Summary:

- Due to cost-cutting measures, Intel’s Q3 2023 operating income for its CCG increased by 43%.

- The Data Center and AI segment turned a profit in Q3 2023 after reporting a loss in the same period last year.

- Intel showcased progress in its IDM 2.0 transformation strategy with successful product launches and advancements in EUV manufacturing.

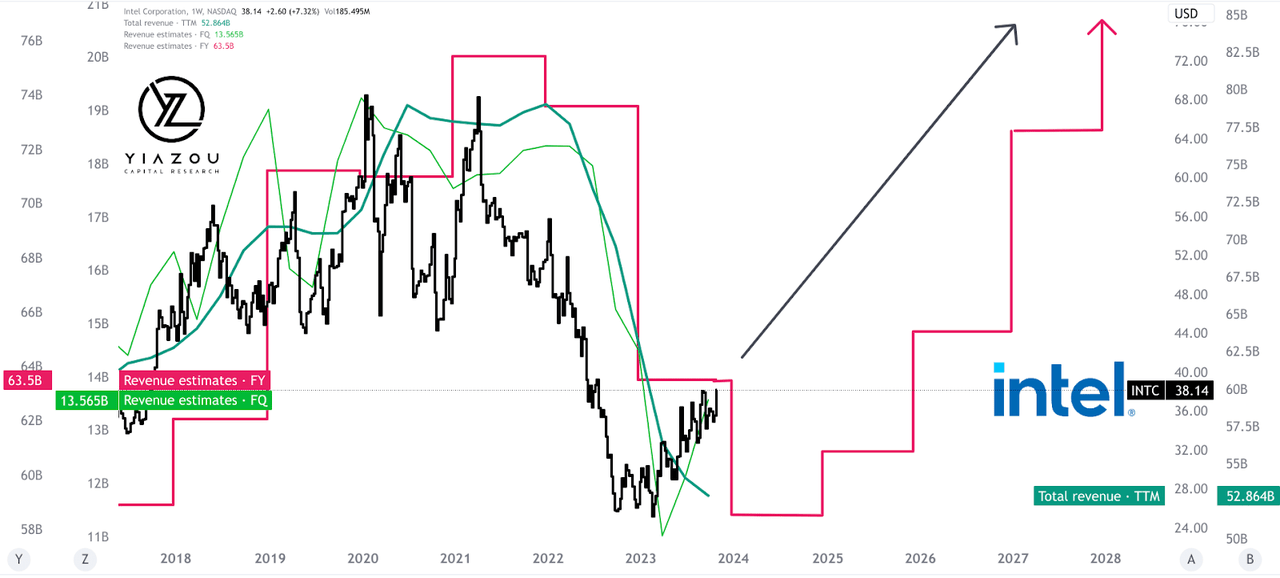

- Due to Intel stock price’s positive correlation with revenue estimates, any positive revenue forecast revisions could further boost INTC to previous all-time highs of $60-$68 by 2025-2026.

Ignatiev/E+ via Getty Images

Investment Thesis

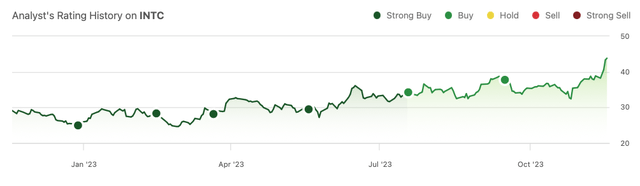

Since we wrote our piece and pointed to a bottom for Intel Corporation’s (NASDAQ:INTC) stock around ~$25, there has been a meteoric rise in value, underscoring the company’s strong market recovery and investor confidence.

The narrative has significantly evolved from a purely technological perspective to a broader analysis encompassing Intel’s financial resurgence. This transformation is attributed to effective cost-management strategies, enhanced segment earnings, and a remarkable upswing in Intel Foundry Services (IFS) revenues.

Even though INTC is no longer trading at dirt cheap levels ($25-$30), we remain confident in its future direction with additional upside potential, as the bull run has just started. Investors should monitor forecasts, as the positive relationship between revenue estimates and the stock price has led to a bullish trend in Intel’s stock, primarily driven by optimistic long-term revenue projections, fueling investor optimism and market confidence.

Author’s Ratings

Cost-Cutting Drives Robust Q3 Earnings, Surpassing Expectations with a Bright Outlook

To begin with, the cost-cutting measures have proven effective in enhancing Intel’s financial performance. Intel reported cost reductions of $3 billion in 2023. The exit from non-core businesses like the pluggable module portion of its silicon photonics business indicates Intel’s strategic focus on optimizing its portfolio.

