Summary:

- Amazon continues to excel in terms of revenue growth and cost control, with strong Q3 results showing expanded margins.

- The company’s new business ventures, such as Amazon Pharmacy, Clinic, and AI AWS improvements should further increase its economic moat.

- Shares of Amazon may be undervalued by up to 18%, with long-term growth rates in the high teens expected.

- Strong Buy rating issued.

We Are

Investment Thesis

Amazon (NASDAQ:AMZN) continues to excel both in terms of revenue growth and cost control. The firm’s most recent Q3 results saw the firm generate massive YoY growth in revenue, operating income, and overall margins.

I still believe the firm is well poised to benefit in the long-term from their massive economic moat with multiple new business ventures such as Amazon Pharmacy and Clinic and their expanded generative AI solutions set to further increase the size and breadth of their moat.

Given that shares appear to be somewhere between fairly valued and an 18% undervaluation combined with growth prospects of high teens for the coming ten years, I continue to believe Amazon will earn great returns for patient, long-term investors.

Upgraded Strong Buy rating issued.

Company Background

Amazon is an American e-commerce and cloud/web service provider that dominates almost every market in which it operates. Their economic and social influence is realized across the globe through various business segments which give the company significant breadth and economic moat.

The bulk of Amazon’s revenues arise from their e-commerce sales with Amazon Web Services (AWS) being their second primary source of sales. Significant revenues are also realized through their Prime subscription service and through their offering of digital advertising solutions.

The immense scale on which Amazon operates has allowed the company to develop an ingrained presence in the lives of most Americans and Europeans. The breadth of services offered by the firm makes it almost impossible for the average person to live their life without benefitting from Amazon-related products or services in one way or another.

Economic Moat – Q3 FY23 Update

Amazon harbors a true mega-moat status as its breadth of services and product offerings create significant long-term value opportunities for the company.

I conducted a full in-depth analysis of Amazon’s economic moat back in January 2023 which I still believe to be mostly valid, you can check it out here: “Amazon: Deep Dive Analysis Reveals Excellent Long-Term Value”. To read my most recent early summer update, click here.

In this update article, I would like to discuss the development of Amazon’s new “Clinic” business, AWS, and their variety of AI integrations into their service

Q3 saw Amazon significantly expand its Amazon Clinic platform, a virtual healthcare marketplace that offers care solutions for over 35 different conditions along with the opportunity to buy affordable pharmaceutical products through Amazon Pharmacy.

I believe the rapid expansion of Amazon Clinic is making the platform more of a serious contender and market disruptor when compared to traditional pharmacies and care methods.

The opportunity for both underserved customers and those who want rapid care to access an online doctor in minutes presents a truly attractive healthcare solution that I think will be particularly popular among the younger generations of consumers.

Furthermore, Amazon is partnering with Blue Shield of California to offer a first-of-its-kind model to provide more affordable pharmacy care to its members where Amazon Pharmacy will offer fast, free home delivery of prescription medications to more than 4.8 million Blue Shield of California members, starting in 2025.

The firm is also testing 60-minute drone delivery using Prime drones in a few towns with wider-scale rollouts expected further in the future.

Overall, I believe this more serious endeavor into the pharmaceuticals and care business can generate huge moatiness for the firm. Amazon has the power to forge powerful strategic partnerships with key established players within the industry which could allow their Amazon Pharmacy and Clinic to grow rapidly.

Their unique set of pre-existing delivery, warehouse, and online infrastructure would make it difficult for a competitor to launch a similar service with an equal set of services. Therefore, I assign this business at present a narrow economic moat and await more financial data to assign more or less moatiness to the new business segment.

AWS continues to grow at a solid pace with new AI improvements leading to significant further growth potential. The firm has partnered with Anthropic to build their AI models which the firm plans to integrate both into AWS services and into their core consumer-oriented businesses.

AWS saw many customer firms integrate the platform services more tightly into their operations structures with the likes of BMW Group (OTCPK:BMWYY), NatWest Group (NWG), PwC, Occidental Petroleum (OXY), and DS Smith (OTCPK:DITHF) adopt new AWS services into their business operations.

A key driver behind this growth came from the benefits many of these firms can enjoy from an operational efficiency perspective thanks to the advanced generative AI tools presented to them by the now Anthropic-enhanced AWS platform.

