Summary:

- Teva is an Israeli pharmaceutical company and the largest global generic manufacturer which suffered numerous challenges in recent years.

- The new management has a clear vision of how to deliver value to shareholders with the help of the company’s strong assets portfolio.

- The company’s fair value is estimated by me to be close to $15 billion, indicating almost 50% upside potential.

JHVEPhoto

Investment thesis

Investors of Teva Pharmaceutical (NYSE:TEVA) experienced a lot of pain in recent years as the company faced multiple challenges and litigations, which led to a massive reputation loss. However, the new CEO of the company outlined the company’s new strategy in the first half of this year and recent performance suggests that Teva is already making solid moves in line with the strategy. My analysis suggests that Teva has strong assets, and with the new management’s clearly articulated goals, the company is likely to significantly improve its financial performance, which deteriorated significantly in recent years under old management. Moreover, my valuation analysis suggests the stock is almost 50% undervalued. All in all, I assign the stock a “Strong Buy” rating.

Company information

Teva is an Israeli pharmaceutical company and the largest global generic manufacturer. The latest 10-K report shows that Teva produced approximately 75 billion tablets and capsules in 2022.

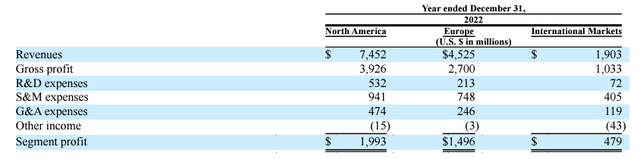

The company’s fiscal year ends on December 31. Teva operates its business through three segments: North America, Europe, and International Markets. Half of Teva’s revenue is generated outside North America.

TEVA’s latest 10-K report

Financials

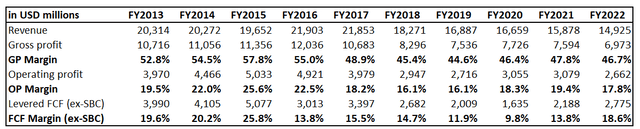

Teva Pharmaceutical faced several challenges over the last decade, including the loss of exclusivity on key products and price decline in the generic domain, which led to a significant decline in revenue between 2017 and 2022. On the other hand, despite the top line weakness, profitability metrics demonstrated solid resilience, and the free cash flow [FCF] margin ex-stock-based compensation [ex-SBC] is still at robust double-digit.

Author’s calculations

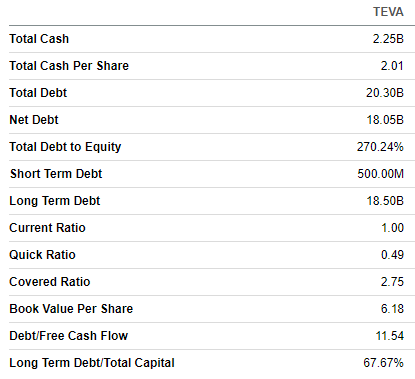

Teva’s balance sheet is highly leveraged, and the company has a substantial $20 billion net debt position. Senior notes were issued in 2016 to finance the deal to acquire Allergan, one of the latest global generics manufacturers. The outstanding debt is decreasing in line with the repayment schedule. Therefore, I do not see substantial risks here. It is also crucial to highlight that the major part of debt is long-term. Short-term liquidity ratios are also in good shape. All in all, I consider Teva’s financial position as decent.

