Summary:

- Microsoft is a dominant technology company with strong revenue growth and a solid management team.

- The company’s cloud business is the largest revenue driver, with significant growth potential and high gross margins.

- Microsoft’s investments in AI integration, such as Copilot, have the potential to drive higher revenue across its suite of products.

Yuriy Komarov

Investment Thesis

I cannot find any company with a more enviable market position than Microsoft (NASDAQ:MSFT).

The growth and opportunity in its Cloud and AI businesses and its revenue durability, structural tailwinds, and management team are unmatched.

While its current valuation is preventing me from giving it a ‘Strong Buy’ rating, there is not another stock I want to own more.

About Microsoft

Microsoft is a technology company that provides consumer and enterprise software, cloud computing, artificial intelligence solutions, and consumer electronics.

Shares are trading around $375. Here’s a look at its 5-year price history:

StockAnalysis.com

Microsoft reported Q1 FY24 earnings on 10/24:

-

Revenue: $56.5 billion (up 12% YoY)

-

Profit: $22.3 billion (up 27% YoY)

As expected, Microsoft’s cloud business became the largest revenue driver after growing 19% YoY, while its LinkedIn and Office business grew 13% YoY.

Revenue

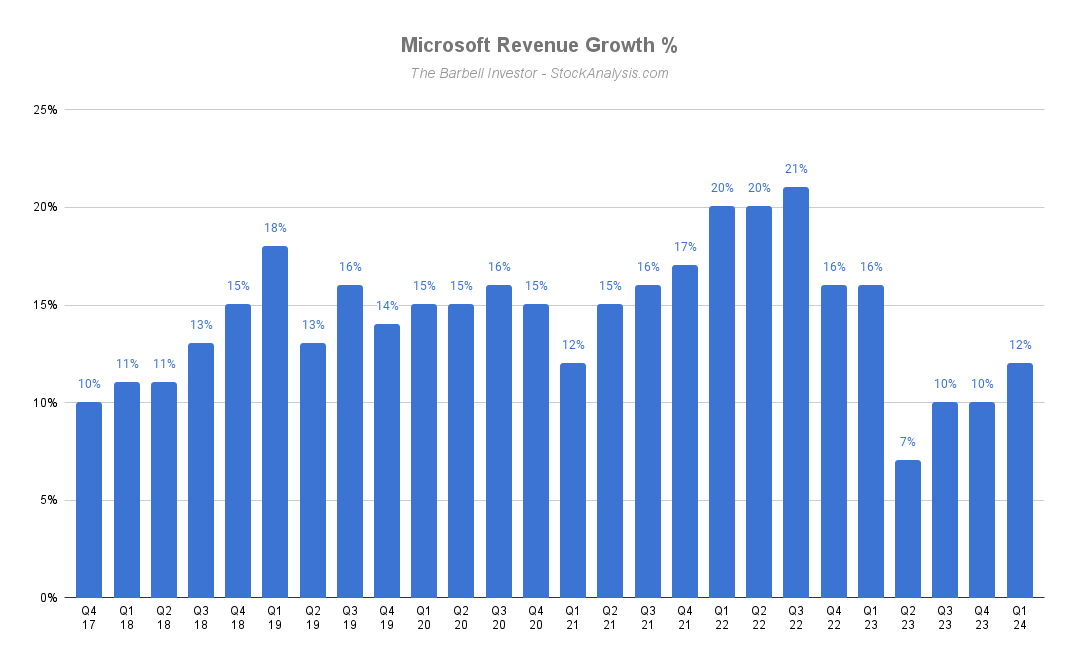

Let’s start by zooming out on the last 7 years where Microsoft, a $2.56 trillion company, has reported double-digit revenue growth in 25 of the last 26 quarters:

