Summary:

- Tesla, Inc.’s Semi rollout has been slow with only a rumored 36 trucks delivered to PepsiCo, far from the projected 50,000 units by 2024.

- Lack of demand, poor design, and production quality issues may be contributing to the slow ramp-up of the Tesla Semi.

- Investors also should temper their enthusiasm for the upcoming Cybertruck, as Tesla has a history of delays and difficulties in bringing products to market.

AntaresNS

About a year ago, I wrote a cautious article on Tesla, Inc. (NASDAQ:TSLA), arguing that investor enthusiasm for the just-released Tesla Semi was unrealistic and unlikely to bear fruit. At the time, Elon Musk, Tesla’s CEO, proclaimed that he expected Tesla to build 50,000 Tesla Semis by 2024. My cautious article drew quite a bit of response, with hundreds of commentators leaving their thoughts and some of them calling me childish names.

With 2 months to go until 2024, let us review the ramp-up and roll-out of the Tesla Semi so far and what it might mean for other products in Tesla’s line-up.

Tesla’s Semi Roll-Out Was Slow As Expected

On December 1, 2022, Tesla delivered its first Semi truck to much fanfare. The customer was PepsiCo (PEP), with the beverage and snack foods company having placed an order for 100 trucks back in 2017 with an initial estimated production date of 2019.

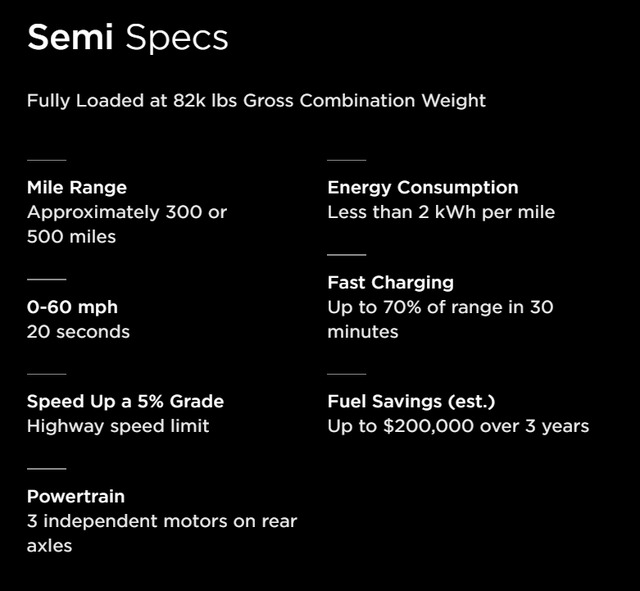

However, as I noted in my article, while the initial delivery of the Semi was quite an achievement for Tesla, there were three main challenges against a rapid adoption of the Tesla Semi amongst end customers. First, almost a year after its first commercial delivery to PepsiCo, Tesla’s website still has scant details on the specifications of the Semi (Figure 1).

Figure 1 – Tesla Semi Specs (tesla.com)

The most important spec for the trucking industry is hauling capacity, or how much load a truck can carry per trip. Electric semi-trailers are limited by regulation to operate at 82k lbs combined weight, 2k lbs above the conventional maximum, but the Tesla Semi’s hauling capacity is limited by the weight of its lithium ion battery and associated cooling and safety equipment. Incredibly, almost a full year after the first Tesla Semi has already been delivered to PepsiCo, there is still no concrete detail on how much the Tesla Semi can actually haul.

A second barrier to adoption is the infrastructure in place to support the Tesla Semi. As I noted in my prior article, Tesla’s current network of super chargers are designed to accommodate its cars and SUVs, and may not be able to handle a 70-80 ft long semi-trailer. So, end users like PepsiCo have to build special charging stations at their service depots to charge their trucks, which limits the Tesla Semi to local deliveries for now.

Finally, in addition to hauling specs, truck fleet owners also need reliability, servicing, and resale data before they can commit hundreds of thousands of dollars to buy new equipment. The generation and collection of this data will take time, often many years. It was simply wishful thinking by Tesla and naive investors to think the company could sell 50,000 units sight unseen based on a few promotional videos and launch events.

Could Production Quality Be The Issue?

What we do know is that in its short lifespan, the Tesla Semi has been involved in 2 national recalls by the National Highway Traffic Safety Administration (“NHTSA”). In fact, details from the 2 recalls suggest production of the Tesla Semi may be 100x less than what Mr. Musk was forecasting in December:

“For the first recall, Tesla said the 35 potentially affected Semi trucks were produced between November 30, 2022, and February 28, 2023. Now, for this second recall, Tesla says the 36 affected vehicles were made between November 30, 2022 and March 15, 2023.”

