Summary:

- Nvidia Corporation reported strong fiscal Q3 earnings and provided a positive guidance for the current quarter.

- The company’s revenue growth was driven by data center revenue gains, particularly in the AI sector.

- While Nvidia’s growth is impressive, the high valuation of its stock may limit further share price gains in the near term.

da-kuk

Article Thesis

Nvidia Corporation (NASDAQ:NVDA) reported its most recent quarterly earnings results on Tuesday afternoon. The company beat estimates easily, and the just-released guidance for the current quarter looks very strong as well. However, Nvidia has experienced massive gains so far this year, and a lot of enthusiasm is built into the stock already, while the valuation is rather high as well. While Nvidia’s business execution is excellent, shares thus will not necessarily rise further in the near term.

What Happened?

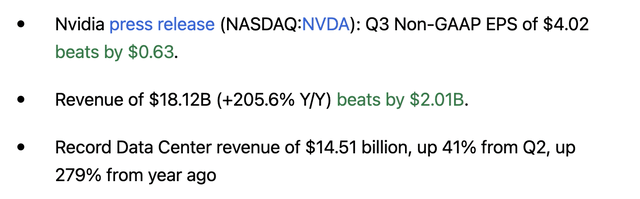

NVIDIA Corporation’s most recent quarterly earnings results were reported on Tuesday following the market’s close. The company’s headline results can be seen in the following screencap from Seeking Alpha:

We see that the company generated hefty revenue growth, but that was already pretty clear due to the guidance the company had given during the previous quarter’s earnings call. Revenues were up by more than 200%, which makes for very hefty growth in absolute terms and which is also almost unseen when considering the company’s already very large size. Not even fast-growers such as Tesla (TSLA) have been able to deliver anything close to revenue growth of 200% in the last couple of quarters.

Revenues were also up by a pretty strong 34% on a sequential basis, which shows that Q2 earnings were not an outlier at all, as revenues continued to soar upward during the last couple of months.

The market’s immediate reaction was inconclusive, as shares have been moving up and down in after-hours trading. At the time of writing, they are up 0.5%, but this could easily change over the coming hours and during Wednesday, as investors and analysts will try to interpret the results and Nvidia’s guidance for the current quarter.

Nvidia: Data Center King

Nvidia’s strong revenue growth was, unsurprisingly, driven by data center revenue gains primarily. The unit experienced revenue growth of 279% on a year-over-year basis, while data center revenue growth was very strong on a sequential basis as well, with sales being 41% higher in Q3 relative to the already very strong second quarter.

Data center growth was driven by AI investments to a large degree. While data center revenues had been growing at an above-average pace for years thanks to investments in computing power by companies such as Meta Platforms (META), Alphabet (GOOG)(GOOGL), Amazon (AMZN), and others, growth got a further “accelerator” with the increased attention on artificial intelligence. Large language models such as ChatGPT require immense computing power, and Nvidia is offering some of the most capable chips for AI tasks. This makes it a prime beneficiary of increased AI investments and AI computing power spending by large tech companies that seek to improve their AI models further and further.

Jensen Huang, Nvidia’s CEO, explained:

“Our strong growth reflects the broad industry platform transition from general-purpose to accelerated computing and generative AI.”

He further explained that while the first wave of AI investments came from Large Language Model startups, consumer internet companies, and so on, more and more companies are moving into the space. This increases Nvidia’s market potential, as the company can sell its chips to more and more potential customers. The new customers that Nvidia is adding include, according to CEO Huang, governments and other state/country actors as well as enterprises from different industries that seek to automate more and more processes with the help of Artificial Intelligence.

Revenue growth is great, but one can argue that profit growth is even more important. After all, the value of a company’s shares is tied closely to the profit — on a per-share basis — that the company generates. Nvidia has generated great revenue growth, but its profit growth is even more impressive: The company grew its adjusted earnings per share, where one-time items are backed out, by almost 6x over the last year. I don’t remember the last time I saw a large company grow its earnings per share by more than 500%, making this an absolute outlier quarter by this tech giant. Profit growth also was very strong on a sequential basis, with earnings per share soaring by another 49% between the second and the third quarter, despite Q2 already being a very strong quarter for the company.

How is Nvidia able to grow its profits this quickly? The answer is that the company benefitted from hefty operating leverage tailwinds and way higher gross margins compared to the previous year’s quarter, on top of also benefitting from a huge sales increase. The gross margin increase of 2,040 base points can be explained by the fact that the high demand for Nvidia AI chips allows the company to demand premium prices: When you have the best products on the market, customers are willing to pay up for these products, especially when supply is tight and there is a lot of demand by different types of customers.

Nvidia doesn’t have to compete on price in the AI space, which has allowed the company to boost prices substantially. Of course, margins will not continue to soar forever — there is an upper limit for gross margins eventually, and with gross margins of more than 70%, Nvidia will be, in all likelihood, not able to boost its gross margins by another 2,000 base points. Nevertheless, operating margin tailwinds could persist for some time, as R&D costs and similar items are distributed over rising revenues and gross profits, which should result in further operating margin tailwinds as long as Nvidia is able to grow its business.

And at least in the very near term, it looks like business growth will remain substantial. The company guides for revenues of around $20 billion for the fourth quarter (the current quarter), which pencils out to a sequential increase of around 10% — which makes for a very nice annualized growth rate.

When we consider that Nvidia has outperformed its own guidance meaningfully during the most recent quarter — actual revenues came in more than 10% ahead of the guidance midpoint — then there is a solid chance that Nvidia’s results during the current quarter will be stronger than what the guidance implies. There is, of course, no guarantee for that, but a company that has a history of beating its own guidance is, I assume, more likely to beat its own guidance in the future, too, relative to a company that has a history of underperforming its own guidance.

While the near-term outlook is thus very positive, investors should consider the fact that this does not mean that Nvidia will grow at the current rate forever. Mathematics and the law of large numbers dictate that Nvidia will not be able to grow at a massive rate forever, thus growth will inevitably slow down at some point. But that does not mean that Nvidia’s growth will be weak — if growth were to slow down to 5% per quarter in the coming years, for example, that would still make for a very nice growth rate.

Is Nvidia A Good Investment?

Nvidia is active in a high-growth industry in which it holds a strong market position. That’s a great position to be in, for sure. That being said, business growth does not necessarily translate into share price gains in the near term — investors that bought Cisco Systems (CSCO) during the dot.com bubble will know that for sure. If one buys shares of a company while the valuation is high, valuation compression can offset underlying earnings and business growth, and total returns may be subpar.

While Nvidia is by far not as expensive as Cisco was during the peak of the dot.com bubble, Nvidia Corporation is pricey: Shares are trading for around 45x net profits right now, based on the current analyst consensus estimate. That is not outrageous, considering the company’s growth and its strong market position, but Nvidia was not always trading at a valuation this high. Waiting for a better entry point might pay off, which is why I am not buying Nvidia Corporation shares at the current valuation despite the hyper-growth the company has experienced during the current quarter, and despite the strong guidance for the current quarter.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META, GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!