Summary:

- PayPal stock is trading at 6-year lows — something or someone needs to turn it around.

- Enter Alex Chriss. He delivered a resounding earnings call, which could be summed up in just two simple, yet powerful, words.

- Meanwhile, PayPal trades at a P/E Ratio of just 11x.

- To me, PayPal is one big asymmetrical bet.

adaask/iStock via Getty Images

Introduction

PayPal (NASDAQ:PYPL) stock is trading at 6-year lows following one of the most spectacular crashes in the growth realm today.

The selloff is justified given structural issues within the business, slowing growth, and rising interest rates.

However, it seems that the worst has already been priced in. And with new, positive developments ahead, sentiment on the stock is slowly flipping to the upside.

With a Forward PE of just 11x, PayPal is in deep value territory.

To me, PayPal is one big asymmetrical bet.

Growth

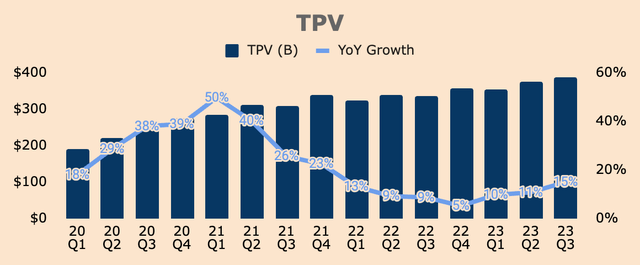

It was a stellar quarter in terms of Total Payment Volume growth. In Q3, TPV was $388B, up 15% YoY, which is the third consecutive quarter where TPV growth accelerated.

This was mainly driven by unbranded processing, which grew 32% YoY, which is an acceleration from 28% in Q2 and 30% in Q1. On the other hand, branded checkout — being the larger business unit — continues to be the laggard, growing only 6% YoY in Q3.

Author’s Analysis

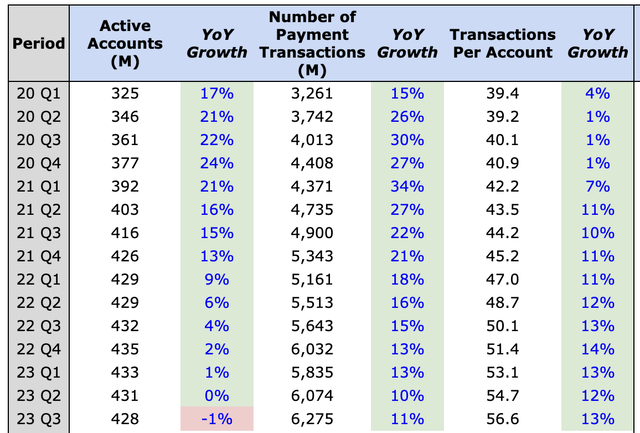

Strong TPV growth was also due to the increase in the Number of Payment Transactions, which was 6.3B, up 11% YoY, as well as Transactions Per Account, which was 56.6, up 13% YoY. This shows strong engagement across the platform, even with the company losing ~3M Active Accounts QoQ.

The drop in Active Accounts is not surprising given management’s focus on retaining higher-ROI, more-engaged accounts while allowing “minimally engaged accounts” to churn off.

Author’s Analysis

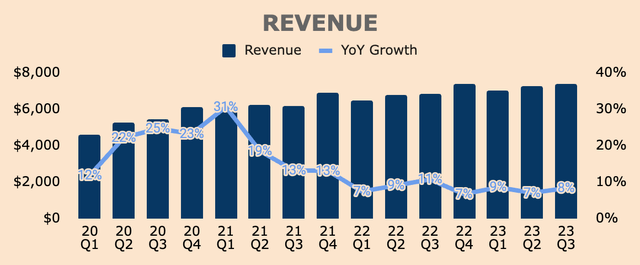

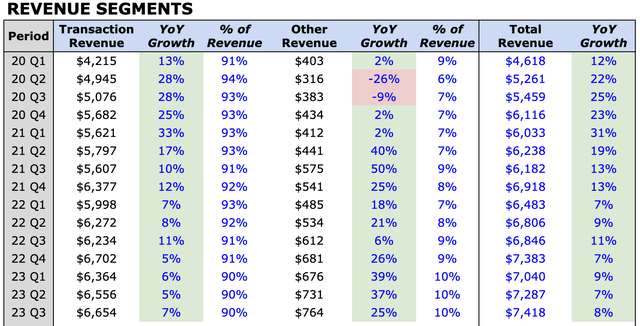

Moving on, Q3 Revenue was $7.4B, up 8% YoY. This beat analyst estimates by $35M. As you can see, Revenue growth seems to be stabilizing in the high-single digits.

