Summary:

- Investing strategy for large-cap stocks: fully invest allocated budget periodically, shift allocations between specific stocks while adhering to overall philosophy.

- We conduct a sum of the parts valuation update for Amazon.com, Inc.: base case target price is $136 per share, bull case target price is $290 per share, and the bear case target price is $85.

- Identifying potential risks to Amazon’s valuation and highlighting the company’s ongoing product innovations and AI advancements.

miss_j/iStock via Getty Images

Investment Strategy For Large-Cap Stocks

We covered both large-cap and small-cap stocks. Our article about large-cap stocks provides value propositions for investors who are interested in exploring the nuances of changing expectations for stock valuations.

Our investment philosophy when it comes to large-cap stocks is that investors should fully invest the budget they have allocated to large caps on a periodic basis. Our article provides guidance to investors on shifting their allocations between specific large-cap stocks while adhering to the overall philosophy of periodic buying.

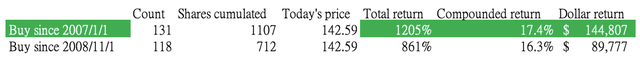

Case Study: Amazon’s Stock Performance

Here is an example to illustrate how not fully investing is doing more harm than good for investors. If you periodically invest $100 in Amazon.com, Inc. (NASDAQ:AMZN) stock, the compounded annual return difference between buying before the financial crisis in January 2007 and buying the dip since November 2008 is 17.4% versus 16.3%. However, in dollar amount and total return, there is a huge difference. You would make $144,807 or 1205% versus $89,777 or 861% if you buy at the high right before the financial crisis.

If this result conflicts with your intuition, here is the explanation: the difference in the returns is simply because if you bought before the financial crisis, you will have already bought 131 times since then. Whereas if you decide to wait and buy the dip, you only buy 118 times. The fear of buying at the top caused you to make less than $55,030 on a total $131,000 budget. It is because you had $1,300 on the side and this money missed the compounding opportunity over the next 16 years.

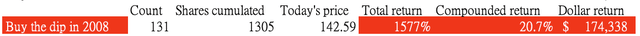

Of course, there will be additional benefits if you time the market right. Below shows that if you happen to allocate the $1,300 set-aside money to buy the dip in 2008, you will make a 1577% return in total and increase the compounded annual return to 20.7%. But, generally speaking, timing the market is harder than full investment.

In fact, this investing strategy applies to most large-cap stocks or index funds. The compounding return effect makes setting money on the side the least favorable investment decision.

So, in the future, our investment article on large-cap stocks should focus on a discussion of the over/equal/underweight of a particular stock.

In aggregate amounts, we recommend investors always periodically and consistently invest all their money within their large-cap allocation budget. Most of the time, investors only need to check whether the large-cap companies still maintain their leadership position before making periodic buys.

In this article, we discuss the reasons that investors should allocate an equal weight on Amazon’s stock.

The Sum Of The Parts Valuation Update

We wrote an article about Amazon in June and tried to value Amazon’s stock by the sum of the parts method. We assumed retail would be growing in the mid-single digits and Amazon Web Services (“AWS”) would maintain high double-digit growth because retail is relatively mature and AWS continues to benefit from increased penetration of IT spending in the cloud.

In the following section, we will discuss what we saw in the Q3 earnings and its impact on our assumptions and Amazon’s sum of the parts valuation.

AWS

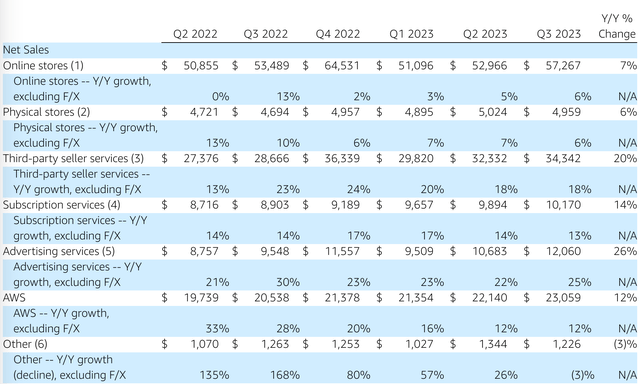

AWS grew by 12% in Q3, a similar cadence as Q2. Hence, after checking these data points, we are comfortable with our AWS assumptions.

This growth momentum is helpful to sustain the thesis of AWS continuing to benefit from the trend of IT spending migrating from on-premises to the cloud, as mentioned by management in the earnings call.

then we have a $92 billion revenue run rate business where 90% of the global IT spend still resides on premises.

In Q3, Amazon was able to stop the margin compression trend in AWS by cutting expenses. Hence, its AWS operating margin increased to 30% from 24% in Q2 2023. This margin expansion sustains our margin assumptions.

a question about AWS margins. So yes, the margin improved 600 basis points quarter-over-quarter, an increase of income of $1.6 billion quarter-over-quarter for AWS, is driven by — primarily by our headcount reductions in Q2 and also continued slowness in hiring, rehiring open positions.

Retail

Now, let’s take a look at its retail business.