Amazon has also implemented many generative AI tools into their core e-commerce and Prime service offerings primarily with the focus of improving the usability of the services for customers.

While the Anthropic deal will allow Amazon to rapidly scale and develop its own in-house generative AI tools, I believe the firm will initially lag behind rivals like Microsoft with regard to the absolute abilities of their AI models.

However, this strategic partnership places Amazon in a great position to become a long-term leader in generative AI, particularly from e-commerce, IaaS, and streaming perspective. The development of AI is often labeled as a “race” and I firmly believe it should be viewed as a marathon rather than a sprint.

The partnership with Anthropic also represents some conscientious cost-control from management with the collaboration presenting a much more cost-effective and less resource-intensive way to enter into the AI space.

Ultimately, I believe Amazon has tangibly expanded its economic moat throughout Q3 thanks to a variety of strategic, significant, and influential developments across its business operations. Furthermore, many of these improvements take months if not years to develop which illustrates just how innovative and obsessive Amazon continues to be when it comes to improving the customers’ experience.

I believe Amazon absolutely still has a massive economic moat that truly can be considered as a mega moat. The breadth, depth, and influence held by their various business operations continue to be essentially unrivaled across the market environments in which they operate.

Financial Situation – Q3 FY23 Update

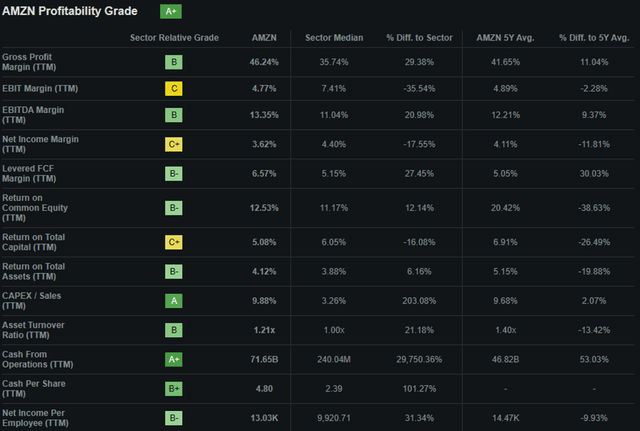

On the whole, Amazon’s fiscal situation remains mostly unchanged with the firm continuing to be an absolute revenue, cashflow and profitability powerhouse. Amazon’s most recent FY23 Q3 10-Q report continues to support this hypothesis with strong growth and great margins being earned.

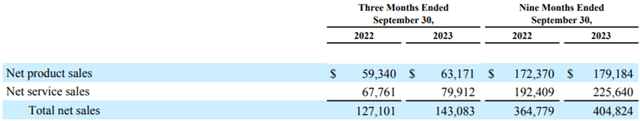

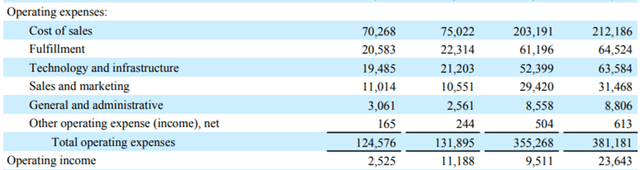

Q3 saw Amazon grow its net product and service sales massively with total net sales growing 13% YoY totaling over $143.1B. This was largely achieved thanks to strong 12% growth from the AWS segment along with resilience in both North American and international markets.

The firm’s Prime subscription service also saw strong 14% YoY growth while Amazon’s digital advertising service grew at a huge rate of 26% YoY. Quite simply, Amazon is firing on all cylinders with the firm making huge gains across its business operations.

Almost more impressive than their strong growth and great revenues is the cost control achieved by Amazon. Last year the firm embarked on a massive new initiative to cut huge amounts of costs from their operations structure in the name of achieving true operational excellence.

Considering that Amazon’s COGS only increased 7% compared to their increase in net sales of 13%, it is clear that the firm has managed to slightly increase its gross margins.

Furthermore, the firm actually saw sales and marketing expenses along with general and administrative costs decrease by around $500M each. When combined with the truly limited rises in fulfillment and technology and infrastructure spending, the firm has significantly expanded its gross margins YoY.