Author’s Analysis

Breaking it down by segment, Q3 Transaction Revenue — which makes up 90% of Revenue — grew 7% YoY due to the growth in TPV and Braintree, offset by a slowdown in PayPal’s core products and services.

On the other side, Other Revenue grew by 25% YoY, mainly due to higher interest income on customer balances.

Author’s Analysis

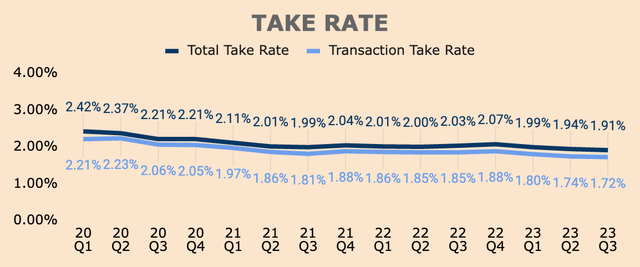

If you haven’t noticed, Revenue continues to grow more slowly than TPV as PayPal’s Total Take Rate and Transaction Take Rate continue to decline, to 1.91% and 1.72%, respectively. According to management, this was due to several factors:

- Lower gains from FX hedges

- Lower FX fees

- Lapping elevated contractual compensation from merchants last year

- Larger merchants making up a greater proportion of TPV

Author’s Analysis

With that being said, it’s encouraging to see TPV growth continue to reaccelerate as PayPal’s unbranded processing business continues to gain traction in a highly competitive payments industry.

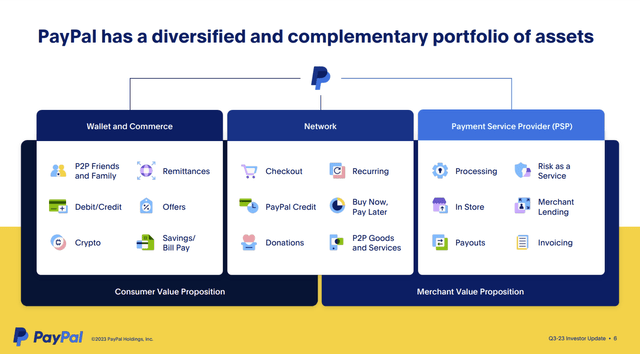

Clearly, merchants trust PayPal as a Payment Service Provider, considering its world-famous branded checkout solutions and network of 400M+ customers — it’s quite an easy choice for merchants to choose PayPal over other providers.

PayPal FY2023 Q3 Investor Update

The issue remains with declining Take Rates, which is not surprising given rumors of PayPal slashing prices to gain market share. PayPal needs to be careful with pricing their services too low as it could lead to the commoditization of payment services.

Fortunately, new CEO Alex Chriss seems to take an opposing stance against lowering prices. In fact, it seems that he wants to raise prices for Braintree solutions, which could improve Take Rates moving forward.

On the merchant side, again, we have tremendous penetration into small businesses and enterprises. We have a beachhead now with Braintree, which I’m really excited about. And I think we’ve earned the right now to expand margin and make sure that we’re really pricing to value and ensuring that we’re delivering what we need to across the board.

(CEO Alex Chriss — PayPal FY2023 Q3 Earnings Call)

Profitability

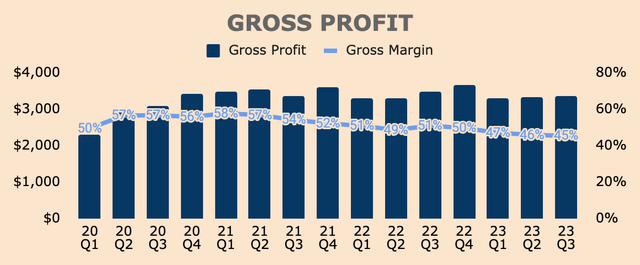

Q3 Gross Profit (or Transaction Profit) was $3.4B, down by 3% YoY. This represents a Gross Margin of 45%, which is about 600 basis points lower than last year.

