Summary:

- Just when you thought Meta is dead, the company executed one of the fastest turnaround stories ever.

- Fundamentals are improving – growth is accelerating and margins are expanding.

- The outlook looks bright – investment in AI, metaverse, and the next-generation social media platform will drive future growth.

- Momentum remains strong – Meta will be back in the trillion-dollar club sooner than later.

Justin Sullivan

Introduction

Remember when people said TikTok would stop Meta (NASDAQ:META) dead in its tracks?

That didn’t age well…

It turns out that Meta and its high-quality assets are just unstoppable.

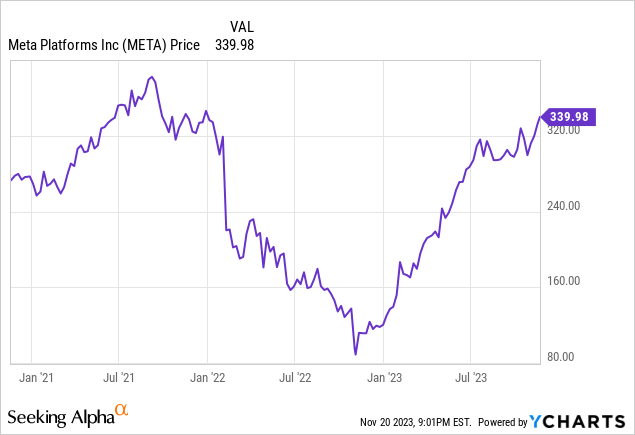

And that is reflected in the stock price soaring 270%+ since its bottom in November last year.

In my previous article, I wrote about Meta’s incredible turnaround story. However, I voiced my concern about the rally losing some steam:

Although I’m long-term bullish on the company, I expect a slight pullback in the near future before continuing its upward march to new highs.

(Riyado Sofian – Meta Platforms: The Big Rebound)

As soon as my article was published, the stock did “pull back” by 15%.

Fast forward to today, the stock is making “new highs” – as I anticipated.

And I expect this to continue as Meta reclaims its $1T market cap status over the next few months. Its strong growth, operating leverage, and durable competitive advantages will eventually push the stock to new all-time highs. It just seems inevitable.

Here’s why.

Growth

Meta is back in growth mode.

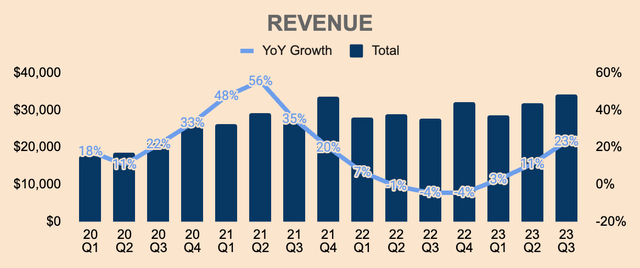

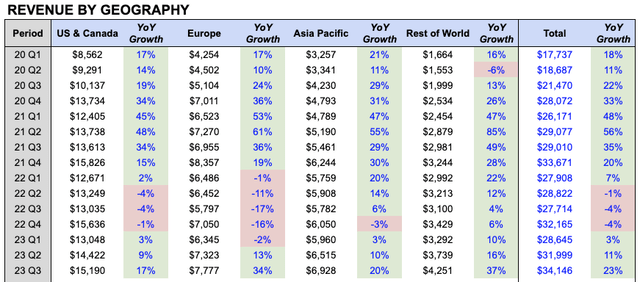

In Q3, Meta generated record Revenue of $34.1B, up 23% YoY, beating analyst estimates by $0.7B. As you can see below, this is the third consecutive quarter of Revenue acceleration.

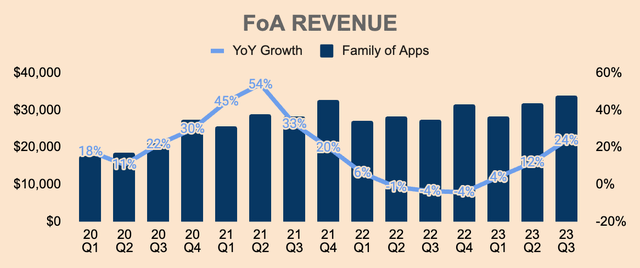

Strong growth was driven by a 24% increase in Family of Apps Revenue, which was $33.9B in Q3, due to:

- a 31% increase in ad impressions, driven by growth in all regions with particular strength in less developed regions.