Seeking Alpha

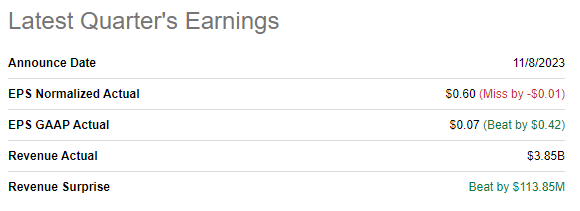

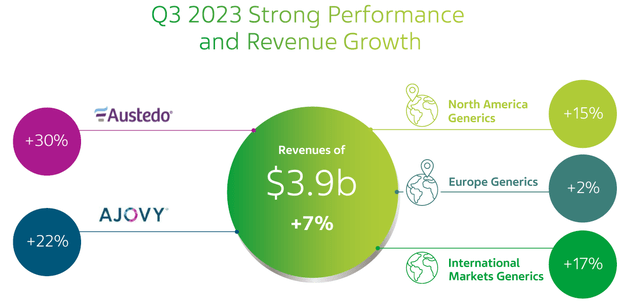

The latest quarterly earnings were released on November 8, when the company topped consensus estimates. Revenue demonstrated a solid 7% YoY growth, and the adjusted EPS was almost flat. Profitability metrics demonstrated expansion, which is a good sign for potential investors. The operating margin expanded YoY by slightly more than 100 basis points. It is important to emphasize that the operating margin improvement was not at the cost of R&D but thanks to the improved SG&A to revenue proportion.

Seeking Alpha

According to the latest earnings call, the strength in revenue was backed by strong growth in flagship products. AUSTEDO and AJOVY, and growth in generics business across all geographies. It is crucial to underline that the management reaffirmed the goal for its most promising product, AUSTEDO’s revenue, to double between FY 2023 and 2027.

TEVA’s latest earnings presentation

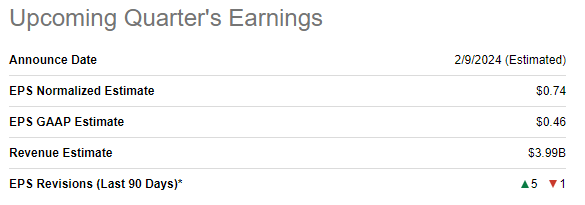

The earnings release for the upcoming quarter is scheduled for February 9, 2024. Quarterly revenue is expected by consensus at $3.99 billion, which indicates a 2.8% YoY growth. The adjusted EPS is expected to expand YoY from $0.71 to $0.74.

Seeking Alpha

Positive dynamics in revenue for the last and upcoming quarters suggest that Teva’s massive headwinds, which pressured the revenue growth, are in the rearview window. There are several apparent factors on the surface that suggest that the company’s future prospects are bright.

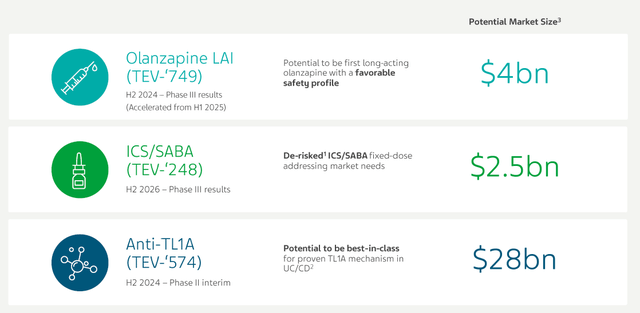

In my opinion, the most important favorable factor for Teva is its robust new product pipeline, both related to innovative medicine and biosimilar franchises. This solid diversification is for the upcoming years to navigate challenges and capitalize on new market opportunities as the healthcare landscape evolves. The company’s strong focus on innovation and building up its offerings portfolio suggests the management prioritizes building long-term value for Teva’s shareholders.

Teva’s latest earnings presentation

The anti-TL1A solution “TEV-‘574” stands out in the company’s pipeline. Teva’s management assesses the potential market size for it at about $28 billion. Such a massive addressable market suggests that it is an underserved market, which might give a strong competitive advantage if the company is faster than competitors to launch the product after all required trials and approvals are conducted and obtained. The fact that the French pharmaceutical giant Sanofi is ready to invest $1.5 billion to collaborate with Teva in this project means that the product’s prospects are indeed very promising.