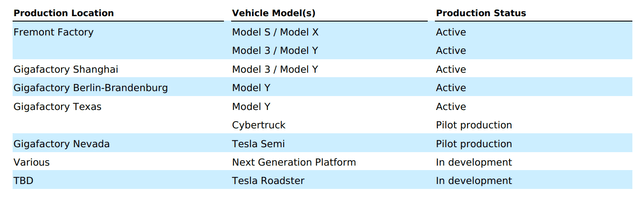

36 trucks produced in 3 and a half months is a long way away from a ramped-up annual production of 50,000. In Tesla’s latest quarterly report, the Tesla Semi is still listed in ‘Pilot Production’ and Tesla has not given any production or delivery figures in its quarterly press releases (Figure 2).

Figure 2 – Tesla Semi is still listed in ‘Pilot Production’ as of September 30, 2023 (TSLA Q3/2023 10Q report)

So, is the Tesla Semi issue due to a lack of demand as I explained above, or could it be due to poor design / production quality (2 recalls in less than 1 year)? Analysts can only speculate, but I believe it may be a bit of both.

Temper Your Enthusiasm For The Cybertruck

For Tesla investors, many have already forgotten about the Semi, since even if production was fully ramped up to 50,000 units / year, it would only contribute a small percentage of total revenues for the company. Instead, all eyes have been directed towards the Cybertruck this holiday season, with news articles being written on a daily basis on the rumored specifications and potential production ramp-up of Tesla’s pickup truck.

What we know so far is that after several long years, the first customers for the Cybertruck will be taking delivery on November 30th, 2023. However, only 100-200 trucks will be delivered in 2023. Instead, Mr. Musk expects to ramp up production and ship 100,000 to 120,000 Cybertrucks in 2024 and 250,000 to 500,000 units long-term.

However, given Tesla’s notorious delays in delivering on their promises (Tesla Semi being 4 years late and still not mass produced; full self-driving (“FSD”) 3 years late and still only Level 2, etc.), investors should not get their hopes up until we see actual mass production of the Cybertruck in Tesla’s factories. Investors should note that Mr. Musk said in Tesla’s latest quarterly earnings call that the company “dug our own grave with Cybertruck” as it is “incredibly difficult to bring to market, to reach volume.”

Cybertruck May Not Move The Needle

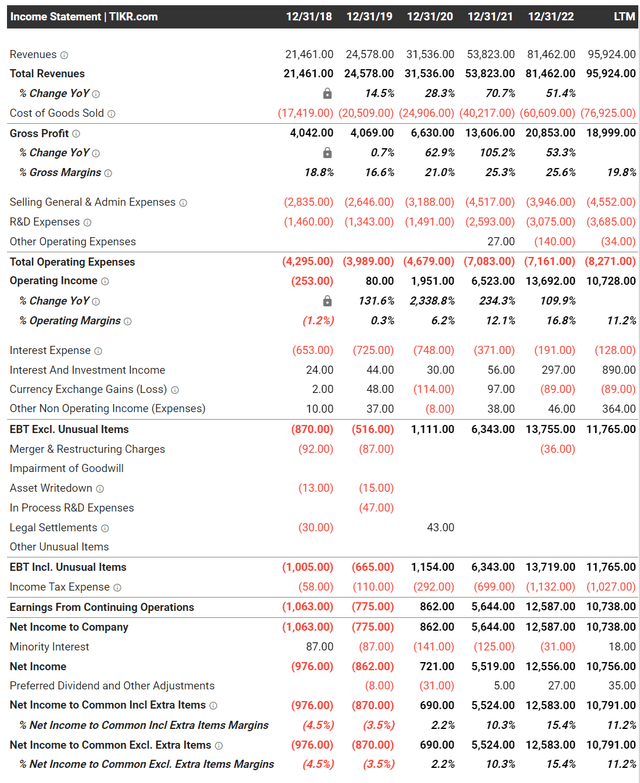

Assuming Tesla can actually deliver 110,000 Cybertrucks in 2024 at an estimated ~$70,000 per vehicle (incredulously, there is still no firm pricing even though the product is expected to be delivered in a few weeks!), the Cybertruck could add $8 billion in revenues for Tesla. While significant, that would still account for less than 10% of revenues for Tesla, with $96 billion in LTM revenues (Figure 3).

Figure 3 – TSLA financial summary (tikr.com)

Price Cuts Lead To Earnings Contraction

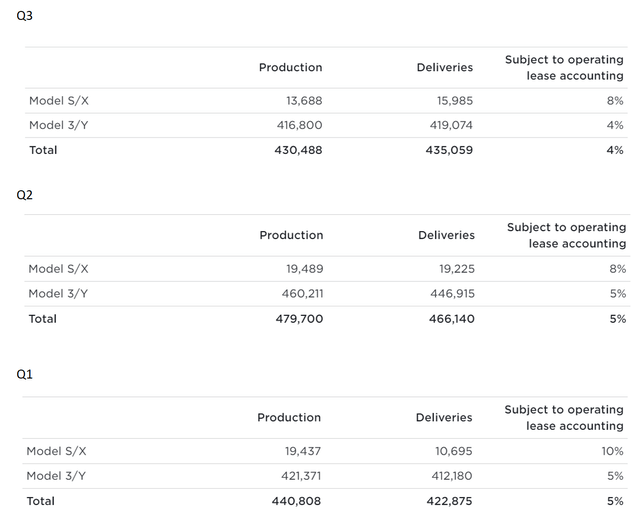

Instead of the Cybertruck, investors should focus on sales of the bread and butter Model 3 and Y, which account for the vast majority of the company’s sales and profits. YTD, Tesla has produced 1.30 million Model 3/Y’s and delivered 1.28 million to customers (Figure 4).

