Summary:

- Textron’s strong revenue growth and margin expansion in 3Q23 support a low PE and a buy rating.

- I expect TXT to trade closer to peers.

- The demand for TXT’s aviation products remains robust, and its venture into the unmanned cargo aircraft segment offers potential revenue growth.

murat4art

Summary

Readers may find my previous coverage via this link. My previous rating was a buy as I believed Textron (NYSE:TXT) was trading at a low multiple and it should trend upwards as it continues to deliver positively on its financial performance. I am reiterating my buy rating for TXT as yet again it is trading at a low PE. With its strong revenue growth and margin expansion reported in 3Q23, driven by strong volume and pricing, I believe TXT should be trading at 17x PE.

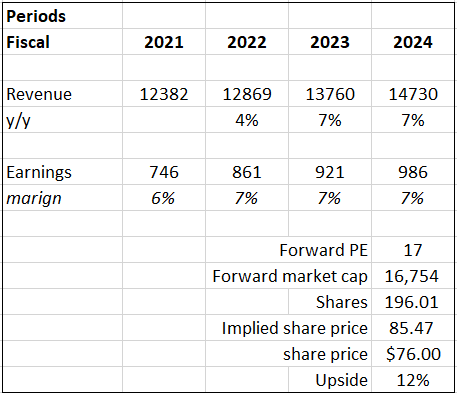

Valuation

Based on my view of the business, I anticipate 7% growth for the next two years, which is in line with market consensus. This estimate was driven by the strength TXT showed during the quarter, with revenue growing 8.6% and margins expanding. This strong growth was driven by higher volume and pricing as well as its strong aviation segment. With strong demands for commercial helicopters and from the military, I expect these demands to support TXT’s future growth. Lastly, Pipistrel’s strong growth and venture into the unmanned cargo aircraft segment have the potential to be a strong revenue growth driver, as evident in the fast-growing unmanned cargo transportation market.

Based on author’s own math

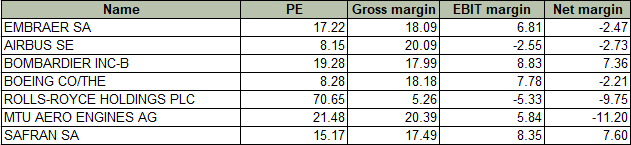

Peers overview:

Based on author’s own math

TXT now trades at 13x forward PE, while peers’ medians are 17.22x. TXT’s gross margin is 16.21%, which is slightly lower than its peer’s 18%. TXT’s EBIT margin is 8.79%, which is higher than its peer’s 6.81%. Lastly, TXT’s net margin of 7% outperforms its peer’s negative 2.47%. Overall, TXT’s has a better bottom line than its peers. With a positive growth outlook and better net margins, I believe TXT should be trading nearer to the peer’s median PE. At 17x, there is an upside of 12%. Therefore, I am reiterating my buy rating.

Comments

For 3Q23, TXT reported total revenue of $3.3 billion. Revenue grew 8.6% when compared to 3Q22. Segment profits also saw improvements year over year. 3Q23 segment profit margin is 9.9%, whereas 3Q22 was 8.8%. Net income also improved from the previous 7.3% to the current 8%. As a result of the strong revenue and margin growth, EPS improved from $1.06 to $1.35 on a diluted basis. The growth in revenue and margin is largely driven by better volume and pricing. From this, it shows that the demand for TXT’s products and aircraft in general is still strong. Despite high inflation, it actually benefited TXT. Even when the price was raised, volume did not suffer, and this speaks volume about TXT’s competitive advantage, which it is able to leverage on its end clients without much resistance.

3Q23 was a strong quarter for TXT’s aviation segment. It grew 14.6% year over year to $1.34 billion. TXT delivered the same amount of jets as last year, while turboprops increased by 5, and this consistent and strong demand for its aviation products resulted in orders growing by 12% year over year. In addition to strong demands, backlogs also grew, ending at $7.4 billion. In order to ensure that its products stay in demand, it has to stay relevant. Thus, they announced two new upgrades, which are the Cessna Citation CJ3 Gen 2 and the Citation M2 Gen 2. By modernizing its existing products, it ensures that their aircraft are always equipped with the latest technology and stay relevant. When it comes to aircraft, the Cessna brand is synonymous with it. The Cessna 172 is one of the most iconic plane, and it is delightful to see that TXT is consistently strengthening this brand through technological innovation. Overall, the demand for TXT’s products is robust and it is not showing any signs of weakening. I believe his strong demand and strong brand name will support its long-term growth outlook.

On to TXT’s Bell segment, its margins improved while revenue remains flat at $754 million. Bells’ segment profit improved from $74 million to $77 million. Its segment margins improved to 10.2% from 2Q23’s 9.8%. Bell’s flat revenue was driven by lower commercial deliveries but offset by higher military revenues. The lower commercial deliveries were caused by manufacturing disruptions due to supply chain issues. Once these supply chain issues are resolved, I expect Bell’s revenue to improve, as the lower deliveries were not caused by a reduction in commercial demands. Based on industry data, the current market size for commercial helicopters is about $743 million, and it is expected to grow to $959 million by 2028, which represents a CAGR of 5.23%. This data signals that demand is still strong as the recovery of COVID has boosted tourism and transportation demand.

In 2022, TXT acquired Pipistrel, which specializes in electric aircraft, and it is reported under the eAviation segment. During the quarter, Pipistrel Alpha Trainer has shown strong growth as Mesa Air ordered 25 trainers. Moving into the full year and beyond, I continue to expect Pipistrel’s strong growth to contribute to TXT’s revenue growth. In addition, TXT also announced that an electric unmanned cargo plane is undertaking system integration and is expected to be in testing by the end of 2023. Based on statistics, the total tangible market for unmanaged logistic transport is anticipated to grow from $11 billion to $29 billion by 2027. Thus, I believe it is the right step to venture into the unmanaged cargo segment, and I believe if executed well, it will provide TXT with another avenue of revenue growth.

Risk & conclusion

The supply chain disruption could pose a risk for TXT if it worsens. Currently, they are facing challenges with it, and it has negatively impacted Bell’s commercial deliveries. With Bell accounting for 22.6% of third quarter revenue, it does have weights on TXT. If it were to worsen, it might tilt the balance and cause Bell’s revenue to decline, as right now it has been offset by strong military revenue.

TXT’s market leadership and its products’ competitive advantage were showcased in 3Q23, as higher volume and pricing drove revenue and margins higher. Its continuous improvements and upgrades to its strong brands are setting them up well for future growth. On top of these innovations, its availability segment has a strong customer base, and demands for their products are still strong. With the unmanned cargo sector expected to grow to triple its current size by 2027, their venture into this market, coupled with their expertise in aircraft manufacturing, provides them with a fresh avenue for growth.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.