As you can see, Gross Margin has been on a continual decline, driven by a 21% increase in Volume-based Expenses, as a result of a higher proportion of TPV from unbranded processing, which typically has higher expense take rates than branded processing.

Regardless, the downtrend in Gross Margin is a concern for investors since this lowers PayPal’s earnings potential.

Author’s Analysis

Fortunately, management hinted at a possible reversal in Gross Margins with Q3 being the “low point”. Hopefully, we see this trend continue in 2024 and beyond.

That said, we did see a decline in our Q3 transaction margin dollars. We do expect them to decline again in Q4, but to a lesser extent. So, I really view Q3 as the low point and we’d expect to see an improvement in the profile in Q4.

(Acting CFO Gabrielle Rabinovitch — PayPal FY2023 Q3 Earnings Call)

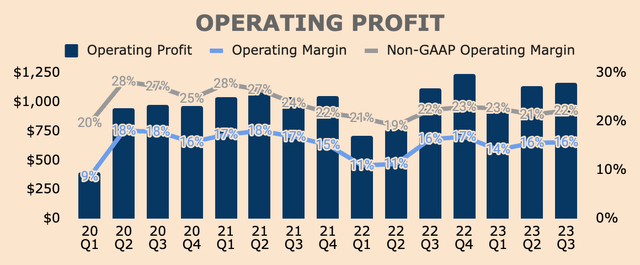

Moving down the income statement, Operating Profit was $1.2B, which is a 16% GAAP Operating Margin and a 22% Non-GAAP Operating Margin. On a YoY comparison, both metrics are basically flat, despite Gross Margins dropping by 6 percentage points YoY. This is largely due to Non-Transaction Operating Expenses being down 12% YoY as PayPal continues to drive operating leverage from cost and productivity initiatives.

Author’s Analysis

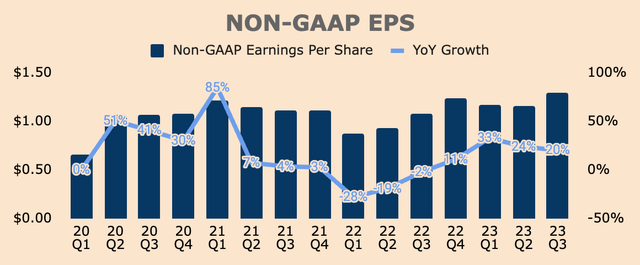

In terms of the bottom line, Q3 GAAP EPS was $0.93, down from $1.15 last year, due to a lower positive impact from PayPal’s strategic investment portfolio.

On the other hand, Non-GAAP EPS reached an all-time high of $1.30, growing 20% YoY. This beat analyst estimates and management’s midpoint guidance by $0.07. Moving forward, I expect this metric to improve as PayPal continues to grow, drive operating leverage, and buy back shares.

Author’s Analysis

All in all, the fundamentals of the business remain solid.

However, PayPal needs to improve Gross Margin to generate real shareholder value. Yes, the company can improve its bottom line by cutting costs, but reducing Operating Expenses can only go so far.

Gross Margin needs to improve — or bottom at least. This way, PayPal can sustain double-digit EPS growth that will surely reward shareholders in the long term.

Health

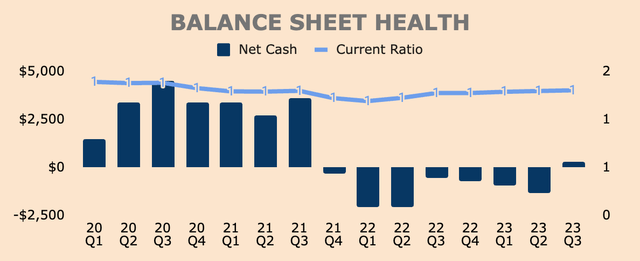

Turning to the balance sheet, PayPal returned to Net Cash positive in Q3 with Cash and Short-term Investments of $11.5B and Total Debt of $11.2B, putting its Net Cash position at $0.3B.