- slightly offset by a 6% decrease in the average price per ad, due to the outsized growth in lower-monetized geographies (e.g. Asia) and products (e.g. Reels).

As a reminder, 2022 was a weak year for Meta due to: 1) the Apple iOS privacy changes, 2) the rapid growth of Reels, 3) and the slowing advertising market.

However, Meta finally put these issues to bed, especially with Reels no longer being a headwind to growth:

We estimate that Reels is now net neutral to overall company ad revenue. In many ways, Reels has now graduated from being an early initiative to now being a core part of our apps.

(CEO Mark Zuckerberg – META FY2023 Q3 Earnings Call)

This is crucial because Reels has “driven a 40% overall boost to Instagram engagement” – and with improved monetization, Reels should be a meaningful contributor to growth for years to come.

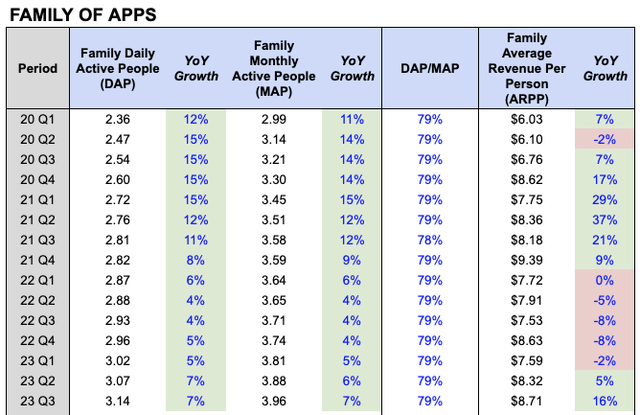

That being said, Meta’s expanding user base also contributed to the company’s overall growth. In Q3, both Family Daily Active People and Family Monthly Active People were up 7% YoY to 3.14B and 3.96B, respectively.

DAP as a % of MAP also remained at 79%, showing high engagement within the platform. Again, Reels had a major impact on engagement. In addition, AI-driven feed recommendations also drove engagement, with a “7% increase in time spent on Facebook and a 6% increase on Instagram”. Clearly, the company’s heavy investments in AI have been paying off handsomely.

Additionally, Family Average Revenue Per Person grew 16% YoY to $8.71, showing strong demand for Meta’s advertising platform as well as Reels’ improved monetization.

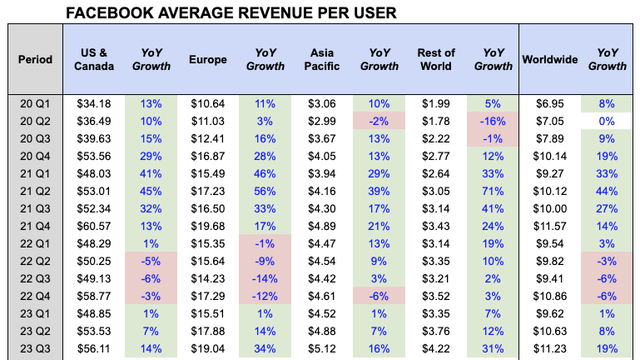

Looking at Facebook Average Revenue Per User can also give us a clue as to which region is driving the most growth and which region has the largest potential for growth.

As you can see, the metric is growing across all regions, which shows strong pricing power across all regions, which is important. On aggregate, Worldwide ARPU grew 19% YoY to $11.23, with particular strength in Europe and Rest of World. The opportunity lies in increasing monetization in Asia and Rest of World, which is only one-tenth of the figure in North America.

As you can see below, Asia and Rest of World are the two smallest regions in terms of Revenue, despite having much larger populations than North America. Hence, improving monetization in these less developed regions could generate monumental Revenue for Meta.

