Summary:

- Roku’s CEO believes that all TV, including advertising, will eventually be streamed and has positioned itself to capture a sizable portion of that traditional TV ad business.

- Its third-quarter earnings showed robust revenue growth, account growth, and a return to positive free cash flow, leading to a 45% increase in the stock price.

- The company’s streaming app, The Roku Channel, has become a popular platform for advertisers, with high reach and engagement, giving Roku a competitive advantage in the streaming ad market.

JHVEPhoto

Roku (NASDAQ:ROKU) Chief Executive Officer (“CEO”) Anthony Wood said on the company’s third quarter 2023 earnings call that he founded the company with the idea that eventually “all TV, including advertising, is going to be streamed.” The thesis for an investor buying this company is that it can capture a meaningful chunk of the $60 billion a year traditional TV ad business as it transitions to streaming.

The company reported earnings on November 1, 2023, and investors liked what they saw, with Roku showing robust revenue growth, account growth, and a return to positive free cash flow (“FCF”). A week later, the stock hit an intraday high of $86.40 on November 9, 2023, up 45%. Management had a lot of good things to say on the earnings call. Still, they also informed investors that the advertising market is not yet out of the woods. So, while the company may have solid long-term growth potential in the streaming ad market, the short-term could be rocky.

This article will discuss the good, the bad, and the ugly of holding this stock.

It operates one of the most popular streaming channels

Before Roku became publicly traded, it generated most of its revenue by selling streaming devices — an enormously competitive market. It was going head-to-head with Amazon’s (AMZN) Fire TV and Alphabet’s (GOOGL) (GOOG) Google Chromecast, and growth was already beginning to slow.

The company’s S-1 registration statement stated:

We generate player revenue from the sale of streaming players and platform revenue primarily from advertising and subscription revenue share on our platform. We earn platform revenue as users engage with content on our platform and we intend to continue to grow platform revenue by monetizing our TV streaming platform. In the six months ended June 30, 2017, player revenue represented 59% of total revenue and declined 2%, and platform revenue represented 41% of total revenue and grew 91% from the six months ended July 2, 2016.

Source: Roku S-1.

Management probably realized that when it entered the public market, it would eventually have to show Wall Street profitability and that the slower-growing, lower-margin player segment wouldn’t get the job done. The company stated in the S-1 that its business model was to “grow gross profit” and made it evident that it planned to accomplish that by emphasizing its higher margin platform segment. Its S-1 stated, “In the six months ended June 30, 2017, player gross profit represented 19% of total gross profit and declined 28%, and platform gross profit represented 81% of total gross profit and grew 104% from the six months ended July 2, 2016.”

Since advertising makes up most of the platform revenue, it should have been apparent that Roku would primarily monetize its streaming platform via advertising. However, management was initially in a quandary. According to this Variety article, some of the more popular channels on its platform, like YouTube, don’t share ad revenue with Roku. Since it couldn’t strong-arm larger companies like Google to share ad revenue, the solution was for the company to develop its own streaming app to maximize the ad opportunity. Thus, The Roku Channel (“TRC”) was born in September 2017, the same month Roku had its Initial Public Offering.

TRC has become a jumping-off point for viewers to discover captivating free and premium content on Roku, with over 350 live channels, Roku Originals, Sports, Popular Movies, Children’s Entertainment, and more. For advertisers, it has become an excellent forum for placing ads and a source of rich user data. For Roku, TRC has become the golden goose of the platform. In the third quarter, the company reported, “The Roku Channel was again a top-five app on the platform by both reach and engagement, with Streaming Hours up more than 50% year-over-year.” Roku’s CEO added during the earnings call that TRC’s engagement is “comparable to the engagement of apps like Paramount Plus, Peacock, and Max.”

Reach measures the number of unique individuals who have seen a marketer’s advertisement — a critical metric for advertisers. A streaming app that has a high reach indicates that a marketer’s ad campaign has reached a large number of its target audience. Additionally, the higher an app’s audience engagement, the more valuable it becomes for advertisers because they know it will provide access to an audience actively consuming and interacting with content. Streaming Hours are an engagement number. When advertisers see TRC’s streaming hours rapidly climbing, it becomes an even more desirable destination to place ads.

