Summary:

- Nvidia Corporation’s Q3 earnings are highly anticipated, with expectations of strong growth and potential for a surge in stock value.

- Risks include geopolitical tensions, competition from other tech giants, and potential disruptions in the supply chain.

- Nvidia’s strategic partnerships and innovations in various industries position it as a linchpin for long-term investors.

Justin Sullivan

What is the Goal of This Article?

If you have read any of my previous articles on NVIDIA Corporation (NASDAQ:NVDA), you know I am extremely bullish on the company and its success in the stock market. I have been a shareholder of Nvidia since 2019 and predicted it would be a $2T market cap company by 2030, and now believe it could even go higher by then.

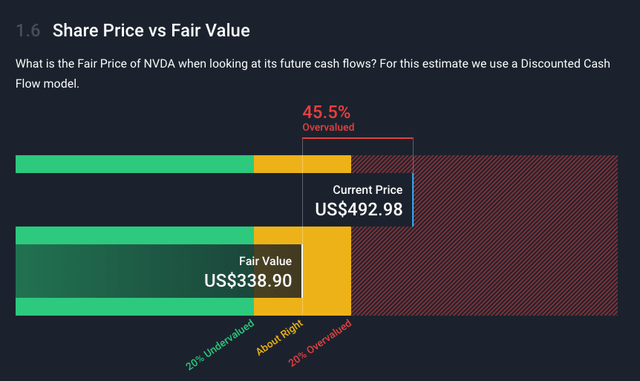

However, I am mindful of the volatility Nvidia trades with, the over-valuation of the stock if you view it from Ben Graham’s intrinsic value perspective, or the geopolitical risks the company has faced. These factors have always deterred some institutional and retail investors from buying the stock, saying the stock was too “rich,” or waiting for when the price is “right.” I want to educate investors on the risks, rewards, and catalysts they should be paying attention to for the near and long term, and the stock may never be cheaply valued due to its innovation prowess. Holding this stock for the short or long term is not for the faint of heart, and I will explain why.

NVDA DCF Model (Simply Wall St. – NVIDIA)

Don’t Be Shortsighted

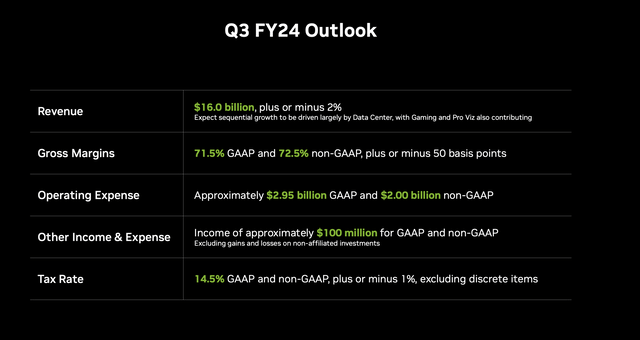

As Nvidia stands on the verge of revealing its Q3 earnings (to be released Tuesday November 21st after the bell), the investment community is poised to dissect the numbers with precision, seeking indicators of the company’s immediate financial health. Analysts have set the bar high, with expectations of $16.09 billion in revenue, signaling robust sequential growth of 19% and a staggering year-over-year increase of 171%. Such figures are not mere metrics; these figures represent Nvidia’s relentless march at the forefront of the AI revolution, providing the crucial tools — the proverbial picks and shovels — that are shaping the technological landscape of the future.

In the short term, meeting or surpassing these projections could drive an estimated 8 to 10% surge in Nvidia’s stock value, a testament to the company’s robust performance and ability to execute. Wondering when to start buying or selling Nvidia shares is a risky game, as the fluctuations downward could be larger if Nvidia missed Q3 Earnings and guided down for the rest of the year. I am not a technical analyst or short-term trader, but because this company moves so fast on the technology front, it only takes one unexpected announcement to move the stock even higher, so in my opinion this stock is one you hold onto for the long term. First let’s dive deeper into what Q3 earnings may hold for those focused on this time in place.