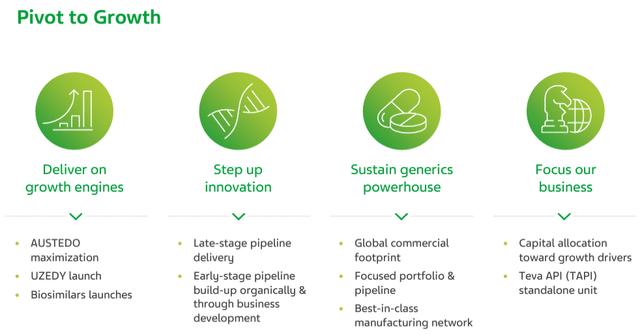

The company’s strong portfolio of current products and hard work to launch new promising offerings give me a high conviction that Teva can sustain its stellar profitability over the long term. Substantial indebtedness has been a big concern for investors over several recent years, but I like the deleveraging dynamics, and with wide FCF margins likely to be sustained, I expect the balance sheet improvement trend to continue. I also like the fact that in May 2023 the management articulated its strategic plan to improve the company’s financial performance through its “Pivot to Growth” initiative. All the management’s strategic priorities described look sound to me, and I agree with the key success factors for the business.

Teva’s presentation for investors

Valuation

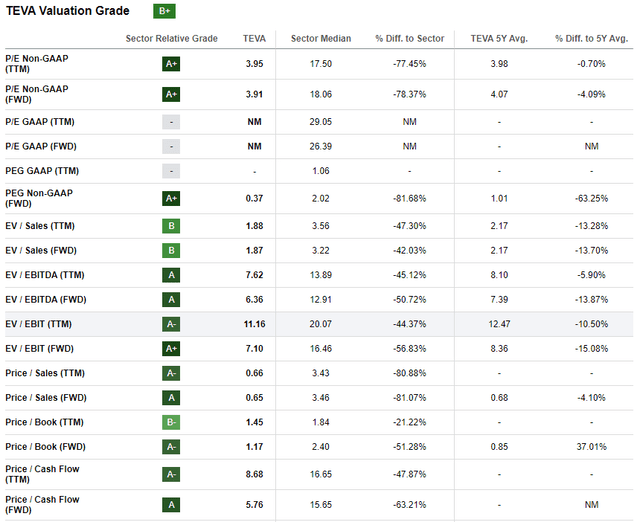

The stock price declined by 8% year-to-date, significantly underperforming the broader U.S. market. The stock is also slightly underperforming the U.S. healthcare (XLV) sector and the iShares MSCI Israel Capped ETF (EIS). Seeking Alpha Quant assigns the stock an attractive “B+” valuation grade because current valuation ratios are moderately lower than historical averages and significantly lower than the sector median. That said, the stock is very attractively valued from the valuation ratios perspective.

Seeking Alpha

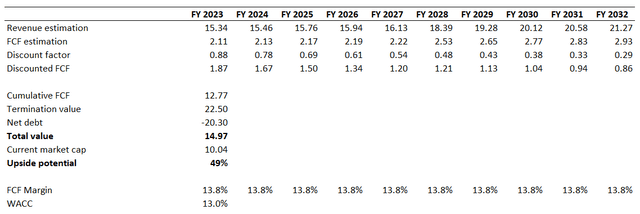

After experiencing a sharp revenue decline in recent years, the company stopped paying out dividends in 2017. Therefore, simulating a discounted cash flow [DCF] model looks like the only sound option to expand my analysis. I use an elevated 13% WACC, given the high level of uncertainty regarding the company’s ability to regain investors’ confidence. I incorporate revenue consensus estimates for the next decade, projecting a 4% CAGR. I also use a 13.8% flat FCF margin, which is the last five years’ average.

Author’s calculations

According to my calculations, the business’s fair value is close to $15 billion, which indicates almost 50% upside potential from the current market cap. That said, my target price for TEVA stock is $13.

Risks to consider

With its headquarters in Tel Aviv, Israel, Teva faces geopolitical risks, particularly concerning recent military conflicts in the region. A notable portion of the company’s manufacturing facilities are located in Israel, which adds disruption risks to R&D and manufacturing as well as broader adverse economic implications.

Teva has a “rich” history of costly litigations, which resulted in multimillion-dollar fines and penalties. Teva even paid more than half a billion dollars in penalties to settle bribery investigations by DOJ and SEC. If new cases of misconduct emerge, this can significantly undermine Teva’s reputation and lead to new substantial settlement payments, which will diminish value for shareholders.

Bottom line

To conclude, Teva is a “Strong Buy”. I think that it is a good turnaround play as the new management has a clear vision of how to utilize the company’s strong assets efficiently. My valuation analysis suggests the stock is massively undervalued.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.