Summary:

- Amazon is a dominant force in various sectors including e-commerce, cloud computing, subscription services, supermarkets, and advertising.

- The company’s most profitable segment is AWS, which generates over $40 billion in revenue with operating margins of over 30%.

- Amazon’s long-term strategy, focus on customer satisfaction, and ability to see opportunities in failures have contributed to its success.

4kodiak/iStock Unreleased via Getty Images

Amazon is one of those companies that is always under the scrutiny of investors. Generally misunderstood, it has received criticism from a large portion of professional investors. Many of them have gone so far as to say that Amazon was a vehicle to send money from Wall Street to consumers’ pockets. On numerous occasions, many of them have indicated that Amazon’s retail business was disastrous and that the company should raise prices to increase its margins and maximize cash flow per share in the short term. What is the response of the founder of Amazon to these criticisms?

We’ve done price elasticity studies, and the answer is always that we should raise prices. We don’t do that, because we believe – and we have to take this as an article of faith – that by keeping our prices very, very low, we earn trust with customers over time, and that that actually does maximize free cash flow over the long term.

This is a type of philosophy that fascinates me. The philosophy of that which is not obvious. Building businesses by doing the opposite of what the vast majority of investors want. Think long-term and ensure sources of growth with a loyal customer base that trusts Amazon and the products and services the company offers.

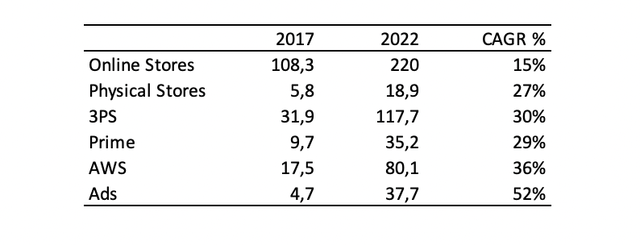

Over time, Amazon has planted various seeds, some have flourished and others have not, that’s business. The key is that those that have flourished have done so much more than those that have withered. The following image is proof of this.

Sales of Amazon’s segments (Own Models)

The evolution of sales in all segments is fascinating, a result of the process of constant reinvestment and the search to keep the consumer satisfied and therefore maximize cash flow per share in the future. Below I explain in more detail my vision of the company’s business lines and how I believe they can evolve in the long term.

Retail business

In the retail business, Amazon has a 40% market share in the US and controls 13% of global GMV transactions. In my opinion Amazon should not suffer in this segment. Firstly, e-commerce sales account for 22% of retail sales internationally. E-commerce still has the capacity to grow and continue stealing market share from physical sales. Secondly, Amazon has managed to gain the trust of consumers and make many customers make it a habit to purchase products on Amazon. Although the beginnings were complicated, the company understood that expanding its logistics network was essential to deliver orders to customers in the shortest time possible. In 2017, Amazon had less than 200 warehouses throughout the United States. At the beginning of 2022, the company had more than 900 (investment in PP&E went from $100 billion in 2019 to $250 billion in 2022). Imagine what investment would a competitor have to make to replicate such logistics infrastructure… In addition to this advantage, Amazon has a differentiating point compared to other e-commerce companies. Their customer loyalty. The two categories of Amazon customers (Prime and non-Prime) have spending statistics that few retailers have. 85% of prime customers visit Amazon once a week, compared to 56% of non-prime customers. Furthermore, 1/3 of visits to Amazon end in a purchase. In the case of prime customers, 50% shop on Amazon at least once a week!

The retail business is not only valuable because of its scale and scope, but also because of the accessory services that Amazon has been developing in parallel. Namely: the 3PS business and digital advertising.

Regarding 3PS: Amazon realized that as they achieved growth, many companies were interested in selling their products through the platform. In exchange for using its ecosystem, Amazon began to charge for the services provided and, in addition, gave the possibility of doing storage and logistics in the company’s own distribution warehouses. In exchange for a percentage of the value of sales, Amazon provides sellers with transaction security and use of its distribution network. This guarantees sellers that distribution will be efficient and that the potential market is expanded when they use the company’s sales network. On the other side, Amazon benefits from other people’s ideas and does not incur the risks of developing a product. A win-win for both parties. If you can’t beat your enemy, join him.

