Summary:

- Microsoft’s diversified product portfolio and unique technological capabilities, thanks to strategic partnership with OpenAI, make it well-positioned to fuel future growth.

- Microsoft Azure is narrowing the gap with the market leader, AWS, in the global cloud computing market.

- My valuation analysis suggests the stock is about 15% undervalued.

Chip Somodevilla/Getty Images News

Investment thesis

My initial bullish thesis about Microsoft (NASDAQ:MSFT) worked well as the stock rallied 30% since late April, significantly outperforming the broader U.S. market. Today, I want to reiterate my “Buy” rating for MSFT despite a massive year-to-date rally. The company demonstrates unmatched resilience as its revenue grows at double-digits even in the current harsh macro environment. Strategic partnership with OpenAI helps Microsoft to differentiate its cloud offerings as Azure increased its market share in Q3 at the expense of major competitors Amazon (AMZN) and Google (GOOG). The company is well-positioned to continue integrating cutting-edge artificial intelligence [AI] solutions in its broad set of software offerings. Moreover, my valuation analysis suggests that the stock is still about 15% undervalued.

Recent developments

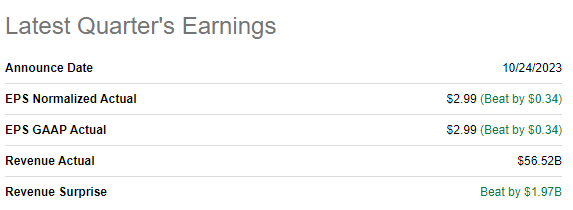

The latest quarterly earnings were released on October 24, when the company smashed consensus estimates. Revenue grew YoY by an impressive 12.8%, which is a strong bullish sign in the current harsh macro environment. The adjusted EPS followed the topline and expanded YoY from $2.35 to $2.99. This solid EPS improvement was due to the strong operating leverage. Profitability metrics expanded significantly, the gross margin was at a stellar 71%, and the operating margin expanded YoY from 42.9% to 47.6%. The Intelligent Cloud segment was the major growth driver during the quarter as sales increased by 19% YoY here, and the segment’s share in the total revenue mix expanded from 41% to 43%.

Seeking Alpha

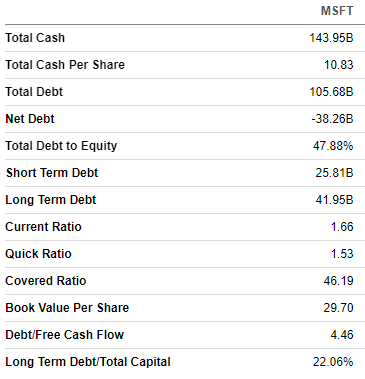

Stellar quarter enabled the company to generate more than $18 billion in levered free cash flow [FCF] during Q1 FY2024, which enabled MSFT to continue improving its fortress financial position. As of the latest reporting date, the company had a staggering $144 billion of cash outstanding, which is almost $40 billion higher than the total debt. The leverage ratio is very low, and short-term liquidity metrics are in excellent shape. The company has vast financial resources to continue building value for shareholders in-house or via new acquisitions.

Seeking Alpha

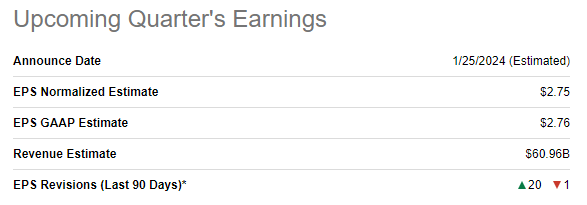

The earnings release for the upcoming quarter is scheduled for January 25, 2024. Quarterly revenue is forecasted by consensus at almost $61 billion, which indicates YoY top-line growth acceleration to over 15%. The bottom line is expected to follow the revenue growth by expanding YoY from $2.32 to $2.75. There were 20 upward EPS revisions over the last 90 days, which is a massive bullish sign.

Seeking Alpha

Let me share my thoughts regarding the company’s prospects to explain why I agree with optimistic consensus expectations. Apart from the company’s stellar financial performance and fortress balance sheet, which make MSFT well-positioned to continue investing heavily in innovation, there are several more positive signs.

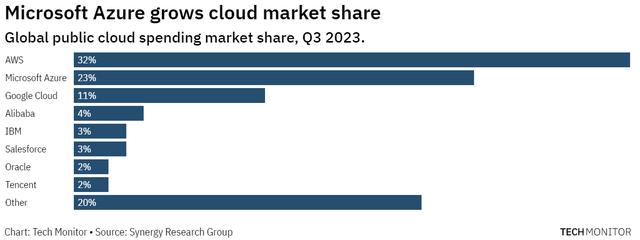

The company apparently succeeds in prioritizing more high-value commercial and cloud application businesses, which addresses the evolving needs of enterprises undergoing digital transformation. The global computing market is expected to compound at a 14% CAGR up to 2030, which is a massive secular tailwind for Microsoft’s most promising business segment. Apart from positive secular shifts toward cloud technologies, it is also crucial to highlight Microsoft’s excellence in this business. Despite Amazon’s AWS still by far leading in the global public cloud market with a 32% share, Microsoft’s second position with a 23% market share also looks formidable. Moreover, in Q3 2023, Microsoft Azure’s market share rose by one percentage point, partially at the expense of AWS.