The Barbell Investor – StockAnalysis.com

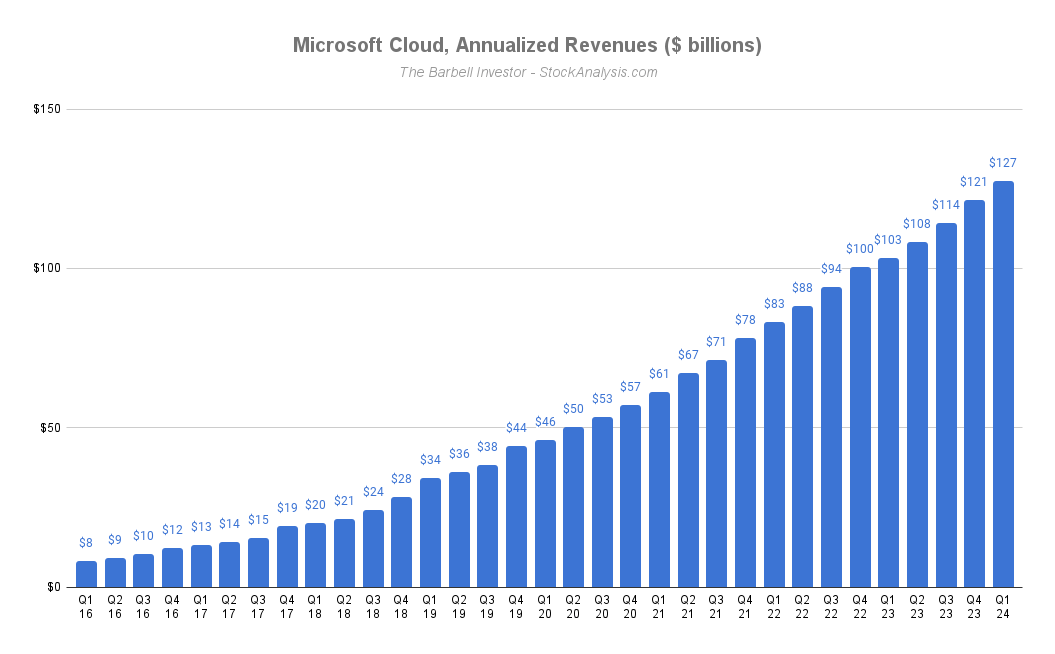

The primary driver continues to be Microsoft Cloud. When Satya Nadella became CEO in 2014, the commercial cloud business generated less than $5 billion in annualized revenue. A year later, management set a goal of $20 billion in annualized revenue by the end of FY18.

They exceeded that target by a wide margin and have been growing wildly ever since:

The Barbell Investor – StockAnalysis.com

As of Q1 FY24, Cloud’s annualized revenue is now ~$127 billion, more than Microsoft’s total annual revenue in FY19 (~$126 billion). Moreover, Cloud has more than doubled in size over the last 3 years and now, as of this quarter, accounts for the majority (56%) of total revenue.

In addition to the roughly 30% revenue CAGR, Cloud’s gross margins have climbed from 59% to 72% since Q1 FY19. As a result, Cloud’s gross profits reached $93 billion last quarter, a 5x increase since the end of fiscal year 2018 (~$16 billion).

Simply put, Microsoft Cloud is a best-in-class competitor operating in a market with strong structural tailwinds and a massive total addressable market.

“It remains early when it comes to the long-term cloud opportunity.” – Satya Nadella, CEO (Q1 FY24)

I’m highly confident this will be an even stronger business 5 years from now.

While Cloud is the main story here, Microsoft is also the market leader in a number of attractive markets. In fiscal year 2022, its revenue came from:

-

Office products and services: $45 billion (23%)

-

Microsoft Cloud: $44 billion (22%)

-

Windows: $25 billion (12%)

-

Server products: $24 billion (12%)

-

Xbox: $16 billion (8%)

-

LinkedIn ads: $14 billion (7%)

-

Search ads (Bing): $12 billion (6%)

-

Enterprise services: $8 billion (4%)

-

Other: $6 billion (3%)

The vast majority of Microsoft’s revenue mix is sold at the enterprise level to businesses – who are willing to pay more and have the ability to keep paying even during recessions, unlike consumers – and it’s recurring, which is better than one-off purchases because every customer “buys it again” every year. These two characteristics make Microsoft’s business incredibly durable.

Speaking of, Microsoft recently made big investments in OpenAI, now owning 49% of the business, and has been working on integrating OpenAI’s technology into its products. These integrations, known as “Copilot,” are projected to cost around $30 per user.

While it’s still early, Microsoft’s Copilot (AI integrations into its products) should drive significantly higher revenue across its entire suite of professional and consumer products.

“With copilots, we are making the age of AI real for people and businesses everywhere. We are rapidly infusing AI across every layer of the tech stack and for every role and business process to drive productivity gains for our customers.” – Satya Nadella, CEO (Q1 FY24)

The best example of this to date is GitHub Copilot which costs $10-20 a month and has surpassed one million paid users just 18 months after launch. Why the craze?

“GitHub Copilot is fundamentally transforming developer productivity, helping developers complete coding tasks 55 percent faster.” – 2023 annual report

There are more than 100 million GitHub developers.

And beyond developers, Copilot will be rolled out to Office 365 in the near future, of which there are 345 million paid members. I don’t think it’s overstating it to say that Microsoft is in a league of its own regarding AI and AI integration, which should lend itself to an ever-widening moat.

Remember, Microsoft is planning to upsell each Microsoft Office Copilot subscription for $30 per month, on top of the existing prices. Assuming this increases employee productivity, even by just a few percentage points, these will be no-brainer investments for enterprises. In fact, Microsoft will probably be able to raise the prices for the AI add-ons significantly over time – especially as the AI gets better.

If 100 million Office users unlock one Copilot each, that would add $36 billion in recurring revenue to Microsoft’s top line.

