3 year-on-year growth rate reflects the impact of customer optimization efforts. Google Workspace also delivered strong revenue growth, primarily driven by increases in average revenue per seat. Google Cloud had operating income of $266 million, and the operating margin was 3%.

Ruth Porat, CFO, Alphabet Q3 2023 Earnings Call

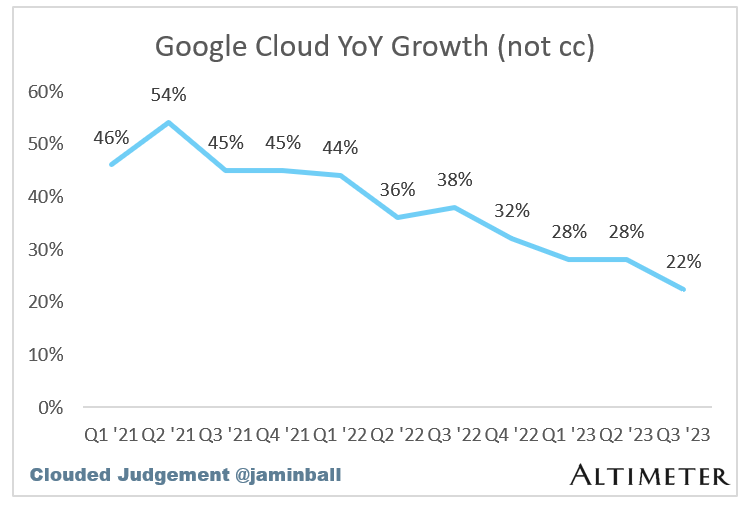

I’ve been often highlighting that GCP has become the “third Supermajor” in the de facto oligopoly among AWS, Azure, and Alphabet’s GCP.

While that will likely be seen as the reality over the long run, GCP had a fairly weak showing in Q3 2023, with growth continuing to decelerate to 22%, while Microsoft’s Azure accelerated growth at a much larger scale and while AWS stabilized growth at an even larger scale.

GCP’s Growth Continued To Slide While Its Peers’ Growth Stabilized

Clouded Judgement

That said, business is not linear, and I believe GCP will stabilize at some point and resume growth within what I believe will be an industry that grows for decades to come.

Businesses do not meet expectations quarter after quarter & year after year. It just isn’t in the nature of running businesses. And, in our view, people that predict precisely what the future will be are either kidding investors, kidding themselves, or both.

-Warren Buffett

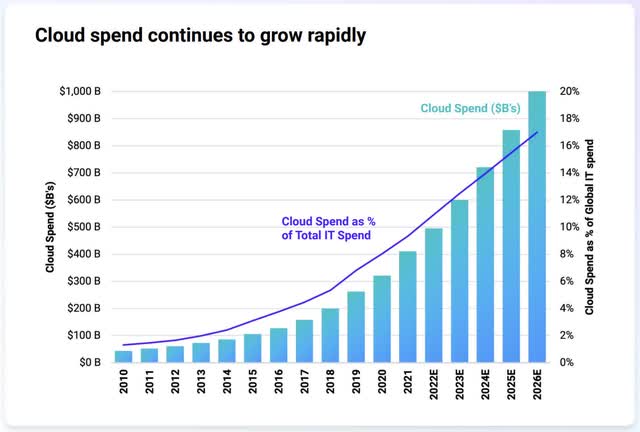

90% of Global IT Spend Remains On-Prem, Indicating That GCP, AWS, & Azure Have Long Runways For Growth

Datadog Q3 2023 Earnings Presentation

Further, not only will more and more IT spend transition to the cloud, but also the entire workload volume of earth will continue to grow over time. In short, there’s a giant runway ahead for GCP, notwithstanding its near term hurdles that are likely more a result of the fastest interest rate hiking cycle in American history than anything else (and this goes for Azure and AWS, though Azure has been performing exceptionally).