Microsoft’s strategic partnership with OpenAI also unlocks new growth drivers. OpenAI’s ChatGPT is a real technological leap in the generative AI domain. Microsoft already integrates the chatbot’s capabilities across some of its products, especially Azure, which helped the company narrow the gap with AWS. However, I think Microsoft will not stop there and will integrate OpenAI’s capabilities across its product portfolio. This will improve Microsoft’s position as the most dominant software company in the world and will also likely put the company at the forefront of AI-driven solutions.

The fact that Microsoft boasts a diversified and robust set of products makes the company resilient to the current challenging environment. Despite massive macro headwinds caused by high inflation, tight monetary policies across the developed world, and a high level of geopolitical uncertainty, Microsoft’s quarterly revenues never showed a YoY decline since the beginning of 2022, when adverse events started unfolding. Out of the eight last quarterly earnings, YoY revenue growth was single-digit only three times. Such resilience suggests that the company’s competitive advantages are unmatched, and the moat is very wide.

Valuation update

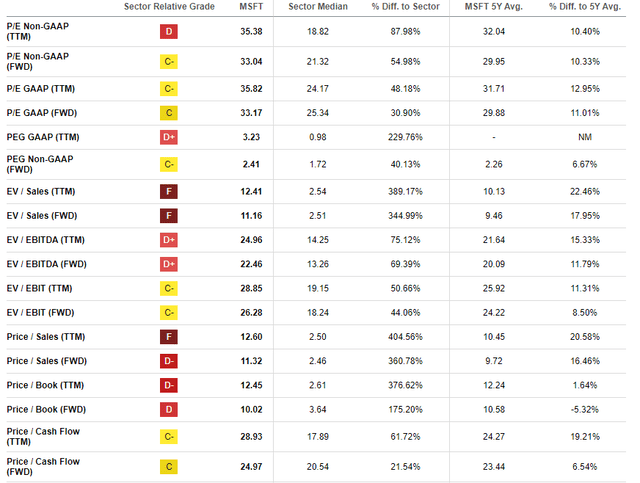

The stock rallied by 53% year-to-date, significantly outperforming the broader stock market and the technology (XLK) sector. MSFT’s current valuation ratios are higher than historical averages across the board, though discrepancies do not look like a significant overvaluation. From the historical multiple perspective, MSFT looks approximately fairly valued.

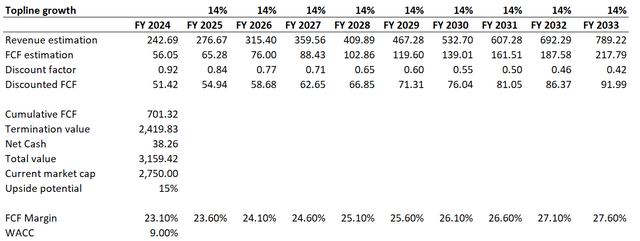

I want to proceed with the discounted cash flow [DCF[ simulation. Given the company’s wide moat and unmatched brand, I use a low 9% WACC for discounting. Revenue consensus estimates forecast an 11% CAGR for the next decade, which I consider too conservative. Given the company’s strong positioning in the fastest-growing technological niches like cloud computing and AI, I prefer to use a more optimistic 14% revenue CAGR for the next decade. I use a 23.1% TTM FCF margin for my base year and expect it to expand by 50 basis points yearly.

According to my DCF simulation, the business’s fair value is approximately $3.2 trillion, which is 15% higher than the current market cap. That said, my target price for MSFT is $421. The upside potential looks attractive to me.

Risks update

Tight monetary policies across the developed world significantly weigh on the global PC market. Demand for Microsoft’s key software offerings is heavily dependent on PC sales. According to IDC, global PC shipments are declining despite sporadic improvements. Spending on PCs heavily depends on the broader economy’s health, which is cyclical. Recession risks are still high for the world’s largest economies, which adds a high level of uncertainty regarding the sustainable recovery of the global PC market.

Given the company’s massive scale and dominant position in the global software market, MSFT faces substantial antitrust scrutiny. For example, the company experienced a tough antitrust fight to complete its $69 billion acquisition of Activision Blizzard (ATVI). As Microsoft’s and Amazon’s dominance in the cloud computing business expands, the controversy regarding anti-competitive practices arises. For example, a month ago, there was news that both companies were to face a UK antitrust probe over cloud services. Having such thorough antitrust scrutiny increases the uncertainty level regarding the company’s ability to expand its reach to new domains further from the regulatory point of view.

Bottom line

To conclude, MSFT is still a “Buy”. The stock is very attractively valued even after a solid year-to-date rally. Recent developments suggest that the company has an unmatched competitive edge to continue driving double-digit revenue growth and expand profitability metrics. I am very optimistic about the company’s positioning in the AI race, and its broad set of products makes it resilient to the current storm.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.