Summary:

- PayPal reported solid earnings results earlier this month.

- Despite a decline in active accounts, PayPal continues to grow its business at a high single-digit rate.

- The company’s stock has momentum on its side, but the decline in customers nevertheless poses a long-term risk to the bullish thesis.

dontree_m/iStock via Getty Images

PayPal (NASDAQ:PYPL) reported solid earnings results for Q3 earlier this month, but it still struggles to increase its active user count, which has been on the decline for the third consecutive quarter. Back in August, I warned that if the company continues to lose customers, its stock could become a value trap as the loss of customers will prompt investors to look for other growth opportunities. Since that time, the company’s shares depreciated by ~10%.

I continue to believe to this day that PayPal could become a value trap, but I’ve nevertheless added its shares to my portfolio recently as its stock could also become a short-term momentum play. This is mostly due to the fact that despite the decline in customers, the company continues to grow its business at a high single-digit rate at a time when the overall market is recovering from the weakness that it experienced in September and October. As such, I’ll likely hold the shares for a while until they reach my price target of over $60 per share since it seems that with the rising market PayPal’s shares have temporarily found their support level and are unlikely to tumble to new lows in the foreseeable future.

PayPal Reports Impressive Numbers

On November 1st PayPal reported its Q3 earnings results which showed that the company generated $7.4 billion in revenues, up 8% Y/Y and above the estimates by $20 million. The company has also exceeded the expectations for its bottom-line performance as its non-GAAP EPS stood at $1.30, above the estimates by $0.07. What’s more is that the total payment volume during the period increased by 15% to $387.7 billion, which helped mitigate the downside from the decline in active accounts from 431 million in Q2 to 428 million in Q3.

Such a performance indicates that PayPal is likely to remain one of the main fintech companies in the world due to its strong brand value and solid positioning in the market. In my latest article on the company, I wrote how PayPal charges higher fees for transactions in comparison to its peers. The aggressive increase in total payment volume in Q3 indicates that customers continue to prefer sticking with well-known names to facilitate transactions even if it leads to higher costs for them. Considering that we’ve seen similar increases in recent quarters as well, it’s safe to say that PayPal is likely to continue to generate decent results in the foreseeable future despite the pressure from the competitors.

At the same time, the latest overhaul of the business and the shakeup of the C-suite indicates that the company could have the potential to finally fix the active accounts issue in the future and no longer rely solely on high fees to counterweigh the loss of customers. After all, the loss of customers has been one of the main factors that dragged the shares lower in recent quarters and at least it’s good to see that the new management aims to tackle this issue. While it’s too soon to tell whether the new leadership will be successful in finding a fix, the new focus on maximizing the value from each business unit could at least ensure that PayPal is able to continue to grow at a predictable high single-digit rate in the following quarters.

Another thing that PayPal has going for it is the growth of the overall market which was fueled by the positive Q3 GDP data last month. Since markets continue to appreciate from late October and there’s an indication that the economy is likely to keep its momentum in Q4, PayPal is likely not going to disappoint its investors in the following months and end the year on a high note. It already expects its non-GAAP EPS in FY23 to be ~$4.98, up from $4.13 a year ago and above the consensus of $4.95.

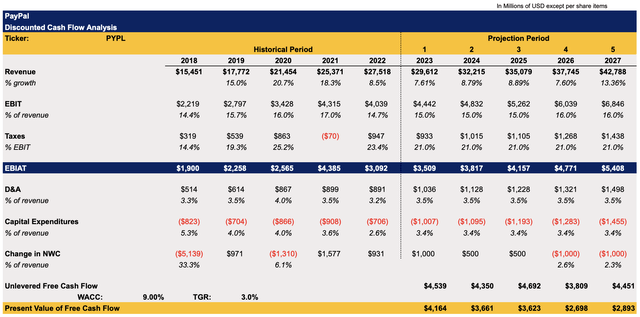

All of those developments make it possible to believe that PayPal could be undervalued at the current levels. Below is my DCF model in which most of the assumptions are closely aligned to the street estimates and there are reasons to believe that they won’t be far off from reality. Considering that PayPal has been mostly growing its revenues at a high single-digit rate in the last several quarters, it makes sense to believe that it will be growing at a similar top-line rate in the future. The EBIT as a percentage of revenues was in the range of 14.4% to 17% in the last five years, so the assumptions for the following years are in the same range. The tax rate in the model stands at 21%, which is the standard corporate tax rate in the U.S. The assumptions for other metrics in the model are mostly averages of previous periods. The WACC in the model stays at 9% while the terminal growth rate is 3%.

