Summary:

- Amazon’s stock has climbed nearly 75% this year, amid a rebound in earnings compared to a difficult 2022.

- Firming margins accelerating momentum in areas like advertising support a strong outlook.

- We are bullish on the stock and see a path for shares to reclaim the all-time high sooner rather than later.

Brett_Hondow

Amazon.com, Inc. (NASDAQ:AMZN) has rallied more than 75% year-to-date as one of the best-performing mega-cap stocks in the market. Compared to the period of extreme volatility in 2022 pressured by headwinds from high inflation and climbing interest rates, the company is benefiting from improving macro conditions.

Indeed, that was our thesis when we covered the stock last year citing AMZN as a potentially big winner amid cooling inflation considering the company’s exposure to consumer spending and the pulse of the broader global economy. Shares are currently trading at a 19-month high, and there are several reasons to expect even more upside.

The sense we have is that Amazon is hitting its stride in terms of operational and financial momentum with an impressive earnings outlook. Ultimately, we believe AMZN remains undervalued and the path here is for a rally back towards its 2021 all-time high.

AMZN Financial Recap

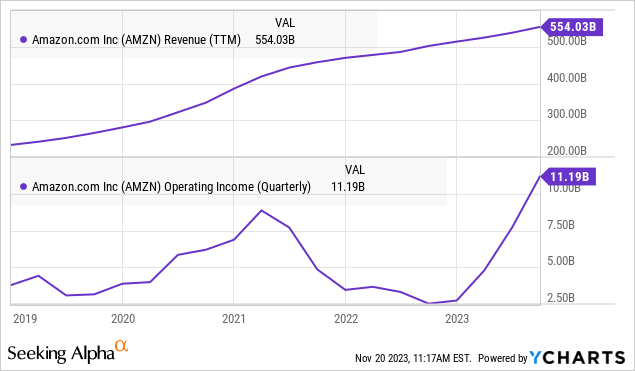

The key to understanding Amazon right now is simply that the company is more profitable than ever with a runway for even stronger earnings going forward.

Indeed, AMZN Q3 EPS of $0.94 was up 225% from $0.24 in Q3 last year, and the second highest in the company’s history, only behind the record Q4 2021 of $1.39, which coincidentally marked the top for the stock. Q3 operating income at $11.2 billion already surpassed pandemic-era highs, with the 7.8% operating margin, trending higher sequentially over the last four quarters.

A large part of this strength reflects efficiency improvements to its North American fulfillment network, moving from a centralized model to eight regional hubs that have delivered cost savings. Lower energy prices and cooling inflation have also helped on the cost side.

Similarly, the international segment approached breakeven in Q3, benefiting from leveraging operating scale from investments made over the last several years. In AWS, demand for cloud services has stabilized compared to the slowdown last year, with management citing AI initiatives as adding a boost to sales.

On this point, Q3 firm-wide revenue growth of 13% reaching $143.1 billion has accelerated, compared to trends in the single digits last year. Online sales are up and high-margin subscription services have also been strong. More favorably, the data shows that Amazon is generating growth in new areas, particularly in advertising services, up 25% y/y on an FX natural basis.

This is important because even as AWS’s 12% revenue growth rate is down from trends above 30% in early 2022, this newfound sense of operating diversification is adding a quality component to the stock with more consistent underlying cash flow.

The trends here largely explain how and why shares of AMZN have reversed higher in 2023. From a high-level perspective, we can connect the dots to the resilient economic environment that has evolved stronger than expected compared to the baseline last year. Amazon took steps to generate cost savings and support margins including through modest headcount reductions which are paying off.

Maybe the chart that best summarizes the setup in AMZN is the sharply higher free cash flow, reaching $21.4 billion over the past year. This pace is consistent with the stated strategy to optimize cash flows reflecting the overall strength of the business.

What’s Next For AMZN?

There’s a lot to like about Amazon heading into 2024 with the backdrop being a new stage of the economic cycle. Recent data showing inflation surprising to the downside has helped build the consensus that the Fed is done with rate hikes while also opening the door for potential Fed rate cuts by next year.

Getting past two of the biggest headwinds in the economy over the last two years should be supportive of a new wave of growth.

As the economy stabilizes under the “soft landing” scenario where the Fed has successfully averted a recession, the world’s largest e-commerce player stands to benefit as consumers find some relief on the side of discretionary spending between stabilizing prices and greater credit availability.

In turn, Amazon Web Services through enterprise customers should also capture this impulse in the economy. In many ways, the attraction of AMZN is its role and operating profile at the intersection of global consumer spending and high-level themes in technology.

Again, the trends here are global. An outlook for lower bond yields and a less restrictive Fed going forward has already translated into a declining U.S. Dollar. The upside here would be for a stronger performance of Amazon’s International segment.

Putting it all together, the bullish case for the stock is that there is room for current revenue and earnings estimates to outperform expectations.

According to consensus, Amazon’s revenue is expected to climb by 11.4% next year as a continuation of the rebound in 2023. The 2024 EPS forecast of $3.43, up 29% y/y, climbs above the 2021 $3.24 water line.

Going forward, the expectation is that firming margins allow earnings to continue exceeding the sales trend. This would be achieved as service segments including advertising and subscriptions gain importance in their contribution to income on a relative basis.

We believe that top-line estimates are conservative with stronger sales adding to the earnings momentum over the next decade.

AMZN Stock Price Forecast

As it relates to valuation, we’re looking at the 2024 1-year forward P/E at 42x as otherwise reasonable and justified by a stock expected to nearly double earnings over the next two years.

Keep in mind that AMZN is expected to reach record EPS by next year, even as the stock is still down more than 20% from its all-time high. The difference is that shares were trading at a P/E multiple closer to 70x back in 2021. We believe the current earnings trends including the firming margins, and more overall diversified operations including strength in advertising can support a higher premium.

For how AMZN can reclaim its all-time high, the case we make is that 2024 EPS can come in about 10% stronger than the current consensus estimate toward $3.77 with a 50x multiple that would get shares to approach $190.00 as our year-ahead price target for the stock.

The way we see it playing out, improving market sentiment over the next few quarters, coupled with stronger-than-expected earnings reports over the next few quarters can support some modest multiples expansion. This would also be facilitated by the macro backdrop of stabilizing interest rates.

Final Thoughts

We rate AMZN as a buy with the view that the company is well-positioned to benefit from high-level macro themes into 2024. Monitoring points here include the operating margin and trend in free cash flow. We want to see AWS sales growth remain in the double digits while a more positive contribution from the international segment could be a big story through next year.

On the other hand, the risk to watch would be for a more concerning deterioration of the economy. A scenario where inflation rebounds, forcing the Fed to continue hiking, would likely pressure the outlook for consumer spending and lead to renewed volatility in the stock.

From the stock price chart, as long as shares remain above $120 as a key area of technical support, the call here is that the bulls are in control and the momentum is positive.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Add some conviction to your trading! Take a look at our exclusive stock picks. Join a winning team that gets it right. Click for a two-week free trial.