Regarding advertising services: This segment has provided significant growth for Amazon in recent years. Although the main players in the digital advertising market are the giants Meta and Alphabet (through Google and specifically Google Services), the potential of Amazon is higher. This is because consumers’ mindset is in purchasing mode, unlike Google and Meta, where people are in observation mode. How much is it worth promoting a product on a marketplace where the probability of purchase is high? For this reason, advertising on Amazon is more valuable and experiences higher growth than Google and Meta. In a challenging year for digital advertising (2022), where the two giants reported flat results, Amazon grew at a rate of 20%! In addition to all this, operating margins in digital advertising are typically around 40%, so we can estimate that the company is currently generating around $14 billion solely in this segment.

AWS

AWS also possesses the characteristics of a good business, mainly high switching costs and recurring income coming from a fragmented customer base. Currently, there are three major players at scale (Amazon, Microsoft, and Google) fighting to secure a dominant position in the market. It is highly unlikely that new competitors will enter this market. The entry barriers in the form of capital expenditures and the high Mean Time To Profit (MTTP) protect insiders from competition. Since its launch, AWS has grown from zero to a revenue of $80 billion in 2022. The business has expanded, generating profits, and adding new features that increase user value. Margins hover around 30%, although this should not be the focus. The properly formulated question is: will Amazon be able to maintain its customer base in such a competitive landscape with Microsoft or, to a lesser extent, Google? The advantage Microsoft has over AWS or Google Cloud is that the bulk of customers (businesses already digitalized or in the process of digitalization) already have Microsoft’s software. It is much easier to develop cloud strategies through Microsoft because the incremental cost of adopting them is low (vs the cost of replacing everything and sending it to other cloud providers). In addition, users are already familiar with Microsoft’s ecosystem and the and the switching costs are high for those companies that have developed all their cloud services with them. However, this same argument also works for Amazon. Companies that have developed all their databases in the Amazon ecosystem would need to make billion-dollar investments to reverse these changes and not achieve marginal improvements in the long term.

That is why I believe AWS will continue to grow. This growth can come in two ways: attract new customers (it is difficult to compete with MSFT or low-cost providers like Google) or increase the functionalities of the platform, currently focused on generative AI for greater analysis and data processing. This increase in functionalities seeks to increase customer retention and make the long-term relationship more lasting. This reduces terminal value risk and guarantees the durability of the business in the long term. The management team has expressed, regarding AWS, that:

We expect […] increased infrastructure CapEx to support growth of our AWS business, including additional investments related to generative AI and large language model efforts.

Once Amazon’s main lines of business have been understood, it is important to resolve the key question of this analysis: how much is Amazon worth? It is conservative to estimate growth in real free cash flow (operating cash flow – maintenance capex) of around 13% in the coming years. Where does this number come from? I believe that the 3PS, AWS and digital advertising segments will contribute the most to the company’s growth. This is due to greater recurrence of income, greater monetization and greater potential market in the future. Estimates of 15% in the next 5 years are justified for these businesses, due to their oligopolistic nature, advantage vs competitors and tailwinds such as e-commerce, increased digitalization and higher penetration of digital advertising in the market. In the case of online stores, growth will be somewhat weaker since the control that Amazon has over the outcome of this segment is much less than in previous ones. Regarding Prime, its assessment is complex for me. How do you value a service with which Amazon seeks to increase the loyalty of its customers?

Indeed Amazon is a very complicated business to value due to its multiple lines of business and complex accounting. Valuing the company by multiples such as the PE ratio or even preparing a DCF seems difficult due to how erratic the company’s investment dynamics can be. The company’s average ROIC is around 10%, although it is greatly depressed by excessive PP&E acquisition write-downs in recent years. The return on cash (adding depreciation and amortization) is always higher than 20% in recent years. With a cost of capital less than 10%, the value that Amazon generates in the long term (gap between ROIC and cost of capital) is greater than 10%.

Although at current prices the company is far from the expected return that I set, I believe that no investor should sell Amazon due its quality, as well as its culture of reinvestment, innovation and long-term focus. The recent Q3 results show resilience in all segments, with net sales growing 13% and operating profit more than quadrupled in the same period. Reduced fulfillment costs, increased discipline on spending and stronger demand across all verticals helped Amazon recover the profitability that had temporarily lost during the inflation crisis of 2021-2022. These results, combined with the positive long term vision I have about Amazon, make me insist on the fact that any long term investor should consider Amazon for providing growth and stability in the years to come.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

My average mean price on Amazon is around $100, way below the current price of the company. Even though the current price is not extremely high, investors should be cautious when determining the rate of return they demand to investments.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.