Operating income was up a whopping 344% YoY with the previous year’s losses being transformed into huge incomes thanks to great revenue growth and solid cost control.

Net income increased to $9.9B with diluted EPS of $0.94.

FCF also increased to $21.4B for the TTM with a YoY improvement (considering a TTM figure from September 30, 2022) of 8.7%.

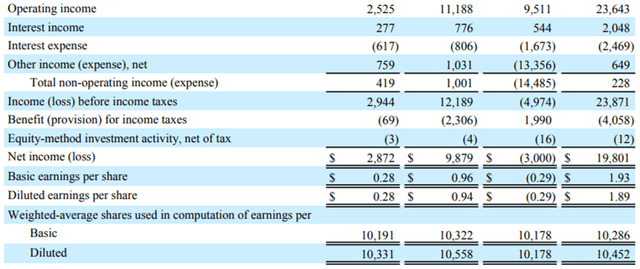

Seeking Alpha | AMZN | Profitability

Seeking Alpha’s Quant continues to derive an “A+” profitability rating for Amazon which I believe perfectly represents the firm’s current and future earnings potential.

Amazon’s balance sheets continue to be in great shape with the firm’s quick ratio of 0.70x and current ratio of 0.98x easily covered by their massive FCF.

Quite simply, the firm’s massive unlevered free cash flows should allow the firm to continue covering any and all maturing debentures with ease. When combined with the massive cost savings currently being pursued by Amazon, I do not see any liquidity or stability concerns for the firm.

It is safe to say that from a long-term perspective, Amazon continues to have an excellent fiscal position which should allow them to innovate and expand with ease.

An impressive Q3 from a revenue, income, and gross margin standpoint has not gone unnoticed by investors with shares rallying from late-October lows. Even in tough macroeconomic conditions, it appears Amazon is able to produce huge profits from its various business operations.

Valuation – Q3 FY23 Update

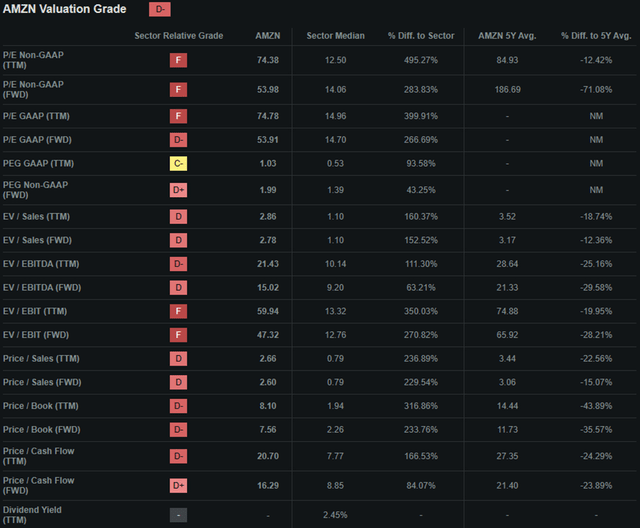

Seeking Alpha | AMZN | Valuation

Seeking Alpha’s Quant has assigned Amazon with a “D-” Valuation rating. I am inclined to disagree with this relative quant assessment as it suggests the firm’s shares are materially overvalued, which I do not believe to be the case.

The firm is currently trading at a P/E GAAP FWD ratio of 53.91x and a P/CF ratio FWD of 16.29x. Their FWD Price/Book ratio is 7.56x and the firm’s EV/Sales FWD is 2.78x. While these metrics are certainly quite elevated and not exactly indicative of a deep-value opportunity, I believe they are mostly appropriate given the firm’s significant growth prospects.

Furthermore, these letter grades and absolute figures must be taken with a pinch of salt. Ultimately, the grade given by Seeking Alpha’s quant is relative to industry peers. However, while Amazon’s various business units may have comparative peers, I believe the firm is truly incomparable as a whole.

Given the massive expansion into new business areas and industries, I believe Amazon will still be able to grow at a rate somewhere in the high teens for at least the next ten years therefore easily warranting these elevated valuation multiples.

Seeking Alpha | AMZN | Advanced Chart

From an absolute perspective, Amazon’s shares have shown strong performance throughout 2023 with massive YTD gains of around 70% returning 5Y average returns to above market levels (as compared to the S&P 500 tracking index (SPY)).