Author’s Analysis

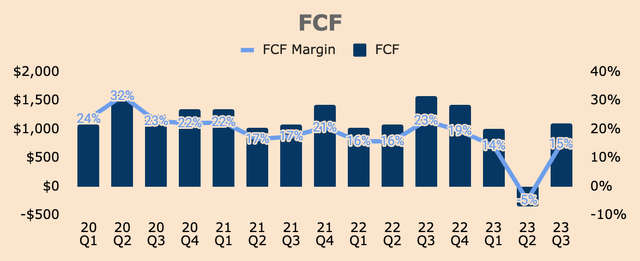

In Q3, PayPal generated $1.1B of Free Cash Flow, which is a 15% FCF Margin.

As a reminder, PayPal signed an agreement with KKR to sell up to €40B of BNPL loan receivables originated by PayPal. As a result, PayPal’s Free Cash Flow is negatively impacted as such loans were classified as held for sale, or HFS. This is why we see a negative FCF in Q2 ($1.2B negative impact).

Specifically in Q3, FCF included a negative impact of $0.8B from the BNPL loans originated as held for sale. Without this impact, FCF would have been $1.9B, reflecting an FCF Margin of 26%.

Author’s Analysis

In October, PayPal already sold the “first tranche of back book credit receivables sale to KKR in October, receiving ~$1.4B in proceeds”, and the company plans to “close on the next tranche” soon. Management mentioned in their Q2 Investor Update that this deal should generate a total of $1.8B of cash proceeds.

Overall, this should bump up PayPal’s FCF in Q4.

In other news, PayPal also sold Happy Returns to UPS for $465M as management shifted their focus on “core business and strategic priorities”. I think we could see more divestitures like this as there have been a number of head-scratching acquisitions over the last decade. By focusing on its core competencies, I think PayPal will be a much leaner and meaner business moving forward.

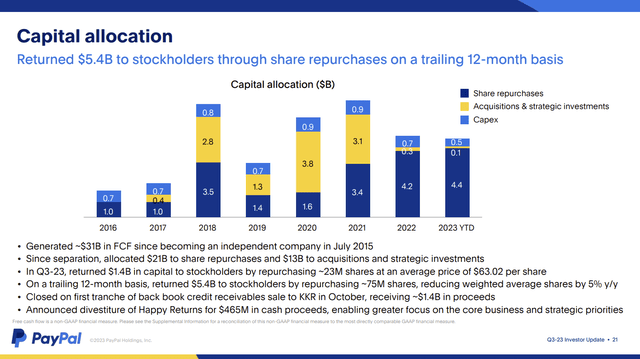

PayPal FY2023 Q3 Investor Update

With healthy FCF and cash proceeds from divestitures, PayPal will continue to buy back shares aggressively, even more so given its plummeting stock price.

In Q3, PayPal bought back ~23M shares for $1.4B, at an average price of $63.02. Given the current share price of $56, I expect the buyback train to accelerate.

In fact, as of Q3, PayPal has $11.5B left available for future repurchases, which is roughly 19% of its current market cap of $61B.

Outlook

Here comes the most interesting part about PayPal: its future.

There are a lot of changes happening lately — particularly with management — but let’s briefly take a look at management’s guidance first.

For Q4:

- Revenue to grow 6% to 7%, which is a slowdown from Q3’s growth of 8%. According to management, branded checkout growth has been lower than expected heading into Q4.

- Non-GAAP EPS to grow 10% YoY to $1.36 — a little light in my opinion.

- Transaction Margin to improve sequentially, although it will still be down YoY.

- Non-GAAP Operating Margin to contract YoY.

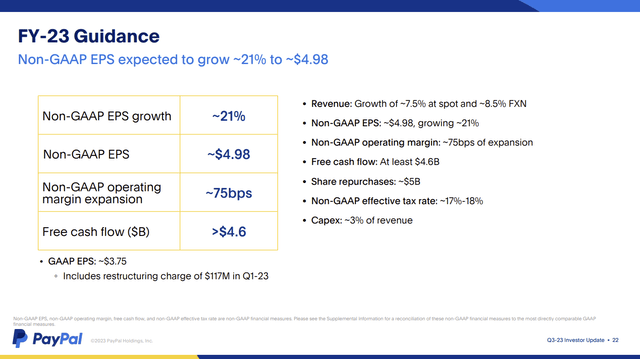

For FY2023:

- Revenue to grow 7.5% YoY.