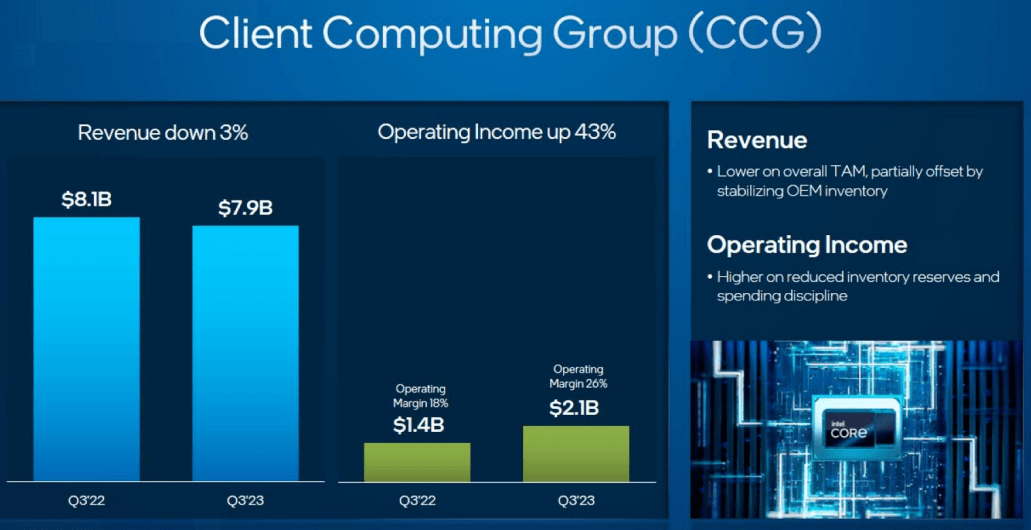

In Q3 2023, Intel’s Client Computing Group (CCG) segment reported an operating income of $2.073 billion, marking a substantial 43% increase compared to the same period in 2022 ($1.447 billion). A significant contributor to the improved operating income was a reduction in period charges, amounting to $562 million, driven by the sell-through of previously reserved inventory and lower reserves taken in Q3 2023.

The company’s implementation of various cost-cutting measures resulted in a $352 million reduction in operating expenses. Despite the overall increase in operating income, Intel experienced a $304 million decrease in product margin, primarily due to lower desktop revenue.

Q3 Presentation

Similarly, Intel’s Data Center and AI (DCAI) segment reported an operating income of $71 million, significantly improving from the operating loss of $139 million in Q3 2022. The company’s cost-cutting measures resulted in a $405 million reduction in operating expenses.

The decrease in product ramp costs led to a reduction of period charges by $180 million. This positive change was partially offset by an increase in server unit cost, primarily from the mix of Intel 7 products, leading to a $299 million decrease in operating income.

Surprisingly, in Q3 2023, Intel’s IFS reported revenue of $311 million, a substantial increase of $233 million from Q3 2022, while reporting an operating loss of $86 million, compared to $90 million in Q3 2022.

Fundamentally, the increase in revenue for Intel Foundry Services is a promising development, indicating growing demand for the company’s services, particularly in packaging and multi-beam mask-writer tools. Nonetheless, the continued operating loss still concerns the segment’s profitability. Lastly, the revenue growth in IFS is a positive sign of potential growth opportunities for the company.

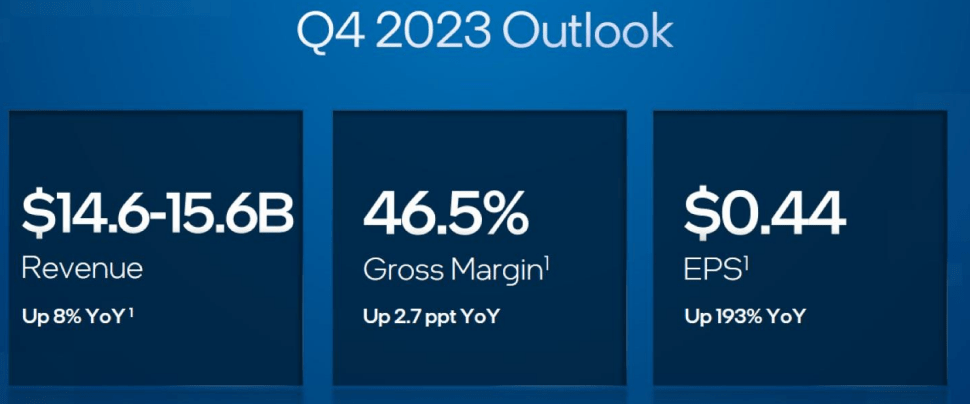

Intel’s Q3 2023 earnings surpassed revenue expectations and marked the third consecutive quarter of beating estimates. Whereas the EPS of $0.41 exceeded expectations by $0.19, reflecting solid profitability. Looking ahead, Intel’s Q4 revenue guidance in the range of $14.6 billion to $15.6 billion, with 8% year-over-year growth, signifies progressive revenue.

This guidance indicates a commitment to deliver on their financial projections and demonstrates their optimism for the future. Finally, the Q4 EPS projection of $0.44 with 193% year-over-year growth indicates accelerating performance in the coming quarters.