Compared to 2021 highs, Amazon shares continue to be available at an absolute discount of around 40% relative to historic prices.

While the relative valuation provided by simple metrics and ratios along with the absolute comparison begins to create a baseline of understanding regarding the value present in Amazon shares, a purely quantitative valuation method must be completed.

The Value Corner

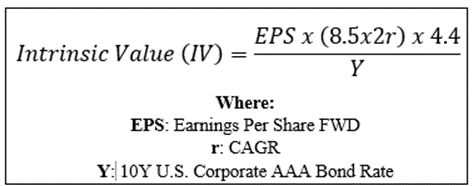

By utilizing The Value Corner’s specially formulated Intrinsic Valuation Calculation, we can better understand what value exists in the company from a more objective perspective.

Using Amazon’s current share price of $145.80, an estimated 2025 EPS of $4.65, a realistic “r” value of 0.18 (18%), and the current Moody’s Seasoned AAA Corporate Bond Yield ratio of 5.61x, I derive a base-case IV of $177.50. This represents an approximately 18% undervaluation in shares.

When using a more pessimistic CAGR value for r of 0.15 (15%) to reflect a scenario where Amazon struggles to earnings due to a recession impacting their core e-commerce business, shares are still valued at around their current price of $153.50.

Considering the valuation metrics, absolute valuation, and intrinsic value calculation, I believe Amazon is still trading somewhere between a fair value position and a modest undervaluation.

In the short term (3-12 months), I find it difficult to say exactly what may happen to the stock. While the strong future growth prospects are alluring, any short-term negative catalyst could result in a sudden drop in share prices along with a panic-driven selloff.

An overall souring in investor sentiments regarding the direction the U.S. economy is taking as a whole could also see Amazon shares lose value. Given the mixed macroeconomic signals currently being generated by global economies, I believe making any short-term prediction on Amazon shares would be unreliable and excessively speculative.

In the long term (2-10 years), I see Amazon strengthening its position as the go-to company when it comes to e-commerce, streaming, cloud computing, and AI.

The ability for Amazon to launch new service and product offerings such as Amazon Clinic and Pharmacy using their pre-existing infrastructure gives the firm a huge leg-up on new entrants when it comes to competing within their respective market environments.

Risks Facing Amazon – Q3 FY23 Update

The primary risks facing Amazon remain largely unchanged compared to previous analysis. Nonetheless, for a more extensive analysis into the risks facing the firm, I recommend reading my initial deep-dive analysis here.

Ultimately, Amazon still faces the most risk from failed execution of future innovations and development strategies along with the potential for a recession in 2024 hurting the growth in revenues of their core business segments.

A recessionary macroeconomic environment would lead Amazon’s core consumer clients to feel significant pressure on their incomes which would most likely result in a cutback in spending on nonessential items.

While Amazon has significantly diversified its revenue streams even compared to just two years ago, the firm would still feel a real hit in revenues should such a recessionary environment materialize.

From an ESG perspective, no tangible change has happened at Amazon with the risk of unionization still remaining the largest threat for the company to manage.

Summary

Amazon has shown investors that its cost-cutting strategy and desire to achieve operational excellence are paying off well. The strong growth in revenues thanks to numerous new service and product innovations has combined with an overall reduction in costs resulting in strong incomes and expanded margins.

I believe the firm is well set to achieve significant future growth and thanks to its more cost-effective operational structure Amazon should be able to earn massive outsized returns on its invested capital.

While the short-term environment looks cloudier than ever thanks to a complex macroeconomic environment, I see a prosperous and growth-oriented future for Amazon with tangible competitive advantages providing tailwinds for the firm for at least the next 10 years.

When combined with a potential for around an 18% undervaluation in shares, I still believe Amazon makes for perhaps one of the most compelling long-term investment opportunities in the market. I think this company will reward patient investors with great multibagger returns.

I upgrade my rating to a Strong Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I do not provide or publish investment advice on Seeking Alpha. My articles are opinion pieces only and are not soliciting any content or security. Opinions expressed in my articles are purely my own. Please conduct your own research and analysis before purchasing a security or making investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.