Here you might ask, “What competitive advantage does TRC have over streaming apps like Paramount Plus, Peacock, and Max?” The answer is that Roku has a significant strategic advantage by being the largest U.S. streaming platform. The company uses its content recommendation system to steer users toward content appearing on TRC. Anthony Woods said the following on the earnings call:

We promote content that’s in The Roku Channel in our user interface when they’re deciding what to watch. And so, that position in the viewer journey is a big competitive advantage and allows us to grow the scale and engagement in The Roku Channel with much smaller content budgets than other companies that have similar scale have to spend in order to reach that sort of — in order to achieve that kind of reach. And so, it’s a big competitive advantage in our business model.

Source: Roku Third Quarter 2023 Earnings Call.

However, even with that advantage, management is very serious about building a more robust programming slate and expanding advertising on TRC. In 2022, the company hired veteran TV executive Charlie Collier, the man behind hits such as “The Walking Dead,” “Mad Men,” and “Breaking Bad” when he was President of AMC. He was also head of Fox Entertainment and guided that company’s acquisition of Tubi. Collier began his TV career on the advertising side and eventually worked himself up to be the head of Court TV’s advertising unit. Roku is a relatively new content distribution and advertising player and may have yet to earn much respect. With Collier at the helm, the company hopes the entertainment and advertising industry takes it much more seriously. If you are a Roku investor, it is vital to monitor the progress of Collier’s efforts to create better original programming and bring more advertisers to TRC.

Revenue growth returns in 2023

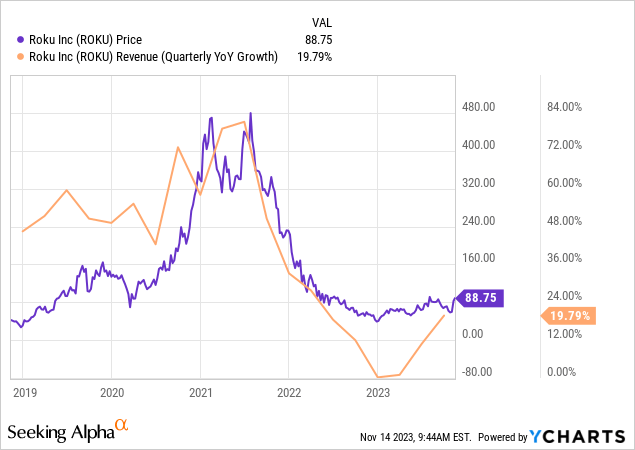

The post-pandemic problems for Roku began as quarterly year-over-year revenue growth peaked at 81% in the second quarter of 2021. The company’s revenue growth is highly dependent on the growth of the digital advertising market. According to PricewaterhouseCoopers, the digital ad market grew 35.4% in 2021 and rapidly decelerated to 10.8% in 2022. One analyst projects digital advertising to only grow 7.8% in 2023. Between its active account growth beginning to slow in 2021, high inflation diminishing the economy, the Federal Reserve jacking up interest rates, and digital advertising backing off its high growth rates in the pandemic aftermath, Roku’s revenue growth fell off a cliff in the second half of 2021 into 2023, and the stock price imploded.

Revenue growth appears to have bottomed out in the first quarter of 2023 when the company reported 1% revenue growth. When management recently reported third-quarter 2023 revenue of $912 million, up 20% over the previous year’s comparable quarter, Roku investors rejoiced because it appeared that the worst of the downturn was over. Total revenue growth reaccelerated because platform revenue, primarily advertising, rose 18% year-over-year, recovering from the first quarter this year when platform revenue shrank 1% from the comparable quarter in 2022. Roku’s President of Media, Charlie Collier, included language on the third quarter’s earnings call that gave investors hope that advertising was recovering when he said:

We saw a continued rebound in video advertising from second quarter into third quarter. And in third quarter, year-on-year growth of video advertising on Roku actually outperformed the overall ad market and the linear ad market in the U.S.

