Summary:

- Walmart Inc. is expected to deliver strong Q3 earnings above consensus estimates pre-market on November 16th.

- However, there are red flags from macro data suggesting a potential guidance downgrade for the next quarter and the full fiscal year 2024.

- Walmart stock is only slightly overvalued according to valuation analysis.

Daniel Aguilar/Getty Images News

Investment thesis

Walmart Inc. (NYSE:WMT) reports its quarterly earnings tomorrow, November 16th, pre-market. The stock has demonstrated strong year-to-date performance thanks to strong financial performance in the previous couple of quarters. The company rarely misses consensus estimates. Therefore, I expect WMT to deliver another solid quarter.

However, there are several red flags from the macro data indicating that the management might downgrade guidance for the next quarter and the rest of the fiscal year. Moreover, my valuation analysis suggests the stock is slightly overvalued. All in all, I assign WMT a “Hold’ rating before the upcoming earnings release.

Company information

Walmart is the world’s largest retailer and also the world’s largest employer. The company operates more than ten thousand retail units across 20 countries.

The company’s fiscal year ends on January 31. Walmart operates via three segments: U.S., Sam’s Club, and International. According to the latest 10-K report, the U.S. segment accounted for 69% of total sales in FY 2023.

Financials

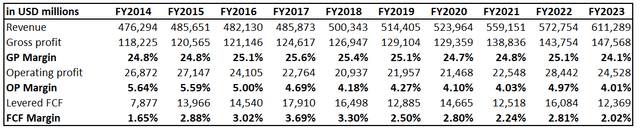

Walmart’s financial performance over the last decade reflects one simple truth – traditional brick-and-mortar retail is losing competition to more convenient e-commerce. Walmart’s revenue compounded at a 2.8% CAGR over the past decade, which is not far above the historical average of the American inflation rate. That said, in real terms, the company’s revenue almost did not grow. Profitability metrics have been stagnating as well over the last decade, with the free cash flow [FCF] margin almost halved in FY 2023 compared to the decade’s peak of FY 2017.

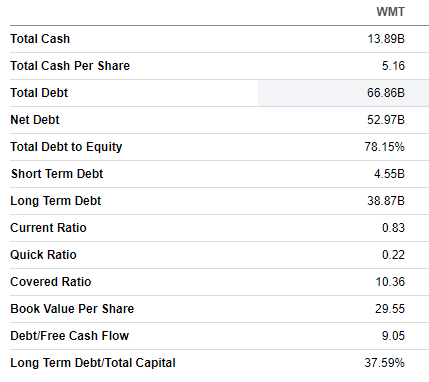

Walmart’s balance sheet is solid, with almost $14 billion in outstanding cash as of the latest reporting date. Walmart’s high credit rating and low leverage ratio mean the company is in an advantageous credit position with solid potential to raise additional debt finance if needed. Despite having razor-thin profitability metrics and a capital-intensive business model, Walmart’s consistent dividend increases and active share repurchases demonstrate a commitment to shareholder value and a sound capital allocation approach.

Seeking Alpha

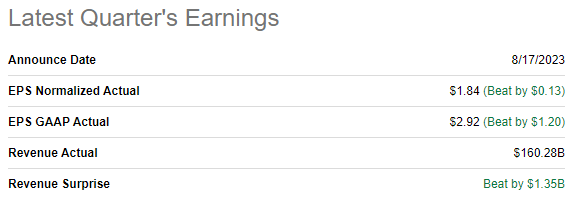

The latest quarterly earnings, for Q2, were released on August 17, when the company topped consensus estimates. Revenue grew by 5.9% YoY, and the adjusted EPS expanded from $1.77 to $1.84. I want to underline that the operating leverage did not contribute much to the YoY EPS growth since the operating margin expanded by only five basis points.

Seeking Alpha

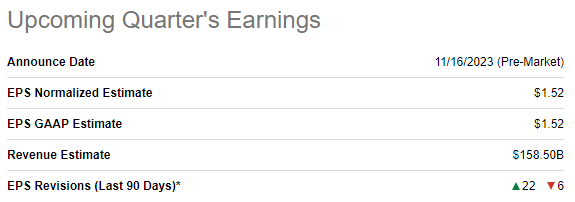

I will not dig deeper into the details of the latest quarterly earnings because the company releases its Q3 of FY 2024 tomorrow pre-market. Thus, I would better prepare for the upcoming earnings release. Consensus estimates forecast quarterly revenue at $158.5 billion, which indicates a 4.6% YoY growth. The adjusted EPS is forecasted by consensus to be almost flat. Walmart rarely misses revenue and EPS consensus estimates; therefore, there is a high level of probability that Q3 earnings will also be above forecasts.