Q3 FY24 Outlook for NVDA (NVDA Investor Relations Presentations)

The Risk and Rewards for Nvidia’s Q3 Earnings

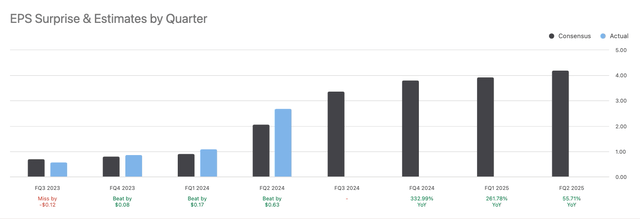

The anticipation for Nvidia’s Q3 earnings is high, and as mentioned previously, analysts have set the bar high, expecting Nvidia to deliver robust growth figures. The consensus estimates for earnings per share (EPS) are anticipated to grow by a whopping 475%, emphasizing Nvidia’s strong market position and surging demand for AI and data center applications. However, amidst this optimism, there are risks. Any deviation from the expected results could impact the stock’s short-term performance heavier than its upside, in my opinion. Keep in mind I am not a fortune teller and could be wrong here.

NVIDIA EPS Surprise and Estimates (Seeking Alpha – NVIDIA Overview)

The focus will likely be on data center revenues, the most critical segment for Nvidia, and the company’s ability to maintain supply through the next few quarters despite all the economic and geopolitical challenges that exist. Given that a substantial portion of Nvidia’s data center sales hinges on the Chinese market, these restrictions could impede the company’s sales momentum and lead to production delays. While Nvidia has asserted that the impact on financial results in the near term may not be meaningful, the long-term effects could be more pronounced if the geopolitical tensions persist.

The investment required from a technology and knowledge worker perspective for AI development, alongside cautious technology spending by businesses, might also slow the pace of revenue growth from AI applications. These factors, combined with the differentiation between “contenders and pretenders” in the AI space, could result in a slower realization of financial rewards from AI developments, potentially affecting market confidence and Nvidia’s stock performance. If organizations cannot realize their expended returns on investment and efficiency improvements with AI, we could see this fast-paced trend slow temporarily.

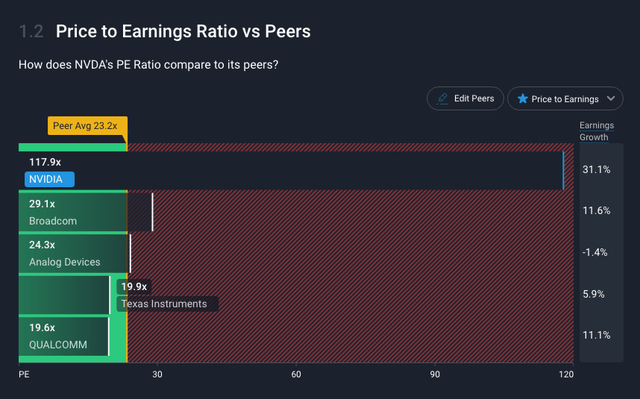

NVDA Price to Earnings Ratio vs. Peers (Simply Wall St. App – NVDA)

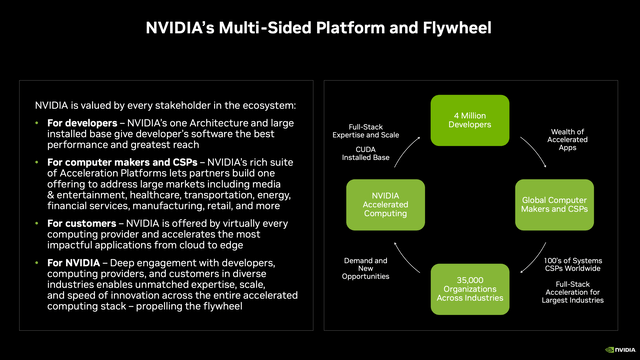

Looking at the stock from an intrinsic value standpoint, it ultimately fails on many metrics and is considered overvalued for many analysts. Nvidia is being anticipated by some to soon face renewed competition from formidable competitors such as Advanced Micro Devices, Inc. (AMD) and the hyperscalers who are starting to build their own chips. I believe Nvidia’s holistic strength, is driven by their advanced CUDA software network and Nvidia AI Enterprise solutions that work superiorly when on Nvidia hardware.

This well thought out and intentional flywheel effect Nvidia has created, is a strong enough moat that even Big Tech will have trouble overcoming. Even if they compete in certain areas of business, I believe Big Tech companies such as Google (GOOG), Microsoft (MSFT), Amazon (AMZN), Intel (INTC), and Meta Platforms (META) will want to continue evolving their partnerships that would benefit both sides.