Source: Roku Third Quarter 2023 Earnings Call.

Collier later added, “I fully expect the year-on-year growth rate of video ads in fourth quarter to be similar to third.” Since media analysts believe digital media advertising is rebounding, things are looking up for Roku. On another positive note, the company continues to capture more users. Active accounts grew 16% year-over-year in the third quarter to reach 75.8 million active accounts globally, with growth driven by robust growth internationally and solid growth still occurring in U.S. markets despite the platform’s numbers approaching half of the broadband households in America. As the active account numbers increase, the more viewers Roku can reach with its ads, the more advertisers are willing to pay to get that larger audience.

On the path to profitability

In the first quarter of 2023, the previous Chief Financial Officer (“CFO”), Steve Louden, told investors that the company intended to lower operating expenses (“OpEx”) year-over-year growth to single digits by the fourth quarter of 2023 — something that it needed to do. After all, the company had grown its OpEx by over 70% in the fourth quarter of 2022, which was utterly unsustainable when you think about it. In September, the company announced a recent initiative to cut costs that involved slashing 10% of its workforce and shutting down a few offices. Through these measures, it plans to achieve positive EBITDA (Earnings before interest, taxes, depreciation, and amortization) in 2024. The good news for investors is that these efforts appear to be paying off. CFO Dan Jedda said:

Turning to OpEx, we anticipate Q4 year-over-year growth in the negative mid-teens, a significant improvement from OpEx year-over-year growth of approximately 70% in Q4 of last year. We will continue to operate our business with discipline to defend margins with a focus on driving positive free cash flow over time. Additionally, we remain committed to achieving positive adjusted EBITDA for full-year 2024 with continued improvements after that. We will balance this commitment with investments to further expand our scale, engagement, and monetization.

Source: Roku Third Quarter 2023 Earnings Call.

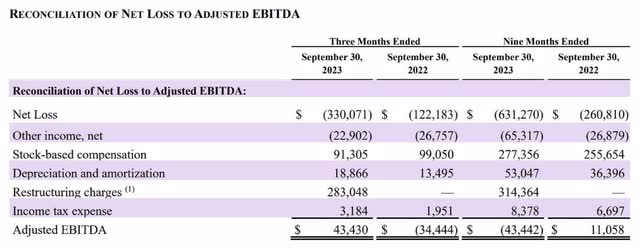

This focus on profitability is music to investors’ ears, as the company has rarely achieved profitability or positive free cash flow (“FCF”) since coming public in 2017. It focuses on adjusted EBITDA as a measure of profitability rather than net income because despite the company being around for a while, it is still a relatively early-stage company that still has a lot of non-cash items, such as depreciation and amortization, as well as one-time events that negatively impact its income statement. Adjusted EBITDA excludes these items, giving investors a clearer picture of Roku’s core profitability.

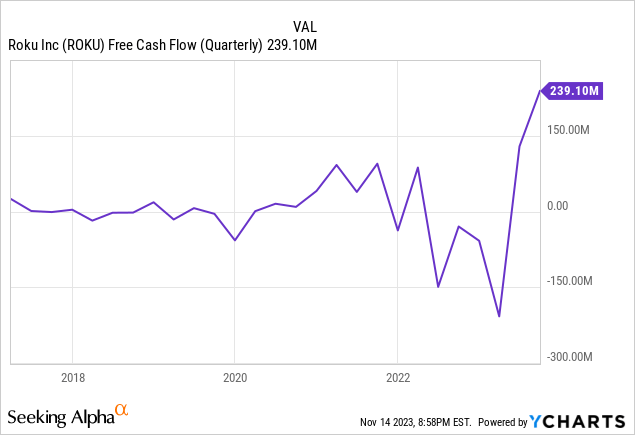

The company reported a third-quarter 2023 adjusted EBITDA of positive $43 million. The CFO attributed that “better than expected” number to “strong top-line growth along with cost reductions and measures we announced in September to further reduce our year-over-year OpEx growth rate.” He also forecasts a positive adjusted EBITDA of $10 million for the fourth quarter. So, the company is ahead of schedule in generating positive EBITDA. Roku also produced a positive FCF of $239 million, the highest in its history as a public company. This rise in FCF was another reason the stock exploded higher post third-quarter earnings.