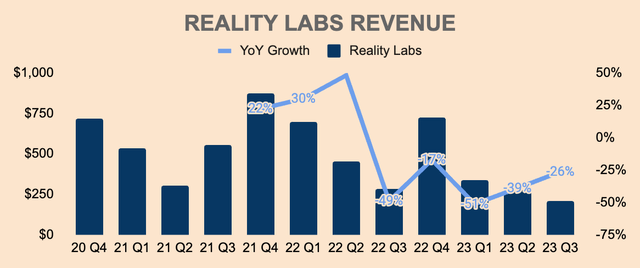

On the other hand, Q3 Reality Labs Revenue was down 39% YoY to just $210M due to lower Quest 2 sales volume. This is expected since a lot of people were waiting on the Quest 3, which hit shelves in October. As such, we should see RL Revenue pick up over the next few quarters.

All in all, Meta is back.

Growth is reaccelerating. Monetization is improving. The network keeps expanding.

Even despite competition.

Even despite regulation and policy changes.

Even despite its sheer size.

That speaks volumes about the company’s high-level execution, visionary leadership, and durable competitive advantages.

By definition, Meta is unstoppable.

Currently, growth is entirely driven by Facebook, Instagram, WhatsApp, and Messenger – imagine how Meta’s AI and metaverse investments may add to the company for decades to come.

Profitability

Meta is killing it on the profitability side as well.

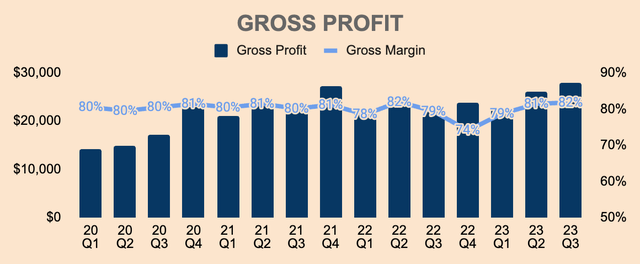

In Q3, Gross Profit was $27.9B, an all-time high for the company. This represents a Gross Margin of 82%, which is an improvement QoQ and YoY, reflecting strong demand, pricing power, and earnings potential.

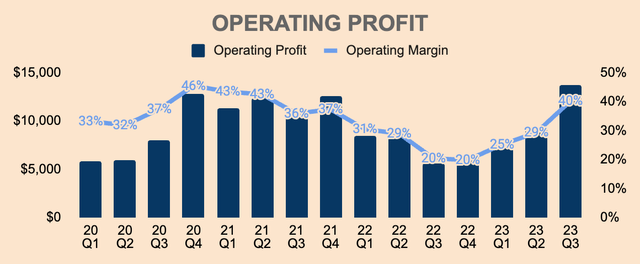

Moving on, Q3 Operating Profit was $13.7B, an all-time high as well. Operating Margin doubled YoY to 40%, signifying Meta’s aggressive cost-cutting initiatives. I was expecting Operating Margin to settle in the mid-30s so this was a huge surprise for me.

Regardless, this massive operating leverage is driven by a 24% YoY reduction in headcount, which stands at 66K as of Q3. According to management, the “majority of the employees impacted by the layoffs are no longer included in our reported headcount” in Q3, so expect Operating Margin to stabilize from here.

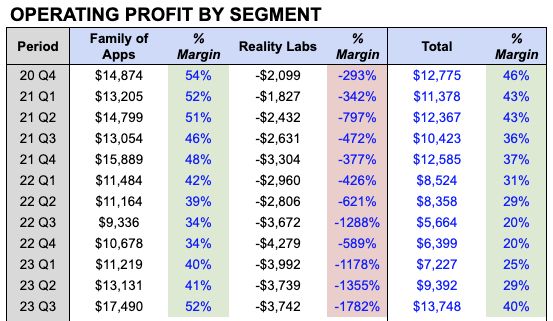

Breaking it down by segment, FoA Operating Margin is back to its prior levels of 50%+, which is incredible given that it was just 34% a year ago.

On the other hand, RL Operating Margin is still at nosebleed figures, burning $3.7B in Q3 alone. As expected, the RL segment will continue to be unprofitable in the next few years as the company continues to invest heavily in the metaverse while adoption in the industry remains low and slow.