We’ve spent a fair bit of time analyzing what we’re seeing, and I’ve spent a good chunk of time myself looking as well, and we like the fundamentals of what we’re seeing in AWS. The new customer pipeline looks strong. The set of ongoing migrations of workloads to AWS is strong. The product innovation and delivery is rapid and compelling.

And people sometimes forget that 90-plus percent of global IT spend is still on-premises. If you believe that equation is going to flip, which we do, it’s going to move to the cloud. And having the cloud infrastructure offering with the broadest functionality by a fair bit, the best securing operational performance and the largest partner ecosystem bodes well for us moving forward.

To conclude this review of GCP, below, we can see the business’ growth year over year, as well as its profitability.

- Note: Google Cloud includes infrastructure and platform services, collaboration tools, and other services for enterprise customers. Google Cloud generates revenues from fees received for Google Cloud Platform services, Google Workspace communication and collaboration tools, and other enterprise services.

Quietly, the business now generates about $34B in annualized sales, with $1B+ in operating income.

Importantly, it’s likely that this operating income is massively understated, i.e., there’s still a great deal of room for GCP’s margins to expand over time, and this is important to the assumptions that we will make in the next section in which we review Alphabet’s valuation.

Quick Valuation Exercise

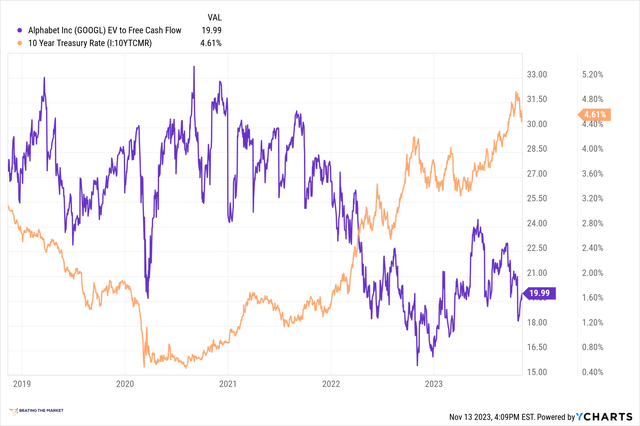

From a high level, Alphabet’s valuation is now quite attractive to me.

The business offers a 5.5% free cash flow yield, which is exceptional in light of the quality of the business.

Alphabet’s 5% FCF Yield (1/19.99) Vs. The 10-Year Treasury Yield at 4.64%

In 2021, I was hesitant about Alphabet’s valuation because I knew rates would rise and it did not have sufficient growth prospects to really overcome the rate hiking cycle.

After years of stagnation and an ~10% decline following Alphabet’s recent report, I think Alphabet is attractive enough at these levels to be bought with confidence. Here are my assumptions underpinning this line of reasoning:

Alphabet’s Valuation

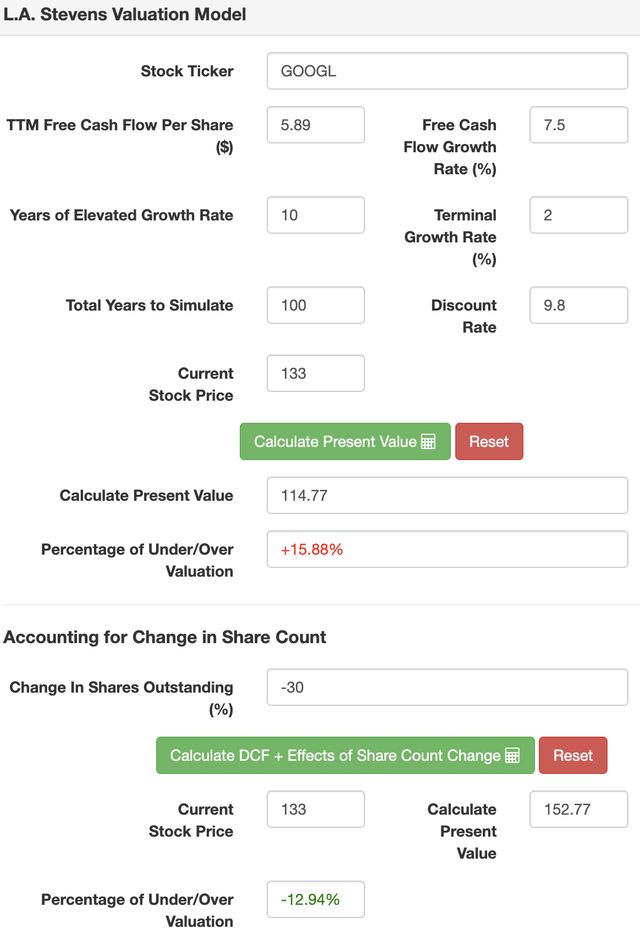

Here are my assumptions for Alphabet’s valuation:

|

TTM revenue [A] |

$297 billion |

|

Potential Free Cash Flow Margin [B] |

25% |

|

Average diluted shares outstanding [C] |

~12.6 billion |

|

Free cash flow per share [ D = (A * B) / C ] |

$5.89 |

|

Free cash flow per share growth rate (reasonable) |

7.5% |

|

Terminal growth rate |

2.5% |

|

Years of elevated growth |

10 |

|

Total years to stimulate |

100 |

|

Discount Rate (Our “Next Best Alternative”) |

9.8% |

And here are the results of the valuation exercise:

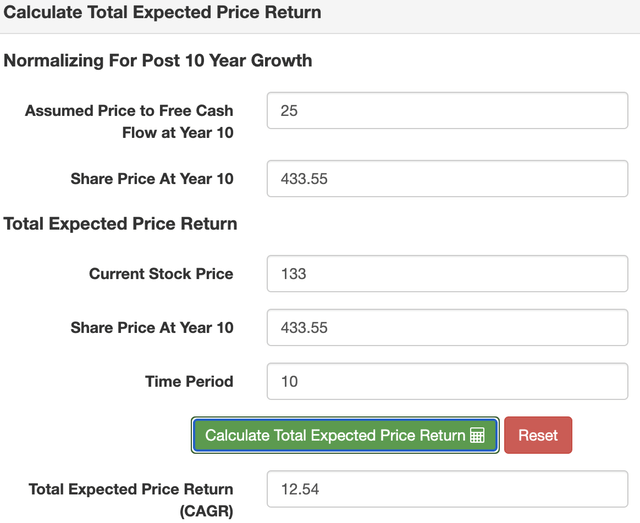

L.A. Stevens Valuation Model L.A. Stevens Valuation Model

As we can see, Alphabet’s projected returns use fairly conservative estimates, e.g., 7.5% annualized growth, have now reached about 12.5%.

Considering the risk we assume in purchasing Alphabet, which is relatively low, I believe this return profile to be attractive.

And, as I’ve mentioned in the past, I believe that as Alphabet’s GCP asset grows to $50B, $75B, $100B, and beyond in revenue, the entire business’ valuation multiple will continue to expand, as its revenues become more like utilities stable revenues, which are less cyclical than its current somewhat cyclical revenue profile, which is comprised of 90% digital ads.

Concluding Thoughts

After taking a break from partnering with Alphabet for the last three years, I am happy that is has begun to sustainably trade in a zone where I feel comfortable buying it and sharing my bullishness on the business with you.

In short, I believe:

- YouTube will continue to be the most dominant social media platform on earth, alongside Facebook.

- Search will continue to evolve, and its brand moat will afford it the ability to navigate possible competitive attacks in the future (note that it still has 90% market share).

- And, very importantly, GCP will become the third Supermajor in what will be seen as an oligopoly among AWS, Azure, and GCP. This third point is very key to the long run return profile of the business today, and, while GCP had a weak showing in Q3 2023, I am overall very happy with the business’ growth and profitability thus far.

In closing, I like Alphabet at $133/share for most risk averse investors.

Thank you for reading, and have a great day.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.