If the company can continue to grow revenue, profitability, and FCF, the stock will continue to rise.

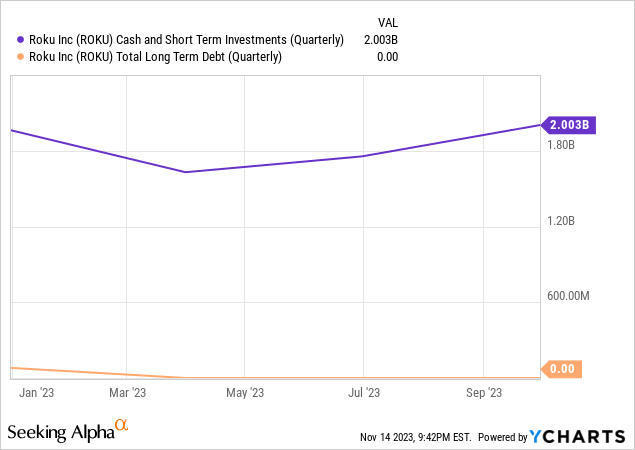

A solid balance sheet

One huge thing that goes in current Roku investors favor is they don’t have to worry about the company collapsing overnight. At the end of the September quarter, it had $2 billion in cash and short-term investments against no long-term debt.

The company has a current ratio (Liquidity ratio) of 2.46 and a quick ratio of 2.37. When these numbers are above 1.0, it indicates that the company can pay off its short-term debt.

The potentially bad and the ugly

In the short term, the economy is not out of the woods yet. Although management believes advertising is on the comeback trail, it sees ad growth limited to specific sectors of the economy. In addition, other parts of the Platform segment face headwinds in the fourth quarter. The CFO warned investors:

We remain cautious amid an uncertain macro environment and an uneven ad market recovery. Ad verticals like CPG [Consumer Packaged Goods] and health and wellness continue to improve, while verticals like financial services and M&E [Media & Entertainment] remain challenged. Additionally, we will face difficult year-over-year growth rate comparisons in content distribution and M&E, which will challenge the year-over-year growth rate of platform revenue in Q4.

Source: Roku Third Quarter 2023 Earnings Call.

Management has every right to be unsure of the economy and the advertising market; it gave cautious guidance for the fourth quarter of $955 million, up 10% year-over-year. It should be interesting to see how much revenue growth the company will ultimately achieve because some Roku bears believe it lacks operating leverage in its business model. In plain English, Roku may fail to generate solid revenue growth without investing lots of money. These investors fear that if Roku reduces OpEx, revenue growth will drop in the face of fierce competition. And if it raises operational expenses, they fear the company might not generate enough revenue beyond the increased costs to achieve lasting profitability. We will see in future earnings reports whether Roku’s cuts to OpEx will result in lackluster revenue growth.

Another risk is competition. Roku may have some advantages against competitors in the streaming business. Still, it is vital to remember that there are low barriers to entry in streaming, and the company is in a David against Goliath struggle. It battles Google, Apple (AAPL), and Amazon on the hardware and content sides of the Connected TV market. These well-known competitors of Roku each have over a $1 trillion market cap compared to Roku’s comparatively tiny $12 billion market cap. The worry is these far larger companies have far more resources and might eventually overwhelm the upstart.