Seeking Alpha

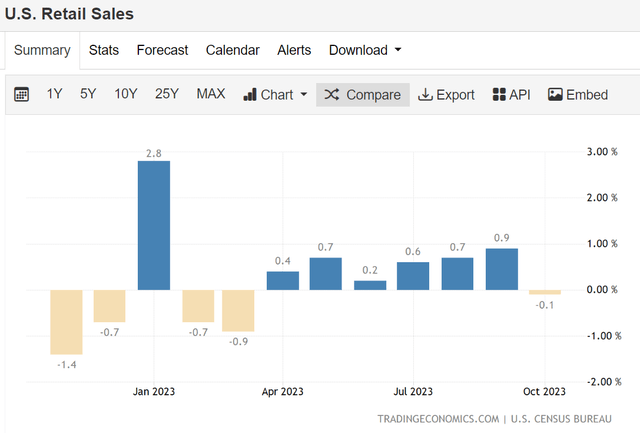

The expected consensus dynamic in WMT’s financial performance looks solid, but I think that guidance will be important for investors. The latest U.S. retail sales data suggests the softening macro landscape that Walmart will need to navigate in Q4. According to the latest reports, retail sales in the U.S. saw a marginal decline of 0.1% in October. Even such a slight dip might indicate a potential shift in consumer spending patterns, which can lead to the company’s management Q4 guidance downgrade. Looks like a potential red flag to me.

The fact that the U.S. consumer confidence index [CCI] has declined for the third month in a row in October also does not add optimism to me about the upcoming earnings release of WMT. This downward trend in consumer confidence adds more complexity to the already challenging macroeconomic landscape, in my opinion. When consumers become more cautious and conservative in their spending patterns, Walmart will likely encounter headwinds despite its low-price business model.

As the Fed’s monetary policy is tight and Jerome Powell still sends hawkish signals, I do not expect a rapid rebound in consumer confidence. Despite inflation cooling down in October, there are still a couple of big reasons why the fight with it is unlikely to be over. First, crude oil prices are still high despite the recent pullback on the robust storage data. Second, geopolitical tensions across the world are escalating, and we now have two big military conflicts happening in Ukraine and Palestine. We also have a “cold war” between the world’s two largest economies, the U.S. and China. Geopolitical tensions lead to deglobalization, pushing inflation up as the most cost-effective supply chain routes experience big disruptions. That said, it is highly likely that Walmart’s management might highlight a cautious outlook regarding the company’s prospects for the foreseeable future.

All in all, I expect Walmart’s earnings release to be mixed. While the company is likely to deliver strong Q3 above consensus estimates, there is also a high probability that the guidance for the rest of the fiscal year might be downgraded, given the fact that the U.S. economy is poised to cool down.

Valuation

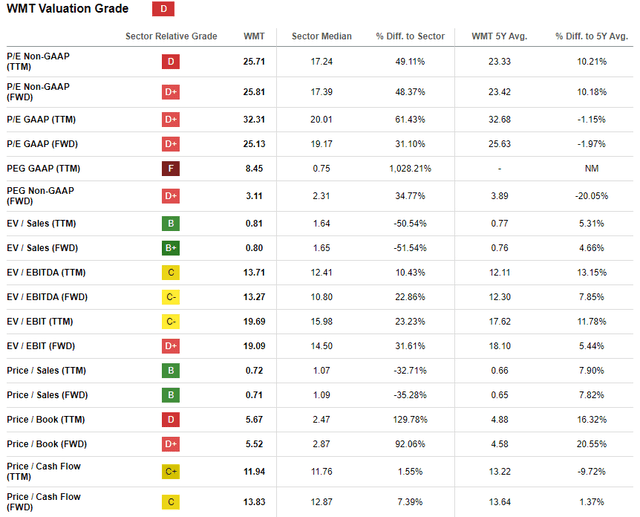

The stock rallied by 17.5% year-to-date, slightly underperforming the broader U.S. market. Current valuation ratios are not far from the company’s historical averages, which means the stock is approximately fairly valued. I ignore the comparison of multiples with the sector median because WMT’s brand strength and the business’s scale are unmatched.

Despite WMT being a dividend machine with 49 straight years of dividend growth, I will not simulate a dividend discount model [DDM] here. The stock is apparently overvalued from the DDM perspective, given the very low forward dividend yield of 1.36% and the modest pace of dividend growth over the last decade.

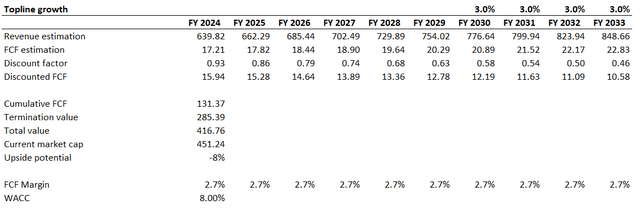

That said, I prefer to proceed with the discounted cash flow [DCF] approach. I use an 8% WACC suggested by Gurufocus. I implement a flat 2.7% FCF margin, which is the last decade’s average. Revenue consensus estimates are available up to FY 2029 and I project a 3% CAGR for the years beyond.

According to my DCF simulation, Walmart Inc.’s fair value is almost $417 billion, which is 8% lower than the current market cap. Given the company’s strong brand and massive scale, I think an 8% premium for WMT stock is reasonable. The current Walmart Inc. stock price of around $170 looks fair to me.

Bottom line

To conclude, WMT is a “Hold” before Q3 earnings. Stellar earnings’ surprising history suggests there is a high probability that the company will top consensus revenue and EPS estimates, which is good. But still, investors might be disappointed after the earnings call as there are a few big reasons why a guidance downgrade is highly likely to happen. Last but not least, the Walmart valuation does not look attractive either.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.