Summary:

- Despite the rising borrowing costs, RIVN continues to report growing production/ delivery trends and improving gross margins over the past few quarters.

- Most importantly, the automaker has been able to command an impressive Average Selling Price of $85.92K (-3.1% QoQ/ +5.4% YoY), implying the robust demand for its premium offerings.

- We expect FQ4’23 to bring forth excellent numbers as well, due to the raised FY2023 production guidance of 54K units, compared to the previous 50K guidance in FQ4’22 earnings call.

- Unfortunately, RIVN has not and is unlikely to achieve profitability over the next few years, implying its sustained trend of cash burn, share dilution, and debt reliance.

- As a result, investors that add here must also temper their near-term expectations, while sizing their portfolios according to their risk appetite.

hapabapa

We previously covered Rivian Automotive (NASDAQ:RIVN) in August 2023, discussing its improving margins and expanded production/ delivery numbers, demonstrating the stock’s compelling investment thesis despite the uncertain macroeconomic outlook.

While we had rated the stock as a Buy then, we had also urged patience and iterated a recommended entry point of $15s for an improved margin of safety.

In this article, we will be discussing RIVN’s high growth trend across its financial and production/ delivery results, further building upon its outperformance over the past two quarters. Combined with the deep pullback observed in its stock prices, we maintain our buy rating.

The RIVN Stock Is Cheap Here, Given Its High Growth Trend

For now, RIVN has delivered a double beat FQ3’23 earnings call, with revenues of $1.33B (+18.7% QoQ/ +149.4% YoY) and adj EPS of -$1.19 (compared to FQ2’23 levels of -$1.08 and FQ3’22 levels of -$1.57).

Despite the rising average interest rate for auto loans on new cars at 7.51% in September 2023 (+0.11 points QoQ/ +2.35 YoY), compared to 2019 averages of 4.63%, the automaker has been able to record expanding deliveries of 15.56K units (+23.1% QoQ/ +136.4% YoY) as well.

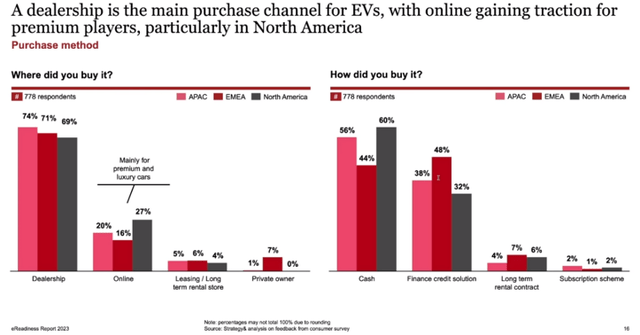

EV Financing Method

Most importantly, RIVN has been able to command an impressive Average Selling Price of $85.92K in the latest quarter (-3.1% QoQ/ +5.4% YoY) and improving gross margins of -35.7% (+1.1 points QoQ/ +135.4 YoY) as its Normal factory improves its production scale.

This further lends strength to PWC’s automotive survey results, in which 60% of the North American consumers choose to fund their EV purchases by cash, as compared to 32% whom use loans.

The gap between RIVN’s production and delivery has also been narrowing to 4.6% (-5 points QoQ/ -5.9 YoY) by the latest quarter, albeit with an elevated inventory of $2.53B (+17.1% QoQ/ +169.1% YoY).

We expect FQ4’23 to bring forth excellent numbers as well, due to the raised FY2023 production guidance of 54K units (+121.8% YoY), compared to the prior guidance of 52K (+113.6% YoY) in the FQ2’23 earnings call and 50K guidance in the FQ4’22 earnings call (+105.4% YoY).

Combined with the ongoing upgrades, it appears that the automaker’s long-term production guidance of 150K annually is not overly aggressive as well.

In addition, we may see RIVN generate improved top-line moving forward, thanks to the conclusion of its electric van exclusivity contract with Amazon (AMZN). This may allow the former to directly compete with Ford’s (F) Transit and General Motors’ (GM) BrightDrop models.

For example, F has already delivered 5.91K units of E-Transit (+14.7% YoY) and 106.19K of Transit (+34.4% YoY) YTD, implying a robust market demand for ICE/ electric delivery vans.

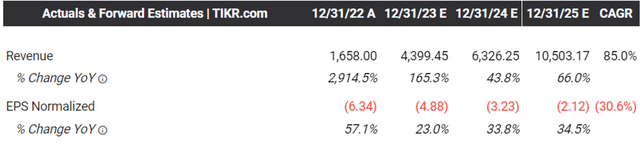

The Consensus Forward Estimates

As a result, we are not surprised that the consensus still estimates that RIVN may generate an impressive top-line growth at a CAGR of +85% through FY2025.

This is compared to its historical revenues of $55M in FY2021 and $1.65B in FY2022, since the company only began to produce and deliver vehicles in September 2021.

Unfortunately, RIVN has not and is unlikely to achieve profitability over the next few years, as similarly reflected in its financial report:

We are a growth stage company with limited operating history and a history of losses and expect to incur significant expenses and continuing losses for the foreseeable future.

With that information out of the way, readers whom continue to read are likely highly convinced RIVN investors, especially made more attractive by the deep pullback.

Nevertheless, a word of caution.

While the automaker may boast a robust net cash position of $6.41B (-14.4% QoQ/ -46.8% YoY), otherwise approximately $7.91B (if we are to include the $1.5B green convertible senior notes), its lack of profitability over the next years implies a sustained trend of cash burn, share dilution, and debt reliance.

RIVN Valuations

For now, since RIVN has yet to report profitability, the only metric we may use to measure its valuation is its FWD EV/ Sales of 2.01x.

When compared to the sector median of 1.10x and legacy automakers, including Ford (F) at 0.93x/ General Motors (GM) at 0.78x, it appears that the RIVN stock may be trading at a premium valuation.

However, we believe that RIVN is actually cheap here, when compared to its US-based EV peers, including Tesla (TSLA) at 6.84x and Lucid (LCID) at 10.52x.

This is especially given the former’s high growth sales projections through FY2025, compared to TSLA’s FWD CAGR of +21.8% and LCID’s at +84.5%.

So, Is RIVN Stock A Buy, Sell, or Hold?

RIVN 1Y Stock Price

Based on the chart above, it is apparent that RIVN has returned most of its hyper-pandemic gains, with the stock currently retesting its critical support levels of $15s.

Given the lower lows and lower highs since the July 2023 peak, it is not overly bearish to assume another retest of its all-time low of $12s, implying a -19.6% downside from current levels.

On the one hand, due to the optimistic factors discussed above, we are choosing to bullishly rate RIVN as a Buy here, since the stock has already returned to our previous recommended accumulation range of between $15 and $17.

On the other hand, with a short interest of 15.68%, the stock may remain volatile for the foreseeable future, depending on when the Fed pivots, market sentiments improve, and cost of borrowings moderate.

Therefore, investors that add here must also temper their near-term expectations, while sizing their portfolios according to their risk appetite.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.