- Non-GAAP EPS to grow 21% YoY to $4.98. This was raised from $4.95, due to Q3 outperformance.

- Non-GAAP Operating Margin to expand 75bps, which is 25bps lower than previously expected, due to the outsized growth of Braintree as well as lower-than-expected branded checkout growth.

- Free Cash Flow of at least $4.6B. This was lowered from $5B in the previous quarter. In the first three quarters, PayPal generated $1.8B of FCF, which means Q4 FCF will more or less be $3B, which is huge.

- Share Repurchases of $5B. In the first three quarters, PayPal already repurchased $4.4B worth of stock, which leaves around $0.6B in Q4. I think this is lowball guidance by management — I expect at least $1B of share repurchases in Q4, which should boost Non-GAAP EPS, consequently leading to a beat in guidance.

All in all, guidance seems too conservative, especially with Non-GAAP EPS. Given the big incoming FCF and lower stock price, I believe PayPal will buy back shares even more aggressively, which should lead to mid-teens Non-GAAP EPS growth for Q4, not 10%.

PayPal FY2023 Q3 Investor Update

But guidance aside, PayPal’s Q3 earnings was one of the most highly anticipated earnings in the history of the company for one reason, and one reason only: Alex Chriss.

Following the stock’s 80% selloff, investors were losing hope and they needed something or someone to turn the company around.

Enter Alex Chriss.

As you all know, Alex Chriss took over the reins from Dan Schulman who has been the CEO of PayPal for nearly a decade.

I’m not going to write down his resume, but to keep it short, Alex Chriss seems to be the perfect CEO to lead PayPal out of the dark.

During his first earnings call, Mr. Chriss sounded sharp, confident, and unforgiving. He was straight to the point, he understood PayPal’s potential, and he wasn’t afraid to point out the company’s shortcomings.

Ultimately, he summarized what his priorities are as the new CEO of PayPal.

To recap my observations and focus areas, our assets and breadth are unrivaled. Our innovation is accelerating and will drive impact. But we must focus and execute. The weight of the organization will be squarely behind:

- Reinventing our consumer experience to drive a clear and durable value proposition with checkout at the center;

- Improving and scaling PayPal Complete Payments for small businesses globally; and

- Driving margin expansion in Braintree and other products for large enterprises.

Additionally, we will invest in our company-wide platform, driving efficiency and acceleration of innovation, while rightsizing our expenses.

(CEO Alex Chriss — PayPal FY2023 Q3 Earnings Call)

If that’s too long for you, Mr. Chriss made sure to drive his point home by compressing his message into two simple, yet powerful, words: profitable growth.

No more growth-at-all-costs mentality. Mr. Chriss wants “margin-accretive revenue growth”. He understood that “unprofitable growth is counterproductive” and unsustainable for any company. And he strives to build a leaner PayPal as he believes that its “cost base remains too high, it is actually slowing us down”.

And we’re already seeing him in action ever since he took the CEO role in September.

- Divested Happy Returns.

- Hired Jamie Miller as the new CFO.

The second point is important because Jamie Miller specializes in spinoffs and deleveraging. Thus, don’t be surprised if we see more divestitures as well as balance sheet deleveraging, leading to a financially leaner PayPal.

That said, PayPal “simply must execute” and if CEO Alex Chriss delivers what he promised to do, we could see strong Revenue and Earnings growth for PayPal for years to come.

He succeeded at Intuit’s Small Business segment — he can do it too at PayPal.

Valuation

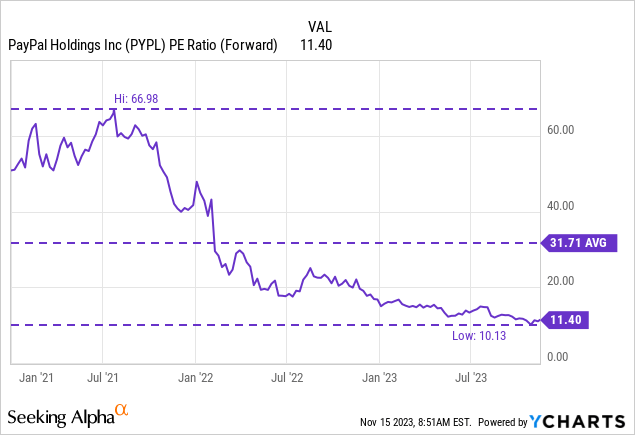

Looking at valuation, PayPal is trading at pretty much its lowest valuation ever. The stock currently trades at a Forward PE Ratio of just 11.4x, well below its peak of 67.0x and average of 31.7x, so on a historical basis, PayPal looks undervalued.