PayPal’s DCF Model (Historical Data: Seeking Alpha, Estimates: Author)

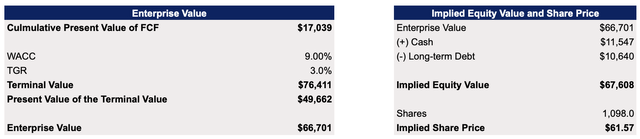

This model shows that PayPal’s fair value is $61.57 per share, which represents an upside of ~6% from the current market price.

PayPal’s DCF Model (Historical Data: Seeking Alpha, Estimates: Author)

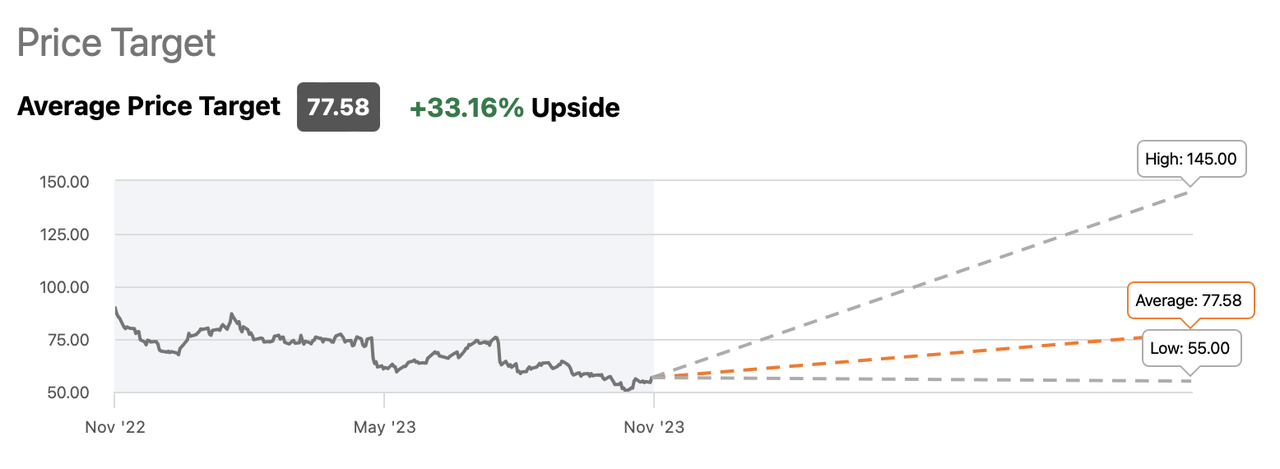

In addition to this, the consensus on the street is that PayPal’s upside could be as high as ~33%, which indicates that PayPal could indeed be undervalued at the current price.

PayPal’s Consensus Price Target (Seeking Alpha)

Why Fundamentals Are Not Enough

Although PayPal’s fundamentals look solid, there’s also a risk that the company is a value trap, and its shares could trade at the current distressed levels for a while. This is due to the fact that the number of its customers has now decreased for the third quarter in a row, which undermines the company’s growth thesis.

While the financials are not affected by this yet due to PayPal’s strong brand value, the company might be prompted to squeeze its existing customers even more in the future so that the upside from facilitating payments continues to outweigh the decline in users. Given the fact that there are better alternatives that facilitate transactions for retail and merchant customers at more attractive rates, there’s a risk that the longer the decline continues – the harder it will be to grow the transaction volumes and defend the bullish thesis.

On top of that, there’s also a risk that next year the macro issues will once again take center stage and have a negative impact on the overall market, especially if the inflation is not tamed and rates stay higher for longer. As such, PayPal likely has a short window to reverse the trend of declining users or otherwise, it risks facing a decline in transaction volume over time.

The Bottom Line

Right now, PayPal’s stock has momentum on its side, which makes it possible for it to reach my price target of over $60 per share in the foreseeable future. However, once the macro risks begin to outweigh the growth opportunities, we could experience an overall depreciation of shares and a subsequent depreciation of PayPal’s stock as well. That’s why I’m not ready to commit to a long-term position in PayPal for now and believe that it’s only a momentum play since there’s a risk that the company’s overall upside is likely to be limited due to the continuous decline of customers.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Bohdan Kucheriavyi and/or BlackSquare Capital is/are not a financial/investment advisor, broker, or dealer. He's/It's/They're solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Brave New World Awaits You

The world is in disarray and it’s time to build a portfolio that will weather all the systemic shocks that will come your way. BlackSquare Capital offers you exactly that! No matter whether you are a beginner or a professional investor, this service aims at giving you all the necessary tools and ideas to either build from scratch or expand your own portfolio to tackle the current unpredictability of the markets and minimize the downside that comes with volatility and uncertainty. Sign up for a free 14-day trial today and see if it’s worth it for you!