The company is also in a delicate position. The Roku platform is popular with users because it has the broadest assortment of streaming channels. When the company started, many streaming channels viewed it favorably as a neutral platform. Yet, today, it also competes against other streaming media on its platform by battling for users’ attention and advertising dollars using its popular The Roku Channel (“TRC”). When Roku bought the failed streamer Quibi and began developing original content for TRC, it started competing with streaming channels from Disney (DIS), Netflix (NFLX), Apple, and more on the original content battleground. The problem for the company is that if it loses its Switzerland platform status by TRC becoming too competitive with other streamers, those streaming companies may eventually move to other platforms. Alternatively, TRC has become an attractive revenue generator for the company, and it’s in the company’s best interest to grow the channel to capture a more significant portion of ad dollars. It will be interesting to see how well it can maintain this balancing act.

Similarly, Roku now competes with its TV manufacturer partners. The Roku Operating System (“OS”) for TVs first became famous through partnerships with TV manufacturers like TCL (OTCPK:TCLHF), Sharp (OTCPK:SHCAY), and Hisense, which have licensed Roku’s OS and branding for TVs. However, Roku recently started manufacturing its own TVs and competing against its TV manufacturer partners, and some TV manufacturers have begun licensing other OS platforms. For instance, TCL now also manufactures TVs using Android for Google TV. One risk for Roku is if its TV manufacturer partners focus more on making TVs for competing platforms and Roku-manufactured TVs fail to gain traction in the market.

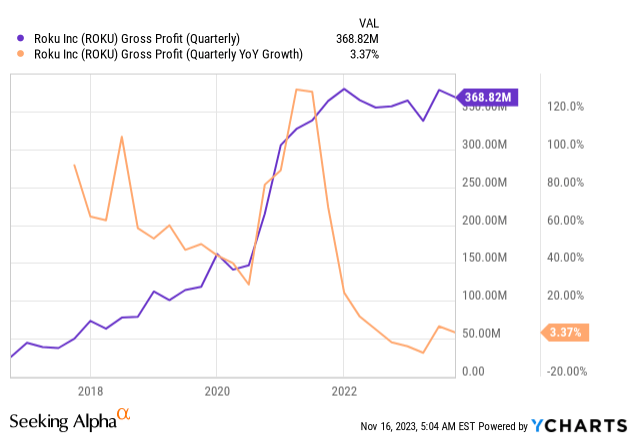

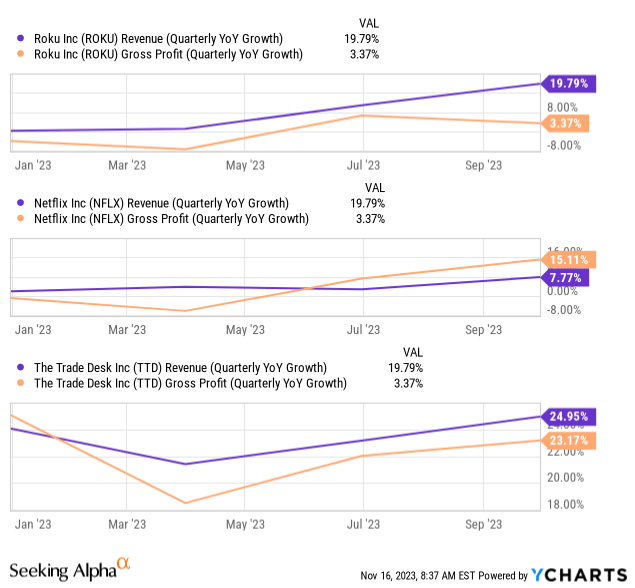

The last significant risk investors should be aware of is the gross profit growth, which the company has emphasized since releasing its S-1 in 2017; it suddenly decelerated at the end of 2021 and into 2023, as seen in the chart below.