Despite Microsoft’s >$200 billion in annual revenue, many parts of its business still seem to be in the early innings.

Growth Forecast

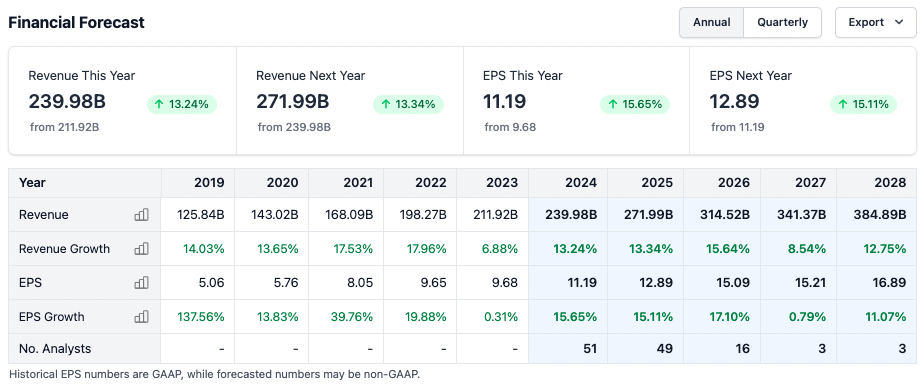

Wall Street analysts are projecting strong top- and bottom-line growth through 2028:

StockAnalysis.com

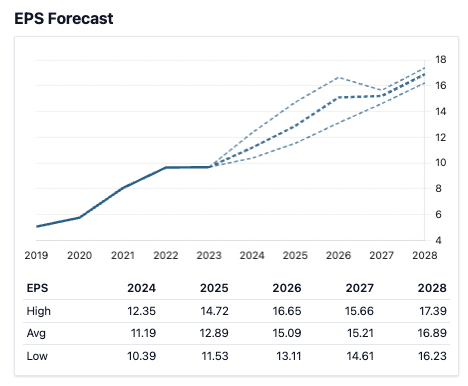

And zooming in on its EPS projections:

StockAnalysis.com

Growth in Cloud, Copilot, Office – it all adds up to great forecasts.

Risks

The main risk with an investment in Microsoft is the threat of competition.

If Google Cloud and/or Amazon AWS steal market share from Microsoft Cloud, its revenue projections could see a large decrease which would trigger a reduction in its valuation multiples (and stock price). Similarly, if Apple or another company released another productivity ecosystem to challenge Office 365 and Exchange, it could pose a threat to Microsoft’s business.

These are threats I’m monitoring but, at this point, these are purely hypothetical. Microsoft is the 800-pound gorilla with a 180 IQ.

Valuation

Microsoft is priced at a premium, which is reasonable given its growth prospects and the strength of the underlying business:

-

Forward P/E: 29.9x

-

PEG: 2.27x

-

EV/FCF: 38.81x (at a FCF margin of 29%)

Here’s a chart that compares Microsoft to its peers:

|

Microsoft |

|

Amazon |

Meta |

Tesla |

Apple |

NVIDIA |

|

|

EV/EBITDA |

21.9x |

15.71x |

19.84x |

15.89x |

37.48x |

20.59x |

77.48x |

|

PEG |

2.31x |

1.44x |

1.85x |

1.03x |

3.81x |

2.6x |

3.29x |

|

P/FCF |

39.75x |

20.1x |

65.16x |

20.49x |

170.68x |

26.44x |

97.57x |

|

5-year Rev CAGR |

13.94% |

18.5% |

20.92% |

19.97% |

47.03% |

8.51% |

22.44% |

|

3-year EPS CAGR |

18.89% |

27.57% |

-0.96% |

1.45% |

200.38% |

21.81% |

44.84% |

I wouldn’t call it a bargain – the expectations are high. At these levels, the premium valuation is a bit of a concern, though its Cloud and Copilot businesses, along with the strength in its core offerings, justify a high multiple.

For me, 22x 2027e EPS (~$335 per share) would be a price I’m more excited about. Anywhere below $320 per share would incline me to move MSFT from a ‘Buy’ to a ‘Strong Buy’ rating.

Conclusion

Microsoft is my favorite position in my portfolio. It is a great business with a great management team. Historically, I may have been tempted to trim a position like this due to its somewhat lofty valuation, but I’ve decided to give this position plenty of “leash” to reflect my long-term bullishness.

As I have stated in my investment philosophy:

“Undoubtedly, a great business with a long reinvestment runway being operated by a skillful management team should demand a similarly rare valuation.

Additionally, I’m focused on long-term value creation. When valuing great businesses, today’s valuations pale in comparison to tomorrow’s revenue, EPS, and FCF.”

Microsoft is a very rare business. And it’s a stock I can’t not own.

Still, the market has priced put a premium price on Microsoft. If I did not already own shares I would have a hard time buying at ~$375 with any size over “dipping my toe in.”

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.