Figure 4 – TSLA 2023 YTD production figures (Author created from company press releases)

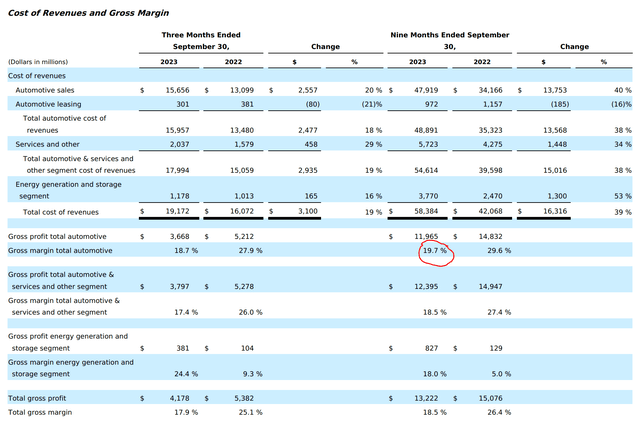

Worryingly, with respect to existing models, although production and delivery volumes have continued to grow YoY, Tesla has been cutting prices to spur demand. This has caused a contraction in gross margin, from 29.6% in YTD/2022 to 19.7% YTD/2023 (Figure 5).

Figure 5 – TSLA facing contracting gross margins (TSLA Q3/2023 10Q report)

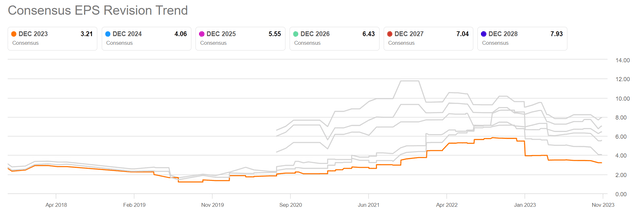

This has caused analysts to ratchet down their earnings estimates for Tesla, with 2023 earnings estimates being cut from $6 in December to $3.21 recently (Figure 6). 2024 earnings estimates have fallen from over $7 to $4.06.

Figure 6 – TSLA earnings estimates have been slashed (Seeking Alpha)

Valuation Still Ridiculously High

For a company facing earnings contraction from $3.62 in 2022 to an estimated $3.21 this year, Tesla’s valuation has actually expanded, from 35x trailing P/E in December to 72x P/E recently (Figure 7).

Figure 7 – But TSLA’s valuation has actually expanded with earnings revisions lower (tikr.com)

Risks To Being Cautious

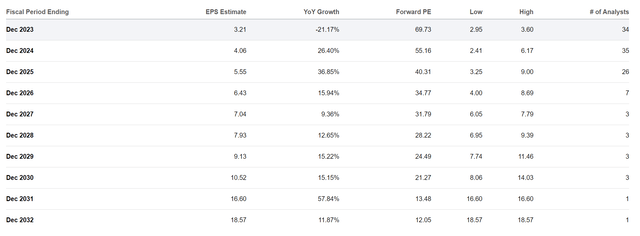

Of course, I could be completely wrong on Tesla, especially if the company can work out the production issues with the Tesla Semi and Cybertruck. If each of those products can contribute $10-15 billion in revenues, and if the company can expand its gross margins, then it is conceivable that Tesla could deliver the $7+ EPS that a few analysts are expecting for 2027 and beyond (Figure 8).

Figure 8 – TSLA EPS estimates (Seeking Alpha)

However, even if we give the company the benefit of the doubt and assume earnings will rebound to analyst expectations, Tesla is still expensive, currently trading at 32x 2027 EPS estimates of $7.04.

Conclusion

Last year, I warned investors from getting too excited with the Tesla Semi, as I anticipated multiple headwinds for the product. So far, I have been proven right, with only a rumored 36 Semis produced and delivered to PepsiCo.

This year, Tesla is once again attempting to impress investors with first deliveries of the Cybertruck expected in a few weeks’ time. Given Mr. Musk has characterized the production of the Cybertruck as “digging their own grave,” I caution investors against building too many expectations for the Cybertruck into their models near term.

Instead, I worry about Tesla, Inc.’s repeated price cuts on existing models leading to declining gross margins and earnings. With declining earnings per share, Tesla is currently valued at 70x Fwd P/E, which seems excessive. Even if we assume the gross margin and production issues can be worked through in the next few years, the company is still trading at 32x 2027 EPS. I remain cautious on Tesla shares and rate it a hold.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.