Summary:

- Tesla, Inc.’s potential outcomes have become clearer and the range of outcomes has reduced considerably.

- Strong fundamental and technical momentum has contributed to Tesla’s success in recent years.

- However, market saturation, unionization, and valuation concerns pose very serious risks for Tesla’s future growth and profitability.

- Trim stakes, or sell out and rotate into other stocks and businesses that have better economics than Tesla’s core auto manufacturing vertical.

Xiaolu Chu

Ah, Tesla, Inc. (NASDAQ:TSLA).

Despite having strong feelings – in both directions – about this automaker over the last few years, we’ve never published our feelings on the stock, despite following it closely.

Why?

In short, the number of potential outcomes for the company has, up until recently, remained too large to wrap our arms around.

In 2017-2021, the picture was foggy. Could this upstart automaker take over a large portion of the global auto trade by 2030? Sure. It could also be out of business.

Sometimes, we feel comfortable writing on a stock with a large potential variance in outcome if we feel like we know the market better than most. You can see this in articles we’ve published about Coinbase (COIN), a company which has a large range of potential outcomes over the next few years.

However, understanding Tesla has eluded us due to the nature of the business, and a lack of confidence on our part in understanding Tesla’s total addressable market, or TAM.

It’s easy to forget, but during the mania in 2021 as many investors struggled to understand why the stock was trading at a 26x revenue multiple, a common refrain from bulls was that “Tesla is not just a car company.”

As Tesla has matured, the company has gotten into a rhythm, and we feel more comfortable now understanding the stock.

The range of outcomes has also been reduced considerably.

The company’s solid cash position and excellent products have all but removed chapter 11 from the menu of options. However, despite the company’s best efforts, Tesla firmly remains an automaker. The company isn’t the singular energy / transportation titan of the future; it will simply remain a piece of the global pie.

Thus, with that in mind, today we thought we’d take a sober look at the company to try and figure out whether or not the stock is a buy at the present valuation.

If you’re short on time – we don’t think it is.

Important Trends

As we’ll cover over the next few sections, there are four, strong trends at play that will affect the stock price of Tesla going forward.

Where you land on the spectrum of “Buy” to “Sell” is simply a function of how heavily you weight the impact of these trends.

On the bullish side, you have two key factors:

- Strong Fundamental Momentum

- Strong Technical Momentum.

On the bearish side, you have two key considerations:

- Saturation / Unionization

- The Valuation.

Let’s examine each of these in more detail.

Strong Momentum

There’s no denying that Tesla has done well over the last few years.

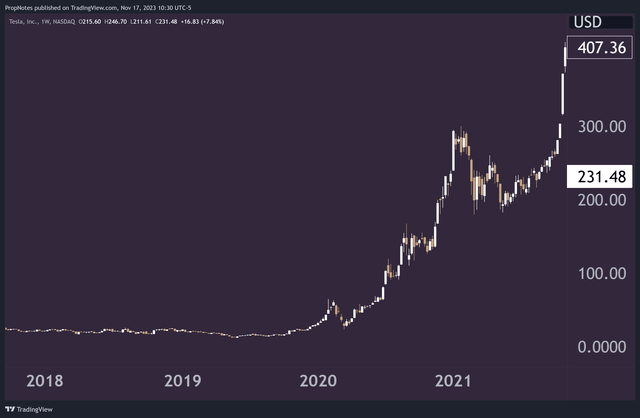

Since the company broke out from its price base right before Covid, the stock has gone on one of the most unbelievable runs – trading from (post-split) $12 to ~$407, a massive 3,300%+ run:

This has been accompanied by a massive run in the company’s underlying financial results.