Author’s Analysis

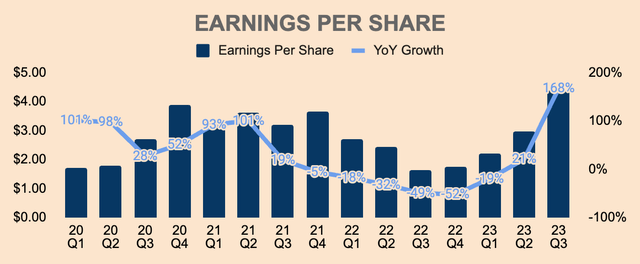

Jumping to the bottom line, Q3 Net Income was $11.6B, which is a 34% Net Margin. On a per-share basis, Q3 GAAP EPS was $4.39, growing by an astounding 168% YoY. This beat analyst estimates by $0.76, or 22%!

That said, Q3 was an absolute home run of a quarter in terms of profitability.

The company’s profitability margins are almost back to peak levels, which shuts down any fears of the company’s declining margins a year ago. And with improving margins, shareholders can sleep well at night knowing that Meta is generating tons of value for them.

Health

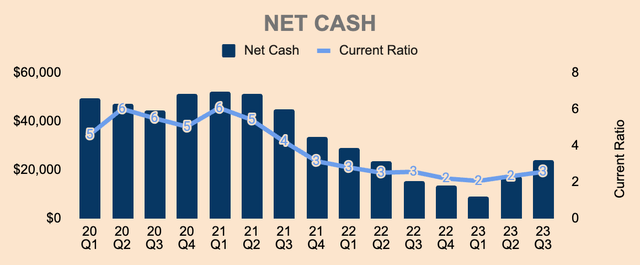

Turning to the balance sheet, Meta has $61.1B of Cash and Short-term Investments with $36.9B of Total Debt, which puts its Net Cash position to be about $24.2B.

As you can see, Net Cash has been increasing over the last couple of quarters after declining in the better part of 2021 and 2022, so this is good to see. I expect Net Cash to continue to increase as the company focuses on efficiency.

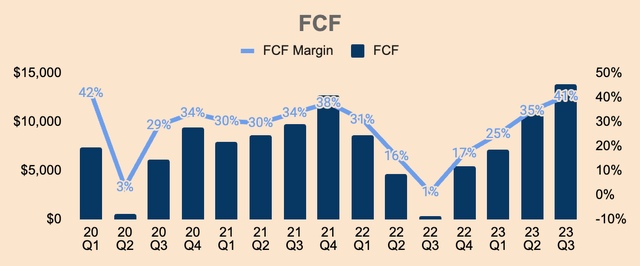

Q3 Free Cash Flow was $13.9B, which is a 41% FCF Margin, due to strong growth and improved profitability. Q3 FCF also benefited from a deferral of income taxes to Q4, so expect FCF Margins to dip slightly in Q4.

With a much improved Net Cash position and FCF profile, Meta continues to buy back shares aggressively, repurchasing $3.7B of stock, which is about $2.9B more than it did in Q2. (Yes, Meta bought the dip).

As of Q3, Meta still has $37.2B remaining in its buyback program, so expect more buybacks in future quarters.

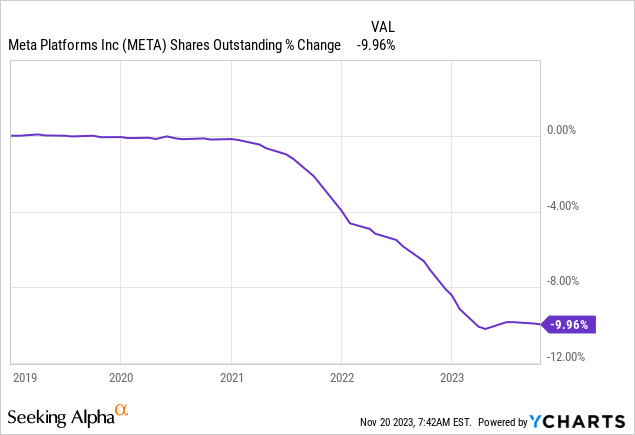

Since the start of the buyback program in 2021, Meta has decreased shares outstanding by nearly 10%, accelerating EPS growth for shareholders. Again, expect more to come.

Outlook

Here’s management’s most recent guidance:

- Q4 Revenue of $36.5B to $40B, implying a 19% YoY and a 12% QoQ growth, at its midpoint guidance. The range is wider than usual, due to “more volatility” and “softer ad spend” at the start of Q4, which coincides with the start of the ongoing conflict in the Middle East.