Q3 Presentation

Intel’s IDM 2.0 Triumph: Milestones in Manufacturing and Market Impact

Intel showcased significant progress in its IDM 2.0 transformation strategy. Notably, the completion of Intel 7 is a vital step on the process roadmap, with nearly 150 million units of Alder Lake, Raptor Lake, and Sapphire Rapids already on the market. Furthermore, Meteor Lake on Intel 4 commenced initial shipments with an aggressive ramp using advanced EUV tools. High-volume EUV manufacturing has begun in Oregon and Ireland, solidifying Intel’s presence in the market.

Focusing on execution milestones, the Intel Core Ultra processor (Meteor Lake) began shipping to customers in Q3. This milestone is essential as it represents a new product’s successful production and launch. The official launch date of December 14 is significant to mark. It has shipped its one-millionth 4th Gen Intel Xeon processor unit, aiming to surpass two million units before year-end. The achievement of shipping one million units is a notable milestone, and surpassing two million units by year-end would demonstrate strong demand for Intel’s products in this category.

Finally, Emerald Rapids, Intel’s 5th Gen Intel Xeon processor, is in production and will begin shipping to customers in October 2023 (also launching on December 14). The fact that Emerald Rapids is already in production and shipping to customers signifies that Intel is executing its product roadmap effectively.

How Top-Line Trends Could Propel Stock to $60-$68 by 2025-2026

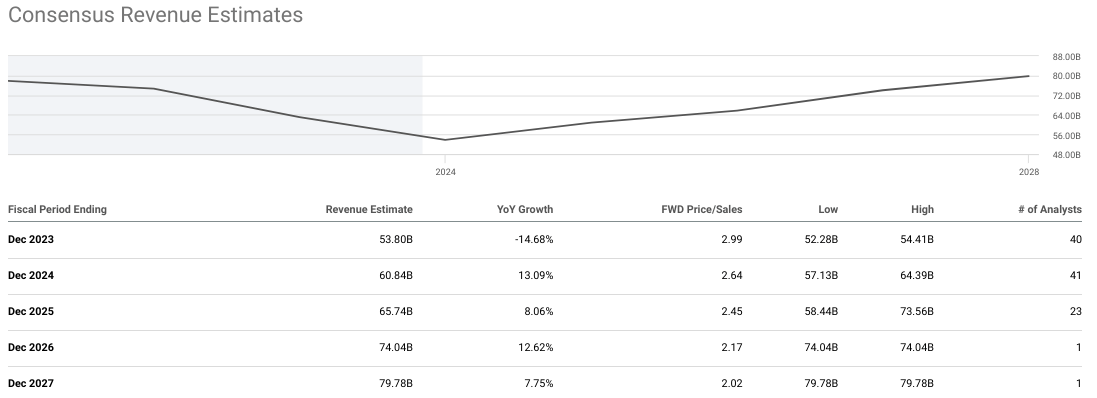

Intel is a legacy tech company, and the street finds its stock performance closely tethered to its financial performance, with particular emphasis on its top-line revenue figures. Revenue is a barometer of the business climate’s favorability and the company’s ability to expand its market share. Notably, Intel faced a huge decline in revenue in both 2022 and 2023, a pattern mirrored by its stock price. Interestingly, a double-top formation occurred in 2020 and 2021, simultaneously impacting the stock price and revenue.

The strong correlation between revenue and stock performance resulted in a bullish upswing for Intel’s stock in 2023. The optimism stemmed from long-term revenue estimates, which projected substantial top-line growth over the long term. Based on the efficient market hypothesis, the stock price reacts strongly to revenue estimates (the leading indicator of actual revenue).

seekingalpha.com/symbol/INTC/earnings/estimates

Given this scenario, it’s plausible to suggest that any further positive revisions in Intel’s revenue forecasts could catalyze an additional upward shift in its stock price. For instance, if Intel hits revenue estimates, it can hit $60-$68 by 2025-2026. This dynamic underscores the importance of closely monitoring Intel’s revenue forecasts as key indicators of its stock price trajectory. However, it’s crucial to monitor potential exit points, which could become evident through downside revisions in annual revenue estimates. Such revisions may indicate when the bullish trend might change direction.

tradingview.com

Concluding Thoughts

This year marked a turning point with a bullish upswing in Intel’s stock, fueled by optimistic long-term revenue forecasts suggesting a robust recovery and growth in market share. Therefore, the positive outlook is grounded in the efficient market hypothesis, which asserts that revenue forecasts, a critical leading indicator of actual financial performance, heavily influence INTC.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Author of Yiazou Capital Research

Unlock your investment potential through deep business analysis.

I am the founder of Yiazou Capital Research, a stock-market research platform designed to elevate your due diligence process through in-depth analysis of businesses.

I have previously worked for Deloitte and KPMG in external auditing, internal auditing, and consulting.

I am a Chartered Certified Accountant and an ACCA Global member, and I hold BSc and MSc degrees from leading UK business schools.

In addition to my research platform, I am also the founder of a private business.