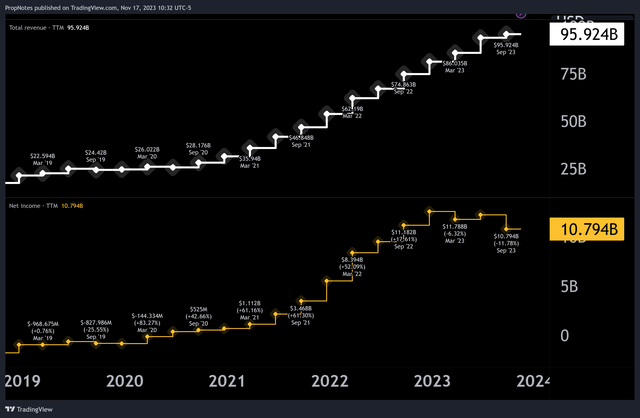

Since 2019, Tesla’s top line has grown from $21 billion to nearly $100 billion, an almost 5x increase, and net income has exploded from ~$1 billion in losses to nearly $11 billion in net profits:

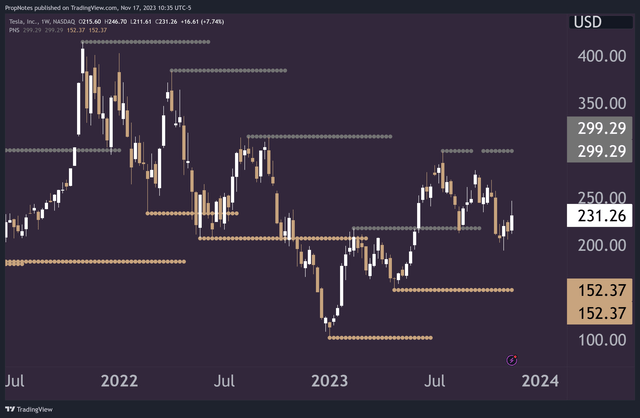

As net profit growth has slowed to basically nothing over the economic slowdown and inflationary period in 2022 and 2023, the stock has come in somewhat, dropping to $100 a share – a 75% decline from 2021 highs:

However, year-to-date, the stock has recovered, trading back up into the middle of the aforementioned range. The stock has also begun making new highs and new lows (as evidenced by the pivot points above), which contrasts with the negative price structure experienced in 2022 that saw lower highs and lower lows.

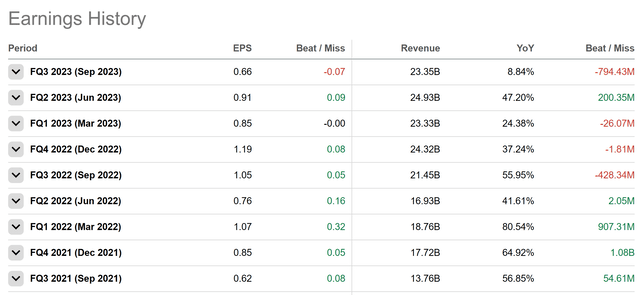

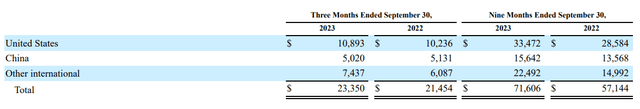

Financially, momentum has also remained relatively strong. Despite historically high inflation and a terrible consumer environment, Tesla managed to eke out 9% top line YoY sales growth, which pales in comparison to previous years, but tops weaker results from peers:

Going forward, we think that there is a probability that the company will continue its strong momentum. Tesla’s product lines are well loved by drivers, and the stock’s momentum is evidence that investors are still giving the company their vote of confidence.

Saturation / Unionization

If you think the company will continue to grow and deliver strong results, then you’re like going to write off these next two sections – but hear us out.

There are some things about Tesla that are unique in the U.S. auto industry:

1.) It’s the only major U.S. automaker that isn’t unionized.

2.) It’s the only major U.S. automaker that hasn’t historically spent money on advertising.

3.) It’s the only major U.S. automaker that produces auxiliary products in additional verticals (Solar tiles, battery packs, dojo chips, etc.)