Amazon increased its retail operating margin to 4.9% in Q3, which helps support our thesis that it can achieve mid-single-digit free cash flow margins long-term. Retail revenue growth also accelerated, suggesting Amazon’s growth initiatives like Amazon Clinic are gaining traction. We believe expanding its retail platform beyond just e-commerce sales can drive continued growth. The solid margin and revenue growth this past quarter indicate these efforts to leverage Amazon’s customer base in new ways are working. We will keep monitoring the impact of these initiatives on long-term prospects.

In this quarter, Amazon expanded its partnership with Blue Shield to offer service for 4.8 million members. This is just an example of Amazon’s initiatives to leverage its retail customer base to increase revenue streams outside of its online retail business.

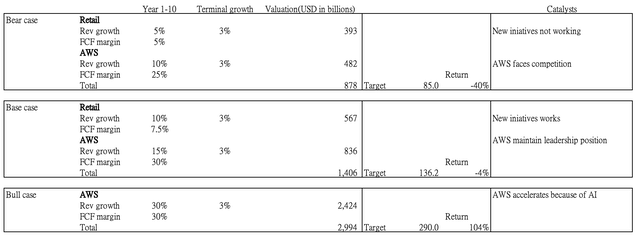

Hence, based on the above observations, we update our sum of the parts model as follows:

We used a WACC of 10% and long-term terminal growth of 3% in our assumptions. Its net debt was -$3 billion in Q3.

Base Case

The company’s retail new initiatives will sustain its revenue growth rate at a CAGR of 10% over the next 10 years and a long-term free cash flow margin of 7.5%. This will lead to a $567 billion retail equity valuation.

AWS will continue to maintain revenue growth at a CAGR of 15% over the next 10 years and a long-term free cash flow margin of 30%. This will lead to an $836 billion AWS equity valuation.

For the base case, our target price will be $136 per share, a 4% downside.

Bull Case

The company’s retail performs the same as the assumptions in the base case.

Because of AI boosting cloud demand as mentioned in our previous article, AWS accelerates to 30% CAGR for the next 10 years and a long-term free cash flow margin of 30%. This led to an AWS valuation of $2.4 trillion.

For the bull case, our target price will be $290 per share, a 104% upside.

Bear Case

The retail’s new initiatives do not work well, and its revenue growth in the next 10 years is only 5%. The long-term free cash flow margin is only 5%. This leads to a $393 billion retail equity valuation.

AWS also slowed to 10% revenue growth as a result of further competition and the long-term free cash flow margin decreased to 25%. This led to an AWS valuation of $482 billion.

For the bear case, our target price will be $85 per share, a 40% downside.

Given AWS’s growth is only 12%, its guidance for Q4, and management’s comments on its customer patterns, we feel that the AI explosive growth case is not happening in the near term. Hence, the bull case probability is low now.

so customers are experimenting with lots of different types of models and then different model sizes to get the cost and latency characteristics that they need for different use cases.

The base case is likely to play out near term as its third-party seller services and advertising services still have strong momentum and have grown at high double digits.

Its subscription services grew by 13% but was lower than its Prime price hike of 17%. Hence, there is some weakness in the consumer count growth. Thus, we envision online and physical retail should stay in single-digit growth ahead.

Downside Risk

Two risks that can trigger a downside risk valuation of $85 per share include further competition in the cloud space and a lack of growth in new initiatives.

We are less concerned about its retail business as the company continues to innovate new products. For example, Amazon was the first to launch its AI-powered speaker and Fire TV. They also improve its online store shopping experience and offer more seller tools with AI features.

Launched product review highlights, a new generative AI–powered feature that lets shoppers in Amazon’s U.S. store quickly determine what other customers are saying about a product before reading through reviews…

Introduced generative AI capabilities to help sellers create product listings as part of numerous innovations…

Previewed a smarter and more conversational Alexa, powered by generative AI and an LLM custom-built for voice interactions…

Announced updates to the Fire TV experience, including an enhanced AI-powered Fire TV voice search..

During the earnings call, management cited metrics to justify their cost leadership position. Although we know its peers are aggressively innovating new products. Hence, we will be monitoring the competitive landscape going forward.

..if you look at the growth of customers using EC2 instances that are Graviton based which is our custom chip that we built for generalized CPUs, the number of people and the percentage of instances launched their Graviton base as opposed to Intel or AMD base is very substantially higher than it was before. And one of the things that customers love about Graviton is that it provides 40% better price performance than the other leading x86 processors.

Conclusion

We think investors should fully allocate funds periodically to large-cap stocks. The benefit of full allocation is better than setting money aside. Although there is also a benefit to market timing, we recommend investors rebalance or shift funds within their large-cap portfolio but maintain full allocation.

We do not see explosive spending from the emergence of AI in AWS in the near term, as enterprise consumers are still exploring the space at the moment. Although retail seems to be supported by strong momentum in advertising and third-party seller businesses, the market seems to have already priced this in. Amazon.com, Inc. stock seems to be fairly valued in our opinion based on our base case valuation. Hence, we are revising our rating to equal weight for the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.