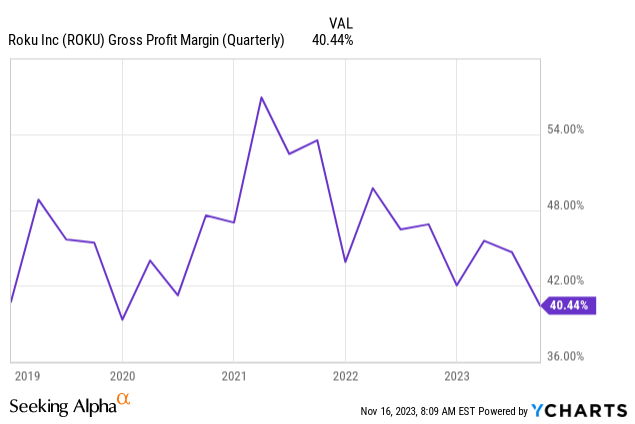

Additionally, gross margins have dived. In 2021, Roku recorded gross margins well above 50%, but in the third quarter, the gross margin sank to 40.4%, as seen in the chart below.

If you listen to the third quarter earnings call, the CFO attributes the gross profit and gross margin decline to restructuring and impairment charges. He said gross profit would have increased 22% over the previous year’s comparable quarter without these charges. However, what is worrying is that the one-time restructuring and impairment charges only account for gross profits and gross margin dropping quarter-over-quarter. It doesn’t account for gross margins dropping over 1000 basis points since 2021. Nor does it account for the steep decline in year-over-year gross profit growth rate starting in 2021. The chart below compares Roku, Netflix (NFLX), and The Trade Desk’s (TTD) revenue growth and gross profit growth.

While Roku doesn’t need to grow gross profits faster than revenue like Netflix, ideally, revenue growth and gross profit growth should be much closer, like The Trade Desk, indicating that the company is effectively converting its revenue into gross profit, which is essential for long-term sustainability. The considerable gap between Roku’s top-line growth and gross profit growth is worrying if it continues, and it is something investors should monitor. Even if Roku reaccelerates and achieves robust revenue growth in the next several years, the stock may not rise much if gross profits and bottom-line profits only move higher at a snail’s pace.

Valuation

Roku has a GF Value of $115.14, or 31% above the stock’s November 14, 2023, closing price of $88.10. So, the stock appears undervalued. A GF value is a proprietary calculation using “historical multiples, past returns and analyst estimates” to calculate fair value, according to Gurufocus. However, the company has a Piotroski F-Score of two, which is terrible. Some investors use this score to measure a company’s fundamentals, and some consider it a terrific way to identify value traps. This poor score also aligns with Seeking Alpha analyst Dair Sansyzbayev’s view in an article published on October 23, 2023, that Roku’s financials are weak. In the same report, he gave a Discounted Cash Flow fair value calculation for the stock of $55, which is 38% below the stock’s November 14, 2023, closing price.

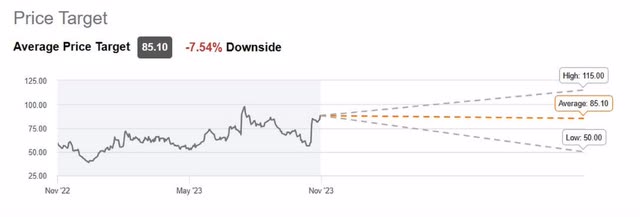

The above chart shows Wall Street analysts’ consensus one-year price target for Roku as $85.10, which has approximately 8% downside. Seeking Alpha Quant gives the company a valuation rating of F.

Finally, on November 14, DA Davidson speculated that Roku could be an “attractive takeout target.” They added, “Roku could have a valuation of roughly $13.7B (compared to a current market cap of around $12.5B), using historical takeout multiples.” If you divide $13.7 billion by Roku shares outstanding of 141,877,000, it equals a stock price of $94.56, only about 4% above the November 15 closing price of $91.1.

Is it a Buy, sell, or hold?

In my opinion, the stock doesn’t have enough upside at this point to buy it because of takeover rumors. Roku is up 124% for the year as of November 15, recently had a massive run since earnings, and the short term could be volatile. Risk-averse investors would be better off if they avoided buying this stock at current prices. However, the company has enough long-term potential upside that if you already hold shares, it may be worth keeping them for the next three to five years as the economy and ad market fully rebound. I recommend Roku as a Hold.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ROKU, GOOGL, AMZN, TTD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.