While some of these aren’t true in a global sense, as Toyota (TM) doesn’t employ union labor, for example, they add up to a serious advantage in Tesla’s largest market:

Thus, the flywheel up to present has looked like this:

- Tesla’s cheaper labor has been subsidized by stock options and a rising stock price which has kept workers happy.

- Zero advertising budget (until recently) has allowed the company to pour capital into the product.

- Adjacent verticals have complimented a Tesla car purchase, and allowed investors to speculate about what the company could look like in the future.

The problem is that each of these factors work in both ways. As they begin to reverse, it could hamper gains in the stock going forward.

The company appears to be stalled on major potential new revenue drivers like robotaxis, as just recently Tesla mentioned that their automated driving capabilities were having issues navigating city streets:

A court in Munich “ordered [Tesla] to reimburse a customer most of the $112,884.80 she paid for a Model X SUV because of problems with the Autopilot function, Der Spiegel reported” in mid-July. A report of the customer’s vehicle “showed the vehicle did not reliably recognize obstacles like the narrowing of a construction site and would at times activate the brakes unnecessarily,” which “could cause a ‘massive hazard’ in city centers and lead to collisions, the court ruled. Tesla lawyers then “argued Autopilot was not designed for city traffic.”

If robotaxis are to be a meaningful profit driver in the medium / long term, then we would expect more progress on the plan to have occurred since it was announced in 2016.

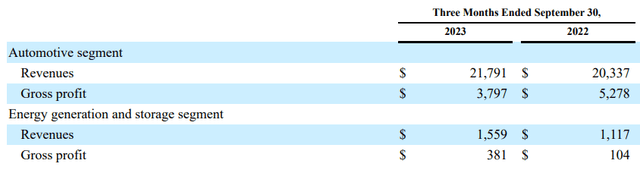

Additionally, the Tesla Energy segment, which has been the subject of significant speculation over time, still only remains a small piece of the business:

As progress stalls on new drivers and auxiliary businesses continue to remain “complementary” as opposed to “core,” we expect that Tesla’s premium multiple will begin to converge with other automaker peers.

On the advertising front, the consumer market has become more saturated with options, and the low-hanging fruit has been snapped up. Tesla has begun running ads to stave off competition and keep their crown, which should eat into margins.

You can see the pressure on the company to do so, given the sharply slowing revenue growth.

Finally, as U.S. workers become less satisfied with receiving compensation in stock that has significant headwinds, it’s possible that Tesla workers will unionize. This will have a potentially smaller impact on Tesla due to its multiple global manufacturing facilities, but this, too, will eat into margins.

Taken together, an unraveling of these factors are likely to put pressure on the multiple.

The Valuation

None of the aforementioned potential headwinds around consumer saturation or unionization are risks for Ford (F) or General Motors (GM). Why? Because both of these companies already deal with all of these issues.

And, what have their results been over the last decade?

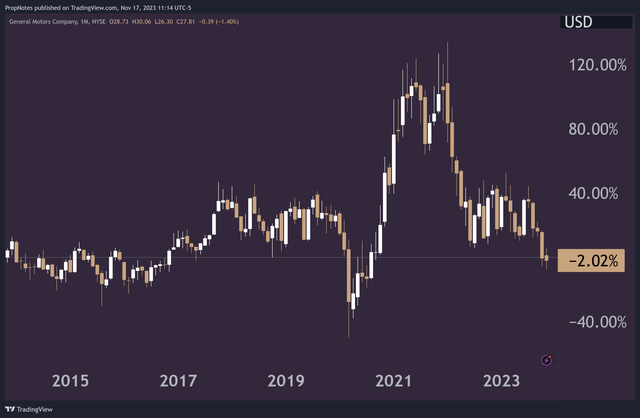

They’ve produced zero meaningful capital appreciation in that time.