- FY2023 Total Expenses of $87B to $89B, lowered from their prior range of $88B to $91B. In the first three quarters, Total Expenses was $64.4B. Taking the midpoint guidance of $88B for the full year, we get Q4 Total Expenses of around $23.6B. Assuming Q4 Revenue of $38.25B (midpoint), Q4 Operating Margin is expected to be about 38%, which is a slight dip from Q3’s 40%. Nothing to panic about since it’s a vast improvement from last year.

- FY2024 Total Expenses of $94B to $99B, with growth driven by higher infrastructure-related costs, higher payroll expenses, and higher RL investments.

- FY2023 CapEx of $27B to $29B, lowered from their prior guidance of $27B to $30B.

- FY2024 CapEx of $30B to $35B, with growth driven by investments in servers and data centers.

Overall, nothing surprising with management’s guidance. They’re basically just saying: “We’re still growing and we’ll continue to invest in growth”.

Guidance aside, the future remains exciting for Meta.

For one, Meta is seeing significant traction with Llama 2, now the leading open-source large language model with 30 million downloads in September. Integrated with Llama 2, Meta also launched Emu, which is a generative AI model that turns texts into high-quality stickers in seconds. Another new feature that leverages Llama 2 is Meta AI, which is “an advanced conversational assistant” that gives users access to real-time information and generate photorealistic images.

These are just the tip of the iceberg in terms of what Meta can offer in the AI realm, and as Meta rolls out more AI features, the stickiness, engagement, and size of Meta’s ecosystem will grow even more.

In other news, Meta’s other recent products are gaining traction as well:

- Launched in August 2022, Advantage+ just reached a $10B run rate with over half of advertisers using this AI tool to automate ad creation.

- WhatsApp Business Platform now generates more than 600 million conversations per day. Click-to-WhatsApp is now at a multi-billion dollar annual run rate. In India alone, Click-to-WhatsApp ad Revenue has doubled YoY. In other words, WhatsApp monetization is picking up and this could be a major growth driver for the company. To quantify the magnitude of this opportunity, there are 2.4B WhatsApp users that can be further monetized.

- Threads has just under 100M monthly active users. The platform is not monetized yet as management is still focusing on growing the community further.

On the metaverse side, Meta also recently launched Meta Quest 3 and the new generation of Meta Smart Glasses, which should boost VR/AR adoption even more.

As you can tell, the outlook looks bright as Meta continues to innovate in the social media space, drive metaverse adoption, and invest in the AI revolution. Being a leader in each of these three industries positions Meta well for future growth.

Valuation

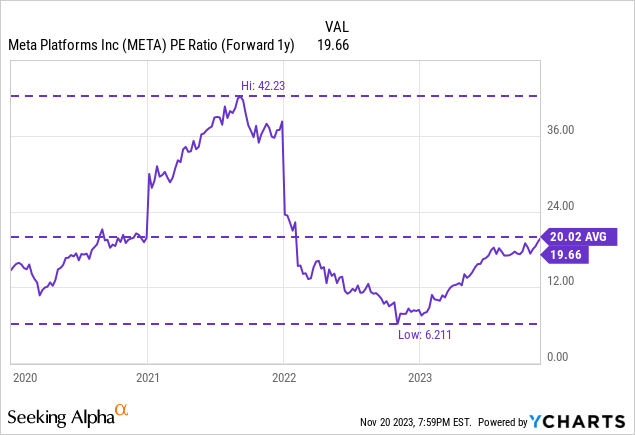

Looking at valuation, Meta now trades at a Forward PE Ratio of 20x, which is in line with its 3-year average. This is still a discount from its peak of 42x but is looking more expensive when we compare it with its lows of just 6x. So on a historical basis, Meta looks like it’s trading at fair value.