NVDA Flywheel Business Model (NVDA Investor Relations Presentation)

In the near-term Institutions and Wall Street analysts will have challenges forecasting or setting accurate expectations of Nvidia’s sales. I believe these challenges will be due to the high demand by both companies and consumers of all Nvidia’s products. On the macroeconomic side of the house Nvidia still is vulnerable to any significant market-wide risks that could become more problematic, such as the banking crisis getting significantly worse, the return of inflation, and escalations in any of the major geopolitical conflicts.

What to Pay Attention to for the Long Term

I have outlined a lot of the risks that one could be concerned about in the short term but now let’s examine the flip side for the long term and what the catalyst could be.

For discerning investors focused on the horizon, the quarterly results are but a checkpoint in a much grander journey for the stock. The true core of Nvidia’s narrative is not captured in a single quarterly performance but in the tapestry of partnerships and innovation that it continues to weave with purpose and speed. This tapestry of strategic partnerships and Nvidia software that powers the need for Nvidia hardware is redefining industries. We will explore the different industries this is impacting and how it is seeding the ground for unparalleled growth in the world of AI. This inflection point we are at with AI is unprecedented, which makes it incredibly hard for analysts and investors to predict what will happen in the future.

NVIDIA Market Platforms (NVDA Investor Relations Presentations)

Now let’s dive into how Nvidia’s partnerships are solving today’s industry challenges and why, regardless of the short-term ebbs and flows of stock prices, Nvidia’s role as the architect of the AI era I believe will cement its position as a linchpin for long-term investors.

Catalysts Continue with Partnerships and Innovation

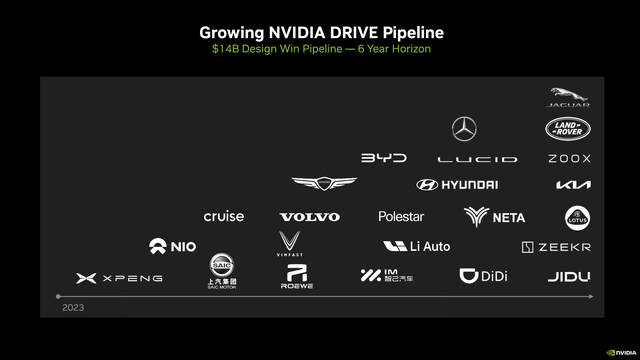

Nvidia’s four large strategic revenue streams are Data Center, Gaming, Professional Visualization, and Automotive. I believe we will continue to see these grow and automotive will start to have a much bigger impact with the growing demand of EVs and one day having autonomous vehicles. I believe Nvidia’s AI software and hardware will continue to impact other industries as well from healthcare, technology, retail, defense, manufacturing and more. See some of the partnerships Nvidia had this past Q3:

NVIDIA AI Impacting Industries (NVDA Investor Relations Presentations)

Automotive Industry

Nvidia’s recent partnership in Q3 with Foxconn marks a significant move in the automotive industry, leveraging Nvidia’s DRIVE platform, including the advanced DRIVE Orin and the upcoming DRIVE Thor systems, to power intelligent electric vehicles (EVs). This collaboration combines Nvidia’s AI and supercomputing capabilities with Foxconn’s manufacturing prowess, setting the stage for the development of next-generation EVs that promise enhanced automation, safety, and performance.

By integrating the state-of-the-art Nvidia DRIVE Hyperion 9 platform, Foxconn is positioning itself to deliver some of the world’s most sophisticated software-defined vehicles, potentially transforming the automotive landscape and fueling the evolution of smart mobility. Before this partnership Nvidia had secured a growing pipeline of $14B design deals for their Nvidia Drive system over the next 6 years.

NVIDIA Auto Deal Pipeline (NVDA Investor Relations Presentation)

Another automotive partnership has been formed between Nvidia and Microsoft Azure to offer Omniverse Cloud Services as a strategic move to accelerate the digitalization of the automotive industry. Nvidia’s simulation engines for virtual factories and autonomous vehicles provide a comprehensive platform for automakers to streamline their manufacturing and design processes. By hosting these services on Azure, Nvidia ensures a scalable, secure, and efficient environment for automotive companies to innovate and reduce time to market.