Here’s Ford’s total return:

And here’s GM’s:

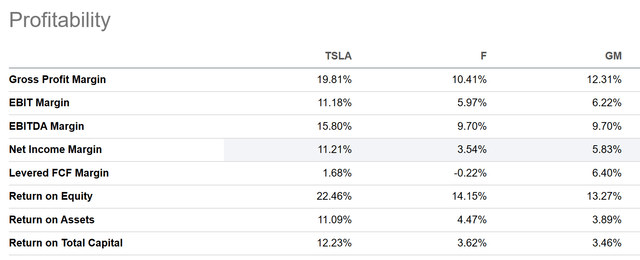

Unionization and a commoditized market have choked the profit from these firms, while they have spared Tesla:

Today, TSLA’s net income margins are more in line with global competitors like Toyota. However, here’s the real kicker. If Tesla is likely to be subjected to the same headwinds that F and GM have, it’s not unfair to say that margins will likely trend toward those peers’.

We see margins decreasing over time due to higher input costs as we’ve laid out, which we estimate could settle around 8-9% net.

This is better than F & GM, and around what other companies, like Toyota, produce. However – where are F and GM trading?

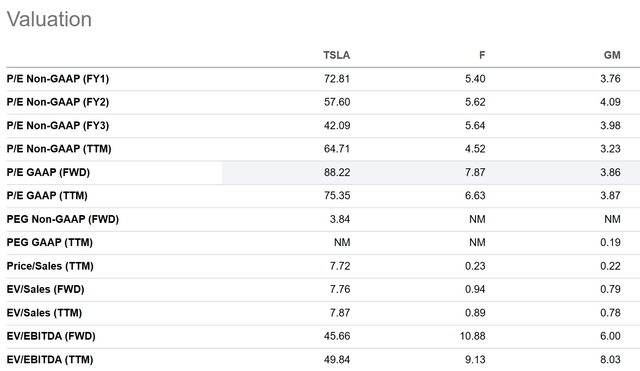

As it turns out, they’re about 12x cheaper than Tesla on bottom-line metrics, and 35x cheaper on top line sales:

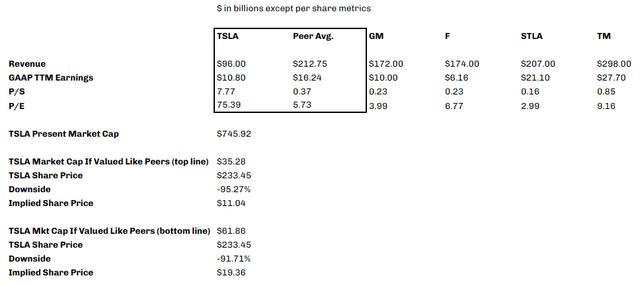

If Tesla was valued on similar multiples to major peers, then TSLA shares would be trading somewhere between $11 and $19:

This is a long way from the company’s present share price of ~$233.

While we don’t expect the company to trade down to these levels anytime soon and momentum up to this point has been strong, an unraveling of the aforementioned unique business drivers as discussed could pressure the multiple significantly and cause investors to push it back in line with peers. This could lead to serious losses for investors.

Given our estimates, it’s not out of the realm of possibility that Tesla could be a sub-$100 stock in the next few years. This factors in the likelihood that Tesla will remain a stronger auto brand than F, GM and other peers over the interim.

Summary

Sure, the company has a lot of momentum at this point, and they continue to make strides on battery technology and several other meaningful fronts.

However, most of these fronts haven’t added up to Tesla becoming anything other than a great automaker with a solid brand. This should lead the company to trade at a premium to other companies, but could lead to a significant discount to where it’s at today.

In addition to the risks, there’s a relatively small amount of corresponding upside. Tesla is already the 7th largest publicly traded company in the United States – where is the multiple expansion opportunity from here? It’s hard to see.

We rate Tesla a “Sell.”

Disagree? Let us know why in the comments.

Cheers!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.