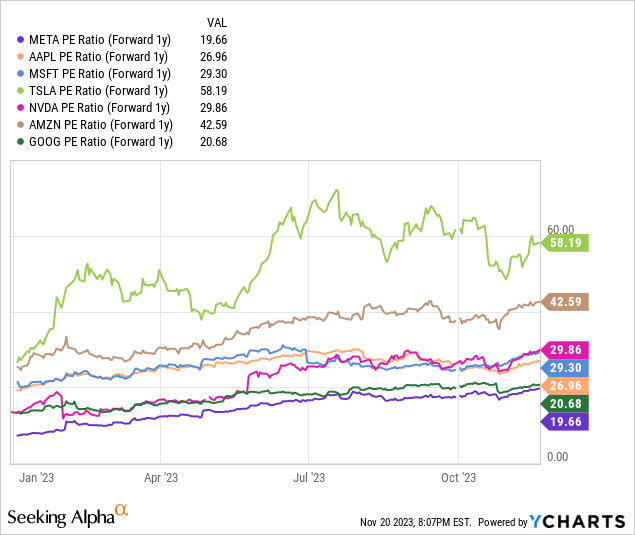

Here’s how it compares to other big tech firms, specifically, the other members of the Magnificent Seven. As you can see, Meta is trading at the bottom of its peer group, implying relative attractiveness among peers, despite having rallied 180% YTD.

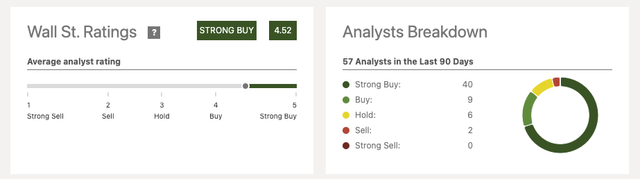

Wall Street is also incredibly bullish on Meta, with an average Strong Buy rating and only 2 Sell recommendations. The average analyst price target is $373, implying a 10% upside from here.

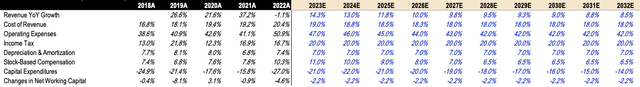

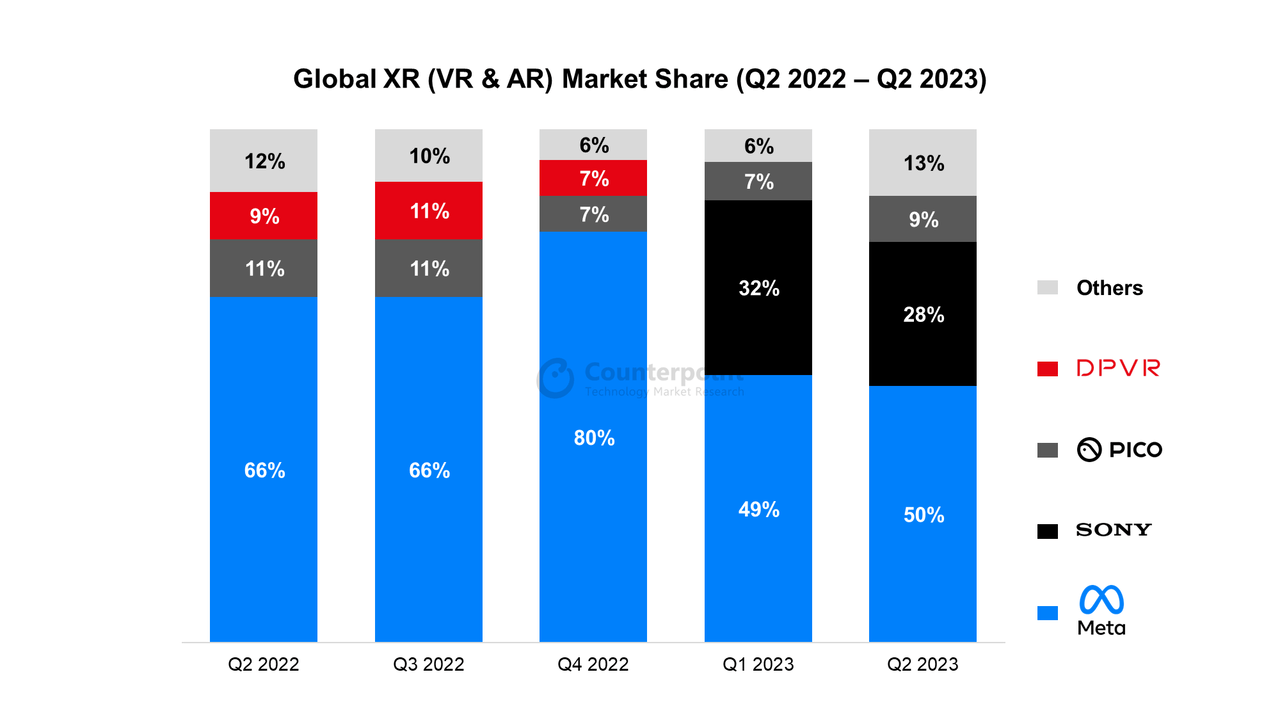

I’m bumping up my price target on Meta as well. Here are my key assumptions for my DCF model:

- Revenue: Follows analyst estimates for the first three years and drop rates down to just 8.5% by 2032.

- Total Expenses: Follows management’s guidance of $87B to $89B for FY2023 and $94B to $99B for FY2024. Additionally, I expect Operating Margin to improve from 34% this year, to 40% in the long term.

- CapEx: Follows management’s guidance of $27B to $29B for FY2023 and $30B to $35B for FY2024. I expect CapEx to remain high over the next few years but will drop gradually as a % of Revenue.

Based on my assumptions above, I expect Meta to generate $313B of Revenue by 2032, with a FCF Margin of about 34%.

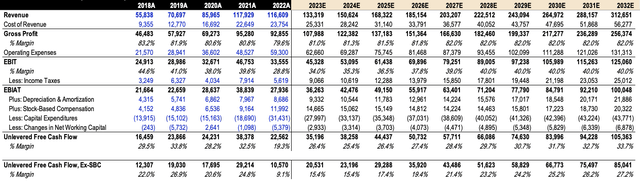

Using a discount rate of 10% and a perpetual growth rate of 2.5%, I have a fair value estimate of $386 for Meta stock, which implies a 14% upside based on the current price of $340.

Granted, it is not as cheap as it was a few quarters ago, but given the improvement in fundamentals, massive growth potential, and upbeat sentiment, it seems that the stock breaking to new all-time highs in the next 12 months is inevitable.

Regardless, I believe Meta is a great long-term investment.

Risks

Competition

In my eyes, the biggest competitor to Meta is X, which is quickly becoming one of the best platforms for content creators, especially since the Elon Musk takeover, rebranding, and platform monetization. Musk is also building an everything app through X – we all know what Muck is capable of.

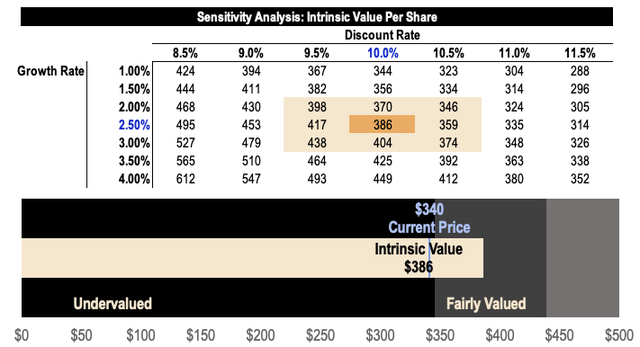

In addition, Meta’s RL also faces tough competition from two major VR makers: Sony and Apple. As you can see, Sony is taking market share with its recently launched Sony PlayStation VR2. Apple has yet to release its Vision Pro headset, but when it does, it could mean a smaller piece of the pie for Meta.

Policies and Regulations

Policy changes within Apple iOS or Android and government regulations are unpredictable and could have a significant impact on Meta’s performance.

Thesis

Q3 represents another “mic-drop” quarter for Meta. It reflects Meta’s incredible turnaround, high-level execution, and impenetrable social media ecosystem.

Just when you thought that Meta was dead in the waters – because of competition, because of a dying Facebook brand, because of reckless spending on the metaverse – Zuck and Co. showed the world what Meta is truly capable of.

As we saw in Q3, growth is accelerating, margins are improving, and EPS is skyrocketing. And the future for Meta remains as exciting as ever with continued investments in its social media platforms, AI, and the metaverse.

The fundamentals, momentum, and outlook of the business remain strong and this should drive the stock price higher.

In my opinion, Meta will be back in the trillion-dollar club sooner than later – the company is just unstoppable at this point.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.