Nevertheless, PayPal trades at a discount for valid reasons, such as slowing growth, declining transaction margins, and rising interest rates. However, it seems that a PE Ratio of just 10x is as low as it gets.

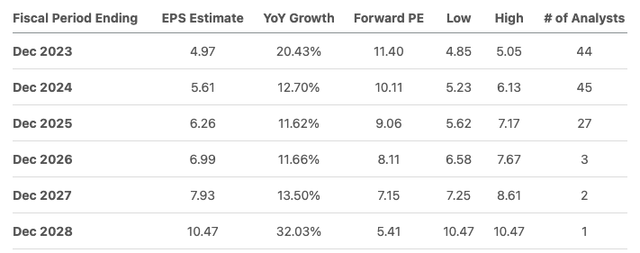

Analysts project EPS to grow around 11% to 12% in the next few years, which is quite conservative given management’s focus on “profitable growth”. But assuming that is the reality and assuming that the multiple does not compress further, 11% to 12% annual returns are actually not that bad.

Seeking Alpha

But assuming better-than-expected EPS growth and multiple expansion, then we could see decent upside potential for PayPal stock. As an example, if EPS grew by 15% in 2024 to $5.72 due to operating leverage and PE expands to 15x due to falling interest rates, then PayPal’s stock should be priced at around $85 by the end of 2024, which is plausible.

My DCF model also shows that PayPal is undervalued.

Here are my key assumptions:

- Revenue: Follow analyst estimates for the first three years and then growth stabilizes at 8% for the remaining years.

- FCF: I expect an FCF of $4.7B in 2023, which is in line with management’s guidance of at least $4.6B. Over the years, I expect FCF Margin to improve from 16% in 2023 to 19.4% in 2032.

-

Capex: Set at 3% of Revenue based on management’s guidance.

Author’s Analysis

Based on these assumptions, I project a Revenue of $60B by 2032, producing FCF of over $11B.

Author’s Analysis

Using a discount rate of 10% and a perpetual growth rate of 2.5%, I arrive at a fair value estimate of $104 a share for PayPal stock, which is almost double its current price of $57.

This is also higher than the average analyst price target of $78.

Author’s Analysis

Given that PayPal’s PE ratio is at an all-time low and that my somewhat conservative DCF model shows that it’s trading well below what I consider its intrinsic value, I believe PayPal stock offers an asymmetric risk to reward for investors — limited downside, massive upside.

Risks

Competition

PayPal faces tough competition including:

- Big Tech like Apple Pay (AAPL) and Google Pay (GOOG).

- Other fintech firms such as Adyen (OTCPK:ADYEY) and Block (SQ).

- Legacy processors like Fiserv (FI) and FIS (FIS).

The eventual commoditization of financial and payment processing services is a real threat and that could erode PayPal’s margins and ultimately, its bottom line.

New Executives

As you may know, there have been some management changes lately — new CEO, new CFO, new CTO.

While CEO Alex Chriss’ ambitions for PayPal are convincing, it’s too early to tell whether he’ll succeed or not.

Thesis

Structurally, PayPal is going through some issues, including a slowing branded checkout segment and declining transaction margins.

That got many declaring that PayPal is a dying brand — no point investing in this dinosaur.

However, PayPal’s fundamentals remain strong and the company has high-quality assets with massive untapped potential.

That’s what new CEO Alex Chriss sees — and he’s committed to turning the company around towards profitable growth.

Only time will tell whether he succeeds or not.

Meanwhile, TPV growth is accelerating, unbranded processing is taking off, and EPS is growing by double digits.

At only 11x Forward PE, shares are highly undervalued, which is also why the company is buying back shares aggressively.

To me, PayPal is one big asymmetrical bet.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.