NVIDIA Omniverse and Microsoft Azure Partnership (NVIDIA Website)

Healthcare Industry:

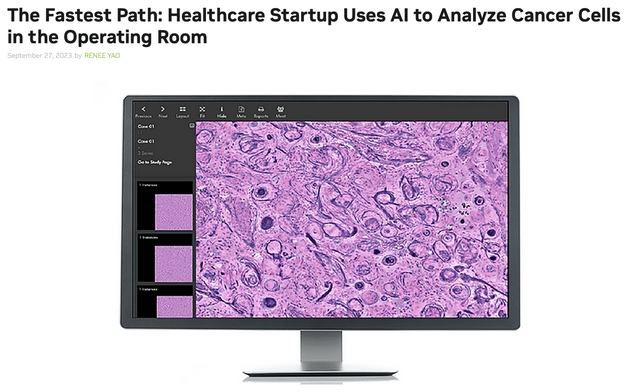

This partnership between Invenio Imaging and Nvidia is set to revolutionize cancer care by enabling the rapid analysis of tissue biopsies during surgeries using AI. Invenio’s technology, powered by Nvidia’s GPUs and software, can provide insights within minutes, a process that traditionally takes weeks. This immediacy can significantly improve surgical decision-making, especially for aggressive cancers that quickly progress. Invenio’s incorporation of Nvidia’s Jetson Orin modules for real-time AI inference and the successful use of their NIO systems in Europe indicate a promising path to clinical deployment, with potential FDA approval on the horizon.

Invenio Imaging and NVIDIA Partnership (NVDA Website)

Software Industry:

The collaboration between Dropbox and Nvidia exemplifies how Nvidia’s AI capabilities can enhance other technology platforms. By integrating Nvidia’s AI foundry into Dropbox’s offerings, the partnership aims to improve Dropbox’s universal search tool and AI summarization functionalities. This will enable more personalized and efficient user experiences, leveraging Nvidia’s expertise in AI to bolster Dropbox’s content management capabilities. For Nvidia, this showcases its continued influence in proliferating AI technology across various sectors, and for Dropbox, it represents an evolution towards more intelligent, AI-driven services.

Dropbox and NVIDIA Partnership (NVIDIA Website)

Services Industry:

The partnership between Infosys and Nvidia exemplifies “Enterprise AI Transformation,” aiming to enhance productivity with generative AI across industries. Infosys will incorporate Nvidia’s AI ecosystem into its Topaz platform to create AI-first solutions. Crucially, Infosys will establish an Nvidia Center of Excellence to train 50,000 employees on Nvidia AI technologies, significantly extending Nvidia’s reach.

This collaboration utilizes Nvidia’s advanced AI frameworks and tools, demonstrating the transformative potential of AI in business operations and customer service. For investors, this signals Nvidia’s deepening penetration into the enterprise market and potential for sustained growth, underpinning the long-term value proposition for Nvidia’s shareholders.

Telecommunications Industry:

The partnership between Nvidia and Amdocs aims to revolutionize the $1.7 trillion global telecommunications industry by leveraging Nvidia’s AI foundry service on Microsoft Azure. This service provides a complete solution for developing and optimizing custom generative AI models. Amdocs plans to use this service to enhance large language models tailored for telecommunications, improving efficiency and customer experiences across the sector. With Nvidia’s accelerated computing and the Amdocs amAIz framework, this collaboration could lead to significant advancements in data processing, network operations, and customer service, impacting over 3 billion people worldwide.

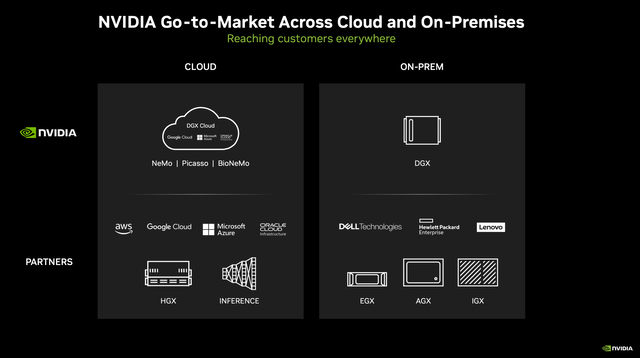

NVIDIA GTM across Cloud and On-Premises (NVDA Investor Relations Presentation)

Cloud Providers Industry:

The collaboration between Nvidia and Oracle to integrate Nvidia’s AI solutions into the Oracle Cloud Marketplace is a significant move in the cloud computing and AI arena. It emphasizes Nvidia’s strategic partnerships with cloud giants, commonly referred to as “HyperScalers,” to expand the reach and accessibility of its AI supercomputing capabilities.

By enabling OCI customers to use their existing cloud credits for Nvidia’s AI solutions, the partnership reflects a user-friendly and flexible approach to consuming AI technologies. It also showcases how Nvidia’s technology is becoming more deeply embedded in enterprise AI development and deployment workflows.

Nvidia’s DGX Cloud and AI Enterprise offerings on OCI not only streamline the model training process but also ensure that the transition from pilot to production is secure, stable, and supported. This is particularly crucial for industries that have stringent requirements for their AI applications, such as healthcare, financial services, and telecommunications.

Sciences and Research Industry:

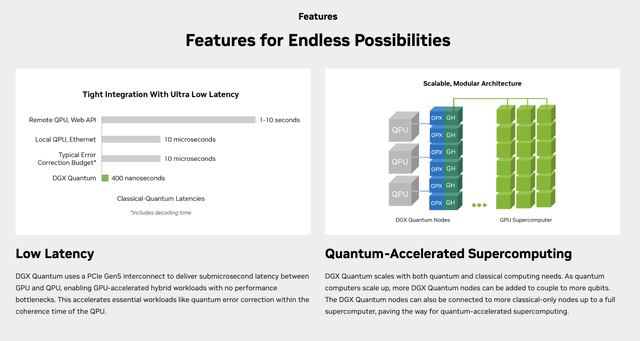

The partnership between Nvidia and BASF for advancing quantum computing research illustrates Nvidia’s strategic depth in fostering innovation across different scientific domains. BASF’s use of Nvidia’s quantum computing platform and GPUs for simulating complex molecules signifies a leap in computational capabilities, which can have a broad impact on industries that require high-level simulations, like chemistry and material science.

NVDA DGX Quantum (NVDA Website)

Nvidia’s CUDA Quantum platform, by serving as a bridge between traditional computing and the nascent field of quantum computing, shows the company’s forward-thinking approach. This platform is being utilized by various research institutions and companies, pointing to a growing community that relies on Nvidia’s technology for cutting-edge research.

The collaborations with entities like the Israeli National Quantum Center, Oxford Quantum Circuits, and others using Nvidia’s Grace Hopper Superchips further underline Nvidia’s critical role in the development of quantum computing infrastructure. These partnerships showcase Nvidia’s potential to unlock new revenue streams through its advanced computing solutions.

Risks in the Long Term Exist

There are several risks that could be present throughout the long term for Nvidia shareholders. These risks would not only impact Nvidia but many other tech companies in the market. Here are the risks in the long-term that shareholders should always be mindful of and make sure they are okay with the volatility that comes along the way.

Big Tech Competition – I believe it is too early for any concern regarding competitors stealing market share, but this could happen further down the road. The specific competitors who are also partners that I would be worried about would be the likes of Microsoft, Amazon, Google, Intel, and maybe even Meta. The concern would be around these big tech companies creating their own GPUs and other proprietary chips that would be designed for their software. This would eliminate much of the dependance on Nvidia GPUs from these large customers, however I believe it is the flywheel effect of the NVIDIA software that will continue to drive better performance on NVIDIA hardware than any competitor (only time will tell).

China Taking over Taiwan – I believe this is the most notable risk that would not only impact Nvidia but all companies across the globe, especially in the western hemisphere. It is because most chip companies have Taiwan Semiconductor (TSM) create their most advanced semiconductors. This is why Taiwan Semiconductor is trying to move as fast as it can to create semiconductor fabrication plants in Arizona, to mitigate this risk.

An Unexpected Departure – Nvidia has one of the greatest founder-led CEOs of all time in my opinion in Jensen Huang. It also has an exceptional executive leadership staff spearheaded by CFO Colette Kress. If Jensen and Colette stepped down unexpectedly, I am not sure who could provide the same level of visionary leadership and execution.

My Conclusion is the Reward is Greater

I still believe the reward that Nvidia shareholders could gain in the long run outweighs any of these possible large risk events occurring. If you invested $1,000 in NVDA 10 years ago you would have gained an outstanding 62.65% annual return, netting you $129,580. Ten years ago, Nvidia did not have near the ecosystem, partnerships, or impact to society that it does today, so one could only assume what the returns will be like in the next 10 years.

Future Market Opportunities (NVIDIA Investor Relations Presentation)

The returns probably won’t be as large since Nvidia has a market cap of $1.2T, but I feel very confident the company can still provide market beating returns for the next decade. It is the continued innovation and flywheel effect of Nvidia’s software driving higher demand for Nvidia hardware in all industries that will drive shareholders’ returns to compound. Let me know what you think in the comments below and if you would buy Nvidia before Q3 earnings.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.